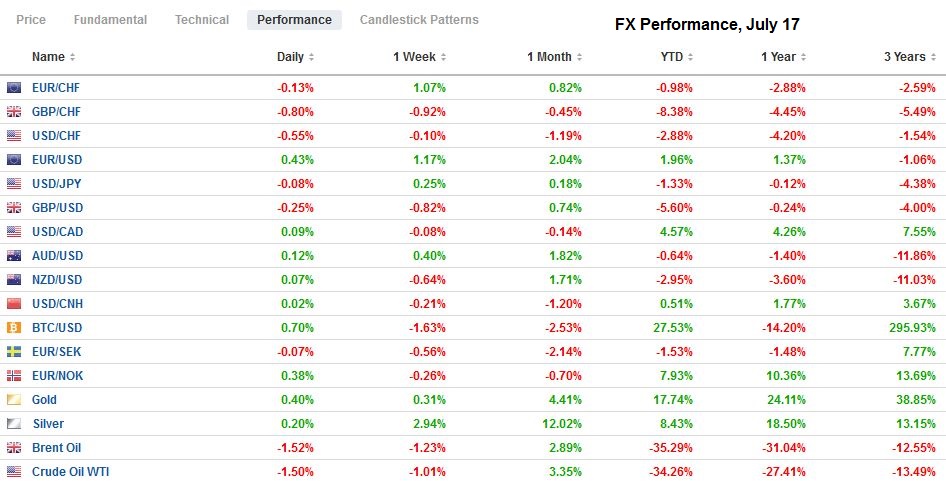

Swiss FrancThe Euro has fallen by 0.18% to 1.0741 |

EUR/CHF and USD/CHF, July 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

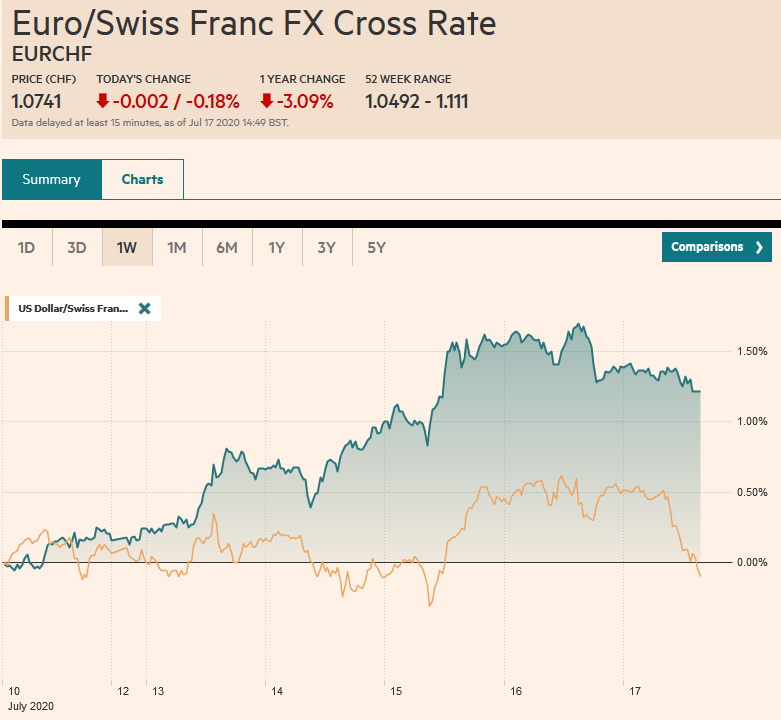

FX RatesOverview: Chinese stocks stabilized after yesterday’s sharp fall and most Asia Pacific equity markets, but Tokyo rose today. European shares are little changed, but the Dow Jones Stoxx 600 is still poised to hold on to modest gains for the third consecutive week. US shares have a firmer bias, and the S&P 500 is up nearly 1% for the week coming into today. It, too, has risen in the past two weeks as well. Yesterday’s NASDAQ volume surpassed NYSE volume, and this often seen as a cautionary sign. Bond markets are little change, and the US 10-year is slipped below 61 bp. It has not settled below 60 bp in three months. The dollar is sporting a softer profile against most of the major currencies but the Canadian dollar. It continues to flirt with key levels around $1.14 for the euro and $0.7000 for the Australian dollar. For the week, the greenback is mixed. The Scandi’s led the advanced, while sterling’s 0.5% loss leads the decliners. The JP Morgan Emerging Market Currency Index is little changed today but holding on to a small weekly gain, its third in a row. Gold is little changed and continues to hover around $1800 an ounce. September WTI finished the past two weeks near $40.75 and is fractionally lower now. |

FX Performance, July 17 |

Asia Pacific

News in the region is light. There are three developments to note. First, the June manufacturing PMI for New Zealand was reported at 56.3 from a revised 39.8 in May (initially 39.7). It is the highest reading since April 2018. In December 2019 and January 2020, it was a little below 49. Second, Indonesia cut interest rates yesterday, and the central bank appears to have intervened to support the rupiah, which has been trending lower and reached its lowest level since late May. Third, the virus has passed the million-mark in India, while Manila may return to lockdown, and Australia’s most populous state will tighten its social restrictions. Tokyo has a record number of cases for the second consecutive day, and Hong Kong’s outbreak may surpass previous highs.

The dollar is in about a quarter of a yen range above JPY107.10. It has been in a range of about JPY106.65 to JPY107.45 this week. The greenback finished last month just below JPY108. It does not appear to be going anywhere quickly. The Australian dollar is in about a quarter of a cent range today below $0.7000. It has traded between roughly $0.6920 and $0.7040 this week. It settled last month a near $0.6900. Although it remains within spitting distance of $0.7000, it has only closed above it twice since early January. Once was in June and once in the middle of this week. The PBOC set the dollar’s reference rate above CNY7.0 for the first time this week. It trading in about a 40-pip range on either side of the reference rate. It is third consecutive week, the dollar has slipped against the yuan.

EuropeTwo EU court decisions have been setbacks for the EC on the eve of a crucial summit. The first was a blow to Brussels’ efforts to address the distortions of the tax arbitrage strategies of multinational corporations. The second-highest EU court ruled in favor of Ireland and Apple that the low tax did not prove to be an unfair corporate subsidy. The second case was the highest court’s decision (which means it cannot be appealed) that the current framework used to transfer data (Privacy Shield) was not adequate to protect the rights of EU citizens. At the heart of the issue is that in the US, which is often portrayed as less statist that Europe requires social media companies to provide user data to national security agencies. EU citizens have greater privacy rights. |

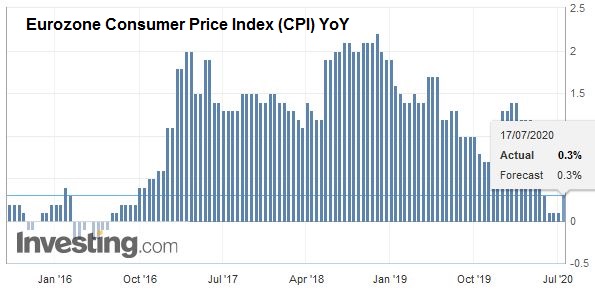

Eurozone Consumer Price Index (CPI) YoY, June 2020(see more posts on Eurozone Consumer Price Index, ) Source: investing.com - Click to enlarge |

| The EU summit begins today, and there does not appear to be a consensus on the outcome. We have been skeptical because the opposition to the proposals does not seem to have been addressed by the proponents. Moreover, the opposition is not just the so-called Frugal Four, and it has little to do with a common bond. On the other hand, we have argued that the prospects for a 750 bln euro package of loans and grants were not the driving force behind the better performing euro and European asset markets. We put more weight on monetary policy and the more than one trillion multi-year funding made available at minus 100 bp interest rate and the apparent ability of most European centers to manage the virus curve. That implies that disappointment with the summit may not have more than a short-term impact on the euro.

The euro peaked in the middle of the week, near $1.1450. It retreated to around $1.1370 yesterday. We suspect that defines the near-term range. There is an expiring for about 585 mln euros at $1.1400 today. Note that Monday, there is an option there for 2.4 bln euros that will be cut and another one for the same amount at $1.1350. North Amerian traders will likely keep it gravitating around $1.1400 today. Sterling was blocked near $1.2665 at the start of the week and is finding support ahead of yesterday’s lows near $1.2520. The low for the week was set on Tuesday, near $1.2480. We suspect that might be tested before the highs. |

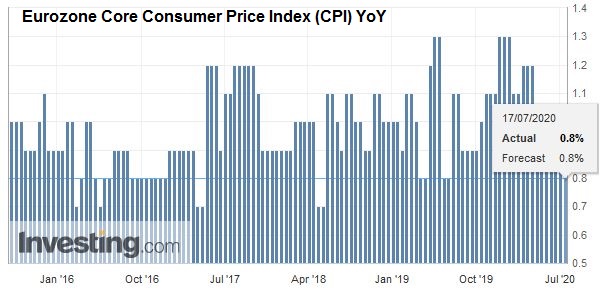

Eurozone Core Consumer Price Index (CPI) YoY, June 2020(see more posts on Eurozone Core Consumer Price Index, ) Source: investing.com - Click to enlarge |

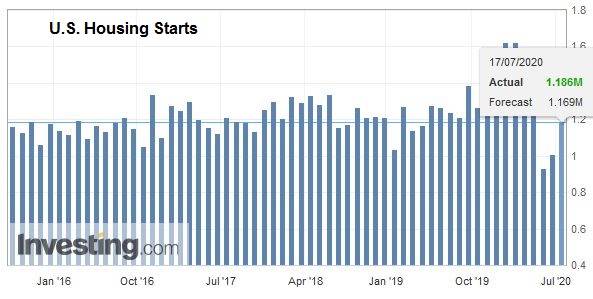

AmericaThe Fed’s balance sheet expanded for the first time in five weeks. The Treasury and MBS purchases and increased use of the commercial paper and TALF facility offset the continued reduction in the swaps with foreign central banks. The balance sheet rose by almost $38 bln to roughly 6.958 trillion. It peaked in the first half of June around $7.168 trillion. As the Fed transitions from financial stability to facilitating the recovery, it may have to expand its purchases. Just like more fiscal action is likely over the next few weeks, more Fed action is also likely, though the strategy may still be crystalizing. Central banks were significant sellers of Treasury bonds in March and April, but they have returned and nearly replaced the full amount of holdings liquidated from the accounts kept at the Federal Reserve. Remember the almost $131 bln of net sales of long-term US assets by foreign investors? It was nearly completely replaced in May according to the latest TIC data that showed about $127 bln in net new purchases of long-term assets. Two US sectors appear to be leading the nascent recovery. The first is manufacturing, and that reflects the re-starting of the auto sector, where output rose by more than 100% from May. The other sector is housing, and this will be confirmed today with a dramatic jump in June housing starts (~20%+). Record low mortgage rates are helping underpin activity. The University of Michigan’s preliminary July consumer confidence reading may be of passing interest. Expectations will likely lead the current assessment, which may have been dented by the new flare-up in the virus. |

U.S. Housing Starts, June 2020(see more posts on U.S. Housing Starts, ) Source: investing.com - Click to enlarge |

The US dollar tested support around CAD1.3500 for the past two sessions, and it held. The initial bounce has taken the greenback toward CAD1.3600. The week’s high, which is also the high so far here in July, was near CAD1.3645. The US dollar has gained on the Loonie in five of the past six sessions. It finished last month near CAD1.3575 and is virtually unchanged on the week. The greenback’s performance against the Mexican peso is different. It has moved lower against the peso in 10 of the past 14 sessions coming into today. However, ranges have been narrow, and after finishing June near MXN23.00, it hs found support near MXN22.25 this week. Net-net, it is flat this week. In the region, the Chilean peso is the best performer, gaining 1%. The Brazilian real is off for the week ahead of today’s session, while the Colombian peso is off almost 0.6%.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,$CNY,Currency Movement,EU,Featured,federal-reserve,Indonesia,newsletter