Category Archive: 6b.) Acting Man

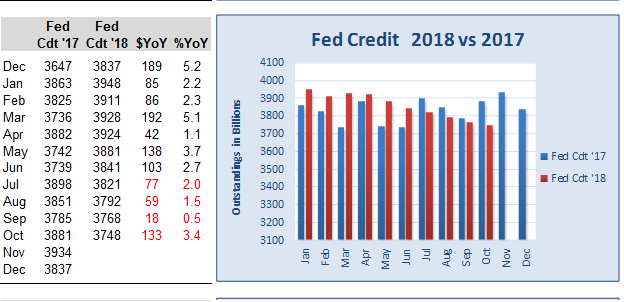

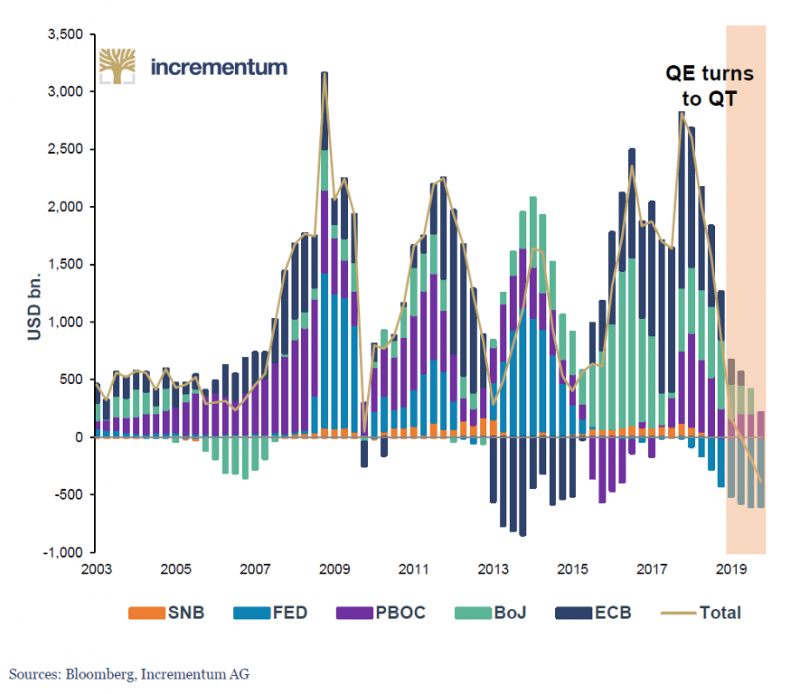

Fed Credit and the US Money Supply – The Liquidity Drain Accelerates

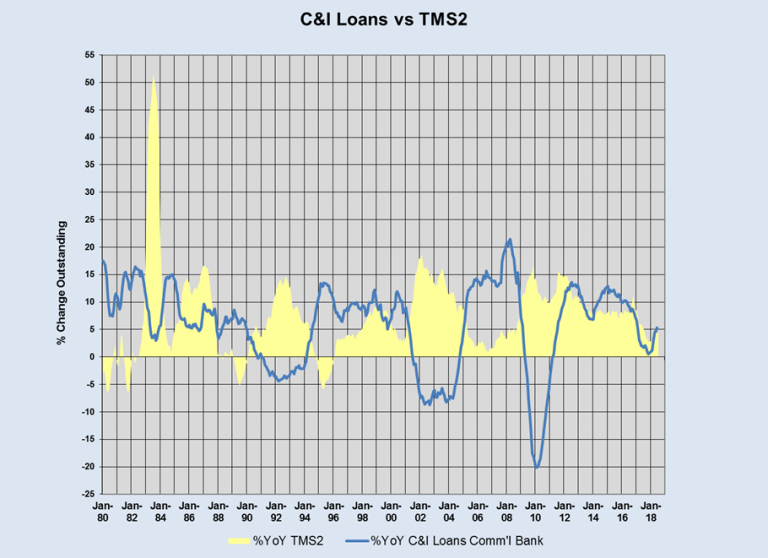

Federal Reserve Credit Contracts Further. We last wrote in July about the beginning contraction in outstanding Fed credit, repatriation inflows, reverse repos, and commercial and industrial lending growth, and how the interplay between these drivers has affected the growth rate of the true broad US money supply TMS-2 (the details can be seen here: “The Liquidity Drain Becomes Serious” and “A Scramble for Capital”).

Read More »

Read More »

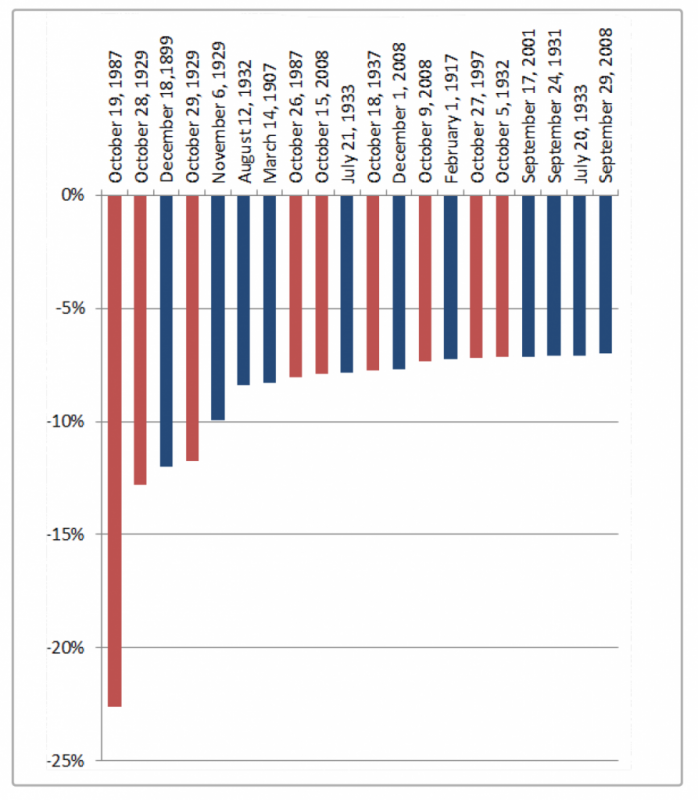

How Dangerous is the Month of October?

A Month with a Bad Reputation. A certain degree of nervousness tends to suffuse global financial markets when the month of October approaches. The memories of sharp slumps that happened in this month in the past – often wiping out the profits of an entire year in a single day – are apt to induce fear. However, if one disregards outliers such as 1987 or 2008, October generally delivers an acceptable performance.

Read More »

Read More »

Switzerland, Model of Freedom & Wealth Moving East – Interviews with Claudio Grass

Last month our friend Claudio Grass, roving Mises Institute Ambassador and a Switzerland-based investment advisor specializing in precious metals, was interviewed by Sarah Westall for her Business Game Changers channel.

Read More »

Read More »

US Equities – Approaching an Inflection Point

A Lengthy Non-Confirmation. As we have frequently pointed out in recent months, since beginning to rise from the lows of the sharp but brief downturn after the late January blow-off high, the US stock market is bereft of uniformity. Instead, an uncommonly lengthy non-confirmation between the the strongest indexes and the broad market has been established.

Read More »

Read More »

A Fake Brexit and the “Noble Dream” – Claudio Grass Speaks With Godfrey Bloom

Introductory Remarks: The “Anti-Politician” Godfrey Bloom, by PT

Most of our readers will probably remember former UKIP chief whip and European Parliament representative Godfrey Bloom. As far as we know, he is the only politician who ever raised the issue of the workings of the fractionally reserved central bank-directed monetary system in the EU parliament. This system is of course central to the phenomenon of the recurring boom-bust sequences...

Read More »

Read More »

An Inquiry into Austrian Investing: Profits, Protection and Pitfalls

“From a marketing perspective it pays to be overconfident, especially in the short term. The higher your conviction the easier it will be to market your investment ideas. I think the Austrian School is at a disadvantage here because it’s more difficult to be confident about your qualitative predictions and even in terms of investment advice it is particularly difficult to be confident in these times because we don’t really have any historical...

Read More »

Read More »

A Scramble for Capital

A Spike in Bank Lending to Corporations – Sign of a Dying Boom? As we have mentioned on several occasions in these pages, when a boom nears its end, one often sees a sudden scramble for capital. This happens when investors and companies that have invested in large-scale long-term projects in the higher stages of the production structure suddenly realize that capital may not be as plentiful as they have previously assumed.

Read More »

Read More »

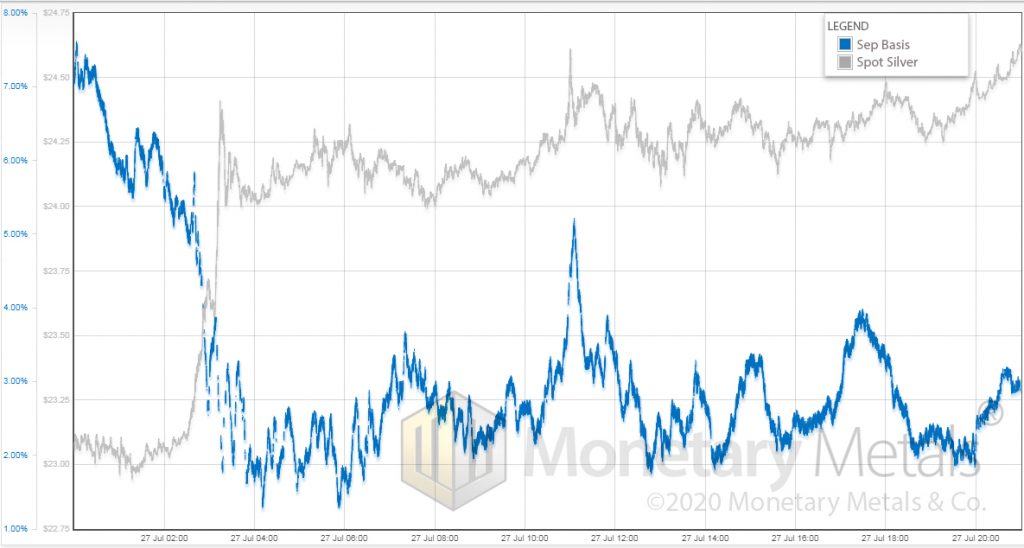

US Money Supply and Fed Credit – the Liquidity Drain Becomes Serious

Our good friend Michael Pollaro, who keeps a close eye on global “Austrian” money supply measures and their components, has recently provided us with a very interesting update concerning two particular drivers of money supply growth. But first, here is a chart of our latest update of the y/y growth rate of the US broad true money supply aggregate TMS-2 until the end of June 2018 with a 12-month moving average.

Read More »

Read More »

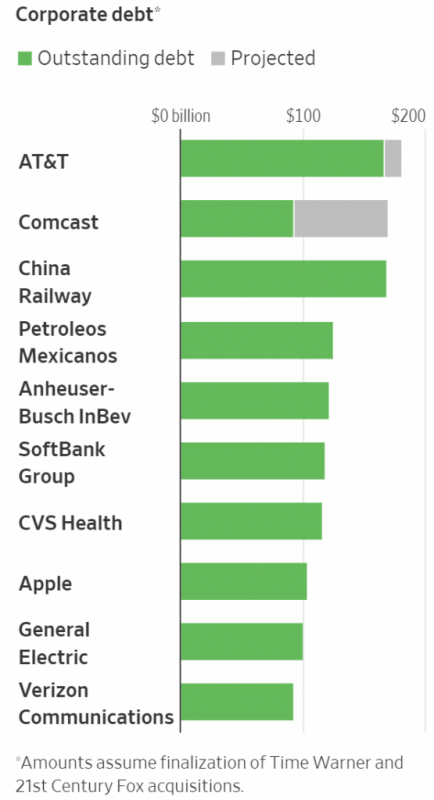

Merger Mania and the Kings of Debt

Another Early Warning Siren Goes Off. Our friend Jonathan Tepper of research house Variant Perception (check out their blog to see some of their excellent work) recently pointed out to us that the volume of mergers and acquisitions has increased rather noticeably lately. Some color on this was provided in an article published by Reuters in late May, “Global M&A hits record $2 trillion in the year to date”, which inter alia contained the following...

Read More »

Read More »

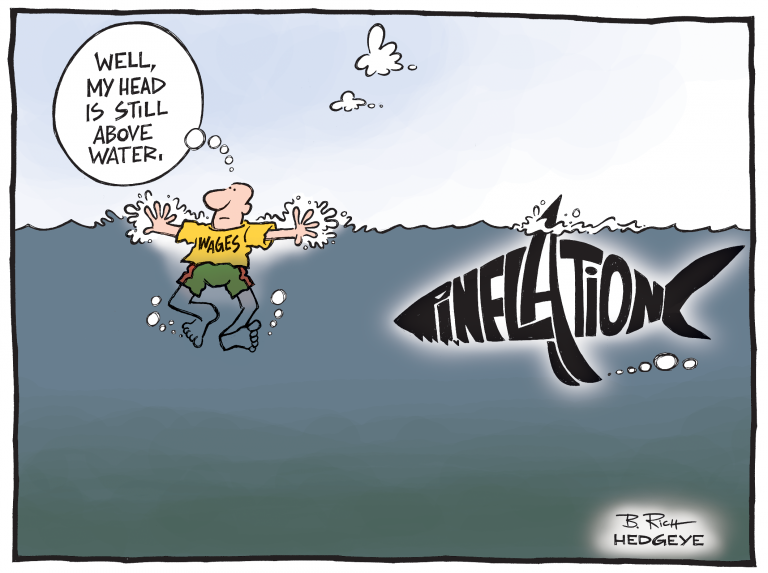

The Fed’s “Inflation Target” is Impoverishing American Workers

Redefined Terms and Absurd Targets. At one time, the Federal Reserve’s sole mandate was to maintain stable prices and to “fight inflation.” To the Fed, the financial press, and most everyone else “inflation” means rising prices instead of its original and true definition as an increase in the money supply. Rising prices are a consequence – a very painful consequence – of money printing.

Read More »

Read More »

Dimitri Speck über Türkei, Italien, EU und Euro

https://www.responsa-liberta.de/ Die aktuelle Lage rund um Italien, EU und Euro – während der Fokus derzeit vor allem auf der aktuellen Regierungsbildung in Italien liegt, führt Dimitri Speck (Seasonax / Tool für Saisonale Statistiken) im folgenden Interview aus, welche Folgen er beispielsweise für die türkische Lira aufgrund der Zinserhöhungen und aktuellen Dollarstärke für möglich hält. Auch …

Read More »

Read More »

Is Political Decentralization the Only Hope for Western Civilization?

A couple of recent articles have once more made the case, at least implicitly, for political decentralization as the only viable path which will begin to solve the seemingly insurmountable political, economic, and social crises which the Western world now faces.

Read More »

Read More »