Tag Archive: Basic Reports

Socialism and Gold

Most people assume that the central bank prints money when it buys bonds. They further assume that this increase in the quantity of money causes an increase in the general price level. And, this leads them to assume that the value of the money is 1 / P (P is the general price level). Therefore, when the central bank prints money to buy bonds, it is diluting the value of the money held by everyone—in proportion to the amount printed divided by the...

Read More »

Read More »

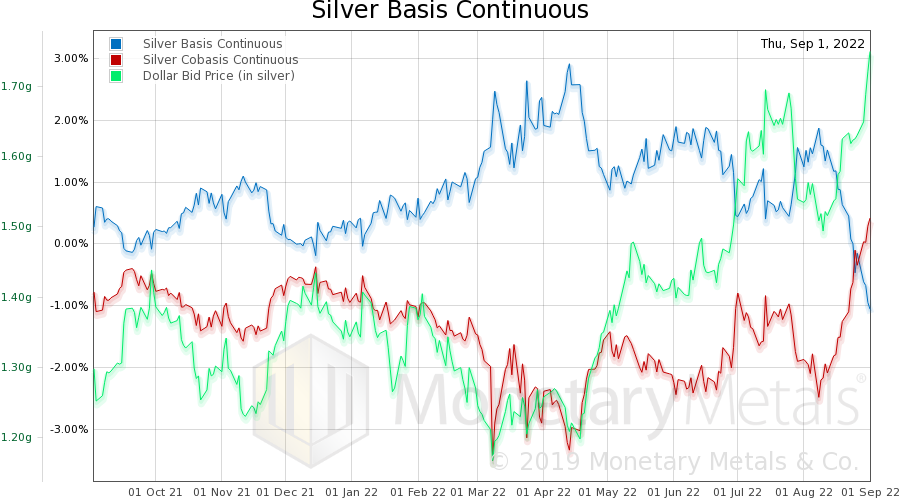

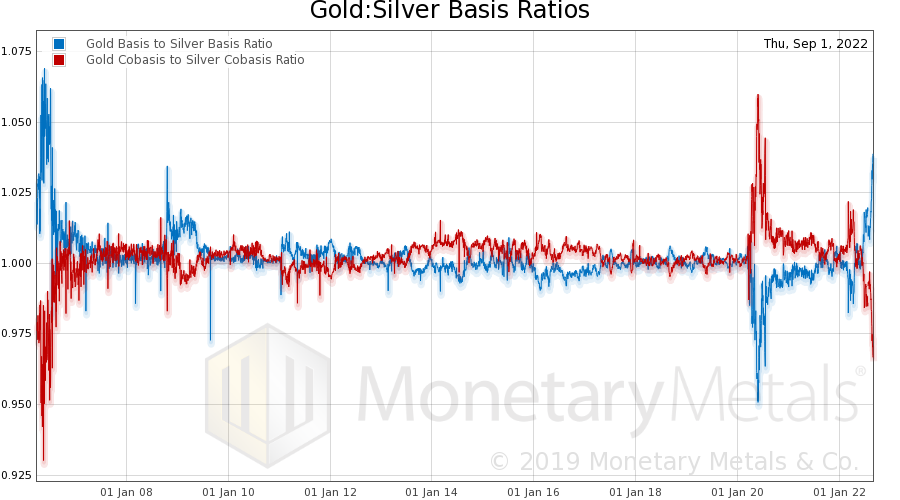

Silver Backwardation Returns, Gold and Silver Market Report 2 March

The big news this week was the drop in the prices of the metals (though we believe that it is the dollar which is going up), $57 and $1.81 respectively. Of course, when the price drops the injured goldbugs come out. We have written the authoritative debunking of the gold and silver price suppression conspiracy here. We provide both the scientific theory and the data.

Read More »

Read More »

Widening Bid-Ask Spreads, Gold and Silver Market Report 17 February

The price of gold rose $14 and the price of silver fell $0.07. The gold-silver ratio rose further with this price action. Welcome to our new Gold and Silver Market Report, or “Market Report” for short. We are separating this from the economics essay, which was attached for many years. As they used to say in many toy commercials of yore, “batteries sold separately”—or in this case essays.

Read More »

Read More »

Monetary Metals Gold Brief 2020

We apologize for not posting articles during January. We have been busy, and going forward will publish a separate Market Report every Monday morning plus macroeconomics essays later in the week, as time permits.

Read More »

Read More »

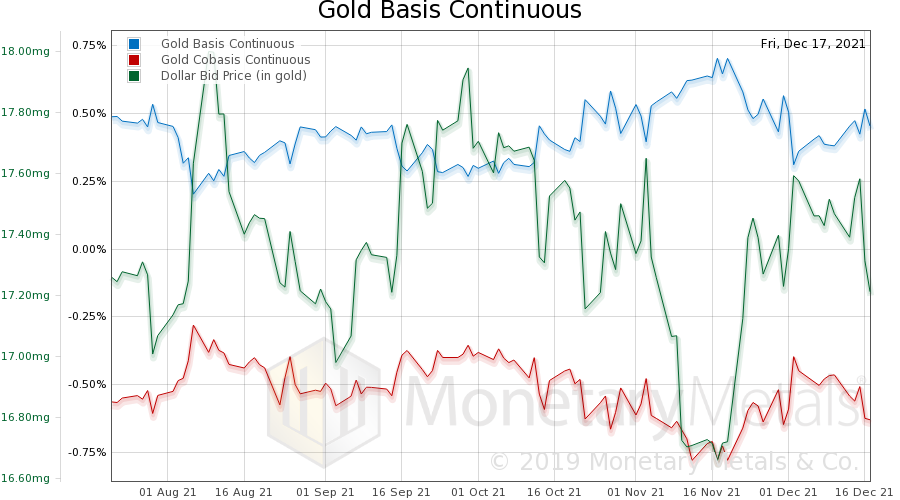

Open Letter to John Taft, Report 17 Dec

Dear Mr. Taft: I eagerly read your piece Warriors for Opportunity on Wednesday, as I often do about pieces that argue that capitalism is not working today. You begin by saying: “Financial capitalism – free markets powered by a robust financial system – is the dominant economic model in the world today. Yet many who have benefited from the system agree it’s not working the way it ought to.”

Read More »

Read More »

The End of an Epoch, Report 8 Dec

“There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.”

Read More »

Read More »

Money and Prices Are a Dynamic System, Report 1 Dec

The basic idea behind the Quantity Theory of Money could be stated as: too much money supply is chasing too little goods supply, so prices rise. We have debunked this from several angles. For example, we can use a technique that every first year student in physics is expected to know. Dimensional analysis looks at the units on both sides of an equation.

Read More »

Read More »

Raising Rates to Fight Inflation, Report 24 Nov

Physics students study mechanical systems in which pulleys are massless and frictionless. Economics students study monetary systems in which rising prices are everywhere and always caused by rising quantity of currency. There is a similarity between this pair of assumptions. Both are facile. They oversimplify reality, and if one is not careful they can lead to spectacularly wrong conclusions.

Read More »

Read More »

The Perversity of Negative Interest, Report 17 Nov

Today, we want to say two things about negative interest rates. The first is really simple. Anyone who believes in a theory of interest that says “the savers demand interest to compensate for inflation” needs to ask if this explains negative interest in Switzerland, Europe, and other countries. If not, then we need a new theory (Keith just presented his theory at the Austrian Economics conference at King Juan Carlos University in Madrid—it is...

Read More »

Read More »

What’s the Price of Gold in the Gold Standard, Report 10 Nov

Let’s revisit a point that came up in passing, in the Silver Doctors’ interview of Keith. At around 35:45, he begins a question about weights and measures, and references the Coinage Act of 1792. This raises an interesting set of issues, and we have encountered much confusion (including from one PhD economist whose dissertation committee was headed by Milton Friedman himself).

Read More »

Read More »

Targeting nGDP Targeting, Report 3 Nov

Not too long ago, we wrote about the so called Modern Monetary so called Theory (MMT). It is not modern, and it is not a theory. We called it a cargo cult. You’d think that everyone would know that donning fake headphones made of coconut shells, and waving tiki torches will not summon airplanes loaded with cargo. At least the people who believe in this have the excuse of being illiterate.

Read More »

Read More »

Bitcoin Myths, Report 27 Oct

Keith gave a keynote address—the only speaker with an hour to cover his topic—at the Gold and Alternative Investments Conference in Sydney on Saturday. Said topic was the nature of money.

“Money is a matter of functions four: a medium, a measure, a standard, a store.”

Read More »

Read More »

Wealth Accumulation Is Becoming Impossible, Report 20 Oct

We talk a lot about the falling interest rate, the too-low interest rate, the near-zero interest rate, the zero interest rate, and the negative interest rate. Hat Tip to Switzerland, where Credit Suisse is now going to pay depositors -0.85%. That is, if you lend your francs to this bank, they take some of them every year. Almost 1% of them.

Read More »

Read More »

Motte and Bailey Fallacy, Report 13 Oct

This week, we will delve into something really abstract. Not like monetary economics, which is so simple even a caveman can do it. We refer to a clever rhetorical trick. It’s when someone makes a broad and important assertion, in very general terms. But when challenged, the assertion is switched for one that is entirely uncontroversial but also narrow and unimportant.

Read More »

Read More »

A Wealth Tax Consumes Capital, Report 6 Oct

It seems one cannot make a name for one’s self on the Left, unless one has a proposal to tax wealth. Academics like Tomas Piketty have proposed it. And now the Democratic candidates for president in the US propose it too, while Jeremy Corbyn proposes it in the UK. Venezuela finally added a wealth tax in July.

Read More »

Read More »

The Purchasing Power of Capital, Report 29 Sep

We discuss capital consumption all the time, because it is the megatrend of our era. However, capital consumption is an abstract idea. So let’s consider some concrete examples, to help make it clearer. First, let’s look at the case of Timothy Housetrader. Tim has a small two-bedroom house. Next door, his neighbor Ian Idjit, owns a four-bedroom house which is twice the size.

Read More »

Read More »

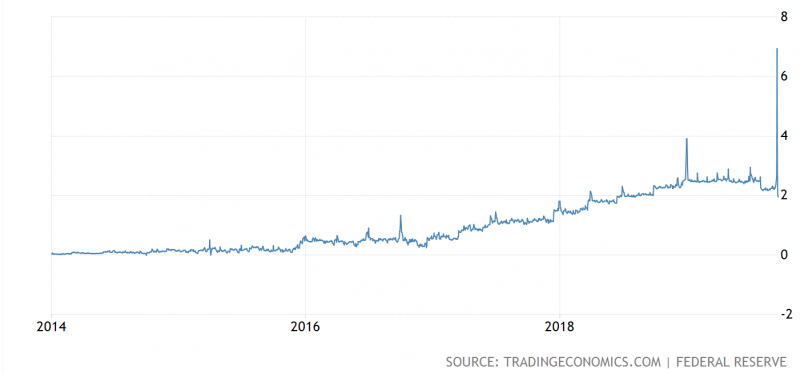

Treasury Bond Backwardation, Report 22 Sep

Something happened in the credit market this week. A Barron’s article about it began: “There have been disruptions in the plumbing of U.S. markets this week. While the process of fixing them was bumpy, it was more of a technical mishap than a cause for investor concern.” Keep Calm and Carry On. So, before they tell us what happened, they tell us it’s just plumbing, it’s been fixed, and that we should not be concerned.

Read More »

Read More »

Why Are People Now Selling Their Silver? Report 15 Sep

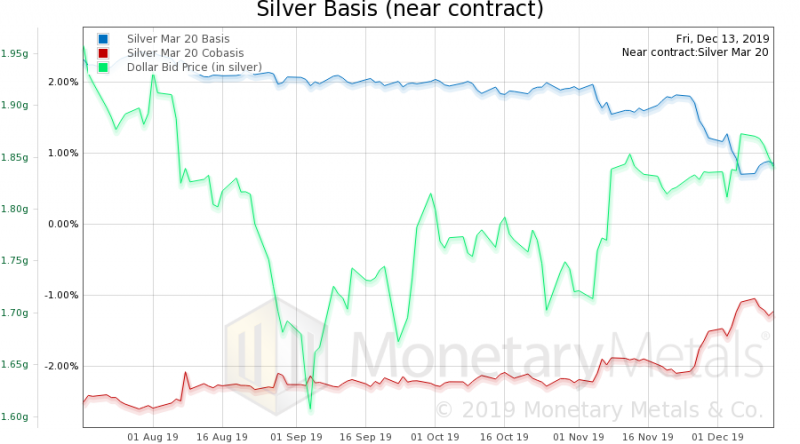

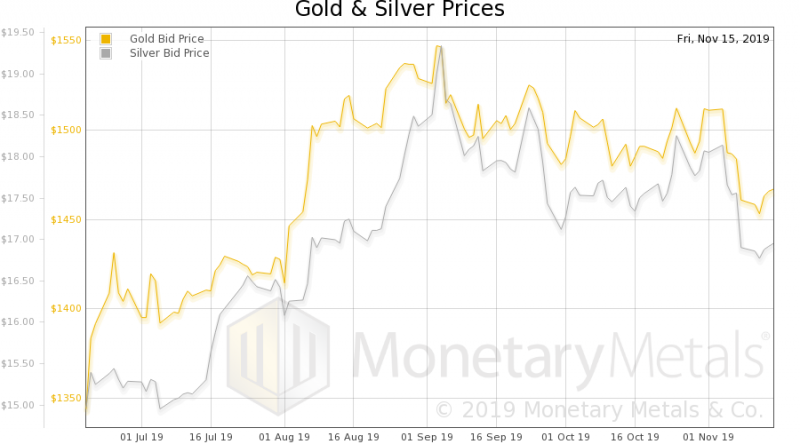

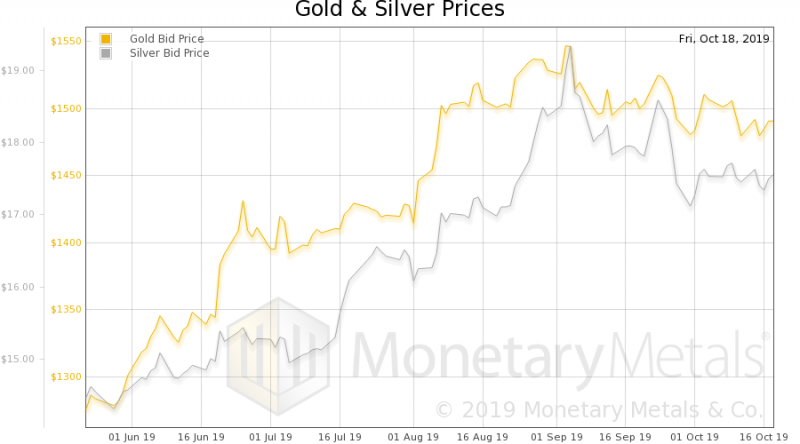

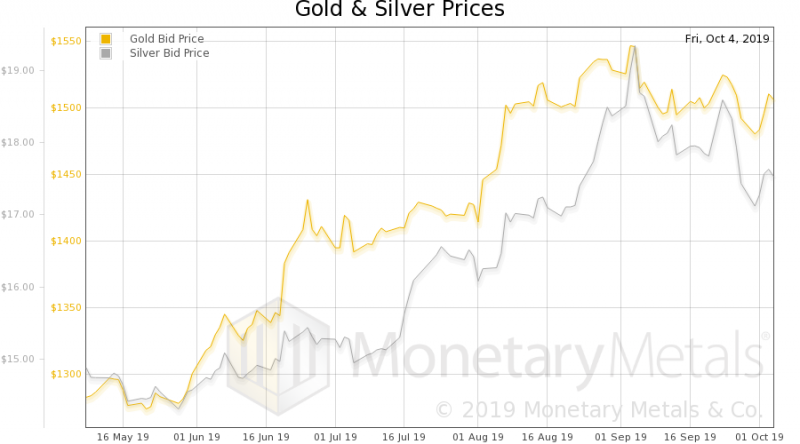

This week, the prices of the metals fell further, with gold -$18 and silver -$0.73. On May 28, the price of silver hit its nadir, of $14.30. From the last three days of May through Sep 4, the price rose to $19.65. This was a gain of $5.35, or +37%. Congratulations to everyone who bought silver on May 28 and who sold it on Sep 4.

Read More »

Read More »

How Is Negative Interest Possible? Report 8 Sep

Germany has recently joined Switzerland in the dubious All Negative Club. The interest rate on every government bond, from short to 30 years, is now negative. Many would say “congratulations”, in the belief that this proves their credit risk is … well … umm … negative(?) And anyways, it will let them borrow more to spend on consumption which will stimulate … umm… well… all of the wasteful consumption for which governments are rightly...

Read More »

Read More »

Asset Inflation vs. Consumer Goods Inflation, Report 1 Sep

A paradigm is a mental framework. It has a both a positive pressure and a negative filter. It structures one’s thoughts, orients them in a certain direction, and rules out certain ideas. Paradigms can be very useful, for example the scientific method directs one to begin with facts, explain them in a consistent way, and to ignore peyote dreams from the smoke lodge and claims of mental spoon-bending.

Read More »

Read More »

Donate to SNBCHF.com

Donate to SNBCHF.com Via Paypal or Bitcoin To Help Keep the Site Running

Please consider making a small donation to Snbchf.com. Thanks

Bitcoin wallet: bc1qa2h6hgd0xkuh7xh02jm5x25k6x8g7548ffaj3j

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

USD/CHF stays above 0.9100 nearing the highs since October

10 days ago -

SNB Sight Deposits: increased by 17.0 billion francs compared to the previous week

10 days ago -

Pound Sterling falls back as upbeat US Retail Sales strengthen US Dollar

11 days ago -

Canadian Dollar remains vulnerable after strong US Retail Sales

11 days ago -

2024-04-09 – Martin Schlegel: Interest rates and foreign exchange interventions: Achieving price stability in challenging times

17 days ago

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: increased by 17.0 billion francs compared to the previous week

10 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Supergau für Jens Spahn wegen RKI Files!

Supergau für Jens Spahn wegen RKI Files! -

STARKES Umfeld, STARKE Renditen: Ein (Börsen-)Jahr voller Erfolg

STARKES Umfeld, STARKE Renditen: Ein (Börsen-)Jahr voller Erfolg -

The Problem with Microlibertarianism

-

Habeck Files: Die Grüne Kernschmelze!

Habeck Files: Die Grüne Kernschmelze! -

The Danger of the West’s Neglect of Individual Rights

-

Bodemann flippt aus: “Wir brauchen mehr Kontrolle”

Bodemann flippt aus: “Wir brauchen mehr Kontrolle” -

The Evil of War

-

Deutscher General: “Wir arbeiten an Operationsplan Deutschland”

Deutscher General: “Wir arbeiten an Operationsplan Deutschland” -

Abolish the CIA and FBI

-

Wichtige Morning News mit Oliver Klemm #288

Wichtige Morning News mit Oliver Klemm #288

More from this category

Gold Outlook 2024 Brief

Gold Outlook 2024 Brief12 Mar 2024

Silver Fever, or Silver Fading?

Silver Fever, or Silver Fading?16 Sep 2022

Silver Update: Scarcity Gets More Extreme

Silver Update: Scarcity Gets More Extreme5 Sep 2022

The Silver Phoenix Market

The Silver Phoenix Market2 Sep 2022

Buy Gold, Because…

Buy Gold, Because…11 Aug 2022

What the Heck Is Happening to Silver?!

What the Heck Is Happening to Silver?!20 Jul 2022

Rare Gold-Silver Crystal Sighting

Rare Gold-Silver Crystal Sighting8 Jul 2022

Will Interest Rate Hikes Fix Inflation?

Will Interest Rate Hikes Fix Inflation?19 Jun 2022

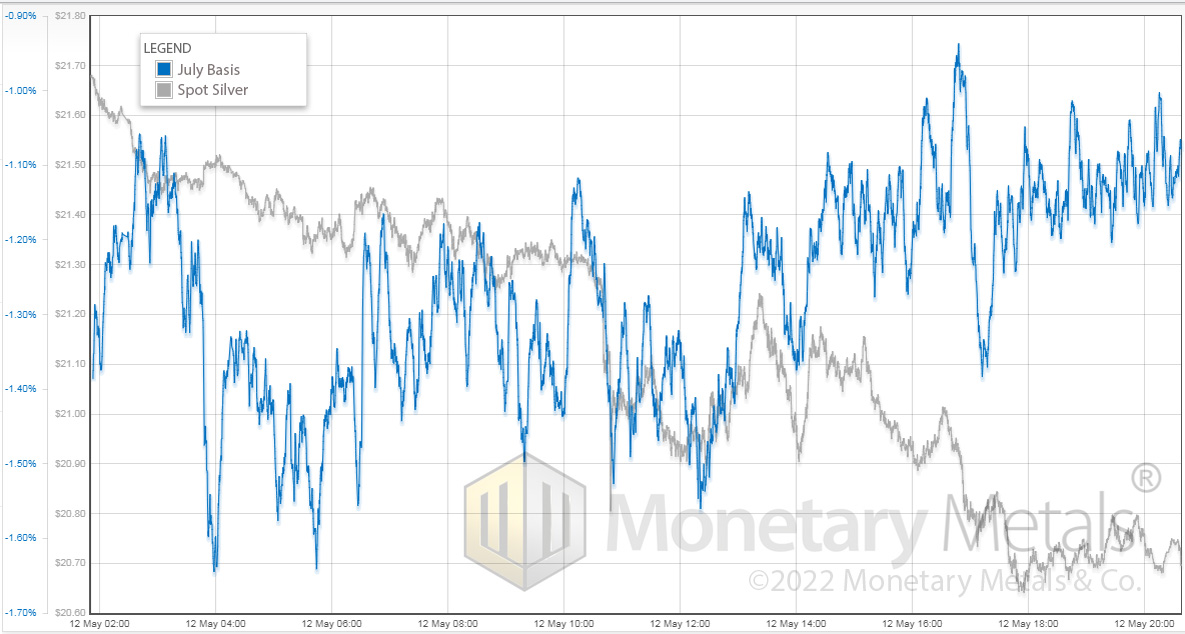

The Silver Chart THEY Don’t Want You to See!

The Silver Chart THEY Don’t Want You to See!16 May 2022

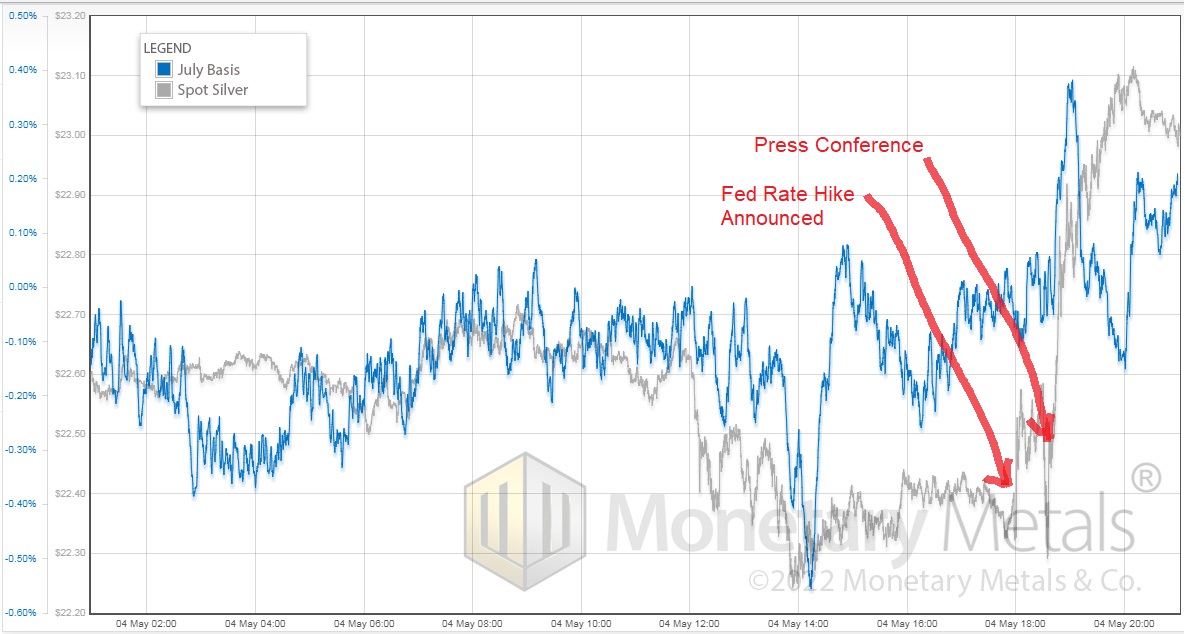

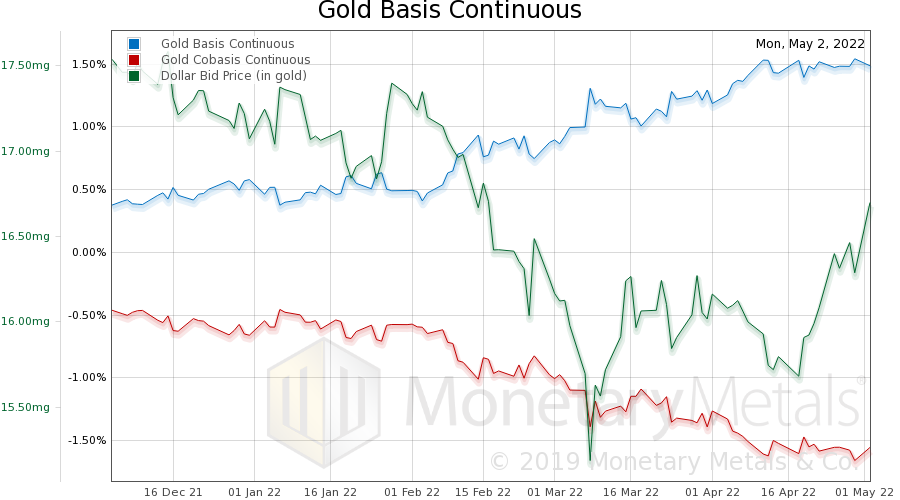

Forensic Analysis of Fed Action on Silver Price

Forensic Analysis of Fed Action on Silver Price9 May 2022

Time for a Silver Trade?

Time for a Silver Trade?4 May 2022

Oil, the Ruble and Gold Walk into a Bar…Part III

Oil, the Ruble and Gold Walk into a Bar…Part III 12 Apr 2022

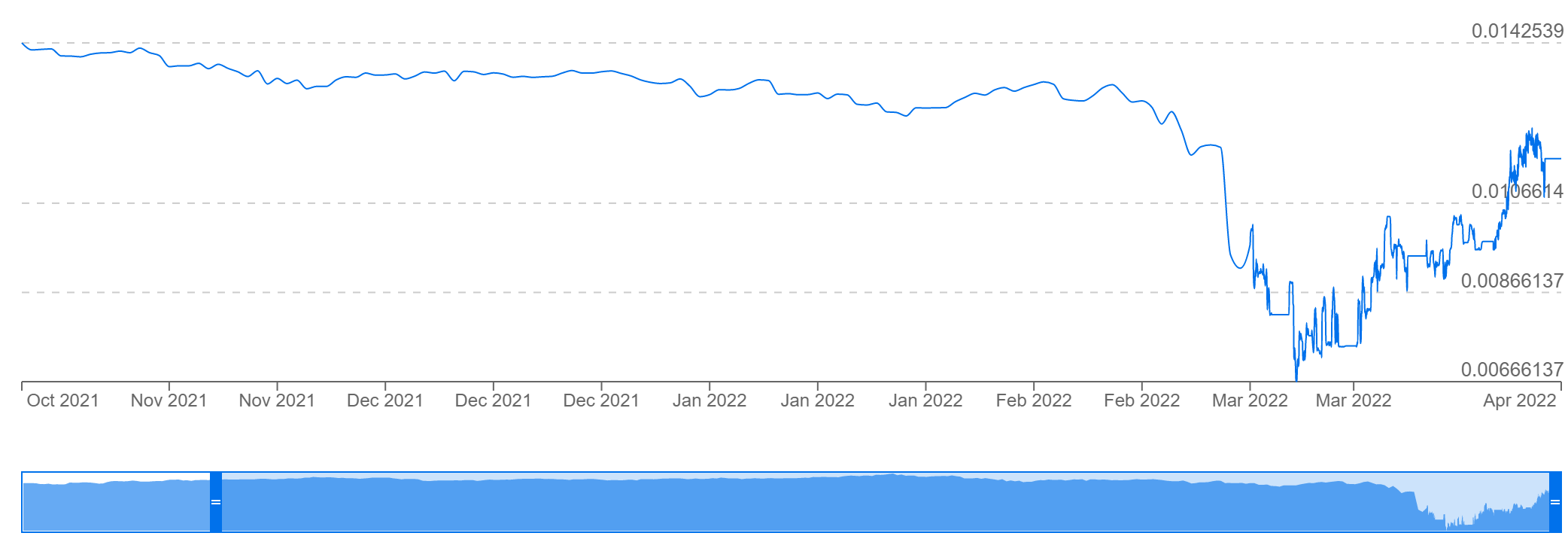

Oil, the Ruble, and Gold Walk into a Bar…

Oil, the Ruble, and Gold Walk into a Bar… 5 Apr 2022

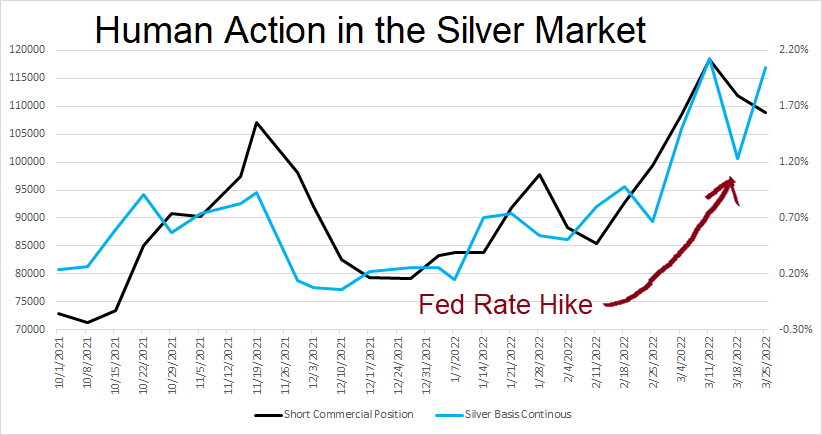

Human Action in the Silver Market

Human Action in the Silver Market29 Mar 2022

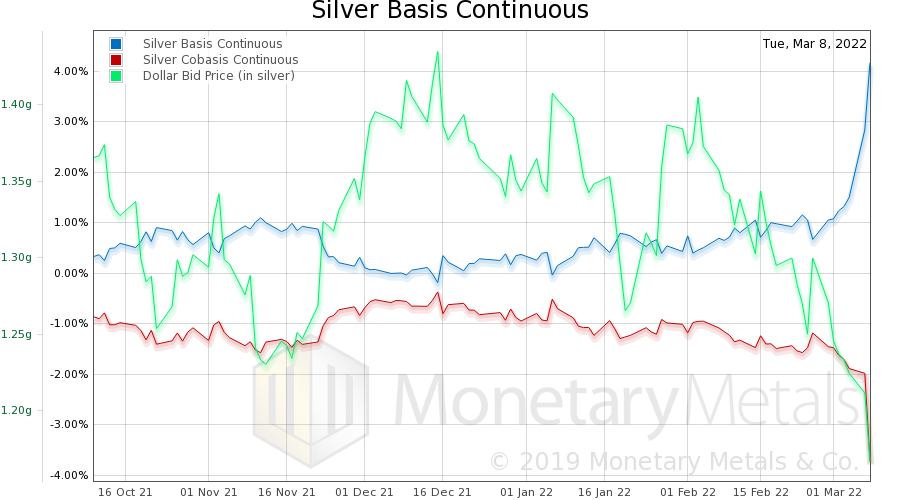

This is Not The Silver Breakout You’re Looking For!

This is Not The Silver Breakout You’re Looking For!10 Mar 2022

Inflation and Gold: What Gives?

Inflation and Gold: What Gives?21 Dec 2021

What’s In Your Loan?

What’s In Your Loan?23 Nov 2021

Perversity Thy Name is Dollar

Perversity Thy Name is Dollar16 Nov 2021

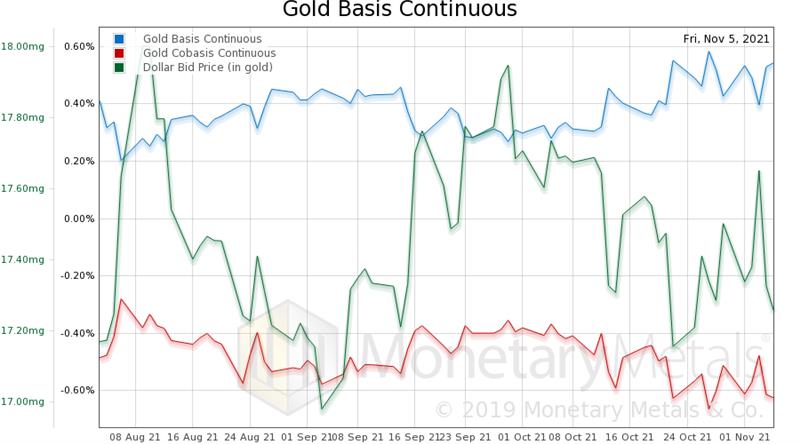

Rising Fundamentals of Gold and Silver

Rising Fundamentals of Gold and Silver10 Nov 2021

Why a Yield on Gold Matters

Why a Yield on Gold Matters3 Nov 2021