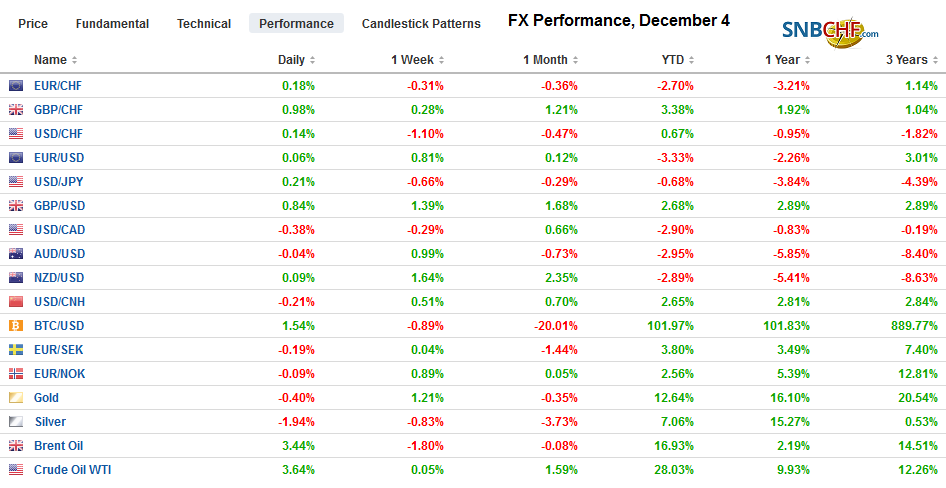

Swiss FrancThe Euro has risen by 0.19% to 1.0957 |

EUR/CHF and USD/CHF, December 4(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The prospect of not just the failure of the US and China to resolve its trade dispute but a new escalation has sapped the confidence that had lifted equity benchmarks and the greenback. Led by more than a 1% decline in Tokyo (Nikkei), Hong Kong, and Australia, all the major markets in the Asia Pacific region fell. European shares, perhaps encouraged by an upward revision to the flash composite PMI, are snapping a four-day 2.75% slide. US shares are firmer in Europe. Bond markets in Asia Pacific played catch up after US 10-year Treasury yields tumbled by the most in nearly four months yesterday (10 bp to 1.71%). A disappointing Q3 GDP from Australia fanned expectations of an asset purchase program next year to send the 10-year bond yield down 13 bp (to ~1.05%). European benchmarks are slightly higher, as are Treasury yields. The dollar has stabilized after yesterday’s drop and is firmer against most of the major currencies. The Australian dollar is the weakest, giving back yesterday’s gains. Sterling is the strongest and traded at new seven-month highs against the dollar and euro. Oil is firmer ahead of the OPEC+ meeting as it continues to claw back the 5% drop (January WTI) at the end of last week. Gold initially extended the recent rally, rising to around $1484 before reversing lower. |

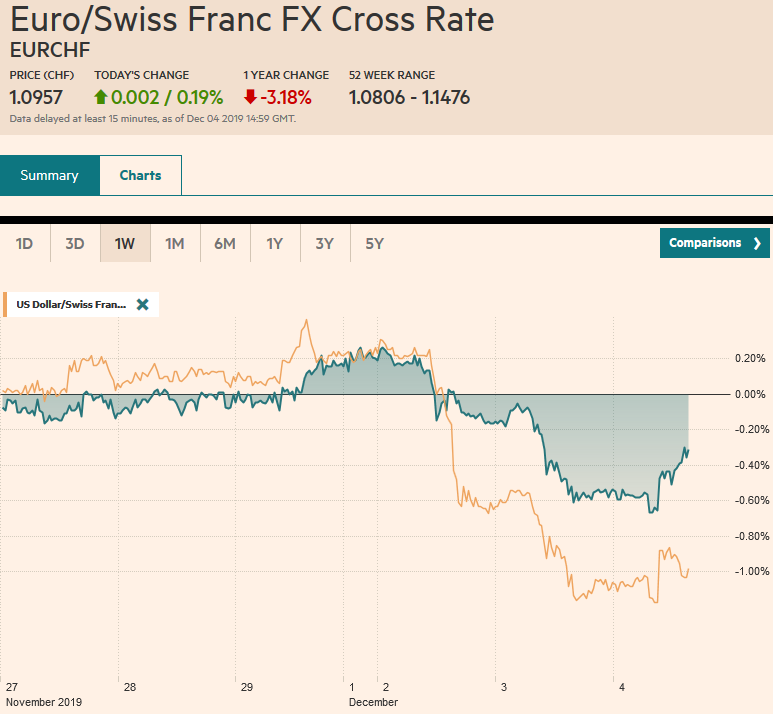

FX Performance, December 4 |

Asia PacificChina’s Caixin Composite PMI rose to a seven-month high of 53.5 (from 51.1). Recall the manufacturing PMI edged up to 51.8 from 51.7. The service PMI rose to 53.2 from 52.0. This mix is very much in line with ideas that the external sector (manufacturing) has been hit by the trade war with the US, while some parts of the domestic economy (services) have begun doing better. |

China Caixin Services Purchasing Managers Index (PMI), November 2019(see more posts on China Caixin Services PMI, ) Source: investing.com - Click to enlarge |

Australia’s data was not as poor as the price action suggests. Q3 GDP came in at 0.4%, which was slightly lower than expectations, but Q2 GDP was revised to 0.6% from 0.5%. The year-over-year pace was spot on expectations at 1.7%, and growth in Q2 was revised to 1.6% from 1.4%. The composite PMI was revised to 49.7 from 49.5. While there is much talk about an asset purchase program, it is not imminent. With the cash rate at 75 bp, there is scope for another cut or two before QE would be considered.

India may move pass the UK and France this year to hold claim to being the fifth-largest economy in the world this year. Yet the Indian economy is slowing down and the Reserve Bank of India is likely to cut rates tomorrow for the sixth time this year. The repo rate began this year at 6.5%. It now is at 5.15%. The economic slowdown in China commands attention. Still, India, with a completely different political system and economic structure, is experiencing a sharp downturn despite the rate cuts, tax reductions and aid to troubled companies. Investors learned last week that the Indian economy grew 4.5% from a year ago in Q3, which is the first sub-5% reading in six years. In Q3 18, the economy grew by 7.0%. That said, the November PMIs rose, and the composite now stands at 52.7, the highest since July. There is an underlying similarity between China and India, and that is a key problem that stems from non-bank financial institutions (shadow banking). The economic slowdown is squeezing the entrepreneurs that relied on it for funding. Both the rupee and yuan have declined about 2.6% against the US dollar this year, but India’s rates are twice China’s (two-year yields are around 5.35% and 2.65% for India ad China, respectively and the 10-year rates are near 6.45% and 3.2%). While China’s inhumane treatment of Muslims has been brought to the world’s attention, India’s actions in Kashmir have escaped much scrutiny.

The dollar, which began the week at its highest level against the yen since May (~JPY109.75), extended its losses earlier today to dip briefly below JPY108.45. It has stabilized and is testing previous support, which now may serve as resistance, in the JPY108.80-JPY109..00 band. There is a roughly $375 mln option at JPY109 that expires today. The Australian dollar’s two-day rally that lifted it a little more than a cent met a key retracement target yesterday a little above $0.6860 and was ripe for profit-taking today. Today’s decline found support today after giving up nearly half of its two-day advance. A break of the $0.6780 area would suggest the squeeze is over. The Chinese yuan edged higher today, but the PBOC’s reference rate was set to weaken the yuan by the most since August. The dollar closed last week near CNY7.0325 and reached CNY7.0735 (highest since October 23) today before pushing back belowCNY7.06. Some linked the recovery to lingering hopes that a US-China deal can be struck over the next 11 days.

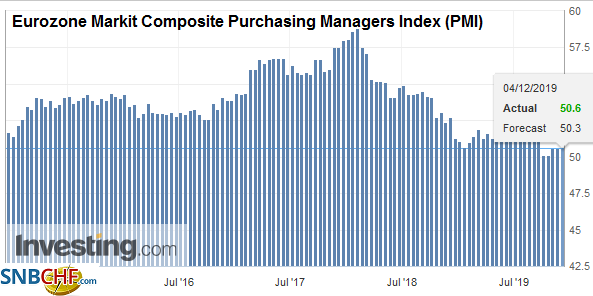

EuropeThe eurozone composite PMI was revised to 50.6 from the flash reading of 50.3, and leaving it unchanged from October. However, several developments are concealed by the aggregate report. First, German data were revised higher. The services PMI stands at 51.7, up from the 51.3 flash report and putting it slightly above the October reading. The composite edged to 49.4 from 49.2 of the flash and 48.9 in October. |

Eurozone Markit Composite Purchasing Managers Index (PMI), November 2019(see more posts on Eurozone Markit Composite PMI, ) Source: investing.com - Click to enlarge |

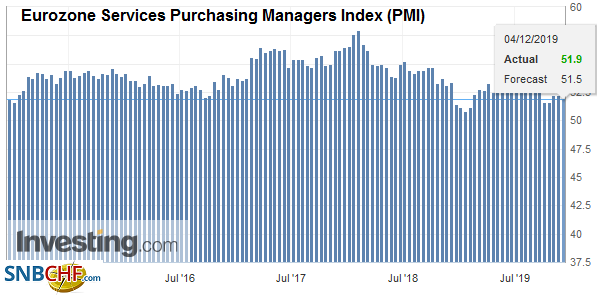

| This lends addition credence to our argument that the German economy is on the mend, albeit slowly from weak levels. Second, France went in the wrong direction. Both the services PMI and composite were revised lower from the flash report and showed small deterioration month-over-month. Third, Spain defied expectations for weakness as both the services and composite gained. At 51.9, the composite is at a three-month high. Fourth, Italy disappointed. The service PMI fell to 50.4 from 52.2, and the composite below back below the 50 boom/bust level (49.6) for the first time since May. |

Eurozone Services Purchasing Managers Index (PMI), November 2019(see more posts on Eurozone Services PMI, ) Source: investing.com - Click to enlarge |

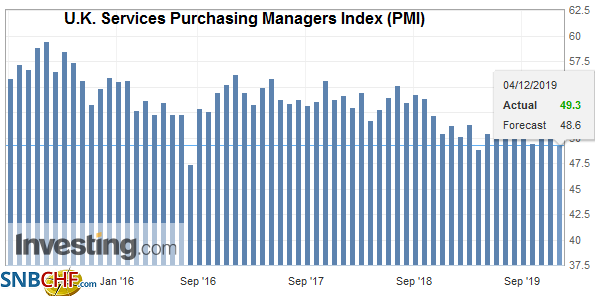

| The UK PMI was not quite as weak as the flash reading suggested, but the services and composite readings remained below 50. They both stand at 49.3 from 50.0 in October. The flash report had them at 48.6 and 48.5 for the services and composite, respectively. Separately, we have noted that the Bank of England has been building its currency reserves at twice last year’s pace (average monthly increase through October of ~$1.5 bln vs. ~$750 mln in 2018). However, it slowed to a crawl last month, rising only by $49 mln, the weakest since a decline was posted this past March. |

U.K. Services Purchasing Managers Index (PMI), November 2019(see more posts on U.K. Services PMI, ) Source: investing.com - Click to enlarge |

The euro traded between roughly $1.1065 and $1.1095 yesterday and is within that range today. A break of the $1.1040-$1.1050 area now would suggest the counter-trend bounce is over. It has not closed off the $1.10-handle since November 5. Sterling is trading at seven-month highs against both the euro and dollar as traders appear to be increasing their exposure as they feel more confident about next wee’s election outcome. Sterling reached almost $1.3065. The euro has traded down to nearly GBP0.8480. In late European morning turnover, sterling’s gains are being pared. The breakout levels can be retesting (~$1.30 and GBP0.8500).

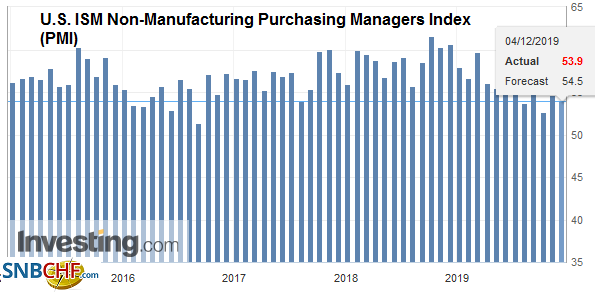

AmericaThe US House of Representatives passed a bill yesterday that allows the sanctioning of Chinese officials for the repression of Muslims. The bill differs from the Senate version and must be reconciled before the president can sign the measure. China has threatened to retaliate and may sanction the bill’s sponsors, but it would be seen as a badge of honor by many. US officials still seem to be hopeful that the “talking and fighting” will not stand in the way of a trade agreement before Trump makes a decision about the December 15 tariffs. The Bank of Canada meets today. There is practically no expectation that it eases policy. The overnight target is 1.75%. At its last meeting, the central bank seemed to soften its neutral stance, but it clearly signaled no great urgency to cut rates. It survived this year’s three rate cuts by the Fed and a slowing of the US economy without easing policy. There appears to be some movement with the USMCA. After talks with the House Democrats, the US trade negotiators have asked Mexico, the only one of the three parties to have passed NAFTA’s replacement, to exclude biologics. This is a significant climbdown for Republicans, who, like some large pharmaceutical companies, have insisted on the inclusion. Mexico’s decision is awaited, but if it agrees, there is a path to House approval, perhaps on December 20, the last session before the holiday break. The US sees the ADP private-sector jobs estimate (~135k from 125k in October) and the final PMI and non-manufacturing ISM. Recall that the manufacturing PMI rose to seven-month highs while the manufacturing ISM eased to 48.1 near the cyclical trough. The most important report, though, is the jobs data at the end of the week, which should be flattered by the return of GM strikers. |

U.S. ISM Non-Manufacturing Purchasing Managers Index (PMI), November 2019(see more posts on U.S. ISM Non-Manufacturing PMI, ) Source: investing.com - Click to enlarge |

The US dollar is stuck in a range between roughly CAD1.3260 and CAD1.3330 for a little more than two weeks. We continue to favor a downside break, and it has to go back below CAD1.3200 to denote anything significant. The market has sold into dollar gains above MXN19.60. Initial support is seen near MXN19.50. We note that other currencies in the region, especially Brazil’s real and Chile’s peso have stabilized, and this helps ease some of the pressure on the peso. Chile’s central bank meets today and is expected to cut rates by 25 bp to 1.50%. Lastly, a word about the S&P 500. It gapped lower yesterday before reversing higher and closing on its highs. A bullish hammer candlestick may have been traced. The gap extends to about 3110.80, which will likely offer resistance. The gap created by the November 1 higher opening that we thought was significant was closed yesterday, and this is understood as a positive technical development.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,China,China Caixin Services PMI,Currency Movement,EUR/CHF,EUR/USD,Eurozone Markit Composite PMI,Eurozone Services PMI,FX Daily,India,newsletter,Trade,U.K. Services PMI,U.S. ISM Non-Manufacturing PMI,USD/CHF