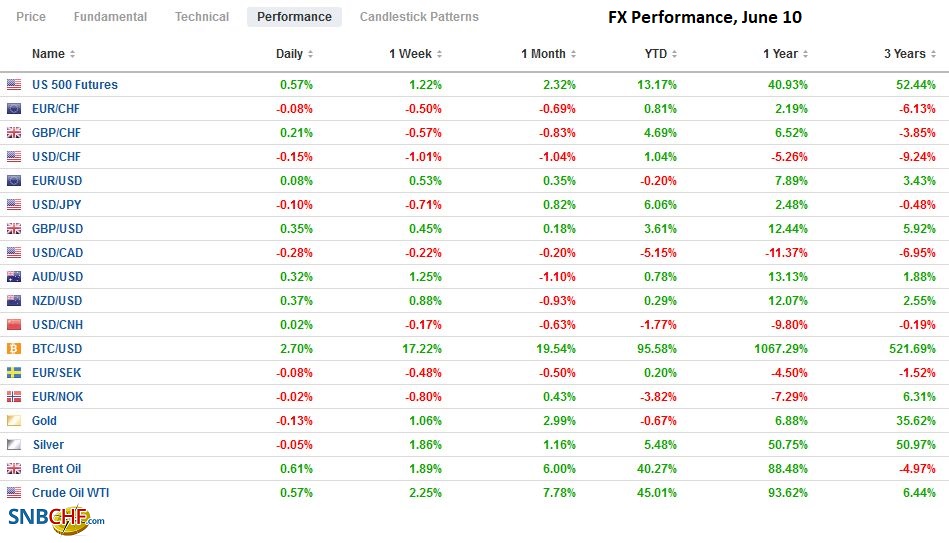

Swiss FrancThe Euro has fallen by 0.06% to 1.09 |

EUR/CHF and USD/CHF, June 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The ECB meeting and the US May CPI report is at hand. The US dollar is consolidating at a higher level against most of the major currencies. Softer than expected, inflation readings are weighing on the Scandis, which are bearing the brunt. The US 10-year yield closed below 1.50% for the first time in three months yesterday, and this may have helped underpin the Japanese yen. European benchmark yields are slightly firmer today, while bond yields in the Asia Pacific region fell as they played catch-up to yesterday’s US yield slump. The large bourses in the region advanced, though Japan was mixed. Europe’s Dow Jones Stoxx 600 is little changed and has a four-day rally in tow ahead of the ECB meeting. US futures are sporting a slightly softer profile. Falling for the third consecutive session, gold has made new lows for the week near $1876. Ahead of OPEC’s monthly report, June WTI is consolidating below $70 a barrel. Steel rebar and iron ore futures advanced for the second consecutive session in Asia, while copper is off for the third session. The US Department of Agriculture releases its monthly assessment of global supply and demand later today. The drought in Brazil and in the western part of the US may give the reports a cautious tone. |

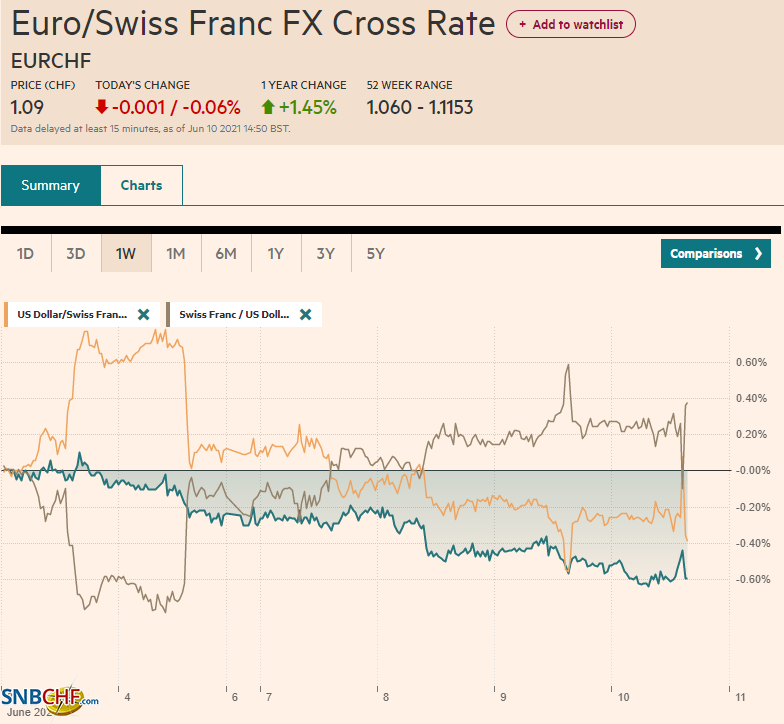

FX Performance, June 10 |

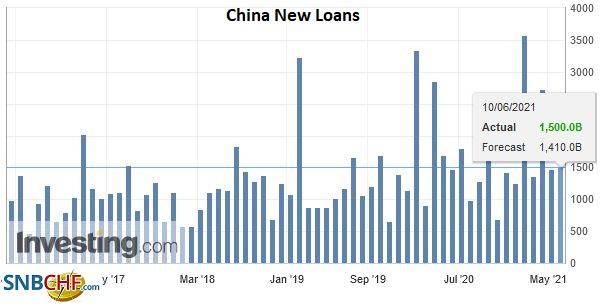

ChinaUS-Chinese commerce officials talked today. It is part of the resumption of the high-level dialogue. However, the suggestion that the talks rallied Chinese stocks today seems like a stretch. More important, reports indicate that the Biden administration is considering a protective tariff on rare earths to help promote the developments of a domestic industry. In particular, neodymium magnets, which are ubiquitous, including in electric vehicles, and nearly 90% come from China. Meanwhile, China has boosted its orders for US agriculture products and is seen accounting for almost a quarter of US farm exports. Beijing agreed to buy $80 bln of US agriculture products over two years and, as of April, was estimated to be more than 20% behind. However, it is stepping up its pace. China reported May lending was strong despite the official efforts to curb it. Bank loans edged up to CNY1.5 trillion from CNY1.47. It is not much, but economists had anticipated a decline. Aggregate financing, which added the lending by the shadow banking, which includes the wealth management arms of the large banks, rose to CNY1.92 trillion from about CNY1.85. |

China New Loans, May 2021(see more posts on China New Loans, ) Source: Investing.com - Click to enlarge |

The Trump administration suspended trade and investment talks with Taiwan, but the Biden administration is set to resume talks as early as today. Washington seems purposely pushing hard, and many do not seem to appreciate that its measures may be putting Taipei at greater risk. Consider that it used a military plane to deliver 75k vaccines to Taiwan, which is an unnecessary provocation. Three US Senators were aboard the flight, and at least one confirmed that if Taiwan was attacked, the US would come to its aid. This confuses the purpose of the US strategic ambiguity. Beijing’s contingency plans would always have to recognize this possibility, but the origin of the opaque position was aimed at Taipei, not Beijing. It was to discourage a unilateral declaration of independence. China responded with an amphibious landing drill near Taiwan. This appeared to be an escalation of Beijing’s show of force. It appears to be concerned that the US (and its allies) are threatening to alter the status quo.

The dollar rose to a four-day high against the Japanese yen, just shy of JPY109.70. It has not been above JPY109.65 since early Asia, where a $1.3 bln option that expires today is struck. Support is seen in the JPY109.30-JPY109.40 area. The greenback has not traded below JPY109 since May 26.

The Australian dollar slipped to a four-day low earlier today but found support a little above $0.7720. The highs for the last three sessions in the $0.7765 area mark resistance. The US dollar edged higher for the third time this week against the Chinese yuan, but it still remains below last week’s settlement (~CNY6.3950). The PBOC set the dollar’s reference rate at CNY6.3972, slightly above expectations for around CNY6.3967.

Europe

There are two elements of the ECB meeting that will draw attention. First, the market is focused on the pace of the bond purchases under the PEPP. The ECB does not specify an amount. In March, it said it would buy at a “significantly higher pace.” If this phrase is not repeated, the participants will conclude it will buy less. If it drops the word “significantly” but keeps the word “higher,” then the market will anticipate a slightly moderated pace but not a return to pre-March levels. We suspect that short-term traders and the media may exaggerate the significance of a few billion euros one way or the other. Since the increased purchases, the euro and yields have risen, contrary to what many see as the economic logic. Second, the ECB staff will provide new forecasts. It is difficult not to see an upward revision in growth if for no other reason than the March forecasts did not incorporate the US stimulus, which the multilateral groups, like the World Bank, IMF, and OECD, have cited as key to their upward revisions to world growth. The staff may also feel compelled to lift inflation forecasts. While the euro has appreciated a little, average oil prices have risen by more.

The EU-UK tensions are rising. The EU is threatening tariffs and quotas as it accuses the UK of backtracking on legally binding commitments and taking unilateral actions. The idea of drawing the customs check in the middle of the Irish Sea was the butt of jokes previously (see PM May). It is to Brexit what Dogecoin is in the crypto space. It began as a joke and has taken on a life of its own. After campaigning for it and winning a mandate, UK Prime Minister Johnson now recognizes that his team underestimated the disruption and delayed parts of the implementations. The grace period for the UK to export sausages and chilled meats to Northern Ireland without checks is to expire at the end of the month. The UK is threatening a unilateral extension. It calls the EU’s approach “excessive purist.” Although the US tax reform proposals that the G7 finance ministers agreed to for a 15% minimum tax puts it at odds with the 12.5% corporate rate in Ireland, Biden is expected to reiterate its warning to the UK as a guarantor of the Good Friday Agreement.

Instead of ending up by 0.1% in May, Norway’s CPI slipped by 0.1% to bring the year-over-year rate to 2.7% from 3.0%. The underlying rate, which adjusts for tax changes and excludes energy, fell by 0.4%, unwinding the April gain and putting the year-over-year pace at 1.5% instead of 2.0%. The question is whether this will change the Norges Bank’s assessment when it meets next week. It has signaled its intention to hike rates before the end of the year. This still seems to be the most likely scenario. The May CPI rose by 0.2% in Sweden, half of what was expected, and the year-over-year rate eased to 1.8% from 2.0%. The underlying rate, which uses fixed mortgage interest rates, slowed to 2.1% from 2.5%. The Norwegian krone is the weakest of the major currencies today, losing a little more than 0.5%, while the Swedish krona is off around 0.2%.

With the brief exception of yesterday’s push to almost $1.2200, the euro has been largely confined to the range set on Monday (~$1.2145-$1.2200). The three-week low seen last week before the US jobs report was near $1.2100. The absence of upside momentum is reflected in the fact that the five-day moving average slipped below the 20-day on Tuesday for the first time in two months. Speculators (non-commercials) in the futures market have been building a gross long euro position for the past seven weeks, and as of June 1, the 237k contracts were the most since the end of January.

Sterling posted an outside down day yesterday, and follow-through selling has seen it fall to about $1.4075 today, its lowest level since mid-May. It has found a bid in the European morning, but it needs to overcome nearby resistance in the $1.4125 area to boost chances that a low is in place.

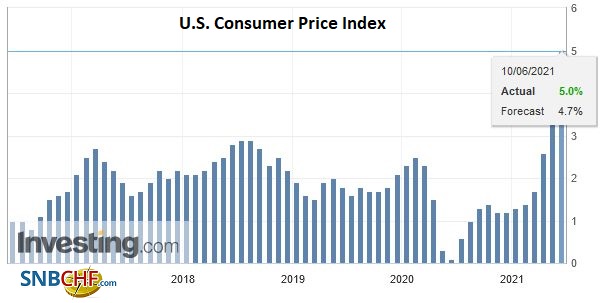

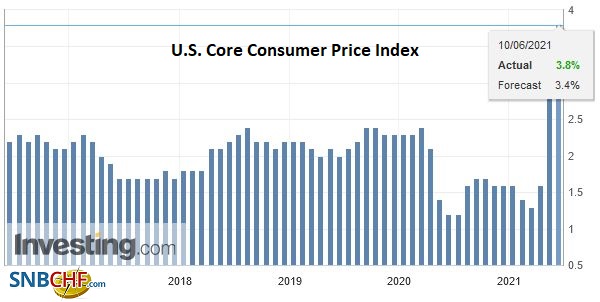

United StatesMay 2020 was the last month that the US reported an outright fall in CPI. This means that the base effect will peak with today’s report. Of course, there are other sources of upside pressure on prices, mostly stemming from the economy re-opening and supply-chain disruptions. If this year’s monthly figures are annualized, the US is looking at inflation a little north of 6%. |

U.S. Consumer Price Index (CPI) YoY, May 2021(see more posts on U.S. Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| At least in part, it appears that the market accepts the Fed’s interpretation that the inflation bump will prove temporary. Yesterday’s 10-year note auction went off without a hitch. The bid cover was the highest since last July, and demand from direct and indirect participants left dealers with among the least amounts on record (less than 16%). At the same time, it appears that there was a large short-squeeze in the futures market. The US is also expected to report that weekly initial jobless claims fell for the sixth consecutive week. |

U.S. Core Consumer Price Index (CPI) YoY, May 2021(see more posts on U.S. Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

The Bank of Canada meeting contained no surprises. Officials looked through the two months of job losses and stuck to the forward guidance that sees the output gap closing in H2 2022. The July 14 meeting will see new macro forecasts, which assuming the economy continues to strengthen, could lead to another tapering decision. Deputy Governor Lane speaks today, and he may provide more insight into how the officials are thinking about these issues.

Mexico’s President AMLO nominated finance minister and long-time aide, Herrera, to replace Diaz at the central bank’s head. Diaz’s term ends later this year, and he has clashed with AMLO on a number of issues, including the return of the central bank’s profits to the government. Ramirez, who is also close to AMLO, will replace Herrera at the head of the finance ministry. The switch was announced shortly after Mexico reported a less than expected decline in May CPI and a tick-up in the core rate. The market appears to be pricing in a hike by Banxico before the end of the year. Separately, Brazil’s May CPI was above expectations at 8.06% year-over-year. Brazil’s central bank meets next week and has already committed to a 75 bp hike.

The US dollar edged up to CAD1.2125 earlier today, which is a new high for the week. Last week’s high was a tad below CAD1.2135. It is hovering around unchanged levels near midday in Europe. A move above CAD1.2145 would likely spur some US dollar short-covering. It has not been above there since mid-May when it topped out in the CAD1.2180-CAD1.2200 area.

After slumping to five-month lows, a little below MXN19.60, the greenback snapped back and settled near MXN19.7360 to snap a three-day slide. It is trading quietly below MXN19.76 so far today. The intraday technicals seem to favor a heavier greenback today.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Brazil,Brexit,Canada,China,Currency Movement,ECB,EUR/CHF,Featured,Mexico,newsletter,Taiwan,U.K.,USD/CHF