Category Archive: 6b.) Acting Man

Mapping the Conflict in the Ukraine

Russian Troops in the Crimea

John Kerry is appropriately aghast at the “incredible act of aggression” by Russia in the Ukraine:

“You just don’t in the 21st century behave in 19th century fashion by invading another country on completely trumped up pre-text,” Kerry told the CBS program “Face the Nation.”

Read More »

Read More »

What’s In Your Loan?

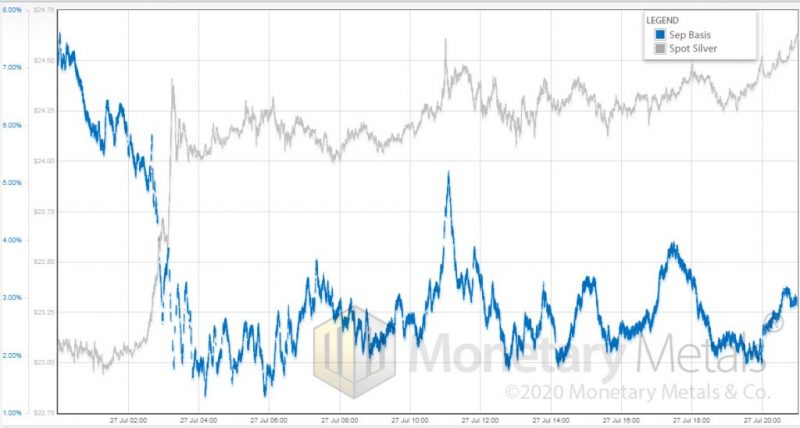

Opposing Monetary Directions

“Real estate is the future of the monetary system,” declares a real estate bug.

Does this make any sense? We would ask him this.

“OK how will houses be borrowed and lent?”

“Look at this housing bond,” he says, pointing to a bond denominated in dollars, with principal and interest paid in dollars.

“What do you mean ‘housing’ bond’,” we ask, “it’s a bond denominated in dollars!”

“Yes, but housing is the collateral.”...

Read More »

Read More »

Post-Covid China

The world should take a lesson from how East Asia ran itself in 2020. Japan had no lockdown. None. With an aging population, its death rate has been creeping up for many years. In 2020, it fell by 0.7%, as if Covid-19 was a life-saver.

Read More »

Read More »

COVID in India

I have just returned from a visit to my family in India. It was hard to escape. To get to the US from India, I needed a COVID test. The Indian government has seriously restricted who can provide COVID testing, treatment, and vaccination. Private doctors and hospitals that are not approved face brutal legal consequences if they provide COVID treatment.

Read More »

Read More »

Did You Make Janet Yellen Rich?

The Stress of Losing Billions. Up until the WallStreetBets crowd short squeezed Melvin Capital for a $7 billion loss, Robinhood had it made. But losing billions is stressful. And when your product blows up your customer the clucking that follows comes hot and heavy.

Read More »

Read More »

Grantham’s ‘Real McCoy’ Bubble in a World Gone Mad

The Lure of Easy Money. Right now happens to be an attractive time to do something stupid. What’s more, everyone is doing it. Maybe you are too. Stock valuations and corporate earnings growth no longer appear to matter. Why not buy an S&P 500 index fund and let it ride? Or, better yet, why not buy shares of Nvidia?

Read More »

Read More »

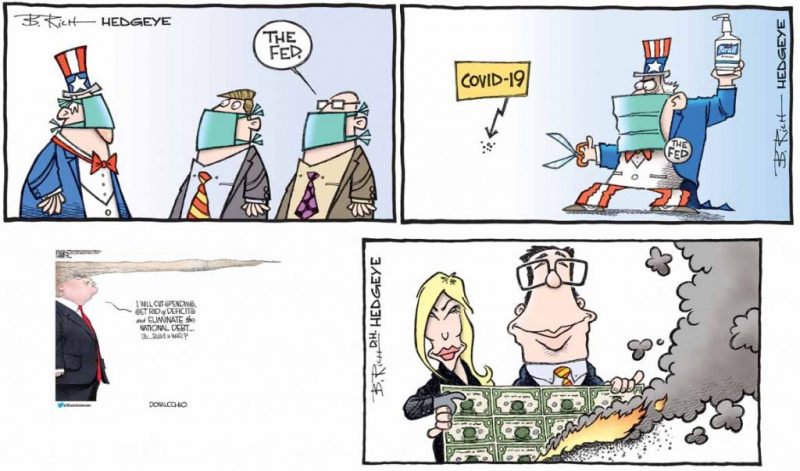

Janet Yellen: Too Dumb To Stop

Autographing Funny Money. The United States Secretary of the Treasury bears a shameful job duty. They must place their autograph on the face of the Federal Reserve’s legal tender notes. Here, for the whole world to witness, the Treasury Secretary provides signature endorsement; their personal ratification of unconstitutional money.

Read More »

Read More »

What You Will Find When You Follow the Money

Lockdown Disaster. It has been a rough go for California Governor Gavin Newsom. Late last week it was revealed that the state Department of Public Health had tickled the poodle on its COVID-19 record keeping. Somehow the bureaucrats in Sacramento under-counted new corona-virus cases by as many as 300,000.

Read More »

Read More »

The Dollar Is Dying

Insulting the Captive Audience. This week, while perusing the Federal Reserve’s balance sheet figures, we came across a rather curious note. We don’t know how long the Fed’s had this note posted to its website. But we can’t recall ever seeing it.

Read More »

Read More »

Game Over Spending

Coming and Going Like a Wildfire. Second quarter 2020 came and went like a California wildfire. The economic devastation caused by the government lock-downs was swift, the destruction immense, and the damage lasting. But, nonetheless, in Q2, the major U.S. stock market indices rallied at a record pace.

Read More »

Read More »

The Decline of the Third World

A Failure to Integrate Values. The only region in the world that has proactively tried to incorporate western culture in its societies is East Asia — Singapore, Japan, Hong Kong, South Korea, and Taiwan. China, which was a grotesquely oppressed, poor, Third World country not too far in the past, notwithstanding its many struggles today, has furiously tried to copy the West.

Read More »

Read More »

US Money Supply – The Pandemic Moonshot

Printing Until the Cows Come Home… It started out with Jay Powell planting a happy little money tree in 2019 to keep the repo market from suffering a terminal seizure. This essentially led to a restoration of the status quo ante “QT” (the mythical beast known as “quantitative tightening” that was briefly glimpsed in 2018/19). Thus the roach motel theory of QE was confirmed: once a central bank resorts to QE, a return to “standard monetary policy”...

Read More »

Read More »

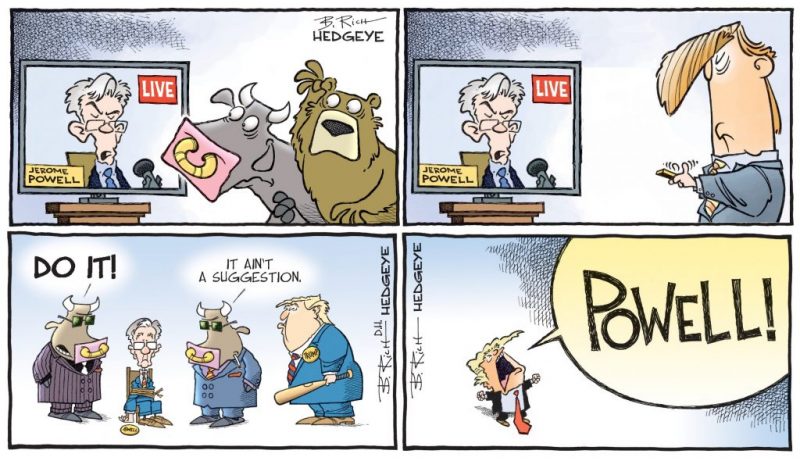

The Secret to Fun and Easy Stock Market Riches

Post Hoc Fallacy. On Tuesday, at the precise moment Federal Reserve Chairman Jay Powell commenced delivering his semiannual monetary policy report to the House Financial Services Committee, something unpleasant happened. The Dow Jones Industrial Average (DJIA) didn’t go up. Rather, it went down.

Read More »

Read More »

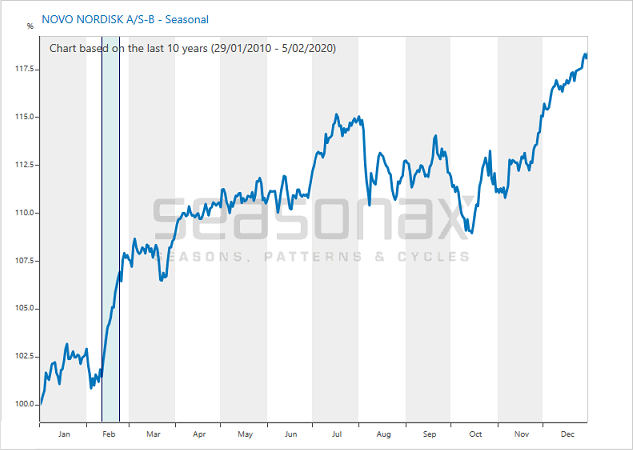

A Pharmaceutical Stock That Is Often Particularly Strong At This Time Of The Year

An Example of Strong Single Stock Seasonality. Many individual stocks exhibits phases of seasonal strength. Being invested in these phases is therefore an especially promising strategy. Danish drug company Novo Nordisk.

Read More »

Read More »