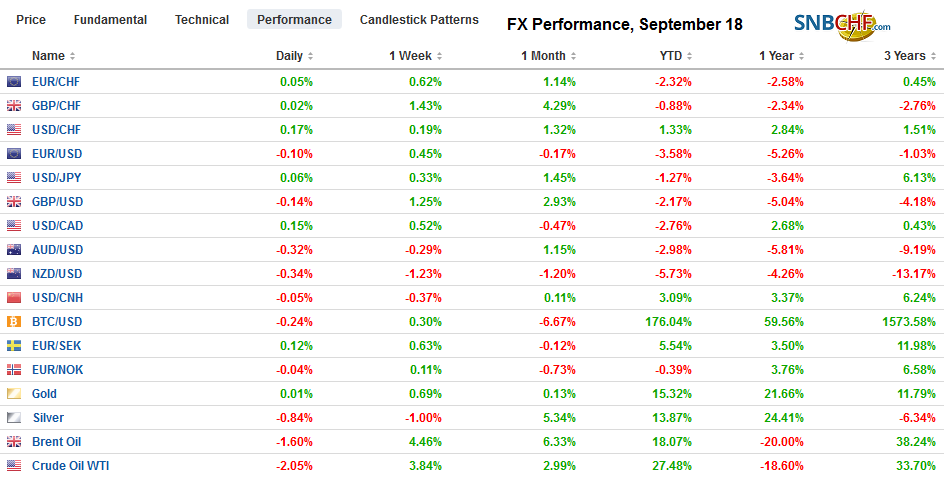

Swiss FrancThe Euro has risen by 0.05% to 1.10 |

EUR/CHF and USD/CHF, September 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: News that Saudi Arabia was able to restore 40%-50% of the oil capacity lost by the weekend strike coupled with the Fed’s efforts to offset the squeeze in the money markets are allowing the global capital markets to trade quietly ahead of the conclusion of the FOMC meeting. Equities are little changed with a lower bias that has been seen in the first few sessions this week. Asia Pacific markets were mixed, with Japan, Australia, Hong Kong, and many small bourses slipped while China, Taiwan, and South Korea advanced. Europe’s Dow Jones Stoxx 600 is struggling to post its first gain of the week, and US shares in Europe are little changed. Benchmark 10-year yields are mostly 2-4 bp lower. The 10-year US Treasury that had surged through 1.90% at the end of last week is yielding about 1.77% now. The US dollar is firmer against all the major currencies, led by the Antipodean and Scandi currencies. The yen and Swiss franc are the most resilient as they nurse small losses. The swings in oil prices seem to be an important driver of several of the large emerging market currencies. Meanwhile, oil prices are a little softer. The front-month Brent futures peaked near $72 and is now a little above $64. It closed last week closer to $60. WTI for November delivery settled last week below $55 and spiked to $64 and is now straddling the $58-area. |

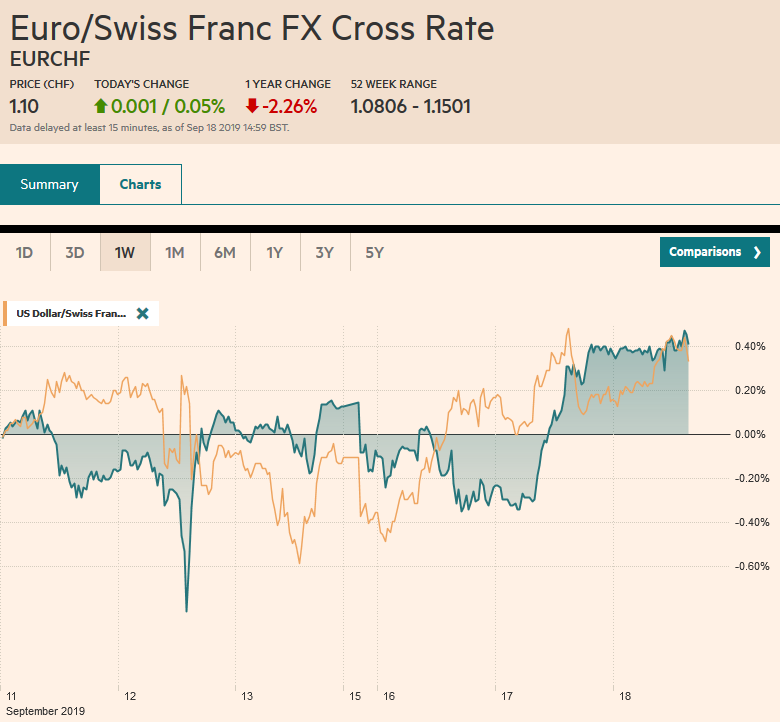

FX Performance, September 18 |

Asia Pacific

Japan continued to run a trade deficit in August. On a seasonally-adjusted basis, Japan’s trade balance has been in deficit except for one month since June 2018 and that was in February. The August shortfall was nearly JPY131 bln. While wider than the JPY104 bln in July, it was smaller than economists projected. The base effect, derived from the performance a year ago, made for a sharp deterioration in both exports and imports. Japanese fell 8.2% year-over-year after a 1.5% decline in July. Exports have fallen nine consecutive months. Last August, exports had risen by 6.5%. Autos and chip-making equipment continue to be depressed. Imports fell 12.0% after the 1.2% fall in July. While exports fell less than economists expected, imports fell more than forecast. There does a clear implication for the BOJ meeting that concludes tomorrow. We expect the BOJ to wait until the impact of the sales tax increase (October 1) can be assessed.

The PBOC set the reference rate for the dollar below where bank models suggested after setting it a little higher yesterday. While the Hong Kong Monetary Authority will no doubt match the Fed’s move, the PBOC will be closely watched as it publishes the new rate for the recently revived prime loan rate Friday. A small cut is expected ahead of the weekend. Separately, Chinese officials have announced intentions to release some pork from state stockpiles, apparently ahead of the upcoming holiday commemorating the 70th anniversary of the revolution. Meanwhile, a bill has begun making its way through the US Congress that seeks to review Hong Kong’s autonomy on an annual basis to renew its special trade privileges that treat its exports differently than the mainland’s.

The dollar is in a narrow range against the yen but is holding above JPY108.00 for the second consecutive session. It appears pinned between two expiring options today: A $575 mln option at JPY107.75 and a nearly $660 mln option at JPY108.25. The greenback reached almost JPY108.40 yesterday. Technically, the dollar looks poised to move higher, and the next hurdle on the upside is JPY109.00-JPY109.30. Yesterday, the Australian dollar recovered from $0.6830 back to $0.6870, but Fri has been pushed back in the European morning to marginally take out yesterday’s low. The intraday technicals look stretched again, but little stands in the way of a test on the $0.6800. An option for about A$585 mln at $0.6865 expires today.

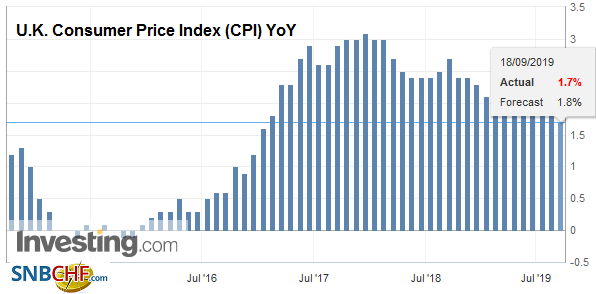

EuropeThe Financial Times reports today that UK Prime Minister Johnson was told in no uncertain terms that the idea that the backstop can be replaced by allowing Northern Ireland to continue to adhere to EU rules on food and livestock (“SPS”) is a non-starter. It is not sufficient to prevent border checks for a majority of goods. The report made it seem like Johnson was surprised. Earlier today, outgoing EC President Juncker said a no-deal Brexit was “palpable.” A day before the Bank of England meets, the UK reported softer than expected inflation gauges. The preferred CPIH, which includes owner-occupied housing costs, fell to 1.7% from 2.0%. |

U.K. Consumer Price Index (CPI) YoY, August 2019(see more posts on U.K. Consumer Price Index, ) Source: investing.com - Click to enlarge |

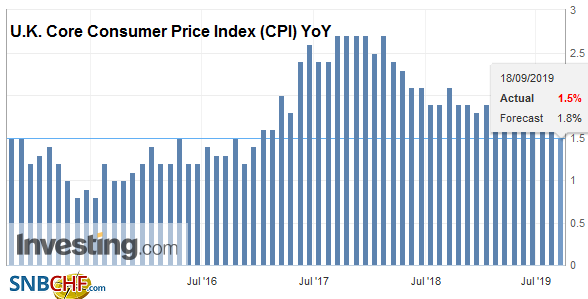

| The median forecast in the Bloomberg survey was for a 1.9% rate. The core rate eased to 1.5% from 1.9%. Both rates have not been this low since November 2016. Sterling was sold on the news to reach the session low near $1.2440 from about $1.2480. |

U.K. Core Consumer Price Index (CPI) YoY, August 2019(see more posts on U.K. Core Consumer Price Index, ) Source: investing.com - Click to enlarge |

| Separately, reports suggest that if Brexit is extended, then BOE Governor Carney may be asked to extend his departure beyond the end of January. |

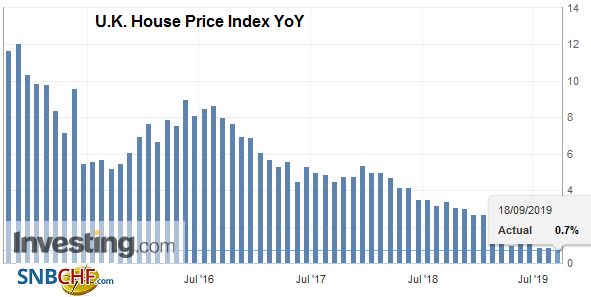

U.K. House Price Index YoY, September 2019(see more posts on U.K. House Price Index, ) Source: investing.com - Click to enlarge |

| Tomorrow the first allotment of the new Targeted Long-Term Refinancing Operation (TLTRO) will be announced as the new ECB measures begin to take effect. Car registrations in the EU (a proxy for sales) fell 8.4% in August and are off 3.2% year-over-year. Separately, we note that Spain looks to be headed for its fourth election in about four years after the King judged that no one can put a majority government together from the existing parliament. Israel’s election looks indecisive again. |

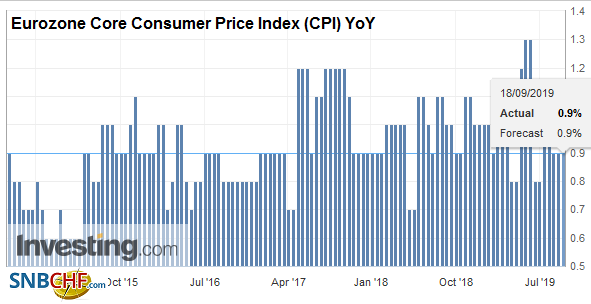

Eurozone Core Consumer Price Index (CPI) YoY, August 2019(see more posts on Eurozone Core Consumer Price Index, ) Source: investing.com - Click to enlarge |

| The euro’s upward momentum seen yesterday in North America stalled near $1.1075. The selling pressure seemed to increase in the European morning with the single currency easing below $1.1040. There is a nearly 580 mln euro option at $1.1030 that will be cut today. Also, there is a 1.6 bln option at $1.10 that might be challenged today, but the intraday technicals suggest it is unlikely. The upside momentum of sterling that lifted it to almost $1.2520 in North America yesterday did not induce follow-through buying today. We suspect the $1.2440 and $1.2480 may contain most of the price action until the FOMC results. |

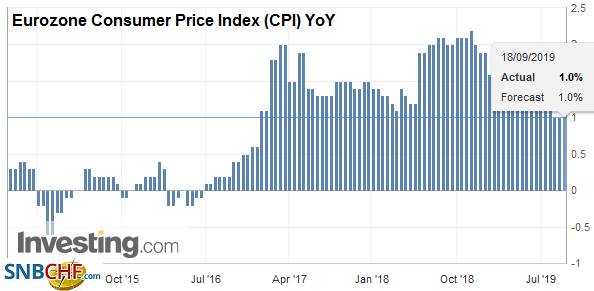

Eurozone Consumer Price Index (CPI) YoY, August 2019(see more posts on Eurozone Consumer Price Index, ) Source: investing.com - Click to enlarge |

America

The Federal Reserve arranged its first system repo in a decade yesterday and preannounced another for today. Yesterday’s was for $53 bln. Today’s $75 bln-operation would allow a rolling over of yesterday’s repo, and a small net add. A surge in money market rates seems to be more of a short-term hiccup, a confluence of factors. We do not think it portends an imminent financial crisis or that the Fed has lost control of the money markets. It took action to help restore the balance and address the funding squeeze. It is most certainly not the same as QE. Asset purchases under QE reflect a permanent change in ownership. An overnight repo is unwound the next day. We have previously advocated alongside others that the Fed should have a permanent (standing) repo facility. This week’s money market developments will likely be one of the issues Powell will address at today’s press conference.

The repo operation is separate from today’s FOMC decision. However, one implication is that it may, on the margin, it may increase the likelihood that the Fed cuts the interest on reserves five basis points less than the target range as it has done previously. We would not want to push this point too far, but we suspect that the Fed is committed to cutting interest rates by 75 basis points in the midcourse correction. There will be a 25 bp move left after today.

The operational definition of midcourse correction from the mid-1990s was three cuts under Greenspan’s leadership. The timing of the third cut (October or December) might be data-dependent. We expected a pause after that third cut. From a macro perspective, not much has changed since the Fed met at the end of July. Trade conflict with China appears to have stabilized for the moment, but large uncertainties remain. For example, preliminary WTO ruling will allow the US to impose tariffs on $5-$10 bln of Europe’s goods for unfairly subsidizing Airbus. The Trump Administration has several other grievances with Europe, including, Nord Stream II, France’s digital tax, defense spending, and its bilateral trade surplus with the US. Inflation, as measured by the core CPI, has accelerated and how the Fed characterizes this will be scrutinized. Many observers suspect the rise in core CPI, like the GM strike, are late-cycle phenomenon.

In addition to the FOMC meeting, the US is expected to report that housing starts in August recovered from the 4.0% decline in July, while permits, which had surged, pullback. Canada reports August CPI. The headline may soften a little, but the underlying core measures are expected to be little changed. This will allow the Bank of Canada to maintain its neutral posture. Brazil’s central bank meets today, and it is expected to cut the Selic rate by 50 bp to a new record low of 5.5%. Many expect another cut before the end of the year.

The US dollar tested the CAD1.33-level yesterday, just shy of the 200-day moving average. As the greenback’s gains were pared across the board, it eased to near CAD1.3235. Although it bounced back to CAD1.3270 in Europe today, the intraday technicals favor it lower. The US dollar recorded a big outside down day against the Mexican peso, trading on both sides of Monday’s range and closing below Monday’s low. There has been no follow-through peso buying so far today. Initial resistance is seen near MXN19.40, though the next target may be the 200-day moving average (~MXN19.28). The greenback has not traded below this moving average against the peso since early August. The dollar also reversed lower against the Brazilian real yesterday after reaching BRL4.1170. Support is seen near last week’s low (~BRL4.0270).

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Brexit,brl,Currency Movement,EUR/CHF,Eurozone Consumer Price Index,Eurozone Core Consumer Price Index,federal-reserve,newsletter,U.K. Consumer Price Index,U.K. Consumer Price Index,U.K. Core Consumer Price Index,U.K. House Price Index,USD/CHF