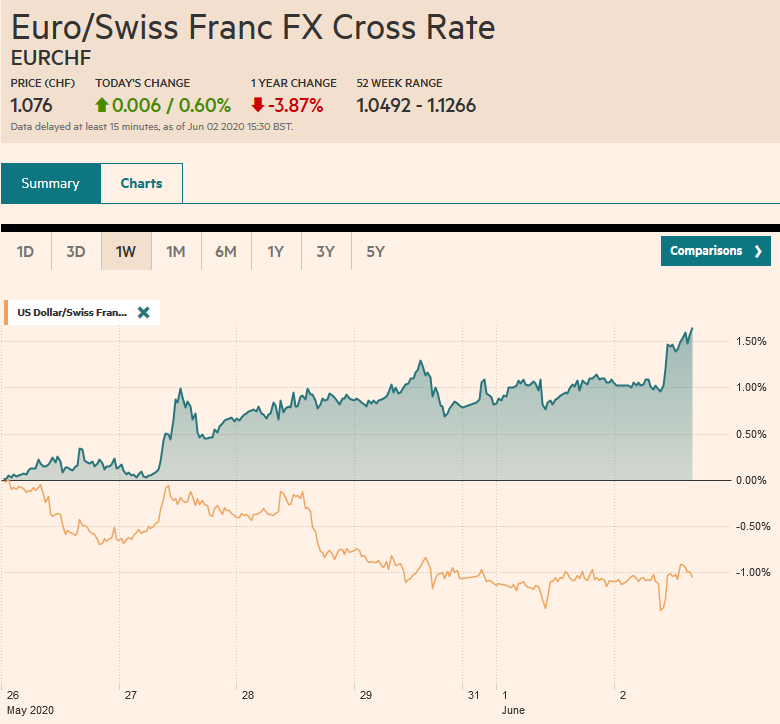

Swiss FrancThe Euro has risen by 0.60% to 1.076 |

EUR/CHF and USD/CHF, June 2(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Liquidity trumps everything else. US equities shrugged off the national guard being called into action in nearly a third of US states, and the S&P 500 closed yesterday at nearly three-month highs. Asia Pacific markets followed suit. Most markets in the region rose by more than 1%. The notable exceptions were Australia and China, where benchmarks rose by 0.2%-0.3%. The Dow Jones Stoxx 600 is up more than 1% in the European morning. It has gained about 2.5% this week already after advancing 3% or more in each of the past two weeks. US shares are extending yesterday’s gains. Bond yields are mixed, Asia Pacific yields were mostly higher, while European rates are softer, and premiums over Germany are narrowing. The US dollar remains out of favor, with the exception of the Japanese yen. The high beta currencies, like the Australian and Canadian dollars, and the Norwegian krone are leading the move, and recently sterling has joined this camp. Most emerging market currencies are also gaining against the greenback. The JP Morgan Emerging Market Currency Index is rising for the fourth consecutive session today, and for the 10th session in the past 12. Gold is consolidating at slightly lower levels as the three-day rally is checked. Oil is moving higher amid hopes of an extension of OPEC+ cuts, with the July WTI contract at new three-month highs near $36.25. |

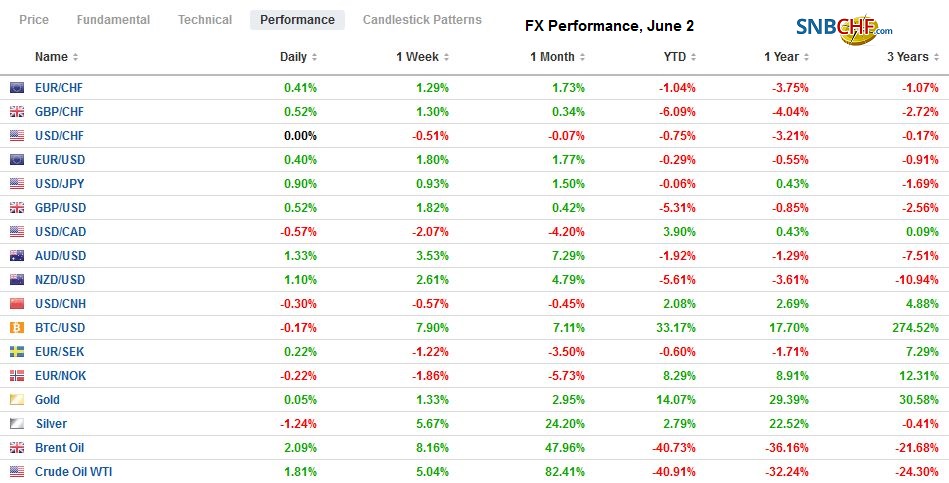

FX Performance, June 2 |

Asia Pacific

Forward points for the Hong Kong dollar continue to pare recent gains, and the three-month points briefly dipped below 100 to return to the upper end of the previous range. The 12-month points also eased by 400 bp are still nearly twice the pre-crisis level. Meanwhile, the PBOC set the dollar’s reference rate at CNY7.1167, weaker than the bank models implied (~CNY7.1203). The yuan strengthened for the fourth consecutive session, and the dollar slipped through CNY7.10 to unwind most of its recent rise.

Moody’s cut India’s credit rating to Baa3, the lowest investment-grade rating. It cited policy risks and slower growth. The rating now matches S&P and Fitch’s assessment. Moody’s kept a negative outlook. Nevertheless, India’s 10-year benchmark eased 3 bp to 5.78%, a new multi-year low. The rupee is strengthening against the dollar for the third session.

The Australian dollar is moving higher for the eighth week of the past ten. The recent advance is even more impressive in the face of tensions with China, as many observers often emphasize the linkages. As widely expected, the central bank left the cash, and three-month target rates unchanged at 25 bp. Separately, Australia reported a larger than expected Q1 current account surplus (~A$8.4 bln vs. median forecast for A$6.1 bln and the Q4 surplus was revised to A$1.7 bln from A$1.0 bln).

The dollar is confined to a narrow third of a yen range above JPY107.50, where a $1.1 bln option is struck that expires tomorrow. Since May 18, the dollar has not traded below JPY107.00 or above JPY108.10. The Australian dollar is poking above $0.6850 in the European morning. It settled last week almost two cents lower. It is at its best level since late January. The year’s high set at the very start was near $0.7020.

Europe

Newswires reported that some ECB members are pushing back against the expansion of the central bank’s Pandemic Emergency Purchase Program (750 bln euros). When such inside stories surface, it often makes sense to ask who is helped or hurt by the “leak.” Often we find that it is those that are losing or lost the debate try to get a wider hearing for their side. After all, the winners have little reason to do so. The ECB meets Thursday. The PEPP program has plenty of firepower for the next several months. In fact, even the more aggressive estimates do not see it the program’s funds exhausted until late Q3. However, it may get a bigger effect to announce its commitment before being backed into a corner. If the ECB does not expand its purchases by at least 500 bln euros, we suspect investors will be disappointed, and that disappointment could be expressed as undoing some of the narrowing of the German premium seen recently.

Germany is debating additional fiscal stimulus that could be worth 100 bln euros. A variety of programs are under consideration, including debt relief for cities and cash for consumers. There is some push for subsidies for car purchases. Meanwhile, the French government has revised this year’s GDP forecast to -11% from -8%. This may offer a hint at the ECB’s staff forecasts that will be updated at the central bank meeting.

The euro has taken out the late March high near $1.1165 to approach the $1.12 area in the European morning. The old high corresponded to a (61.8%) retracement of the swoon in March that took the single currency from almost $1.15 to about $1.0635. Above $1.12, an initial resistance is seen near $1.1240, but the next important level is near $1.13. Sterling is also advancing on the back of a weaker US dollar. Its 1.2% surge yesterday, the most since late March, carried it above $1.25 and it reached $1.2570 in Europe today. The $1.2640 area held it back in April (twice), and the 200-day moving average is near $1.2670, which offers an important technical test.

America

Although we tend to put more weight on US auto sales, which are often a proxy for discretionary household spending, than many, today’s report may attract more attention than usual. After a lowly 8.6 mln vehicles sold in April at a seasonally-adjusted annual rate, the key question is whether the survey data that mostly improved in May reflected an increase in real activity. The median forecast is for vehicle sales to rise to around 11.1 mln. Last May, 17.3. mln vehicles (SAAR) were sold. It is the first hard data outside of the weekly jobless claims for May.

Oil prices have been lifted by hopes that Russia’s declared willingness to continue to cooperate with OPEC will lead to an extension of the maximum output cuts, though Moscow has not confirmed it. Due to extra cuts by Saudi Arabia, Kuwait, and the UAE, the lack of compliance by Iraq and Nigeria have been easily absorbed. Also, US output has fallen for 11 weeks, though shipments from Saudi Arabia appear to have lifted inventories recently. In one telling sign that higher prices may bring back US shale producers, Bloomberg reported that the shut-in oil in North Dakota’s Bakken fields has fallen hunting at an increase in output.

The US dollar continues to drop against its NAFTA partners. The greenback finished April near CAD1.3950 and settled last month near CAD1.3780. Today, it dipped below CAD1.35 for the first time since March 9. The CAD1.3440-CAD1.3460 is the next important technical area, corresponding to an old and unfilled gap and the 200-day moving average. Resistance is now seen CAD1.3550 and then CAD1.3600. The Bank of Canada meets tomorrow and is not expected to alter policy. The Mexican peso was the strongest currency in the world last month, gaining 9% against the US dollar. The global liquidity story and calmer markets underscore the attractiveness of Mexico’s high real and nominal rates. Its one-month bills (cetes) pay almost 5.4%. The greenback is falling through MXN22.00, which supported it last week. The next key technical target is near MXN21.30. Initial resistance is seen in the MXN22.20 area.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,$CNY,Currency Movement,EUR/CHF,Hong Kong,India,newsletter,OIL,RBA,USD/CHF