Tag Archive: Basic Reports

Gold Outlook 2024 Brief

This is a brief preview of our annual Gold Outlook Report. Every year we take an in-depth look at the market dynamics and drivers and finally, give our predictions for gold and silver prices over the coming year.

Read More »

Read More »

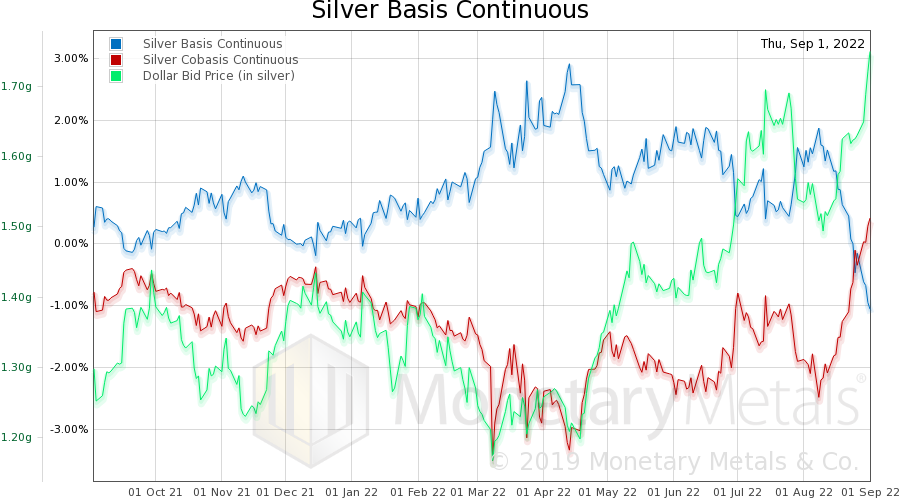

Silver Fever, or Silver Fading?

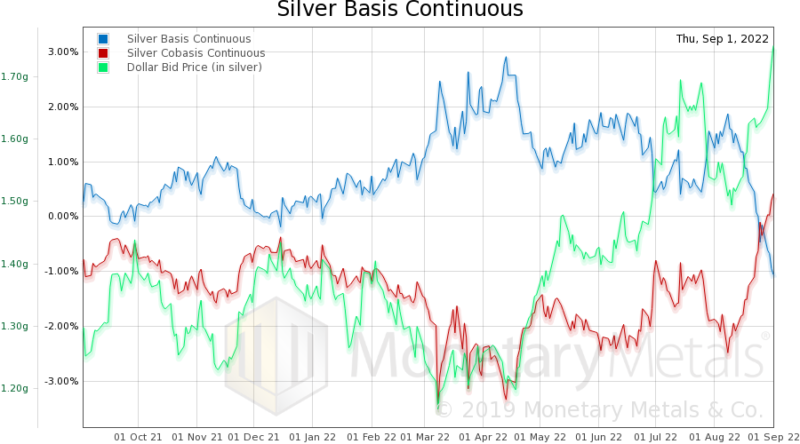

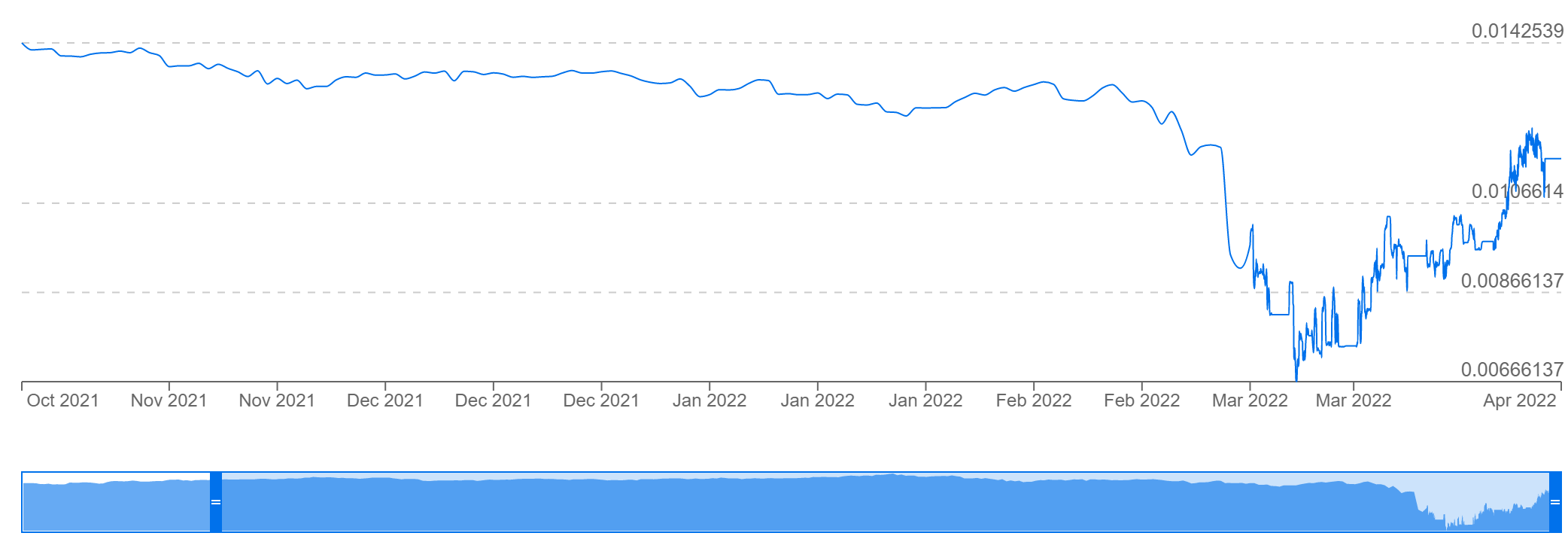

We finally had a resolution, of sorts, in silver. Since April 13, we have had a falling price of silver (indicated as a rising price of the dollar, as measured in silver). And along with this price trend, a growing scarcity of the metal to the market (i.e. the cobasis, the red line). Indeed, the price (of the dollar) and silver scarcity move with uncanny coordination. Almost as if they are linked.

Read More »

Read More »

Silver Update: Scarcity Gets More Extreme

Since our last silver article, the price of silver has dropped. With due respect to Frederic Bastiat, the price is the seen. The basis mostly goes unseen. We will take a look at the market data, revised for a few more days of trading.

Read More »

Read More »

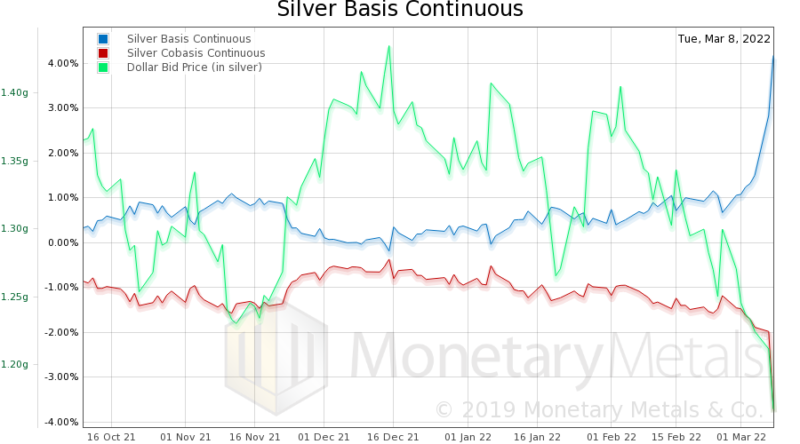

The Silver Phoenix Market

Listen to the audio version of this article here.

The price of silver hit a peak over $26.50 on March 8. It spent about a month and a half breaking down, and then the bottom fell out. It’s currently down from that peak almost 8 bucks.

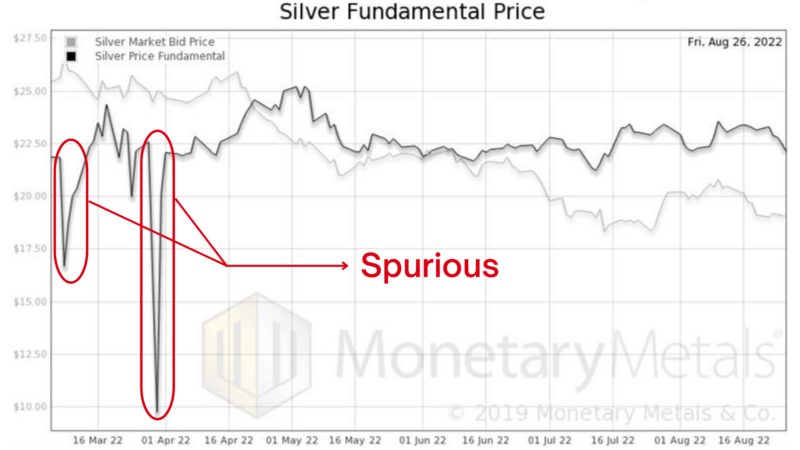

Breaking Down Fundamental Silver Prices

However, the opposite has been happening to silver’s scarcity. First, let’s look at a chart of the silver market price and the silver fundamental price.

Read More »

Read More »

Buy Gold, Because…

It’s pretty, isn’t it? Gold, Liquid Gold, and Inflation. Gold has a unique appearance. It is also astonishingly heavy—much heavier than it has any right to be. It’s just an inch and a quarter in diameter yet weighs 0.075 pounds. Everyone should hold one in his hand (and own a few).

Read More »

Read More »

What the Heck Is Happening to Silver?!

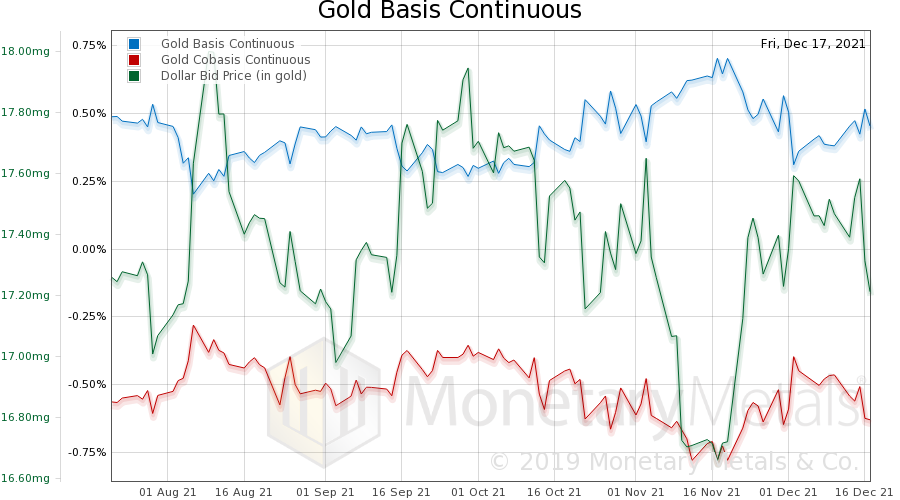

The dollar rose this week, from 17.87mg gold to 18.24mg (that’s “gold fell from $1,740 to $1,705” in DollarSpeak), a gain of 2.1%. In silver terms, it rose from 1.61g to 1.67g (in DollarSpeak, “silver dropped from $19.24 to $18.64), or 3.7%.

As always, we want to look past the market price action. Two explanations are hot today. Let’s look at them first, before moving on to our unique analysis of the basis.

Read More »

Read More »

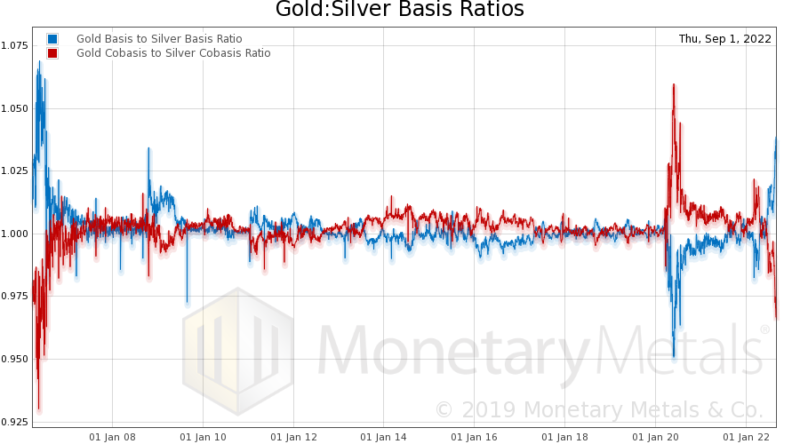

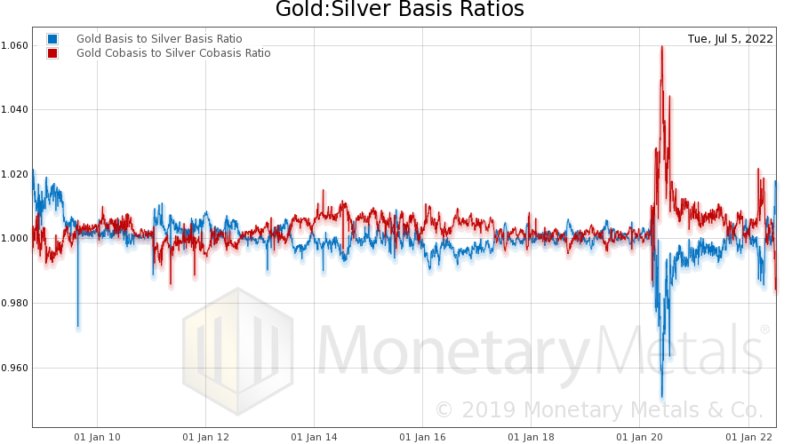

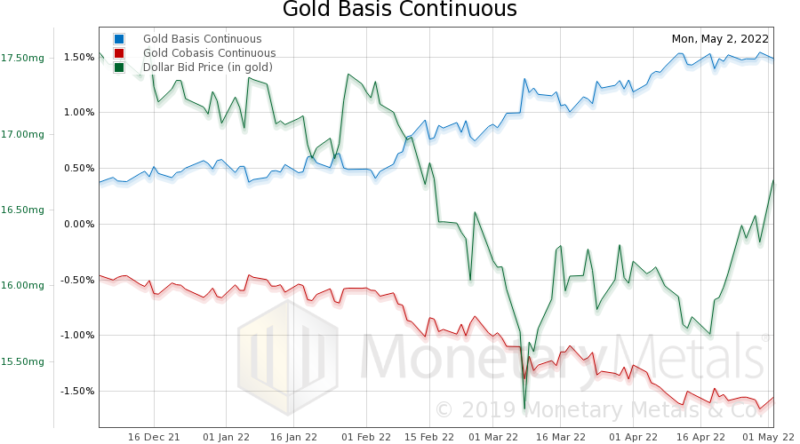

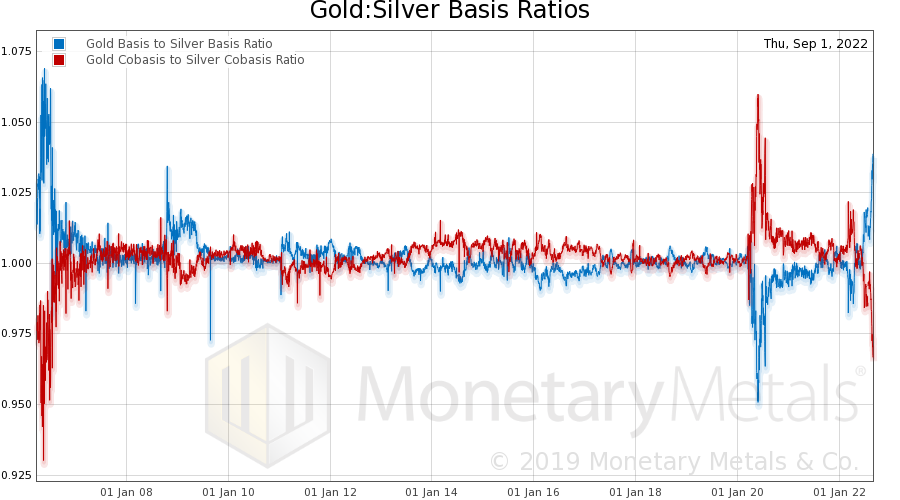

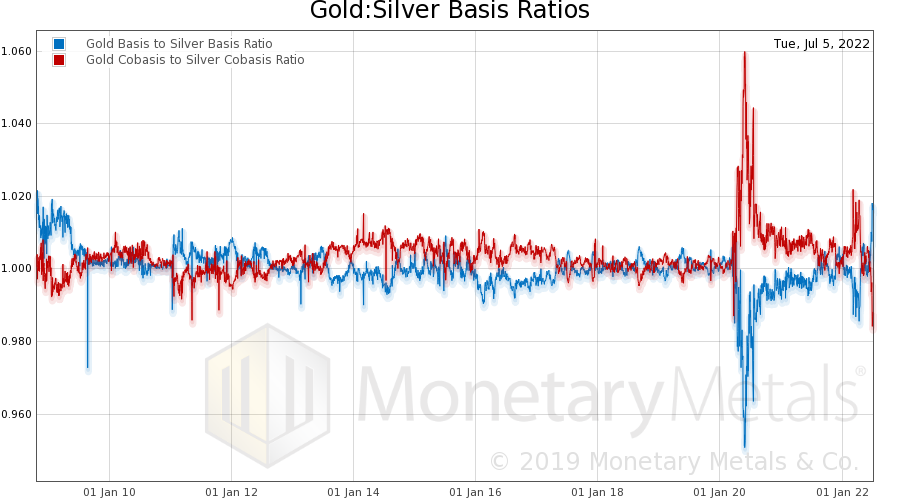

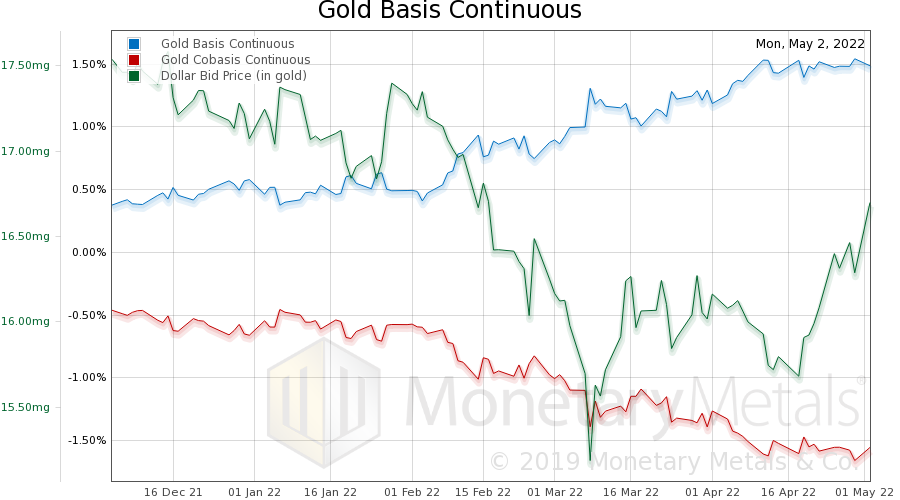

Rare Gold-Silver Crystal Sighting

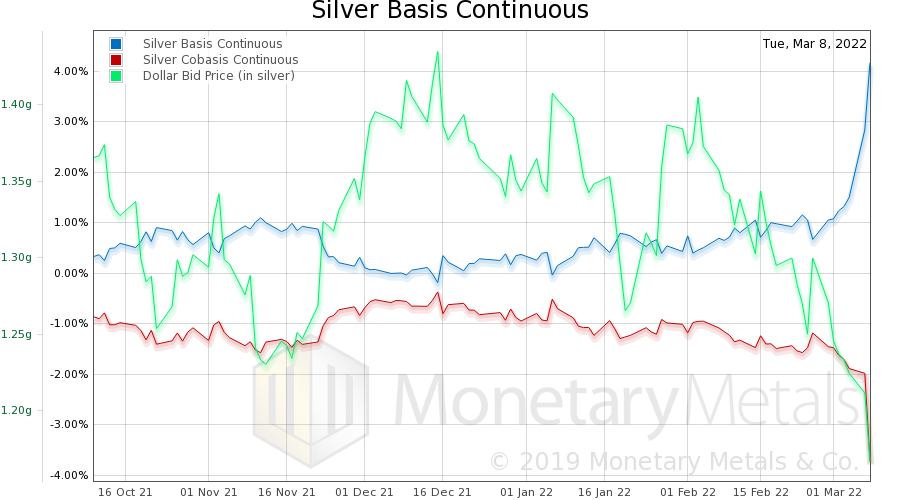

Something has happened which has not occurred since 2009. The silver basis—our measure of abundance of the metal to the market—has gone way under the gold basis. This means silver is less abundant to the market than gold. Here is the picture.

Read More »

Read More »

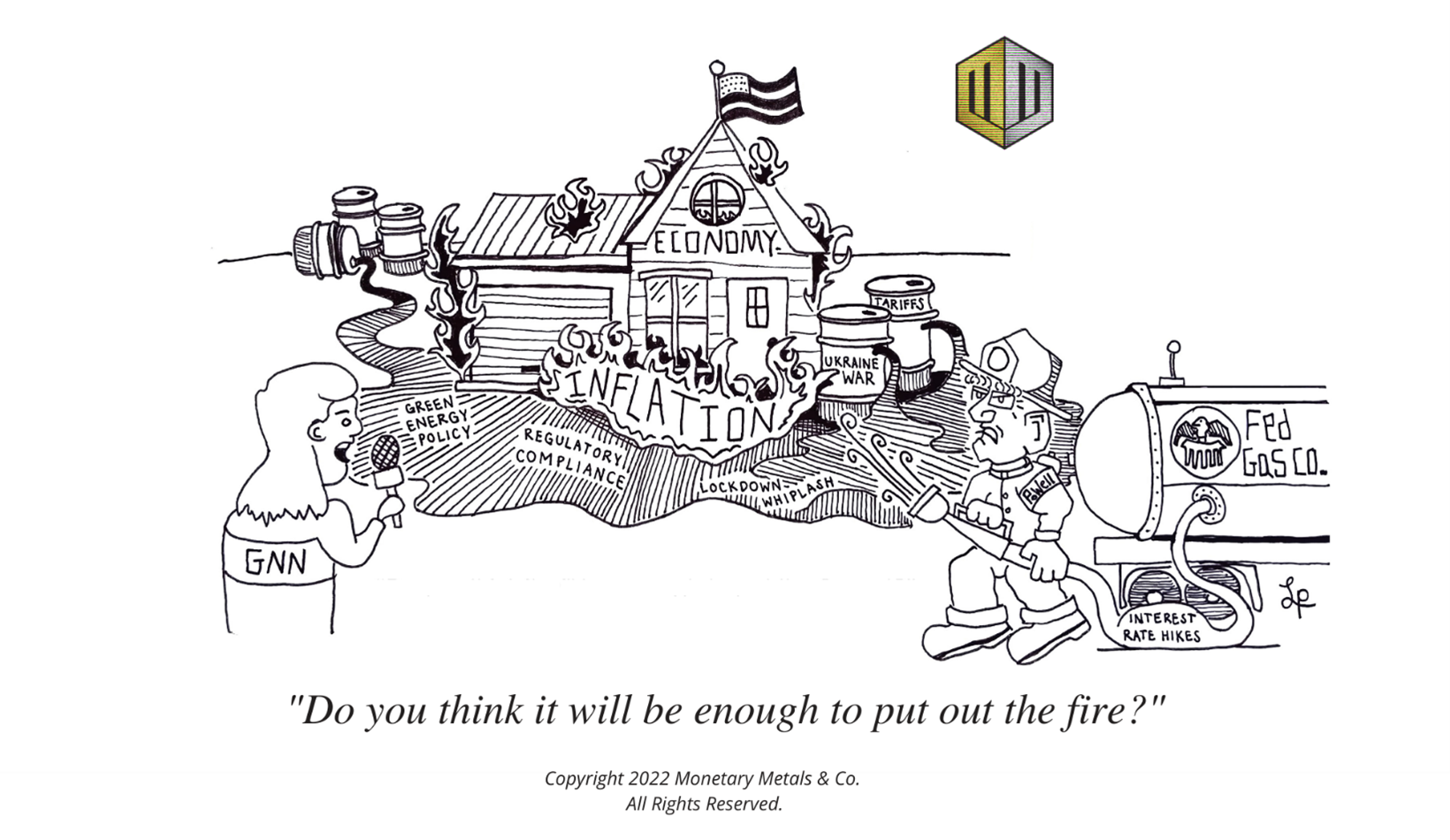

Will Interest Rate Hikes Fix Inflation?

Senator Elizabeth Warren and President Joe Biden claim that inflation[i] is caused by greedy corporations. And they propose to solve this problem by making the corporations pay. Whether it’s extracting a “windfall profits” tax, crushing them under even more regulation, or attacking them with antitrust enforcement, the idea is the same.

Read More »

Read More »

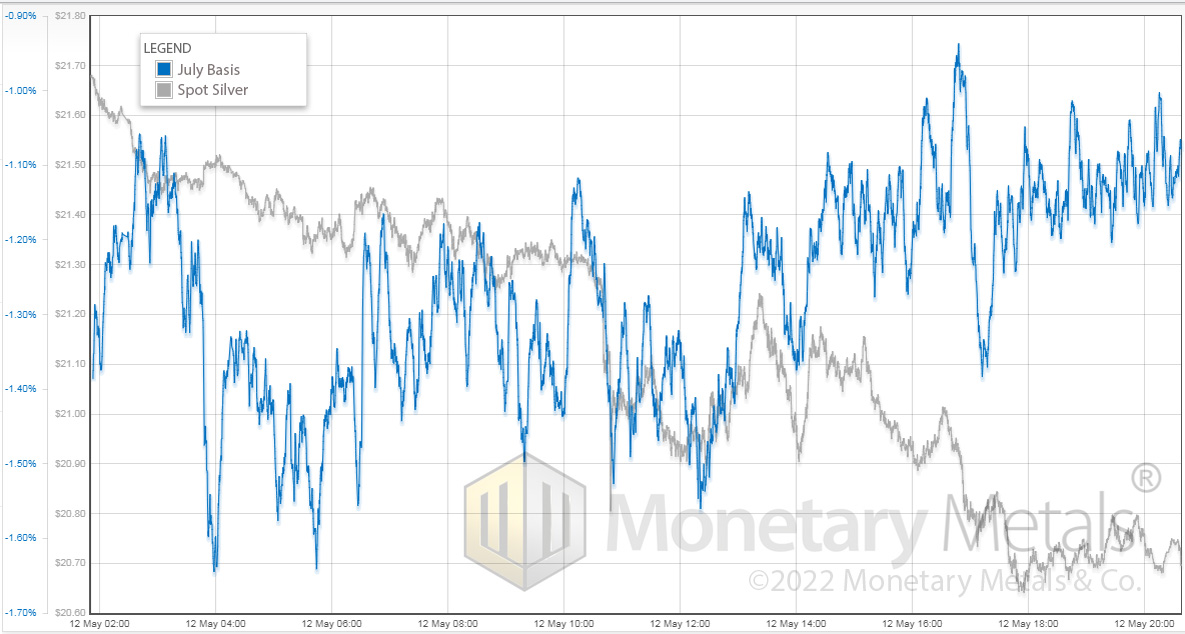

The Silver Chart THEY Don’t Want You to See!

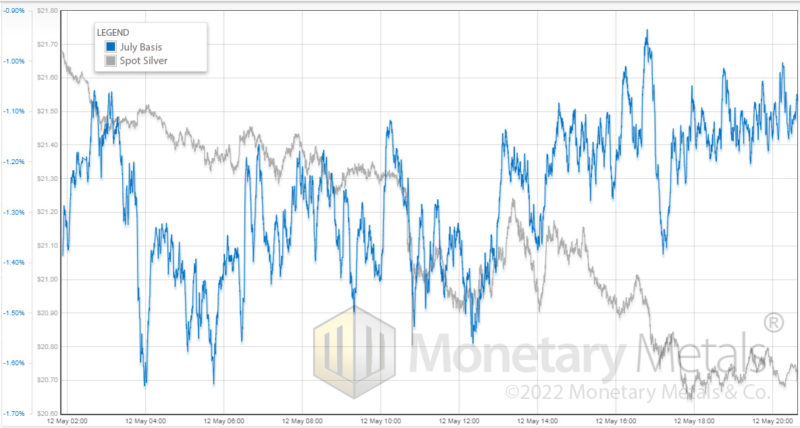

On Thursday May 12, the price of silver fell about a buck. As with every one of these big price moves, the question is: what really happened? Below is a chart of the day’s action, with price overlaid with basis. Basis = future – spot. It is a great (i.e. the only) indicator of abundance or scarcity of metal to the market.

Read More »

Read More »

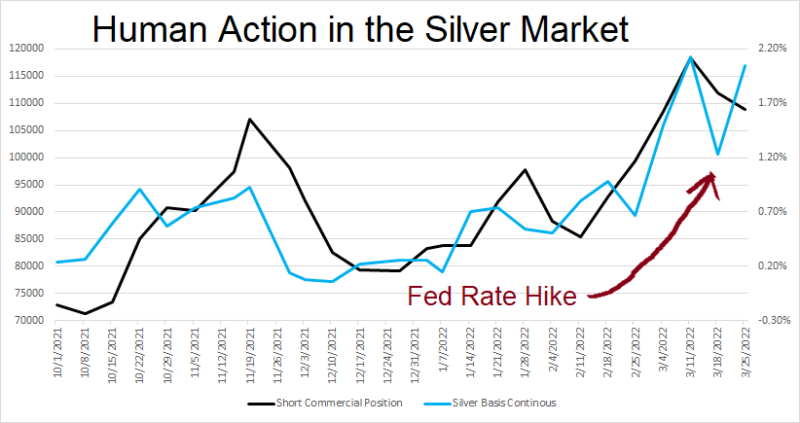

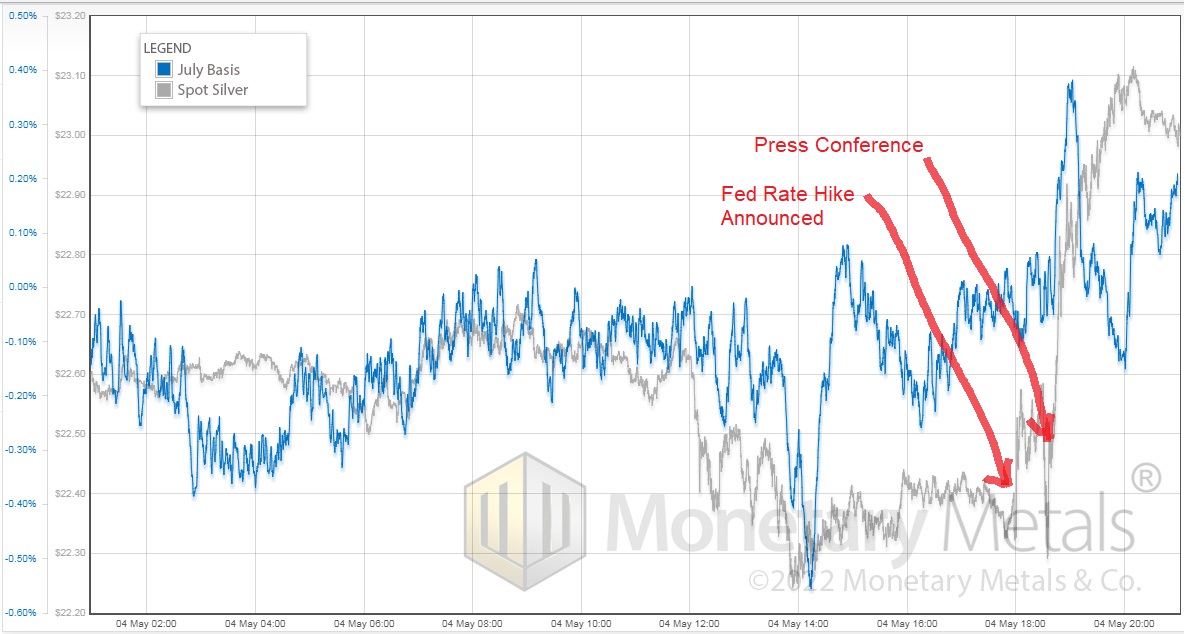

Forensic Analysis of Fed Action on Silver Price

The last few days of trading in silver have been a wild ride.

On Wednesday morning in New York, six hours before the Fed was to announce its interest rate hike, the price of silver began to drop. It went from around $22.65 to a low of $22.25 before recovering about 20 cents.

At 2pm (NY time), the Fed made the announcement. The price had already begun spiking higher for about two minutes.

As an aside, we wonder a bit about how they keep...

Read More »

Read More »

Time for a Silver Trade?

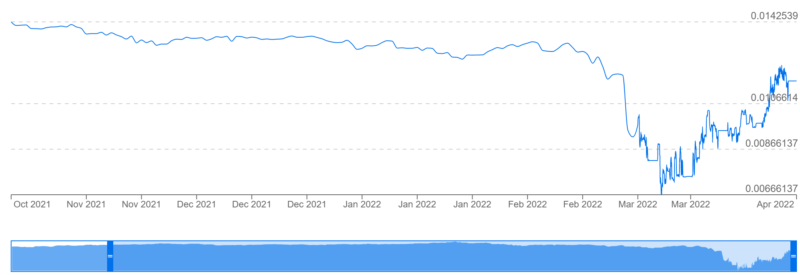

The price of silver has been going down, and then down some more. From over $28 a year ago, and over $26.50 a month ago, it’s now at a new low under $22.50. Four bucks down in a month.

Read More »

Read More »

Oil, the Ruble and Gold Walk into a Bar…Part III

Part III – Gold Standards, the good, the bad, and the ugly. Gresham’s law and gold. Is it even possible to return to a gold standard today? Is Russia leading the push, or do we need something else?

Read More »

Read More »

Oil, the Ruble, and Gold Walk into a Bar…

Part I – Unpacking the narrative of how Russia is going to change the global monetary system. There is a Narrative about Russia and how it will change the monetary system. Many analysts in the gold community are promoting this story. There’s just one problem with this Narrative. It is like how Michael Crighton described the Gell-Mann Amnesia Effect, stating that the newspaper is full of stories explaining how “wet streets cause rain.”

Read More »

Read More »

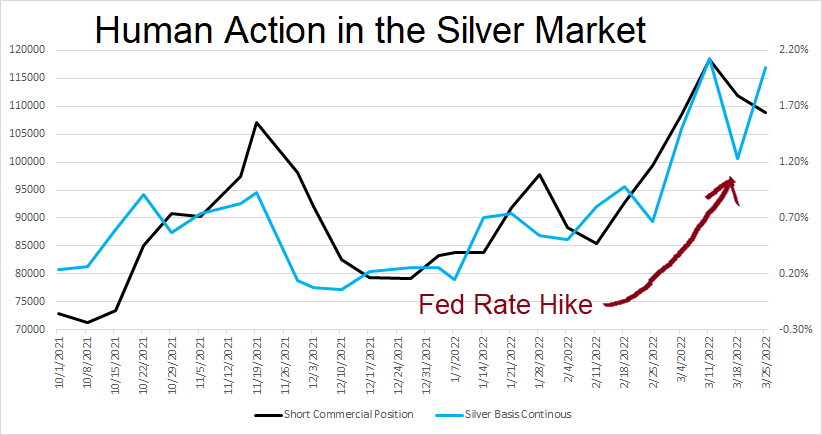

Human Action in the Silver Market

We have recently seen an increase in social media posts about the big increase in short positions by the bullion banks. What would motivate them to short a commodity during this period of inflation, much less a monetary metal when central banks are printing money with reckless abandon? And doesn’t their shorting of silver push down the price?

Read More »

Read More »

This is Not The Silver Breakout You’re Looking For!

Every once in a while, one regrets not acting sooner, or not acting soon enough. In our case, we did not publish this Tuesday evening. We should have. Today the price is down, and others may also call for lower silver prices.

Read More »

Read More »

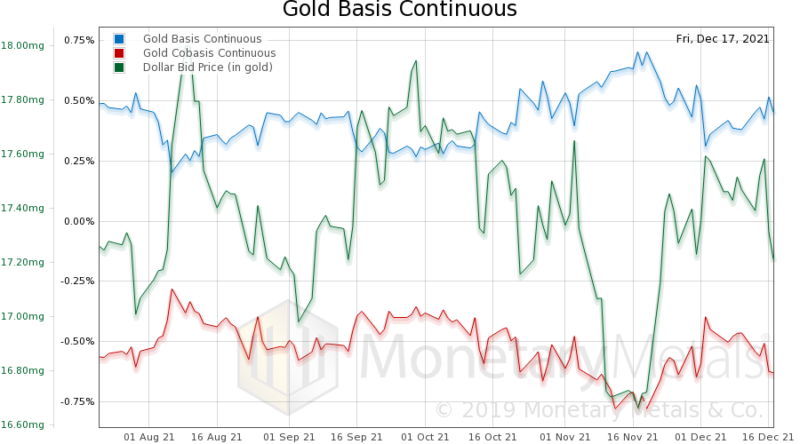

Inflation and Gold: What Gives?

Listen to the audio version of this article here! In the last Supply and Demand update, we discussed some different theories which attempt to explain what causes the gold and silver prices to move. We mentioned the: “…attempt to hold up a famous buyer of metal, while ignoring the thousands of not-famous sellers who sold the metal to said famous buyer.”

Read More »

Read More »

What’s In Your Loan?

“Real estate is the future of the monetary system,” declares a real estate bug. Does this make any sense? We would ask him this. “OK how will houses be borrowed and lent?” “Look at this housing bond,” he says, pointing to a bond denominated in dollars, with principal and interest paid in dollars.

Read More »

Read More »

Perversity Thy Name is Dollar

Breaking Down the Dollar Monetary System If you ask most people, “what is money?” they will answer that money is the generally accepted medium of exchange. If you ask Google Images, it will show you many pictures of green pieces of paper. Virtually everyone agrees that money means the dollar.

Read More »

Read More »

Rising Fundamentals of Gold and Silver

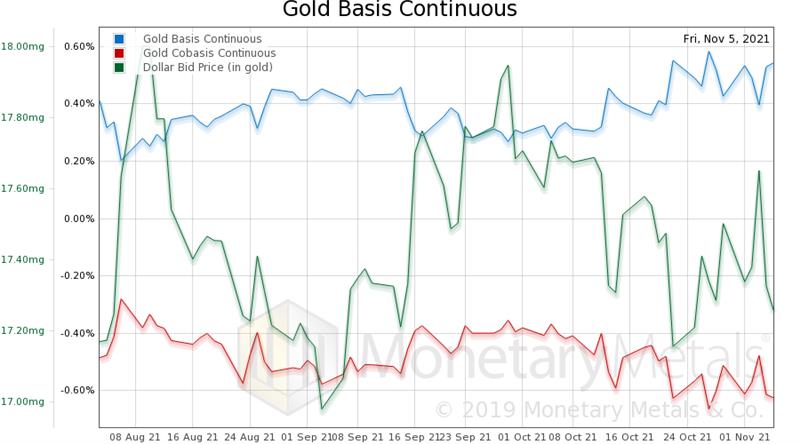

Prices move up and down, in the restless churn of our irredeemable monetary system. There are several schools of thought whose theories attempt to describe, if not predict, the next price move.

Read More »

Read More »

Why a Yield on Gold Matters

Picture, if you can, a world in which gold circulates as the medium of exchange. People pay for everything, from groceries to rent, in gold. Employers pay wages in gold. Productive enterprises borrow gold to finance everything from food production to constructing apartment buildings. In other words, picture a world where there’s abundant opportunities to earn a yield on gold and finance productive businesses in gold.

Read More »

Read More »

Donate to SNBCHF.com

Donate to SNBCHF.com Via Paypal or Bitcoin To Help Keep the Site Running

Please consider making a small donation to Snbchf.com. Thanks

Bitcoin wallet: bc1qa2h6hgd0xkuh7xh02jm5x25k6x8g7548ffaj3j

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

USD/CHF gains ground near 0.8850, potential upside seems limited

9 days ago -

USD/CHF holds below 0.8950 amid Middle East geopolitical risks

2024-06-25 -

SNB Sight Deposits: increased by 2.4 billion francs compared to the previous week

5 days ago -

SNB Surprises the Market (Again)

2024-06-20 -

USD/CHF appreciates to near 0.8950 due to hawkish Fed, SNB Financial Stability Report eyed

2024-06-13

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: increased by 2.4 billion francs compared to the previous week

5 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Canada’s “Worst Decline in 40 Years”

Canada’s “Worst Decline in 40 Years” -

No exceptions, please!

-

#517 Wie viel ist dein Immobilienfonds noch wert? #fonds

#517 Wie viel ist dein Immobilienfonds noch wert? #fonds -

Roboter – KI und Verdrängung des Menschen

Roboter – KI und Verdrängung des Menschen -

El Legado de Biden es PEOR de lo que Parece…

El Legado de Biden es PEOR de lo que Parece… -

Kamala’s Palace Coup

-

How to Invest in High Safety Corporate Bonds

How to Invest in High Safety Corporate Bonds -

7-26-24 Should You Tap Your Home Equity for Retirement Income?

7-26-24 Should You Tap Your Home Equity for Retirement Income? -

UBS questioned by US Senator over $350 million tax evasion case

UBS questioned by US Senator over $350 million tax evasion case -

Lanz: Das Allein “beseitigt” keine AfD Wähler!

Lanz: Das Allein “beseitigt” keine AfD Wähler!

More from this category

Gold Outlook 2024 Brief

Gold Outlook 2024 Brief12 Mar 2024

Silver Fever, or Silver Fading?

Silver Fever, or Silver Fading?16 Sep 2022

Silver Update: Scarcity Gets More Extreme

Silver Update: Scarcity Gets More Extreme5 Sep 2022

The Silver Phoenix Market

The Silver Phoenix Market2 Sep 2022

Buy Gold, Because…

Buy Gold, Because…11 Aug 2022

What the Heck Is Happening to Silver?!

What the Heck Is Happening to Silver?!20 Jul 2022

Rare Gold-Silver Crystal Sighting

Rare Gold-Silver Crystal Sighting8 Jul 2022

Will Interest Rate Hikes Fix Inflation?

Will Interest Rate Hikes Fix Inflation?19 Jun 2022

The Silver Chart THEY Don’t Want You to See!

The Silver Chart THEY Don’t Want You to See!16 May 2022

Forensic Analysis of Fed Action on Silver Price

Forensic Analysis of Fed Action on Silver Price9 May 2022

Time for a Silver Trade?

Time for a Silver Trade?4 May 2022

Oil, the Ruble and Gold Walk into a Bar…Part III

Oil, the Ruble and Gold Walk into a Bar…Part III 12 Apr 2022

Oil, the Ruble, and Gold Walk into a Bar…

Oil, the Ruble, and Gold Walk into a Bar… 5 Apr 2022

Human Action in the Silver Market

Human Action in the Silver Market29 Mar 2022

This is Not The Silver Breakout You’re Looking For!

This is Not The Silver Breakout You’re Looking For!10 Mar 2022

Inflation and Gold: What Gives?

Inflation and Gold: What Gives?21 Dec 2021

What’s In Your Loan?

What’s In Your Loan?23 Nov 2021

Perversity Thy Name is Dollar

Perversity Thy Name is Dollar16 Nov 2021

Rising Fundamentals of Gold and Silver

Rising Fundamentals of Gold and Silver10 Nov 2021

Why a Yield on Gold Matters

Why a Yield on Gold Matters3 Nov 2021