Peculiar BehaviorAs I have shown in previous issues of Seasonal Insights, various financial instruments are demonstrating peculiar behavior in the course of the week: the S&P 500 Index is typically strong on Tuesdays, Gold on Fridays and Bitcoin on Tuesdays (similar to the S&P 500 Index). Several readers have inquired whether currencies exhibit such patterns as well. Are these extremely large markets also home to such statistical anomalies, or is market efficiency winning out in this case? Let us take a closer look. |

|

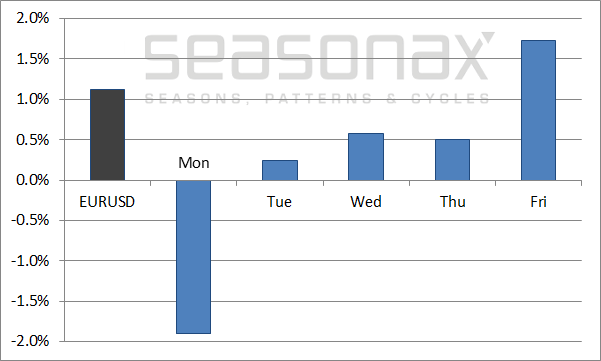

The Euro: Weak on Mondays, Strong on FridaysBelow I examine the performance of the EUR-USD exchange rate broken down by individual days of the week. The chart shows the annualized performance of EUR-USD since 2000 in black, as well as the performance on individual days of the week in blue. The performance is measured from one closing price to the next; for example, the performance on Tuesdays refers to the price change between the market close on Monday to the market close on Tuesday. As the chart illustrates, two days are standing out: the euro’s performance on Monday was quite weak on average, by contrast its performance on Fridays was very strong. The special status of these two days of the week is quite pronounced: on Mondays the euro declined on average by 1.90 percent annualized, while it rose by 1.73 percent annualized on Fridays. Over the week as a whole, the average annualized gain totaled just 1.12 percent. Thus investors who held the euro exclusively on Fridays reaped stronger returns than those who held the currency through an entire week. The average move on Mondays is quite large as well, albeit in the opposite direction. Evidently there exist not only long-term cyclical patterns in the realm of currencies such as annual seasonality (which you can easily look up at www.seasonalcharts.com, or in the Seasonax app), but also specific recurring intra-week patterns. Let us take a look at these patterns in more detail.

|

EUR/USD, 2000 - 2018(see more posts on EUR/USD, ) |

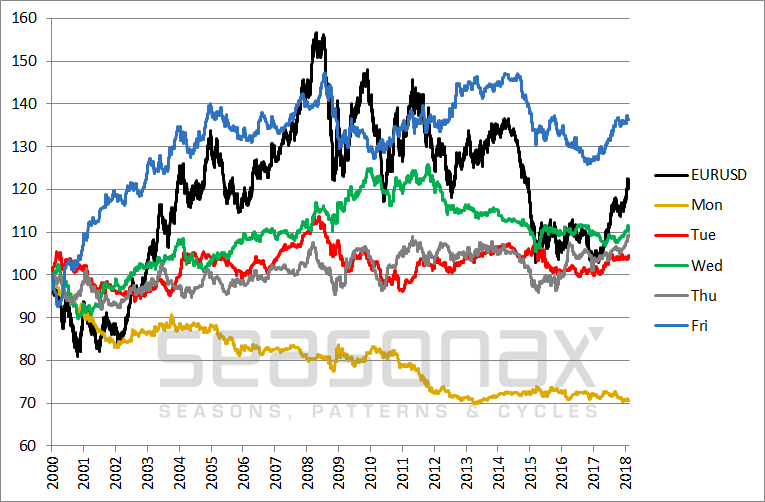

The Days of the Week Under the Magnifying GlassThe next illustration shows the overall performance of EUR-USD since the turn of the millennium in black, as well as the cumulative performance of the currency pair on individual days of the week in other colors. As the chart shows, the gold-colored line depicting the cumulative returns achieved on Mondays suffered a steady decline over many years. Even in bull markets such as that from 2002 to 2008 the euro tended to fall on Mondays. Conversely, the blue line depicting the cumulative returns achieved on Fridays developed quite well overall. |

EUR/USD, 2000 - 2018(see more posts on EUR/USD, ) |

Statistical Anomalies Definitely Exist in the Realm of CurrenciesWe have already discussed the effects the FOMC meeting exerts on the euro, as well as the euro’s annual seasonal trends – in connection with the latter we were able to establish a sound rationale for the existence of the pattern in the form of US tax regulations. We have now addressed a third recurring statistical anomaly in the form of the euro’s intra-week pattern. As noted, particularly the two days surrounding the weekend are standing out in this context. This study clearly shows that anomalous intra-week patterns are quite pronounced in currency exchange rates as well. As a trader, investor or dealer you can take advantage of these and other statistical anomalies. You can do so by either visiting my free-of-charge web site www.seasonalcharts.com, or by calling up the Seasonax app on your Bloomberg or Thomson-Reuters system. As an aside, in the Seasonax app you can e.g. also look up the precise average intra-day patterns of EUR-USD on Mondays and Fridays over any time period you wish to examine. There are never any guarantees in the markets, but you can certainly let the probabilities work in your favor.

|

Full story here Are you the author? Previous post See more for Next post

Tags: EUR/USD,newslettersent,On Economy