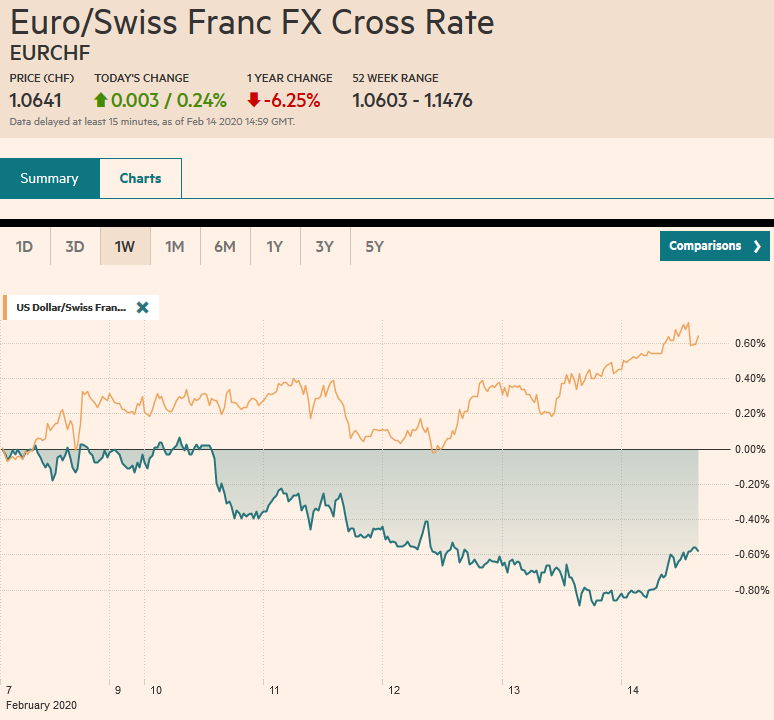

Swiss FrancThe Euro has risen by 0.24% to 1.0641 |

EUR/CHF and USD/CHF, February 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

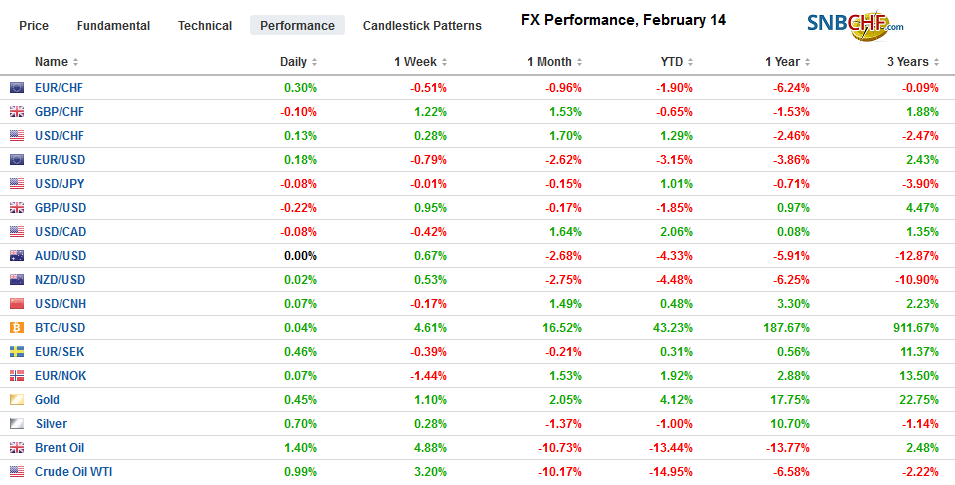

FX RatesOverview: The capital markets are heading into the weekend, still trying to look past the coronavirus despite the new cases in Hubei. Tokyo was a notable exception in the Asia Pacific region, as the other major equity markets, like in Hong Kong, China, Taiwan, South Korea, and Australia, advanced. The MSCI Asia Pacific Index rose for the second week. European shares are little changed, and the Dow Jones Stoxx 600 has risen by about 5% over the past two weeks. US shares are firm, and the S&P 500 has gained about 4.5% over the past two weeks coming into today’s session. Benchmark 10-year yields are softer on the day, but mostly a couple basis points higher on the week. Greece is a notable exception. Its 10-year bond yield broke below 1% for the first time and is finishing the week near 90 bp. The yield of the 10-year UK Gilt, on the other hand, rose 15 bp over the past three sessions and is paring the gains today. The dollar is little changed against the major currencies ahead of the start of the US session. The dollar appears to be in greater demand in the North American session that other centers in recent days. For the week, the dollar is mixed. Sterling has been the strongest of the majors, gaining a little more than 1%, while the euro has been the weakest, shedding a little less than 1% to fall to new two-year lows. Gold is little changed on the day and week, while oil is snapping 5-week and 20% slide with a 2.4% gain for the March contract. |

FX Performance, February 14 |

Asia Pacific

Hubei province reported another 4823 new cases of the coronavirus after a 14.8k surge when the CAT scan diagnoses began being included the previous day. The point to keep in mind is that the surge represents old cases being properly recorded rather than an escalation of the contagion. Tragically, another 116 people died. Many, including the White House, expressed concern about the transparency from China, noting that US health officials have still not been allowed to enter. The Financial Times quotes a noted epidemiologist in London expressing concern that only about a tenth of the cases may be being correctly detected. In Wuhan, he suggests the undercounting may be more extreme, catching maybe one in 19 infections.

Japan’s tertiary index (services) unexpectedly fell by 0.2% in December. Economists had expected a continued recovery as the economy continued to recover from the typhoon and sales tax increase in October. The November series was revised to 1.4% from 1.3% after the sharp 5.2% decline in October. This bodes ills for the first estimate of Q4 19 GDP due at the start of next week. At an annualized pace, economists expect around a 3.5% contraction. Meanwhile, foreign appetite for Japanese bonds remained strong for a second week. In the two weeks through February 7, foreign investors bought roughly JPY2.7 trillion of Japanese bonds. It is the most in two weeks since the end of 2018. Note, however, that the demand for (Japanese and EMU) bonds is not the same as demand for the currency. Hedging out the yen (or euro) exposure back into dollars can generate a higher return than US Treasuries.

The dollar rose against the yen in the first three sessions this week and has slipped yesterday and today. It is virtually flat on the week (~JPY109.75). The greenback flirted with JPY110 but has been capped in front of JPY110.15. Support has been found ahead of JPY109.50. There are two sets of expiring options to note today. The first is at JPY109.75-JPY109.80 for $1.4 bln, and the other is at JPY110 for $1.1 bln. The Australian dollar has stabilized today following yesterday’s quarter percent fall. It is holding on to about a 0.7% gain this week to snap a six-week slide, which means this is the first week it has risen this year. It recorded a multi-year low near $0.6660 to start the week and is finishing above $0.6700. The nearby cap is around $0.6750, where a roughly A$660 mln option is found that will roll-off today. The dollar is edging higher against the Chinese yuan for the third day, but on the week, it has slipped by a little more than a quarter of one percent (~CNY6.9630).

Europe

The UK cabinet reshuffle was not much of a factor until Chancellor Javid unexpectedly resigned (rather than sack his top aides, according to reports). Although Javid had relaxed the fiscal rules, his departure has boosted speculation of a bolder push for spending increases and tax cuts. This bolstered sterling, in part because it is seen as positive for UK growth prospects and takes some burden off monetary policy.

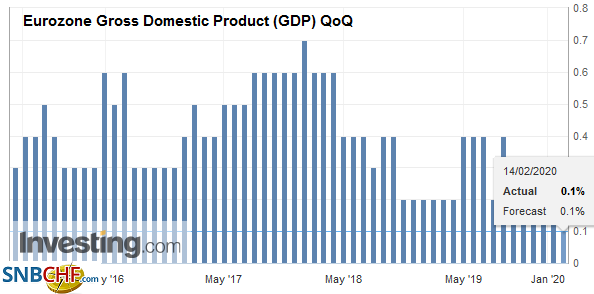

| The eurozone confirmed Q4 19 growth of a measly 0.1% but revised down the year-over-year pace to 0.9% from 1.0%. The new news today though, is that the German economy defied fears after the December plunge in industrial output (-3.5% in December from November) and managed to avoid a second contraction in three quarters. Europe’s largest economy stagnated in Q4. |

Eurozone Gross Domestic Product (GDP) QoQ, Q4 2019(see more posts on Eurozone Gross Domestic Product, ) Source: investing.com - Click to enlarge |

| The significant development this week is that the competition to replace Merkel as Chancellor was thrown wide open after her handpicked successor (known by her initials AKK) stepped down as party chair. Merkel’s critics to the right seem to have the early advantage. A national election will be held next year. |

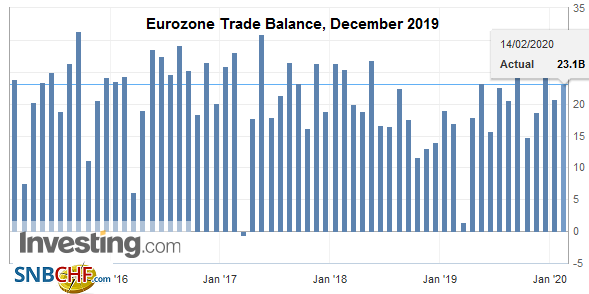

Eurozone Trade Balance, December 2019(see more posts on Eurozone Trade Balance, ) Source: investing.com - Click to enlarge |

The euro fell to new three-year lows today near $1.0825. It fell every day last week and has risen once this week, coming into today’s session. The expiring option at $1.0875 for 1.1 bln euros may help cap it. There is a gap from April 2017 when the results of the first round of the French election were clear, and it extends to $1.0740, which is the next important chart point. As the euro trades at levels not seen in some time, implied volatility is rising. One-month vol was near 3.75% earlier this month and now is around 4.6%, its highest since January 7. Sterling is consolidating yesterday’s 0.6% gain, its most in two weeks. It had a four-day advance coming into today’s session, but buying dried up near $1.3065, have been below $1.2950 yesterday. There is an option for about GBP380 mln at $1.3050 that expires today. One-month sterling vol fell to five-year lows near 5.3% yesterday and is near 5.8% today. We suspect that the Swiss National Bank may have intervened as the euro fell to fresh lows against the franc near CHF1.06. Next week’s sight deposits will shed light on SNB actions, which the US has raised its criticism. Since the end of last November, the euro has risen against the franc in only two weeks.

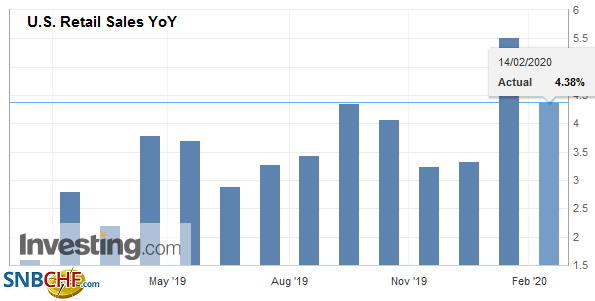

AmericaToday’s US data is likely to be a case of more of the same. The US consumer slowed in Q4 19, and the January retail sales report is likely to show it remained subdued at the start of the year. The headline is expected to match the 0.3% rise posted in December, while the GDP components may slow to 0.3% from 0.5%. Income, the main fuel of consumption, is softening. |

U.S. Retail Sales YoY, January 2020(see more posts on U.S. Retail Sales, ) |

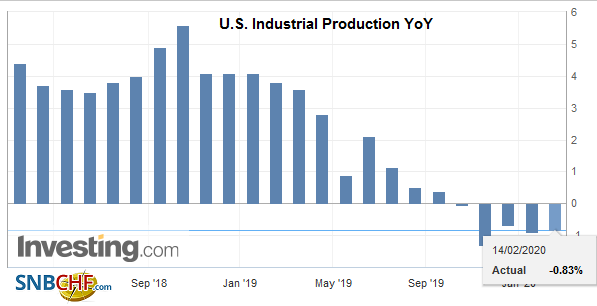

| The increase in real average hourly earnings (0.6% year-over-year) appears to translate into fewer hours, and thus average real weekly earnings were unchanged last month. Meanwhile, the slump in the industrial sector likely continued. January’s industrial output is expected to have fallen for the fourth time in the past five months. Manufacturing production may have contracted. Capacity utilization peaked in November 2016, near 79.6. It has been trending lower and probably slipped below 77%. |

U.S. Industrial Production YoY, January 2020(see more posts on U.S. Industrial Production, ) Source: investing.com - Click to enlarge |

The Federal Reserve is making a strong statement. The market has been abuzz about the fact that the last three term repos were oversubscribed. Yesterday, it announced that starting next week, it was cutting the amount it would offer by $5 bln to $25 bln. It preannounced it would taper by another $5 bln in early March. It would only make sense to do this if it concluded that the increased demand for the term repo reflected banks being drawn to the cheapness of funds than an underlying problem.

As widely anticipated, Mexico’s Banxico reduced the target rate by 25 bp to 7.0%. The decision was unanimous. Previously there was a dissent in favor of a 50 bp move. The central bank raised its inflation forecasts and shaved its growth forecasts. We suspect the next cut will be in May or June. Argentina also cut rates yesterday. It was their sixth cut in less than two months. Unlike Mexico, though Argentina’s rate floor (44%) is below the rate of inflation (~53%). Mexico’s cash target is more than twice the level of CPI.

The Mexican peso is edging higher today as it tries to extend the advance for a fifth consecutive session. After poking through MXN18.80 at the start of the week, the dollar is finishing with a push back below MXN18.60. Last week’s low was near MXN18.56. Chart support is seen near MXN18.50, but a break will set sights on MXN18.00. The US dollar is giving back yesterday’s gains against the Canadian dollar that brought it back to CAD1.3270 after hitting nearly CAD1.3235 in the middle of the week. We have been looking for the Canadian dollar to recover after approaching the lower end of a six-month trading range. A near-term test on the 200-day moving average found near CAD1.3215 looks likely and maybe toward CAD1.3100-CAD1.3150. The Dollar Index is firm at its best level since October. It has only fallen once in the past two weeks and is trying to establish a base above 99.00. Last year’s high was near 99.65.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,China,Currency Movement,EUR/CHF,Eurozone Gross Domestic Product,Eurozone Trade Balance,federal-reserve,MXN,newsletter,U.S. Industrial Production,U.S. Retail Sales,USD/CHF