Category Archive: 4) FX Trends

Chandler: Good Chance Fed Hikes in December

08/30/17 Brown Brothers Harriman's Marc Chandler weighs in on expectations for the Federal Reserve in 2017. Chandler considers the divergent outlook for the ECB vs the FOMC and the implications for the EUR/USD.

Read More »

Read More »

Chandler: Good Chance Fed Hikes in December

08/30/17 Brown Brothers Harriman’s Marc Chandler weighs in on expectations for the Federal Reserve in 2017. Chandler considers the divergent outlook for the ECB vs the FOMC and the implications for the EUR/USD.

Read More »

Read More »

FX Daily, August 30: US Dollar Recovery Extended

The US dollar recovery that began in North American yesterday continued to in Asia and Europe. The geopolitical anxiety sparked by North Korea's missile over Japan subsided. The US response was seen as measured and tempered.

Read More »

Read More »

Two Overlooked Takeaways from Draghi at Jackson Hole

The consensus narrative from the Jackson Hole Symposium was the Yellen and Draghi used their speeches to argue against dismantling financial regulation and the drift toward protectionism. Many cast this as a push against US President Trump, but this may be too narrow understanding.

Read More »

Read More »

FX Daily, August 29: Dollar Losses Accelerate After North Korea Sends Missile over Japan

A brief period of quiet, which some may have confused with a change in posture, North Korea followed up the weekend's test of three ballistic missiles with what appears to have been an intermediate missile that flew over Japan. South Korea responded with its own symbolic display of force by dropping bombs by the DMZ.

Read More »

Read More »

FX Daily, August 28: Monday’s Dollar Blues

The US dollar's pre-weekend losses were extended initially in Asia before it recovered sufficiently to give European participant a better selling level. The dollar selling into the shallow bounce reflects the bearish sentiment, which as we see it, was simply fanned by both Yellen and Draghi did not alter the status quo in their Jackson Hole speeches.

Read More »

Read More »

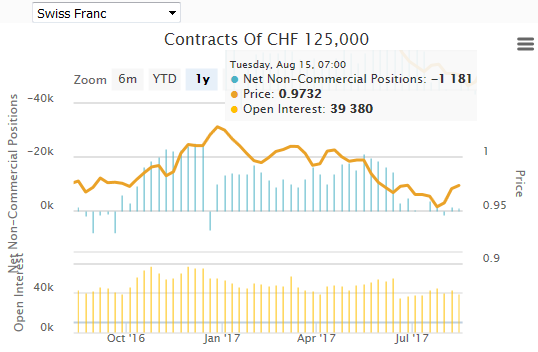

Weekly Speculative Positions (as of August 22): Sterling Bears Press, but Too Much?

The net speculative CHF position has risen from 1.2K short to 2K contracts short (against USD). Speculators continued to amass a significant short sterling position in the futures market. In the CFTC reporting week ending August 22, speculators added 11.7k contracts to the gross short position, lifting it to 107.4k contracts.

Read More »

Read More »

FX Weekly Preview: Three Drivers in the Week Ahead

EMU preliminary August CPI headline rise may not translate into core. US jobs growth is fine; earnings growth is key. Trump's coalition is fraying, and the weekend pardon will not help mend fences.

Read More »

Read More »

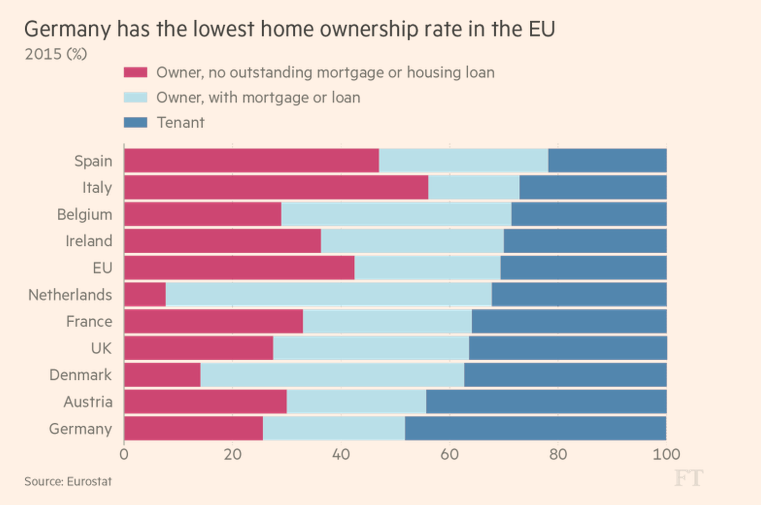

Great Graphic: Home Ownership and Measuring Inflation

Home ownership varies throughout the EU but is overall near US levels. Germany has the lowest home ownership, and Spain has the most. Italy has the least amount of mortgages. US include owner equivalent rents in CPI, the EU does not.

Read More »

Read More »

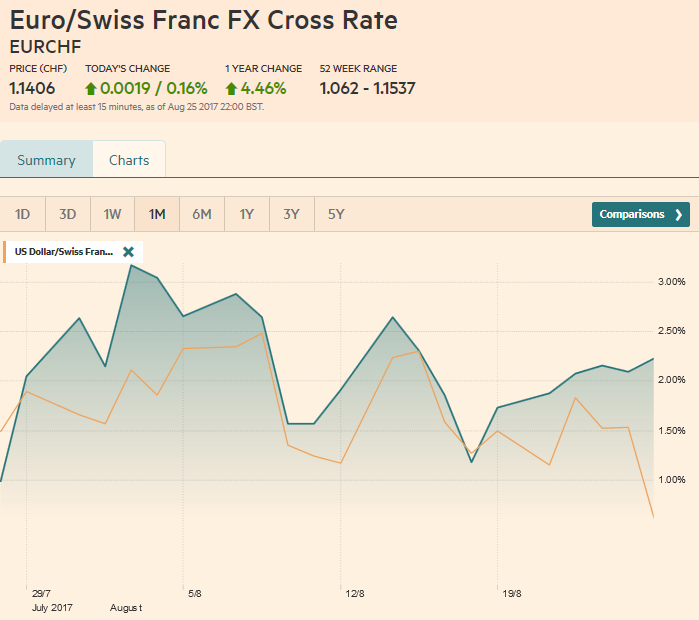

FX Weekly Review, August 21 – August 26: Dollar Loses its Gains Against CHF

The broad technical condition of the dollar deteriorated materially before the weekend. The dollar had some gains versus the franc during the last month, but it lost all during the last days.The EURCHF continues with a 2.5% win for the last month.

Read More »

Read More »

Great Graphic: Small Caps and the Trump Trade

The Russell 2000, which tracks the 2000 smallest companies in the Russell 3000, is threatening to turn positive for the year. It had turned negative in the second half of last week. Many pundits saw its decline and the penetration of the 200-day moving average for the first time in over a year as a sign of an impending down move in the broader equity market.

Read More »

Read More »

FX Daily, August 25: Is the Janet and Mario Show a New Episode or Rerun?

The event that investors have been waiting for and the media frequently linked to whatever price action has taken place has arrived: Yellen and Draghi's speeches later today. Yellen is first. She will speak at 10:00 am ET. This is toward the end of the European trading week. Draghi speaks late in the North American session--3:00 pm ET.

Read More »

Read More »

How will Yellen Address Fostering a Dynamic Global Economy?

Yellen has identified two challenges regarding the US labor market, the opioid epidemic and women participation in the labor force. The topic of the Jackson Hole gathering lends itself more to a discussion of these issues than the nuances of monetary policy. Dynamic world growth needs a dynamic US economy, and that requires more serious thinking about these socio-economic and political issues.

Read More »

Read More »

FX Daily, August 24: Greenback Firmer in Becalmed Markets

The US dollar is enjoying a firmer tone in quiet. Sterling is stabilizing after grinding down to its lowest level since late June. The Mexican peso, which had dropped in thin trading in Asia and Europe yesterday following Trump's threat to exit NAFTA and force Congress to fund the Wall or face a government shutdown recovered fully and is now slightly higher on the week.

Read More »

Read More »

Euro Flirting with Near-Term Downtrend

North American traders began the week by selling dollars. Euro is testing a downtrend off the year's high. DXY is testing its uptrend.

Read More »

Read More »

FX Daily, August 23: Consolidation in Capital Markets Conceals Coming Turbulence

A mixed US dollar will greet the North American participants today. It is softer against the euro and yen, but firmer against the dollar-bloc currencies. Among the emerging market currencies, the eastern and central European currencies are moving higher in the euro's draft.

Read More »

Read More »

FX Daily, August 22: Turn Around Tuesday Sees Firmer Dollar, Rates, and Equities

The US dollar has recouped most of yesterday's declines. However, as we have seen over the past couple of sessions, he North American market appears more dollar negative than Europe or Asia. The dollar's rise through the European morning has left the intraday technical indicators a bit stretched, warning that this short-term pattern continues today.

Read More »

Read More »

FX Daily, August 21: Dollar Edges Higher, While Equities Trade Heavily to Start the New Week

The US dollar is mostly firmer against most of the major and emerging market currencies. The main impetus appears to be some position adjustment emanating from equities. The equity markets turned south in the second half of last week and are moving lower today. Foreign investors appeared to have sold around $100 bln of European equities in 2016 and bought around a third back this year.

Read More »

Read More »

Weekly Speculative Positions (as of August 15): Speculators Add to Sterling and Peso Shorts, While Cutting Euro and Canadian Dollar Longs

The net speculative CHF position has fallen from -1.4K short to -1.2K contracts short (against USD). Speculators made several significant position adjustment in the CFTC reporting week ending August 15, that included an escalation of aggressive rhetoric by the US and North Korea.

Read More »

Read More »

FX Weekly Preview: Transitioning to a New Phase

Jackson Hole marks the end of the investors' summer and a beginning of a challenging several weeks. The abandonment of national business leaders from Trump's advisory board and strong words by Republican Senator Corker, followed by the dismissal of the controversial Bannon, could be a turning point. Neither Yellen nor Draghi may not even address the current policy stance as they discuss the topic at hand, "Fostering Dynamic Global Economy", which...

Read More »

Read More »