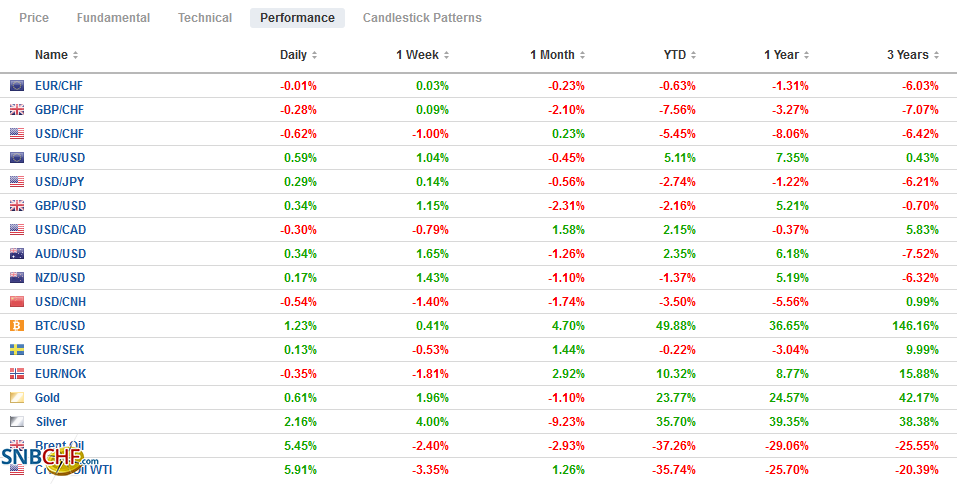

Swiss FrancThe Euro has fallen by 0.05% to 1.0782 |

EUR/CHF and USD/CHF, October 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: New actions to contain the virus are being taken in the US and Europe, but investors are looking past it and taking equities and risk assets, in general, higher to start the new week. MSCI Asia Pacific recouped most of last week’s 0.7% loss with gains of move than 1% in Japan, Hong Kong, South Korea, and Australia. Coming fiscal support helped lift the Australian market by more than 2.5%. Europe’s Dow Jones Stoxx 600 is up for a third consecutive session and is nearing the 200-day moving average that has checked the benchmark over the last three months. US shares are trading with a clear upside bias. Meanwhile, yields are edging higher, and the US benchmark 10-year yield is near 71 bp, while European yields are also slightly firmer. The dollar is under some pressure, falling against all the major currencies, but the Japanese yen and most emerging market currencies are also gaining against the greenback. The JP Morgan Emerging Market Currency Index is higher for the fifth session but remains below the 20-day moving average. Gold has straddled the $1900-level, while oil stabilizes after sliding last week. November WTI is within yesterday’s ranges. |

FX Performance, October 05 |

Asia Pacific

Japan’s service and composite PMI were revised from the initial estimate, but both remain below 50. The service PMI was revised to 46.9 from 45.6 after 45.0 in August. The composite PMI is now at 46.6 from 45.5 flash reading and 45.2 in August. The government has indicated it will have a third supplemental budget. Elsewhere of note, South Korea’s manufacturing PMI rose to 49.8 from 48.5, and Taiwan’s rose to 55.2 from 52.2.

Tomorrow’s Reserve Bank of Australia meeting will be followed the following day by the release of the government’s budget. Imagine if US Treasury Secretary Mnuchin was a member of the FOMC. When the Japanese finance minister attends a BOJ meeting, chins wag about central bank independence. The RBA’s board consists of a governor, a deputy, the Treasury Minister, and six individuals form the private sector. Unlike the Reserve Bank of New Zealand and the Bank of England, the RBA has downplayed the likelihood of negative interest rates. It targets the cash rate and the 3-year yield at 25 bp. The government is promising not to prematurely tighten fiscal policy. It drew the line at 6% unemployment. It is expected to bring forward income tax cuts, new aid for business, and infrastructure spending. It seeks to support the labor market as its “Jobseeker” and Jobkeeper” programs expired last month. Australia will unveil a A$1.2 bln (50%) wage subsidy for hiring apprentices for one year and aims for 100k to be included in the program.

The dollar is firm against the yen near around JPY105.65, near the pre-weekend high. Last week’s high was closer to JPY105.80, where an option for about $460 mln will expire today. The greenback has not traded above JPY106 since September 14. Initial support is seen around JPY105.30. The Australian dollar is trading higher but has been unable to challenge last week’s high a little above $0.7200, where the 20-day moving average is found. We like it higher. Meanwhile, China’s mainland markets remained closed for the holiday, and the offshore yuan has strengthened and is trading near its best levels of the year.

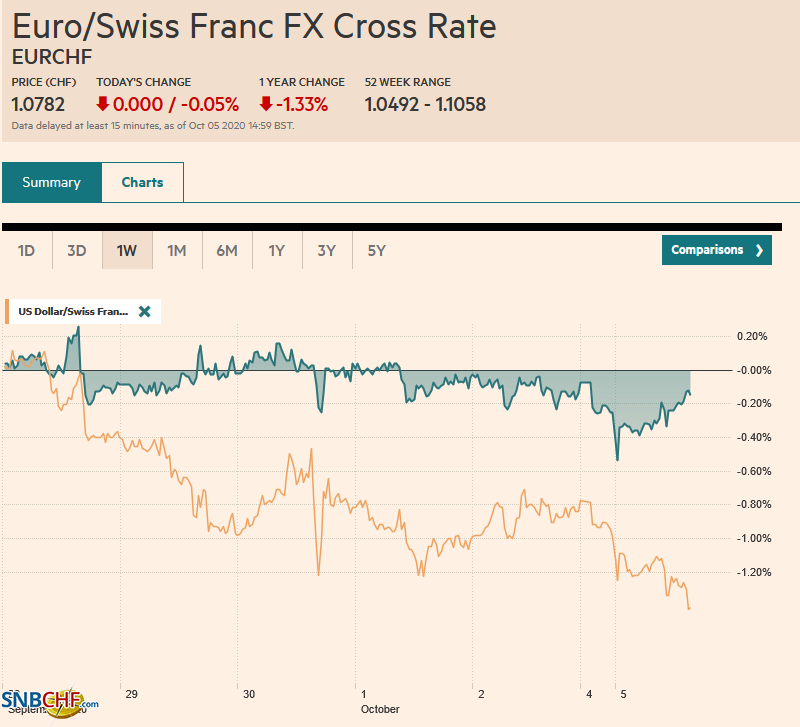

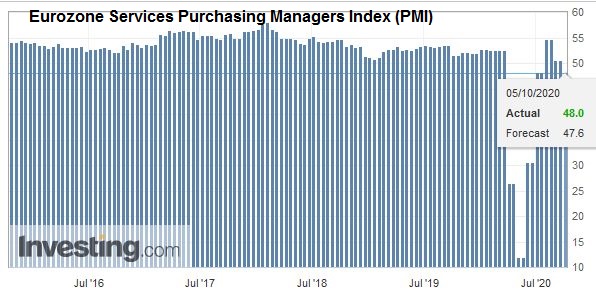

EuropeGerman and Italy’s service and composite PMI surprised on the upside, France was flat from the flash reading, and Spain disappointed. Indeed, Spain is emerging as the weak link, eclipsing Italy. Germany’s service PMI was revised to 50.6 from 49.1 the preliminary estimate, limiting the pullback from 52.5 in August. With the recovery in manufacturing reported last week, the German composite is 54.7 compared with 54.4 in August. France’s readings were unchanged at 47.5 and 48.5 for the service and composite PMI, respectively. Italy’s service PMI rose to 48.8 form 47.1, and the composite pushed back above the 50 boom/bust level to 50.4 from 49.5 in August. |

Eurozone Services Purchasing Managers Index (PMI), September 2020(see more posts on Eurozone Services PMI, ) Source: investing.com - Click to enlarge |

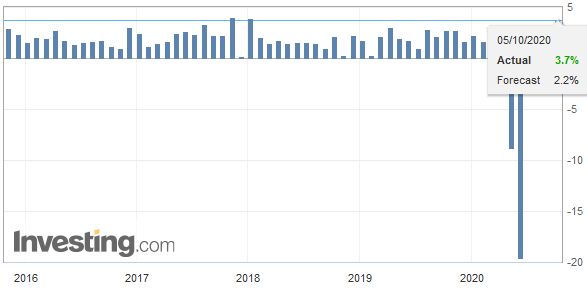

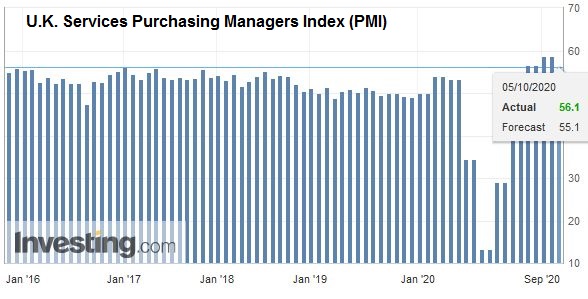

| Spain moved in the opposite direction. The service PMI fell to 44.3 from 48.4, pushing the composite to 42.4 from 47.7. In aggregate, the eurozone service PMI was revised to 48.0 form 47.8 and 50.5 in August. The composite stands at 50.4 rather than the flash’s 50.1. It was 51.9 in August. Separately, the UK’s services and composite PMI were revised higher from the preliminary estimate to stand at 56.1 and 56.5, respectively. |

Eurozone Markit Composite Purchasing Managers Index (PMI), September 2020(see more posts on Eurozone Markit Composite PMI, ) Source: investing.com - Click to enlarge |

| After some apparent progress in negotiations and German Chancellor Merkel signaling some flexibility, UK Prime Minister Johnson and EC President von der Leyden agreed to extend talks for another month. It is not immediately clear how it relates to the EU Summit on October 15-16. However, it seems that there is a little give in any event; after all, Johnson had first claimed the end of July deadline and then mid-October. It appears what is being sought is allow two more weeks of talks and then at the summit enter what is called the “tunnel” to hammer out the precise wording. While there was not break-through on fishing or state-aid, Johnson and von der Leyden talks were characterized as “not unhelpful.” Press reports note that France’s Macron is pushing a hard line on fishing. |

Eurozone Retail Sales YoY, August 2020(see more posts on Eurozone Retail Sales, ) Source: investing.com - Click to enlarge |

| ECB President Lagarde shared some preliminary thinking about a digital euro. Many central banks have begun such work. China is thought to be among the most advanced and has tried some limited experiments. Many ask if the digitalization impacts the role of the dollar and reserve currencies in general. If China is the first mover, will it boost the chances the yuan supplants the dollar? Such questions are based on a misunderstanding. Do not think of the digitalization of the yuan or euro as the introduction of currency, but a payment system. Right now, if a WEIRD (a person from a Westernized, Educated, Industrialized, Rich Democracy) wanted to buy something, s/he could pay by credit card, check, cash, or an intermediary like Venmo or PayPal. The digitalization will offer another means of payment (verified and instantaneous). Lagarde did not seem to take a stand on whether a digitalized euro would be centralized on the ECB’s ledger, or where the central bank sets the transaction and settlement rules while the transactions are recorded by supervised intermediaries. Separately, note that Lagarde will speak three times in as many days in the first part of the week, while Lane, the chief economist, speaks tomorrow. |

U.K. Services Purchasing Managers Index (PMI), September 2020(see more posts on U.K. Services PMI, ) Source: investing.com - Click to enlarge |

The euro is firm near $1.1760, in the European morning. Last week’s high was near $1.1770, and that is the next immediate hurdle. The next objective is around $1.1810, which corresponds to a (50%) retracement of decline since the September 1 high a little above $1.20. Sterling is trading higher, around $1.2960. A move above $1.30 lifts the technical tone. That area could be the neckline of a head and shoulders pattern that projects run toward last month’s highs. We note that despite the credit expansion over the summer and the weak lira, Turkey reported a smaller rise in headline inflation than expected (11.75% vs. 11.77% in August and forecasts for a little north of 12%). Last month, the lira rose in only three sessions. Today is the first time this month the lira is gaining on the greenback. However, the 0.3% rise does not offset the decline seen before the weekend.

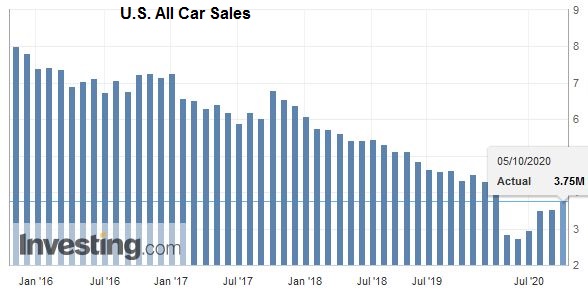

AmericaThe pre-weekend release of the September US employment data strengthened ideas that the recovery is slowing dramatically as Q3 drew to a close. Overall job growth disappointed, though the private sector was near expectations. The decline in the unemployment rate was flattered by a decrease in the participation rate. The number of permanent job losses increased by 300k, and that was before the latest round of lay-offs announced by large corporations. Today’s reports feature the Markit services PMI and composite and the ISM non-services diffusion index. Tomorrow the US reports the August trade balance, and a record deficit is expected. At least seven Fed officials speak this week, including Evans and Bostic today. Chairman Powell speaks tomorrow, and the FOMC minutes from last month’s meeting will be released Wednesday. |

U.S. All Car Sales, September 2020 Source: investing.com - Click to enlarge |

Canada reports its August trade balance tomorrow as well. A C$2.1 bln deficit is expected after a C$2.4 bln shortfall in July. The highlight of the week though, will be the employment report on Friday. Job growth is expected to be half of the 245k increase in August, and this would mean Canada would have recouped nearly 2/3 of the jobs lost compared with about half in the US. Mexico reports September auto production and export figures tomorrow, but the most important data point is Thursday’s release of September CPI. Another reading above the top of Banxico’s band (4%) would appear to limit the scope for monetary policy. However, the central bank does not meet again until November 12.

The US is proceeding with an investigation of Vietnam under the 1974 trade legislation that the Trump Administration has used actively. The investigation is the kind that the results are already known. The narrow issue focuses on last year’s importation and use of lumber that is used for its furniture industry, which appears to have received a critical impetus by rising Chinese costs, and more recently, the US tariffs on many Chinese goods. The US Trade Representative wants to look at Vietnam’s “acts, policies, and practices” that would lead to the under-valuation of the dong and thereby harm US producers. The Treasury’s model shows the dong by 4.7% undervalued, though it was virtually unchanged in 2019. Ironically, Vietnam recorded a $1.3 bln trade deficit last year after $2.73 and $2.87 bln surpluses in 2017 and 2018, respectively. Vietnam’s reserve did rise by about $22 bln last year. Some argue that this prevented the currency from appreciating and that its purchases would add to the deflationary pressures in those countries. US Treasury figures show a $10 bln increase of Vietnam’s Treasury holdings in 2019. Even the most sophisticated models are not likely to show any perceptible impact on US yields from Vietnam’s purchases. Vietnam’s per capita income is around $2600 a year. The US per capita income is nearly 25x higher. The rules of engagement were devised for wealthier countries, and many emerging market countries cannot compete under such a regime. They cheat and push the edge of the envelope. This is not a moralistic judgment but a realpolitik observation. The US strategic interest in seeing a strong, dynamic Vietnamese economy could outweigh the slight.

The US dollar is trading at two-week lows against the Canadian dollar (~CAD1.3265). The greenback has risen against the Canadian dollar for the past three weeks, but the upside correction looks over. A break of CAD1.3250 opens the door to CAD1.3200 and then CAD1.3160, which we expect to see in the coming days. A move above CAD1.3330 would negate this favorable outlook for the Loonie. The greenback is also trading at two-week lows against the Mexican peso (~MXN21.50). The push below MXN21.55 is technically important as it represented the (61.8%) retracement objective of the bounce in the second half of September. The next immediate target is near MXN21.30, but we suspect the dollar is headed back to last month’s low below MXN21.00.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Australia,Brexit,Currency Movement,Digital currency,EUR/CHF,Featured,newsletter,PMI,USD/CHF