Category Archive: 4) FX Trends

FX Weekly Preview: FOMC Highlights Big Week

The days ahead are historic. By all reckoning, Merkel will be German Chancellor for a fourth consecutive term. Many observers expect the election to usher in a new era of German-French coordination to continue the European project post-Brexit and in the aftermath of the Great Financial Crisis.

Read More »

Read More »

FX Daily, September 15: Short Note Ahead of the Weekend

Sporadic updates continue as the first of two-week business trip winds down. North Korea missile launch failed to have much impact in the capital markets. The missile apparently flew the furthest yet, demonstrating its ability to hit Guam. However, there was not an immediate response from the US. South Korea said it had simultaneously conducted its own drill which included firing a missile into the Sea of Japan (East Sea).

Read More »

Read More »

FX Daily, September 14: New Trump Tactics Help Greenback and Rates

In the face of much cynicism and pessimism about the outlook for the Trump Administration's agenda, we have repeatedly pointed out the resilience of the system of checks and balances. Many of the more extreme positions have been tempered, either on their own accord, such as naming China a currency manipulator or pulling out of NAFTA or KORUS, or the judiciary branch, such as on immigration curbs, or the legislative branch itself, as in limiting the...

Read More »

Read More »

FX Daily, September 13: Sterling Shines While Euro Stalls in Front of $1.20

The next leg of the business trip takes me to Frankfurt. Sporadic updates will continue. We have been identifying the $1.3430 area is a reasonable technical target for sterling. It represents the 50% retracement of sterling's losses since the day of the referendum June 2016 when it briefly traded $1.50. Also helping sterling is the unwinding of short cross positions against the euro.

Read More »

Read More »

FX Daily, September 12: Dollar Sports Heavier Tone as Yesterday’s Bounce Runs out of Steam

The sporadic updates continue while I am on a two-week business trip. Now in Barcelona, participating in TradeTech FX Europe. The euro advanced yesterday from NOK9.30 to NOK9.40. It is consolidating in a tight range today. The election results may have been a bit closer than expected, but the weight on the krone yesterday seemed to stem more from the unexpectedly soft inflation report.

Read More »

Read More »

FX Weekly Preview: Forces of Movement in FX: The Week Ahead

The dollar has been declining since the start of the year, but the causes have changed. The drag from US politics may be exaggerated, while European and Japanese politics are worrisome. The economic data may continue to be a drag on US yields, especially if core CPI slips again.

Read More »

Read More »

FX Weekly Review, September 04 – 09: Draghi Dovish? EUR and USD falling against CHF

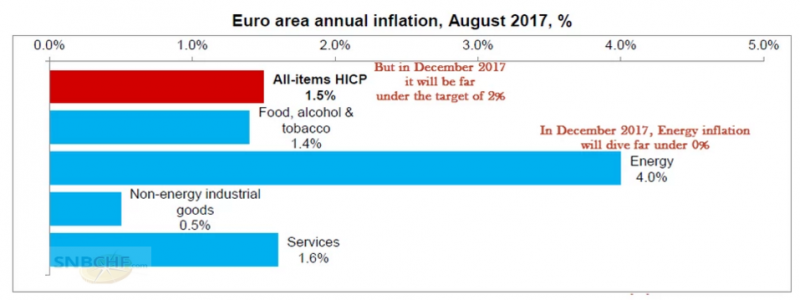

The euro rose close to CHF 1.15 with the ECB meeting this week. Finally traders realized that the ECB committed not to hike rates for a very long time. The ECB will review and take a first decision on the bond purchasing program this autumn. However, this program will come to an end only when the inflation target of 2% becomes in reach.

Read More »

Read More »

I have the worst trading mantra

There is a grain of truth in every trading mantra and maxim but everybody has one that he or she likes best. Adam Button from ForexLive talks about his trading mantra, how he wishes it something with a bit more pizzazz. LET’S CONNECT! Facebook ► http://facebook.com/forexlive Twitter ► https://twitter.com/ForexLive Google+ ► https://plus.google.com/+Forexlive Homepage ► http://www.forexlive.com/

Read More »

Read More »

FX Daily, September 08: US Dollar Tracks Yields Lower

The US dollar has been unable to find any traction as US yields continue to move lower. The US 10-year year is slipping below 2.03% in European turnover, the lowest level in ten months. The risk, as we have noted, is that without prospects of stronger growth and inflation impulses, the yield returns to where was before the US election (~1.85%). The two-year note yield, anchored more by Fed policy than the long-end, is also soft. It yielded 1.25%...

Read More »

Read More »

FX Daily, September 07: ECB Focus for Sure, but not Only Game in Town

The US dollar is trading broadly lower. The ECB meeting looms large. Many, like ourselves, expected that when Draghi said in July that the asset purchases would be revisited in the fall, it to meant after the summer recess, not a legalistic definition of when fall begins. Still, there have been some reports, citing unnamed sources close to the ECB, that have played down such expectations, and warn a decision on next year’s intentions may not be...

Read More »

Read More »

FX Daily, September 06: Wake Me up when September Ends

The US dollar fell to new lows since mid-2015 against the Canadian dollar yesterday. It is flattish today as the market awaits the central bank's decision. We are concerned that given the strong performance and market positioning, a rate hike could spur "buy the rumor, sell the fact" activity. Alternatively, a disappointment if the Bank does not hike could also lead to some Canadian dollar sales.

Read More »

Read More »

Great Graphic: Young American Adults Living at Home

This Great Graphic caught our eye (h/t to Gregor Samsa @macromon). It comes from the US Census Department, and shows, by state, the percentage of young American adults (18-34 year-olds).The top map is a snap shot of from 2005. A little more than a quarter of this cohort lived at home. A decade later, and on the other side of the Great Financial Crisis, the percentage has risen to a little more than a third.

Read More »

Read More »

FX Daily, September 5: Greenback Mixed, North Korea and PMIs in Focus

Reports suggesting that North Korea is moving an ICBM missile toward launch pad in the western part of the country at night to minimize detection, while South Korea is escalating its military preparedness and the US seeks new sanctions, keep investors on edge. Risk assets are mixed. Gold is slightly lower. While the yen is stronger, the Swiss franc is heavier. Asia equities slipped, and European shares are recouping much of yesterday's 0.5% loss.

Read More »

Read More »

FX Weekly Preview: Three Central Banks Dominate the Week Ahead

Following strong Q2 GDP figures, risk is that Bank of Canada's rate hike anticipated for October is brought forward. ECB's guidance to that it will have to extend its purchases into next year will continue to evolve. Among Fed officials speaking ahead of the blackout period, Brainard and Dudley's comments are the most important.

Read More »

Read More »

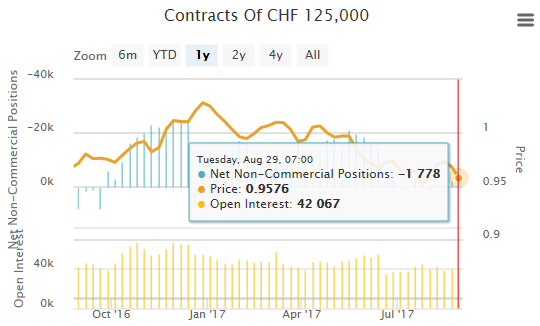

Weekly Speculative Positions (as of August 29): Speculators Make Minor Position Adjustments, but Like that Aussie

The net speculative CHF position has fallen from 2K short to 1.8K contracts short (against USD). Speculators did not make any significant adjustment to gross positions, which we define as 10k or more contracts in the currency futures, during the CFTC reporting week ending August 29.

Read More »

Read More »

FX Weekly Review, August 28 – September 02: The end of big euro rise?

For us, the sudden euro rise from 1.08 to 1.14 is an illusion, the euro will fall sooner or later again. Macron will not help the French economy and low core inflation will prevent that the ECB ends her bond buying program.

Read More »

Read More »

Cool Video: CNBC Clip Tactical and Strategic Dollar Outlook

I appeared on CNBC earlier today to talk about the dollar. I was given the time to briefly sketch out my view of the dollar. Near-term, I am concerned about the political and economic events in September, but I am looking for a better Q4 for the greenback.

Read More »

Read More »

Cool Video: Bloomberg Discussion of Opioid Epidemic and US Labor

I had the distinct of honor of being on Bloomberg television today with David Gura and Francine Lacqua. Dino Kos, formerly of the NY Fed and now at CLS, joined this segment as well. The broad topic was the Jackson Hole Symposium, and the challenge is fostering more dynamic growth.

Read More »

Read More »

FX Daily, September 01: Manufacturing PMIs, US Jobs, and Implications of Harvey

As the markets head into the weekend, global equities are firmer, benchmark 10-year yields are mostly lower, and the dollar is consolidating after North American pared the greenback's gains yesterday. Manufacturing PMIs from China, EMU, and the UK have been reported, while in the US, the August jobs data stand in the way of the long holiday weekend for Americans.

Read More »

Read More »

FX Daily, August 31: US Core PCE Deflator may Challenge the Greenback’s Firmer Tone

The US dollar recovery was marginally extendedin Asia, and while it remains firm, it is lost some of its momentum. The Fed's target inflation measure, the core PCE deflator, may decline from 1.5% to 1.4%, according to the median forecast in the Bloomberg survey. That would be the lowest read since the end of 2015 and likely spur more speculation against another Fed hike before the end of the year.

Read More »

Read More »