Category Archive: 6b.) Acting Man

Stock and Bond Markets – The Augustine of Hippo Plea

Most fund managers are in an unenviable situation nowadays (particularly if they have a long only mandate). On the one hand, they would love to get an opportunity to buy assets at reasonable prices. On the other hand, should asset prices actually return to levels that could be remotely termed “reasonable”, they would be saddled with staggering losses from their existing exposure. Or more precisely: their investors would be saddled with staggering...

Read More »

Read More »

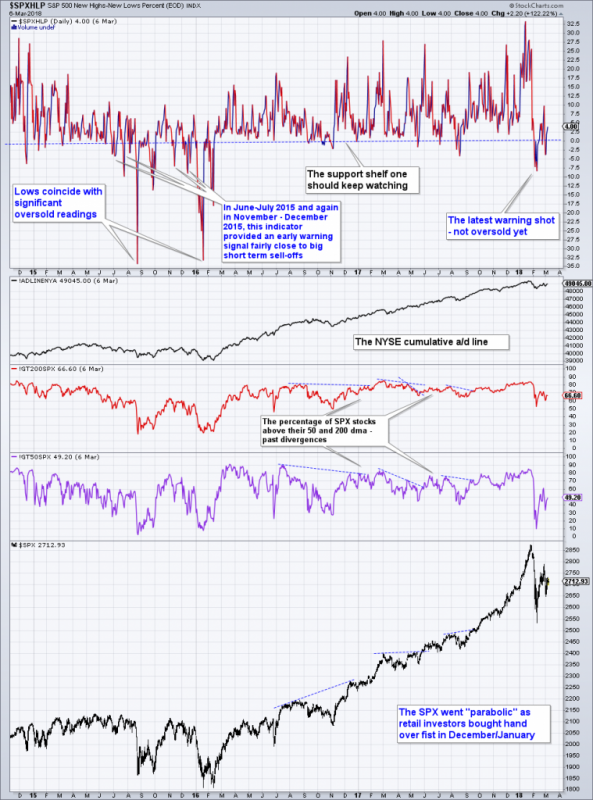

US Equities – Mixed Signals Battling it Out

Readers may recall that we looked at various market internals after the sudden sell-offs in August 2015 and January 2016 in order to find out if any of them had provided clear advance warning. One that did so was the SPX new highs/new lows percent index (HLP). Below is the latest update of this indicator.

Read More »

Read More »

US Stock Market: Conspicuous Similarities with 1929, 1987 and Japan in 1990

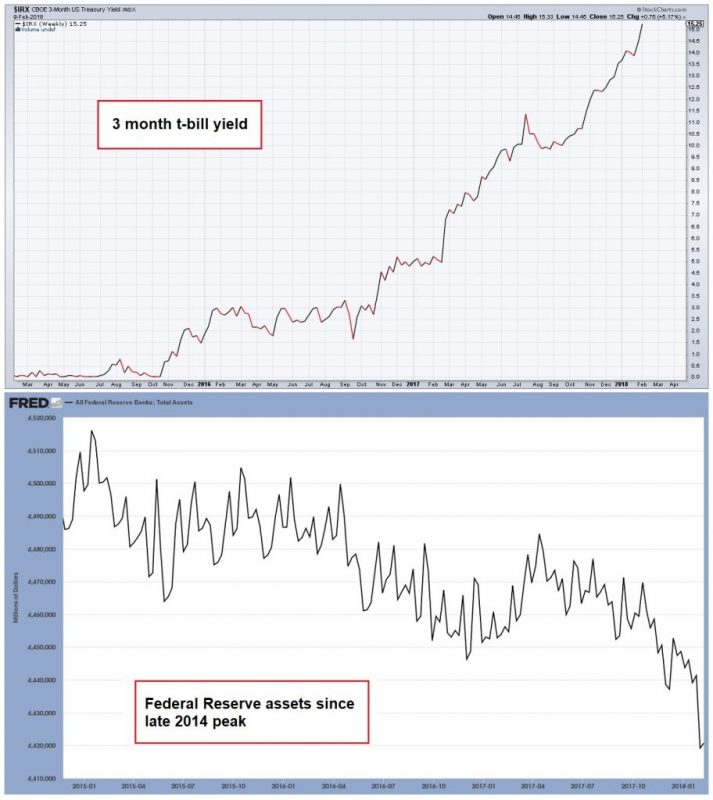

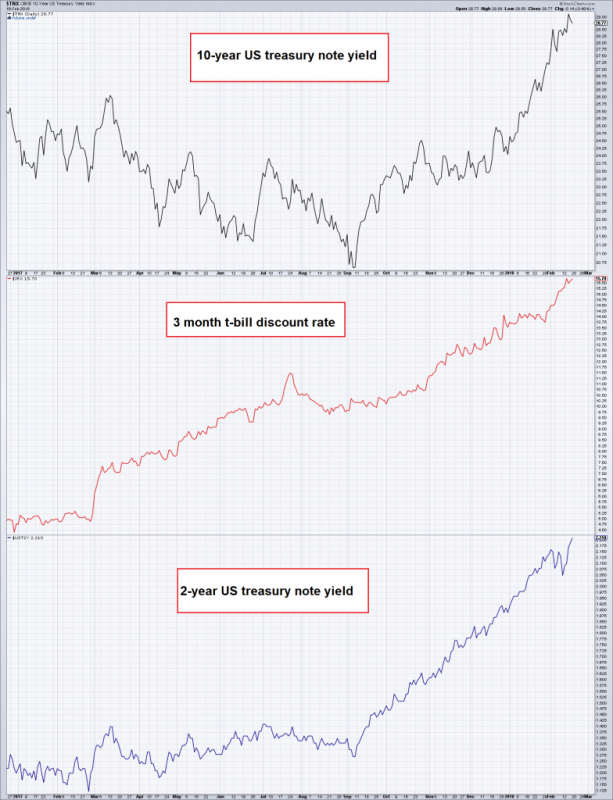

There are good reasons to suspect that the bull market in US equities has been stretched to the limit. These include inter alia: high fundamental valuation levels, as e.g. illustrated by the Shiller P/E ratio (a.k.a. “CAPE”/ cyclically adjusted P/E); rising interest rates; and the maturity of the advance. Near the end of a bull market cycle there is always the question of when a decline will begin, and above all, how large will it be.

Read More »

Read More »

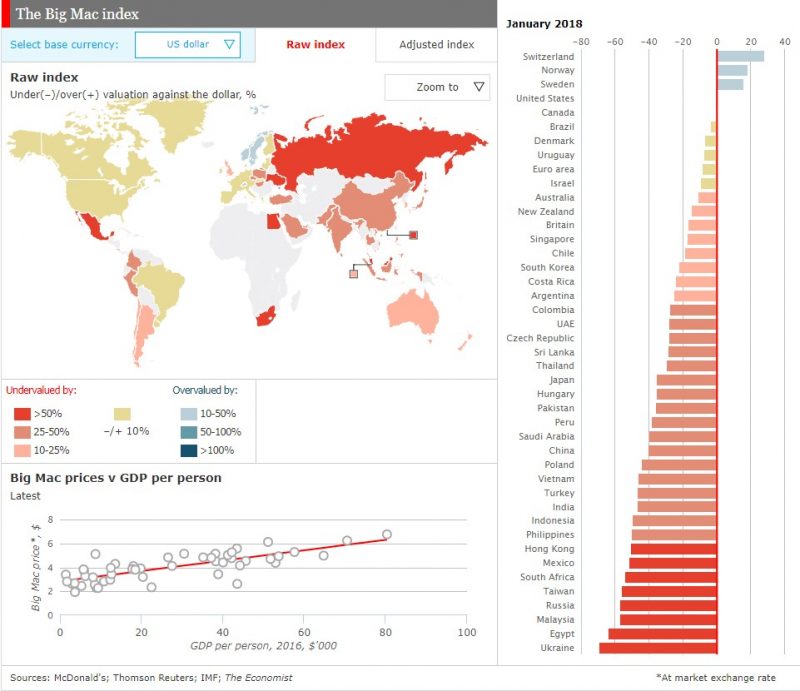

Purchasing Power Parity or Nominal Exchange Rates?

“An alternative exchange rate – the purchasing power parity (PPP) conversion factor – is preferred because it reflects differences in price levels for both tradable and non-tradable goods and services and therefore provides a more meaningful comparison of real output.” – the World Bank

Read More »

Read More »

Socialism and Capital Consumption

We have been promising to get back to the topic of capital destruction, which we put on hiatus for the last several weeks to make our case that the interest rate remains in a falling trend. Today, we have a different way of looking at capital destruction.

Read More »

Read More »

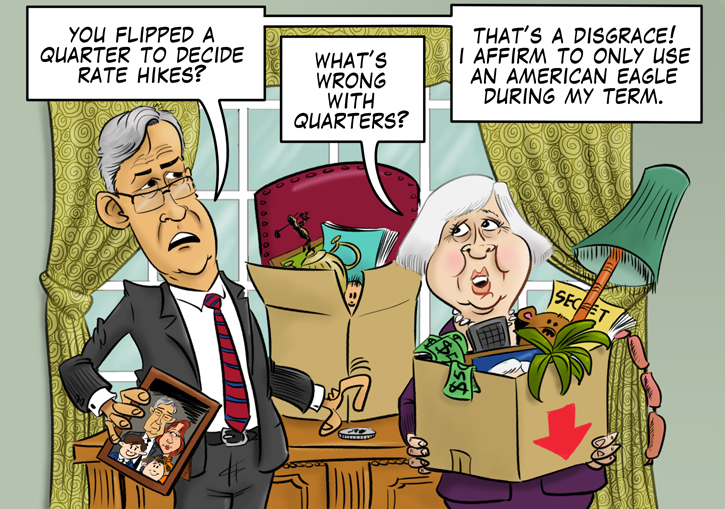

Haunted by Ghosts of the Old Eastern Bloc

Jerome Powell, the new Chairman of the Federal Reserve, just completed his third week on the job. He’s hardly had enough time to learn how to operate the office coffee maker, let alone the all-in-one printer. He still doesn’t know what roach coach menu items induce a heinous gut bomb.

Read More »

Read More »

Update on the Modified Davis Method

Frank Roellinger has updated us with respect to the signals given by his Modified Ned Davis Method (MDM) in the course of the recent market correction. The MDM is a purely technical trading system designed for position-trading the Russell 2000 index, both long and short (for details and additional color see The Modified Davis Method and Reader Question on the Modified Ned Davis Method).

Read More »

Read More »

Market Efficiency? The Euro is Looking Forward to the Weekend!

As I have shown in previous issues of Seasonal Insights, various financial instruments are demonstrating peculiar behavior in the course of the week: the S&P 500 Index is typically strong on Tuesdays, Gold on Fridays and Bitcoin on Tuesdays (similar to the S&P 500 Index). Several readers have inquired whether currencies exhibit such patterns as well. Are these extremely large markets also home to such statistical anomalies, or is market efficiency...

Read More »

Read More »

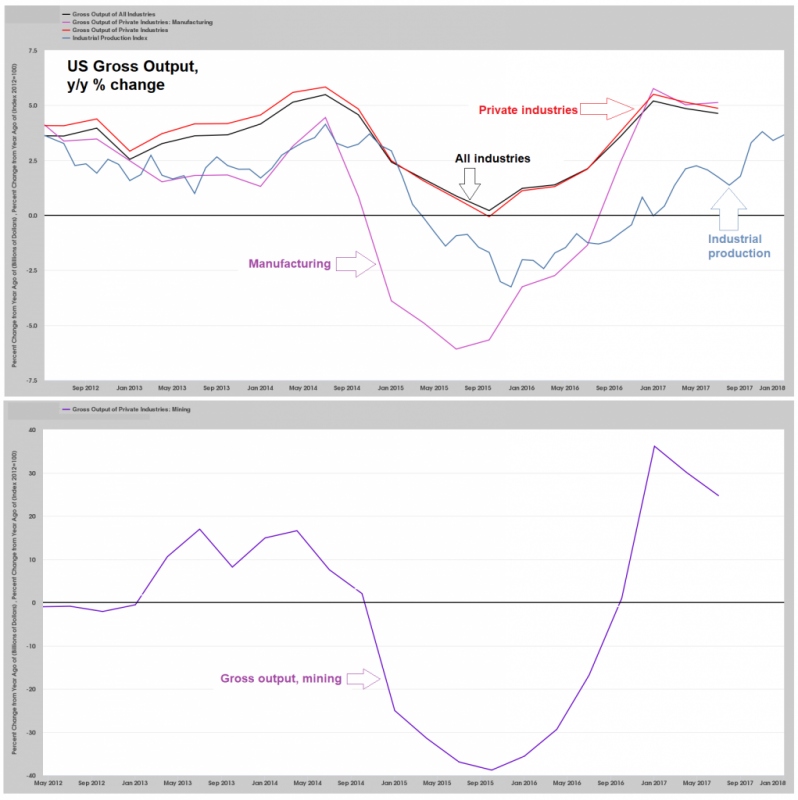

Strange Economic Data

Contrary to the situation in 2014-2015, economic indicators are currently far from signaling an imminent recession. We frequently discussed growing weakness in the manufacturing sector in 2015 (which is the largest sector of the economy in terms of gross output) – but even then, we always stressed that no clear recession signal was in sight yet. US gross output (GO) growth year-on-year, and industrial production (IP) – note that GO continues to be...

Read More »

Read More »

US Equities – Retracement Levels and Market Psychology

Following the recent market swoon, we were interested to see how far the rebound would go. Fibonacci retracement levels are a tried and true technical tool for estimating likely targets – and they can actually provide information beyond that as well. Here is the S&P 500 Index with the most important Fibonacci retracement levels of the recent decline shown. So far, the SPX has made it back to the 61.8% retracement level intraday, and has weakened a...

Read More »

Read More »

Dimitri Speck Part One: The Matterhorn Interview November 2013

Part One: The coordinated effort to suppress the gold price — Dimitri Speck On behalf of Matterhorn Asset Management Zurich, Lars Schall met up with Munich based quantitative market research. PART 2: THE DOUBLE FACE OF GOLD – Dimitri Speck In the second part of this exclusive video interview that was conducted on behalf of …

Read More »

Read More »

The Future of Copper – Incrementum Advisory Board Meeting Q1 2018

The Q1 2018 meeting of the Incrementum Fund’s Advisory Board took place on January 24, about one week before the recent market turmoil began. In a way it is funny that this group of contrarians who are well known for their skeptical stance on the risk asset bubble, didn’t really discuss the stock market much on this occasion. Of course there was little to add to what was already talked about extensively at previous meetings. Moreover, the main...

Read More »

Read More »

What Kind of Stock Market Purge Is This?

Down markets, like up markets, are both dazzling and delightful. The shock and awe of near back-to-back 1,000 point Dow Jones Industrial Average (DJIA) free-falls is indeed spectacular. There are many reasons to revel in it. Today we shall share a few. To begin, losing money in a multi-day stock market dump is no fun at all. We’d rather get our teeth drilled by a dentist. Still, a rapid selloff has many positive qualities.

Read More »

Read More »

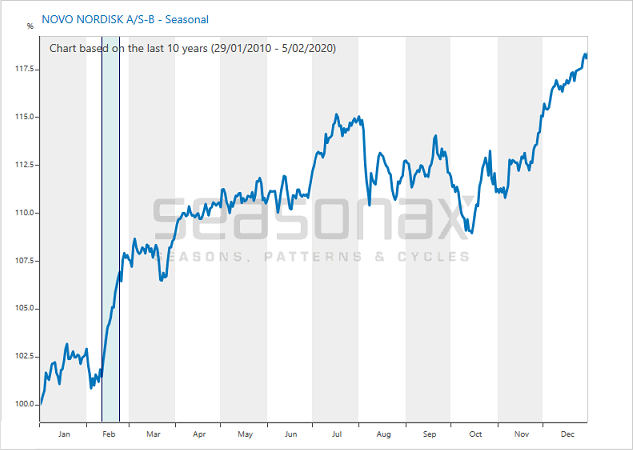

Seasonality of Individual Stocks – an Update

Readers are very likely aware of the “Halloween effect” or the Santa Claus rally. The former term refers to the fact that stocks on average tend to perform significantly worse in the summer months than in the winter months, the latter term describes the typically very strong advance in stocks just before the turn of the year. Both phenomena apply to the broad stock market, this is to say, to benchmark indexes such as the S&P 500 or the DJIA.

Read More »

Read More »

Dimitri Speck Part Two: The Matterhorn Interview November 2013

PART 2: THE DOUBLE FACE OF GOLD – Dimitri Speck In the second part of this exclusive video interview that was conducted on behalf of MATTERHORN ASSET MGMT, independent financial journalist. Part One: The coordinated effort to suppress the gold price — Dimitri Speck On behalf of Matterhorn Asset Management Zurich, Lars Schall met up …

Read More »

Read More »

When Budget Deficits Will Really Go Vertical

United States Secretary of Treasury Steven Mnuchin has a sweet gig. He writes rubber checks to pay the nation’s bills. Yet, somehow, the rubber checks don’t bounce. Instead, like magic, they clear. How this all works, considering the nation’s technically insolvent, we don’t quite understand. But Mnuchin gets it. He knows exactly how full faith and credit works – and he knows plenty more.

Read More »

Read More »

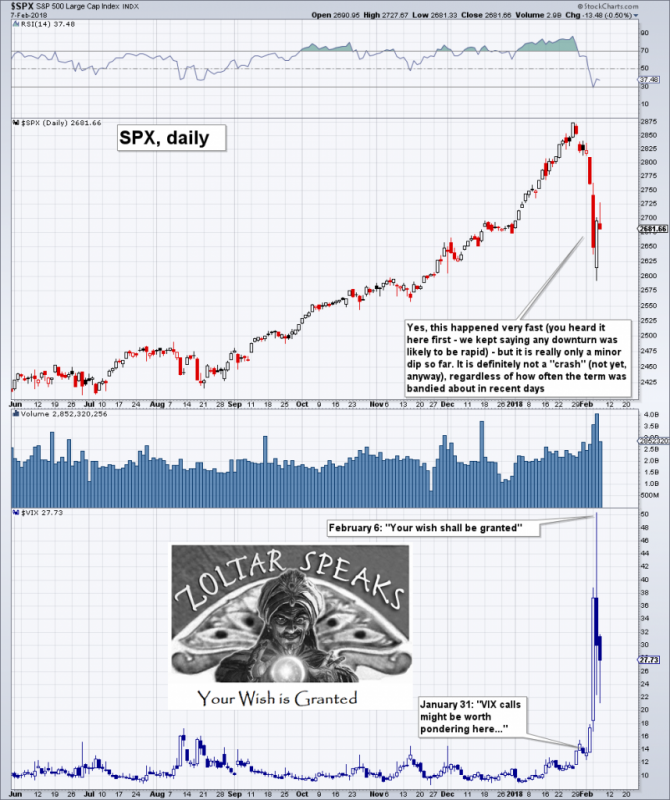

US Stocks – Minor Dip With Potential, Much Consternation

On January 31 we wrote about the unprecedented levels – for a stock market index that is – the weekly and monthly RSI of the DJIA had reached (see: “Too Much Bubble Love, Likely to Bring Regret” for the astonishing details – provided you still have some capacity for stock market-related astonishment). We will take the opportunity to toot our horn by reminding readers that we highlighted VIX calls of all things as a worthwhile tail risk play....

Read More »

Read More »

Too Much Bubble-Love, Likely to Bring Regret

Readers may recall our recent articles on the blow-off move in the stock market, entitled Punch-Drunk Investors and Extinct Bears (see Part 1 & Part 2 for the details). Bears remained firmly extinct as of last week – in fact, some of the sentiment indicators we are keeping tabs on have become even more stretched, as incredible as that may sound. For instance, assets in bullish Rydex funds exceeded bear assets by a factor of more than 37 at one...

Read More »

Read More »