See the introduction and the video for the terms gold basis, co-basis, backwardation and contango.

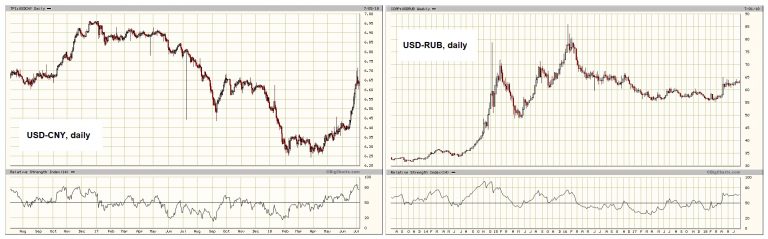

Race to the BottomLast week the price of gold fell $17, and that of silver $0.30. Why? We can tell you about the fundamentals. We can show charts of the basis. But we can’t get into the heads of the sellers. We can say that in the mainstream view, the dollar is rising. The dollar, in their view, is not measured in gold but in rupees in yuan and rubles. You know, all the superior forms of money… OK, all joking aside, the reality is that most currencies are falling. Which means the people in most countries are getting poorer, the capital is getting sucked out. Perhaps those who have gold, to hedge against the risk of a rainy day, now feel the water falling onto their faces? Whatever it is, in just over two months the price of gold has dropped $100. And the fundamentals of gold have softened right along with the price. |

Yuan and Ruble |

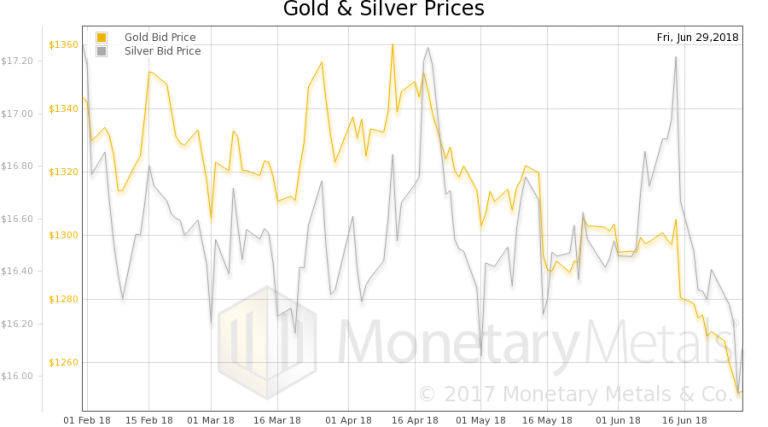

Fundamental DevelopmentsSo whither the price of gold next? We will provide a picture of the changing gold and silver fundamentals. But first, here is the chart of the prices of gold and silver. |

Gold and Silver Prices(see more posts on gold price, silver price, ) |

Gold: Silver RatioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). It went up a bit last week. |

Gold: Silver Ratio(see more posts on gold silver ratio, ) |

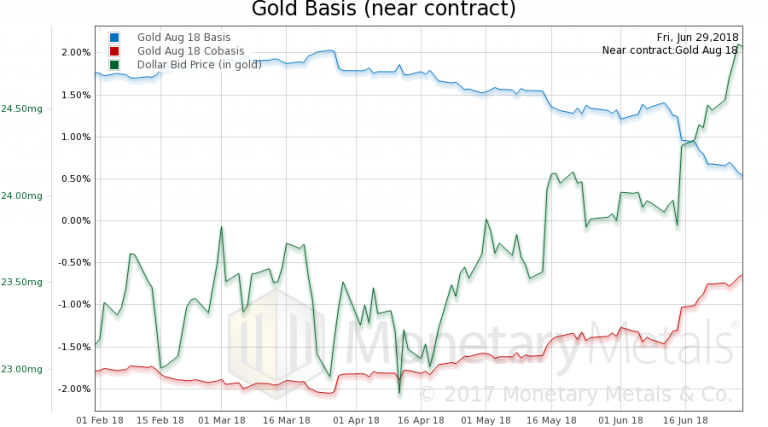

Gold Basis and Co-basis and Dollar PriceHere is the gold graph showing gold basis, co-basis and the price of the dollar in terms of gold price. Yeah, gold looks like it became a bit scarcer, with a rise of about 10 bps in the August co-basis. But the August contract is starting to come under pressure due to the roll. Farther contracts show a small rise in abundance. This drop in price is induced by the selling of physical metal. Unsurprisingly, the Monetary Metals Gold Fundamental Price fell another $26 this week to $1,298. What else would you expect it to do if the price drops and the metal becomes more abundant? |

Gold Basis and Co-basis and Dollar Price(see more posts on dollar price, gold basis, Gold co-basis, ) |

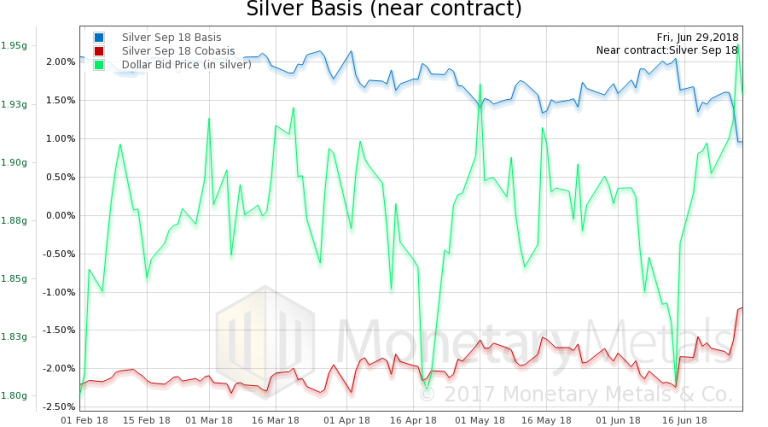

Silver Basis and Co-basis and the Dollar PriceNow let’s look at silver. The price drop in silver may have been a bit larger, but the move of the basis both near and farther out show a rise in scarcity of this metal. The Monetary Metals Silver Fundamental Price rose 41 cents, just about where it was a week prior at $17.46. This should be interesting to watch. Typically, the prices of both metals move together, with silver moving farther to both extremes. But if the gold fundamental price keeps dropping and the silver fundamental price rises, well, there are exceptions to every rule. |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

© 2018 Monetary Metals

Charts by: BigCharts, Monetary Metals

Chart and image captions by PT

Full story here Are you the author? Previous post See more for Next postTags: Basic Reports,capital destruction,Chart Update,dollar price,Gold,gold basis,gold bond,Gold co-basis,gold price,gold silver ratio,newslettersent,Precious Metals,silver,silver basis,Silver co-basis,silver price,yield