Category Archive: 6b.) Acting Man

The Triumph of Madness

Historic Misjudgments in Hindsight. Viewing the past through the lens of history is unfair to the participants. Missteps are too obvious. Failures are too abundant. Vanities are too absurd. The benefit of hindsight often renders the participants mere imbeciles on parade.

Read More »

Read More »

Real High Crimes and Misdemeanors

World Class Entertainer in the Cross-Hairs. Christmas is no time to be given the old heave-ho. This is a time of celebration, redemption, and excess libation. A time to shop ‘til you drop; the economy depends on it. Don’t get us wrong. There really is no best time to receive the dreaded pink slip. But Christmas is the absolute worst. Has this ever happened to you?

Read More »

Read More »

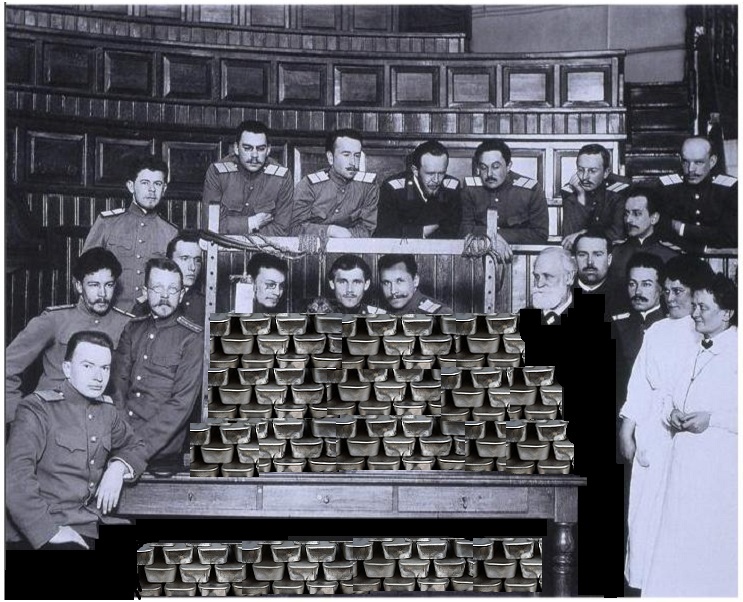

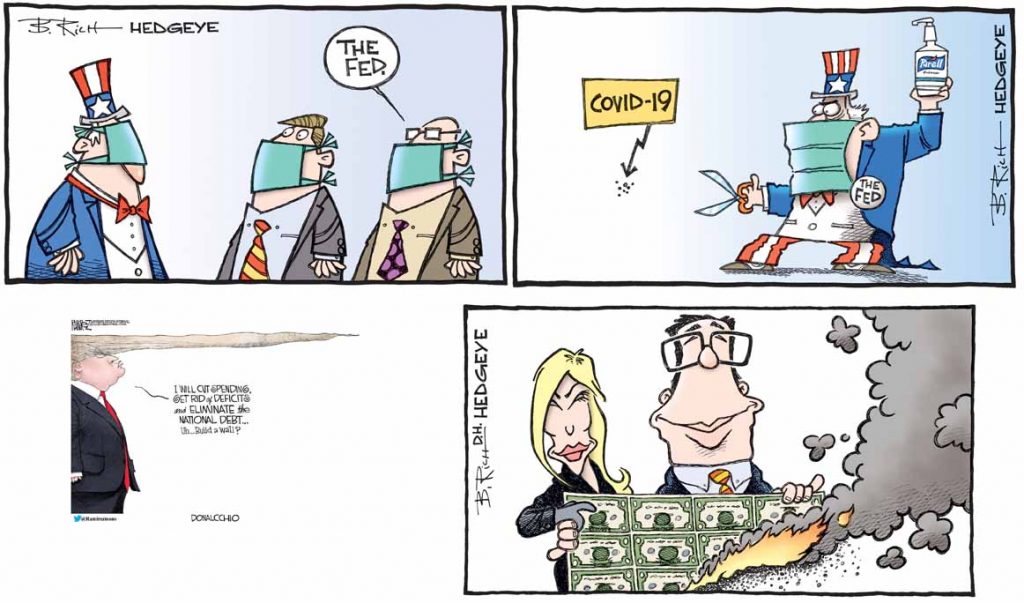

Banana Republic Money Debasement In America

Addicted to Spending. There are many falsehoods being perpetuated these days when it comes to money, financial markets, and the economy. But when you cut the chaff, three related facts remain: Uncle Sam needs your money. He needs a lot of your money. And he needs it bad!

Read More »

Read More »

Riding the Type 3 Mega Market Melt Up Train

Beta-driven Fantasy. The decade long bull market run, aside from making everyone ridiculously rich, has opened up a new array of competencies. The proliferation of ETFs, for instance, has precipitated a heyday for the ETF Analyst. So, too, blind faith in data has prompted the rise of Psychic Quants… who see the future by modeling the past.

Read More »

Read More »

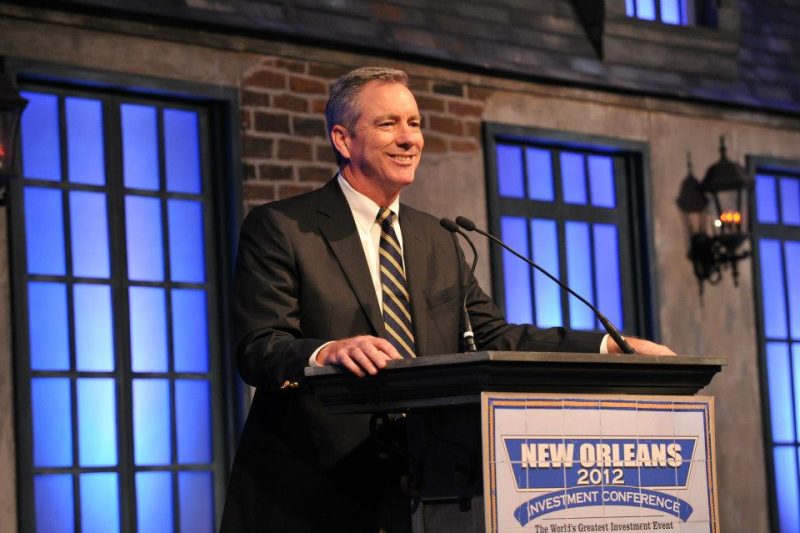

Maurice Jackson Interviews Brien Lundin and Jayant Bhandari

Our friend Maurice Jackson of Proven and Probable has recently conducted two interviews which we believe will be of interest to our readers. The first interview is with Brien Lundin, the president of Jefferson Financial, host of the famed New Orleans Investment Conference and publisher & editor of the Gold Newsletter – an investment newsletter that has been around for almost five decades, which actually makes it the longest-running US-based...

Read More »

Read More »

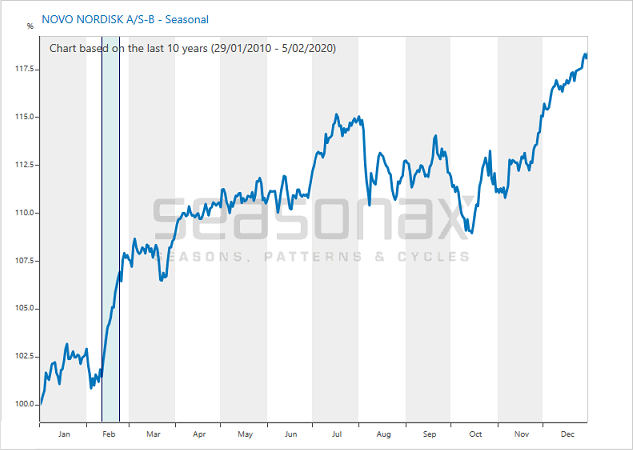

The Golden Autumn Season – One of the Most Reliable Seasonal Patterns Begins

The Strongest Seasonal Stock Market Trend. Readers may already have guessed: when the vibrant colors of the autumn leaves are revealed in all their splendor, the strongest seasonal period of the year begins in the stock market – namely the year-end rally. Stocks typically rise in this time period. However, there are questions, such as: how often does a rally take place, how strong is it, and when is the best time for investors to enter the market?

Read More »

Read More »

America’s Road Map to $40 Trillion National Debt by 2028

Planning on Your Behalf. Watch out! At this very moment, professional economists of all stripes are making plans on your behalf. They are dreaming and scheming new and innovative ways to spend your money long before you have earned it. While you are busy at the gristmill, grinding away for clients and customers, claims are being laid upon your life.

Read More »

Read More »

A Gain of 1,080 percent Annualized – One of the Strongest Seasonal Rallies is Starting Right Now

Bitcoin – An Exceptional Asset. When I first heard about Bitcoin (BTC) in May 2011, it was trading at 8 US dollars. Today, more than eight years later, BTC trades at around 8,000 dollars. A thousandfold increase! An investment of 1,000 dollars at the time would have resulted in a gain of more than a million – a dream result.

Read More »

Read More »

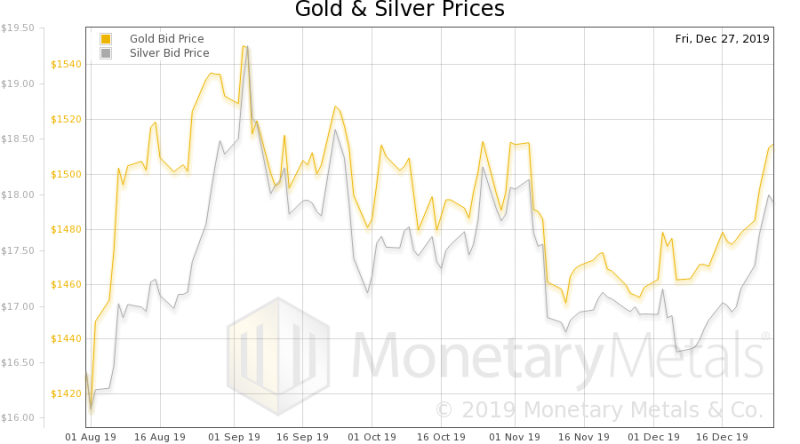

US Money Supply Growth – Bouncing From a 12-Year Low

True Money Supply Growth Rebounds in September. In August 2019 year-on-year growth of the broad true US money supply (TMS-2) fell to a fresh 12-year low of 1.87%. The 12-month moving average of the growth rate hit a new low for the move as well. The main driver of the slowdown in money supply growth over the past year was the Fed’s decision to decrease its holdings of MBS and treasuries purchased in previous “QE” operations.

Read More »

Read More »

Fed Chair Powell’s Inescapable Contradiction

Conflict and contradiction. These were two of the main themes reverberating around the world of centralized monetary planning this week. On Tuesday, for instance, a novel and contradictory central banker parlance – “reserve management purposes” – was birthed into existence by Fed Chair Jay Powell. We will have more on this later on. But first, to best appreciate the contradiction, we must present the conflict.

Read More »

Read More »

Repo Quake – A Primer

Chaos in Overnight Funding Markets. Most of our readers are probably aware that there were recently quite large spikes in repo rates. The events were inter alia chronicled at Zerohedge here and here. The issue is fairly complex, as there are many different drivers at play, but we will try to provide a brief explanation.

Read More »

Read More »

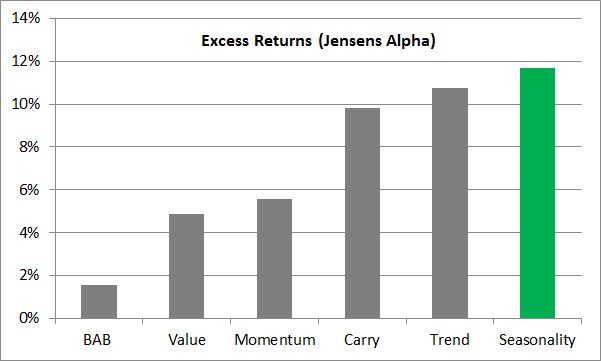

Scientific Long-Term Study Confirms: Seasonality is the Best Investment Strategy!

A Pleasant Surprise. You can probably imagine that I am convinced of the merits of seasonality. However, even I was surprised that an investment strategy based on seasonality is apparently leaving numerous far more popular strategies in the dust. And yet, this is exactly what a recent comprehensive scientific study asserts – a study that probably considers a longer time span than most: it examines up to 217 years of market history!

Read More »

Read More »

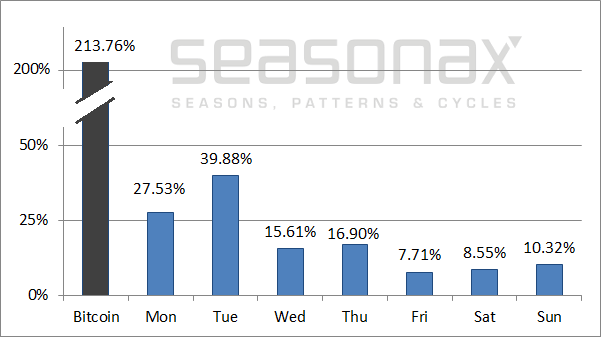

Bitcoin: What is the Best Day of the Week to Buy?

Shifting Patterns. In the last issue of Seasonal Insights I have discussed Bitcoin’s seasonal pattern in the course of a year. In this issue I will show an analysis of the returns of bitcoin on individual days of the week.

It seems to me that Bitcoin is particularly interesting for this type of study: it exhibits spectacular price gains, it is a very new instrument and it is unregulated. Moreover, it trades around the clock, even on weekends.

Read More »

Read More »

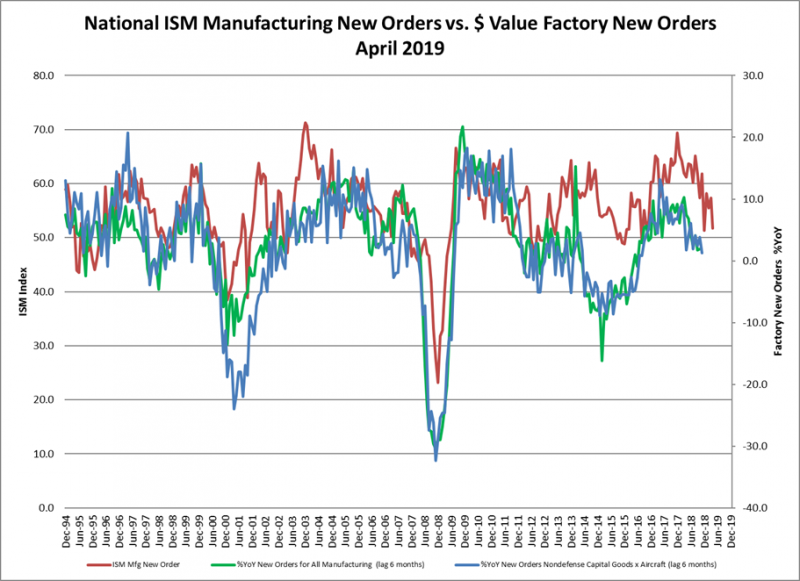

US Money Supply Growth and the Production Structure – Signs of an Aging Boom

Money Supply Growth Continues to Decelerate. Here is a brief update of recent developments in US true money supply growth as well as the trend in the ratio of industrial production of capital goods versus consumer goods (we use the latter as a proxy for the effects of credit expansion on the economy’s production structure).

Read More »

Read More »