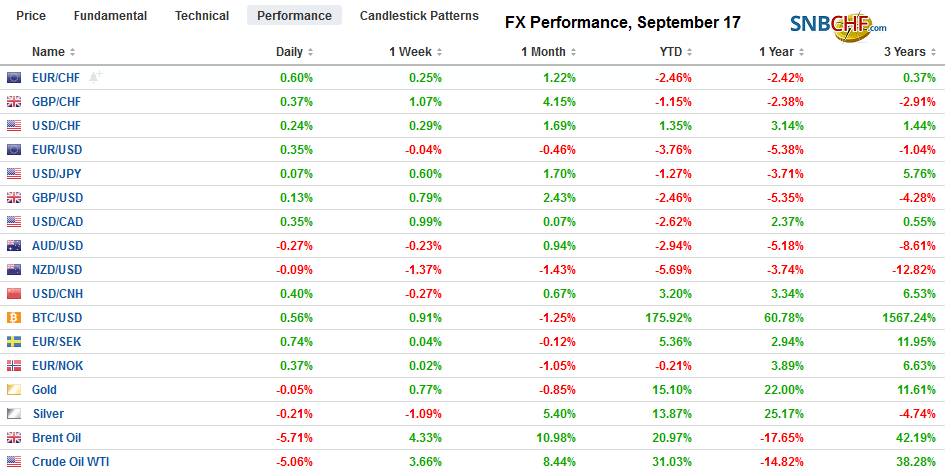

Swiss FrancThe Euro has risen by 0.60% to 1.0984 |

EUR/CHF and USD/CHF, September 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Oil prices have stabilized after yesterday’s surge. Both Brent and WTI are holding on to around $7-$8 a barrel gain. Equity markets are mixed. Some are attributing the losses in Asia Pacific outside of Japan (Nikkei rose its highest level since late April), Korea and Australia to the rise in oil prices. European shares opened lower are straddling unchanged levels. US shares are also flat. Yields are mostly a little softer, though Italian bonds have come under some pressure. The dollar has edged higher against most of the major currencies, though the euro is resisting the pull. The Australian dollar and Swedish krona are the weakest currencies. The RBA minutes seem to suggest an October or November rate cut is likely. The unexpected rise in Swedish unemployment suggests the Riksbank’s hawkishness from the meeting earlier this month will have to be reconsidered when it meets next month. |

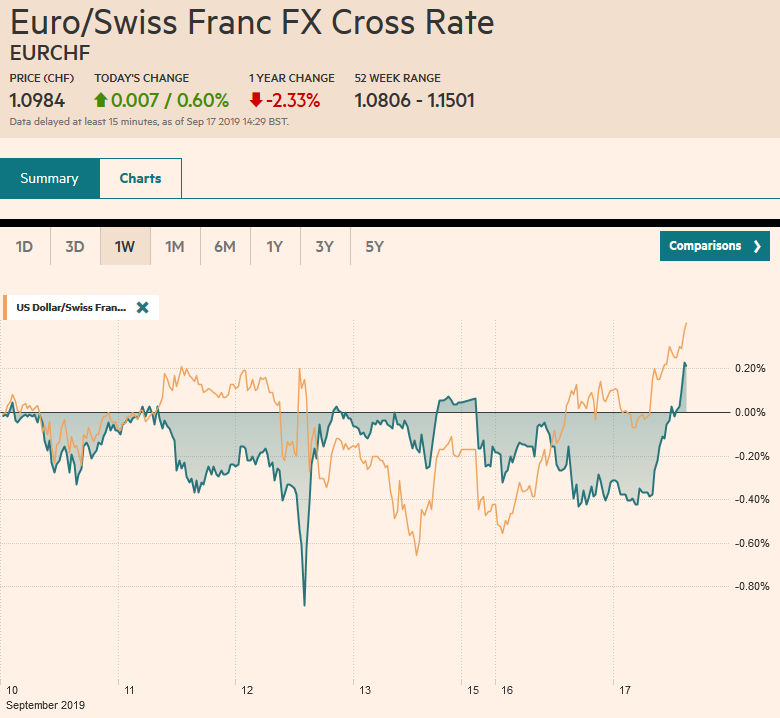

FX Performance, September 17 |

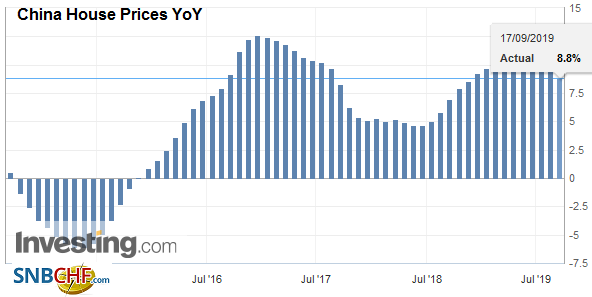

Asia PacificThe market seemed disappointed that the PBOC drained liquidity and failed to cut the one-year medium-term lending facility. We suspect the disappointment may be misplaced. The PBOC is trying to draw attention to the recently reinvigorated prime lending rate. It will be set at the end of the week. A small rate cut is likely, but it is clear that Chinese officials are moving gradually and slower than the market expected. Another reduction in reserve requirements is thought likely now in Q4. Separately, while the market suspects it knows where the “officially” approved dollar top is (CNY7.18-CNY7.20), it has been fishing for the lower end of the range. It appears a little lower than we had anticipated. Rather than around CNY7.10, it now looks closer to CNY7.05-CNY7.06. For the first time in 18 sessions, the PBOC set the dollar’s reference point above where bank models implied (CNY7.0730 vs. CNY7.0707). Moody’s concluded that the ongoing demonstrations in Hong Kong put its institutions at risk. It cut the outlook on its Aa2 rating to negative from stable. The Aa2 rating is equivalent to Fitch’s assessment of AA. It had cut Hong Kong’s rating by a notch earlier this month and also has a negative outlook. The move also leaves the S&P as the outlier with its AA+ rating and a stable outlook. |

China House Prices YoY, August 2019(see more posts on China House Prices, ) Source: investing.com - Click to enlarge |

Minutes from the Reserve Bank of Australia’s meeting earlier this month emphasized the less favorable outlook for the domestic and global economies. Although the Australian dollar was sold in response to the apparent laying of the groundwork for a rate cut in Q4, the OIS market showed little change. Investors may be waiting for tomorrow’s employment report before making a commitment to an October (about nine basis points is discounted) or November move (22 bp has been discounted). The median forecast in the Bloomberg survey calls for a milder jobs report after 34.5k surge in full-time positions in July. Yesterday’s weak Chinese data may also be seen as favoring an early cut.

The dollar recovered against the yen yesterday as the session progressed. After testing the JPY107.45 area early, it finished the North American session a little above JPY108. It has remained above there today and reached a more than JPY108.35 today. The greenback has not traded a full session above JPY108 since July 31. The market looks to test the JPY109 area. The 200-day moving average, which has not been seen since April, is found near JPY109.40. The Australian dollar has been knocking against the $0.6880 cap we identified, and although intraday penetration would occur, there has not been a close above it. We warned that a close below the five-day moving average might be the first sign that the market was giving up on the target. It closed below there (~$6867) yesterday and follow-through selling today pushed it to nearly $0.6835, its lowest level since September 5. Initial support may be nearer $0.6815 today and $0.6770 tomorrow if the jobs data disappoints.

Europe

Although European and UK officials will be meeting daily as the Brexit deadline draws near, there is probably another two weeks or so of running in place. At the conclusion of Tory Party conference in early October, is the critical juncture, when a real proposal (not vague allusions to alternative arrangements) must be forthcoming. That will give negotiators around two weeks to see if it is workable ahead of the key EU Summit on October 17-18. We remain skeptical that a way to “square the circle” has been found. Less than a week ago, the chief EU negotiator Barnier said that there was “no reason to be optimistic.”

Parliament, which is suspended until October 14, remains another threat to Johnson. The UK Supreme Court will hear the case today on the proroguing of Parliament. There are two issues: First, do the courts have the power/right to judge the suspension of parliament and, second, if it does, is the prorogue legitimate. The hearing is scheduled to last a couple of days, and a ruling may not be handed down until next week. Johnson does not have a majority in the House of Commons even if he were to forgive those who voted against the government, as Major did over the vote on Maastricht Treaty.

Sweden’s unemployment defied expectations and on a seasonally-adjusted basis, rose to a four-year high of 7.4% from 7.2% in July. The median forecast in the Bloomberg survey anticipated a decline to 6.8%. The report knocks a leg from under the Riksbank’s argument that the labor is strong and that rates need to rise either later this year or early next. The report follows last week’s softer than expected CPI. Besides likely forcing the Riksbank to reconsider the projected path of the repo rate, it puts the government in a less comfortable position as it unveils its 2020 budget tomorrow.

The German ZEW survey is among the first signs that sentiment may be reaching a trough in Europe’s sputtering economic engine. The current assessment remains dire. It fell to -19.9 from -13.5. A milder deterioration was expected. However, the silver lining was in the expectations component. It rose to -22 from -44.1. It was expected to improve to only -38.

Isreal goes to the polls today for its second election in six months. After the April vote, Netanyahu was unable to form a majority coalition in the 42 days required. Rather than allow the President to give the Blue and White opposition a chance. Netanyahu chose to appeal to the people directly in an election. In Israel’s 71-year history, it has never known a majority government. This often gives smaller parties an exorbitant about of influence. In April, Netanyahu’s Likud (right) and the (centrist) Blue-White coalition won 35 seats in the Knesset. The remaining 50 seats were fragmented. The polls show an extremely tight race again. Netanyahu’s campaign pledges, like annexing the Jordan Valley and Israeli settlements on the West Bank, seem an attempt to secure his right flank and the support of a few religious/nationalist parties. The domestic political drama has had little impact on the currency. In fact, the shekel is one of the strongest currencies this year, rising about 5.5% year-to-date against the dollar. Inflation has stabilized around 1.2%-1.3% this year, and annualized quarterly growth has not been below 3% since Q1 16. The central bank hiked base rate by 25 bp to 50 bp at the end of last year. Officials seemed content and are expected standpat and sit tight when the central bank meets on October 7.

The euro initially extended yesterday’s losses but found new buying interest near $1.0990. It traded a little through $1.1020 in the European morning. The market is waiting for fresh inspiration. There is an 865 mln euro option at $1.10 that expires today and another option for roughly 700 mln euros at $1.1025 that also expires. The option at $1.1040 for 565 mln euros may be too far away to be relevant today. Sterling had been toying with the $1.25 level over the past two sessions. This area is important from a technical point of view, and it is proven formidable. Sterling has fallen about 1.25 cents from yesterday’s high. Two expiring options may denote the immediate range. One option is for GBP215 mln struck at $1.2435 and another for about GBP360 mln at $1.2350.

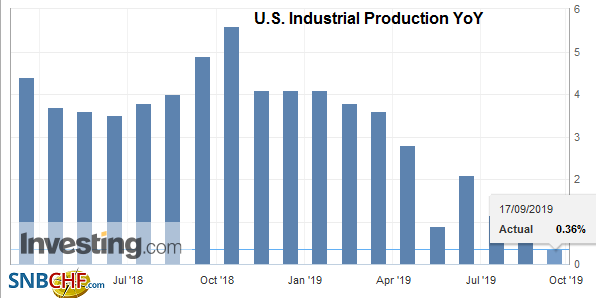

AmericaThe US is expected to report better industrial output and manufacturing figures for August after a 0.2% and 0.4% decline respectively in July. That said, the manufacturing sector, judging from the ISM/PMI readings remain under pressure, suggesting scope for disappointment. At the end of the session, the latest TIC report (for July) will be released. Canada reports July manufacturing sales ahead of tomorrow’s August CPI. |

U.S. Industrial Production YoY, August 2019(see more posts on U.S. Industrial Production, ) Source: investing.com - Click to enlarge |

There were some pressures in the US money markets yesterday that unsettled many observers. First, many seem to be caught off guard by the roll from the September to December Eurodollar futures and what seemed like a widening of the FRA-OIS spreads. Note there was around a 10 bp spread between the September and December futures contracts. Separately, the overnight repo jumped almost 250 bp at the peak yesterday. Two transitory factors were at work. There was the coupon settlement of last week’s auctions and the quarterly tax date. Both drained cash from the market. The rise in the repo rate may have drawn some funds from the fed funds market. Of course, it is worth monitoring, but it seems premature to conclude that the Fed will cut the interest on reserves again later this week, though it remains possible.

The highlights of the Bank for International Settlements triennial foreign exchange include a new estimate of average daily turnover over $6.6 trillion, up from $5.1 trillion three years ago. The dollar is on one side of 88% of the trades. The euro is involved with nearly a third of the trades (32%). The yen is used in 17% of the trades. The Chinese yuan is in eighth place overall and is part of 4.3% of the trades. Its growth over the past three years was only a little faster than the global market, so its share hardly changed.

The US dollar is trading inside yesterday’s range against the Canadian dollar, which was inside the pre-weekend range. This looks like a continuation pattern. A re-test on CAD1.3300 and the 200-day moving average (~CAD1.3310) looks likely. Initial support for the greenback is pegged near CAD1.3240. After being pushed through MXN19.35 before the weekend, the US dollar edged higher yesterday and is recovering further today. It is testing the MXN19.50 area. Nearby resistance is seen near MXN19.55 and then MXN19.60.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Brexit,China House Prices,Currency Movement,EUR/CHF,HKMA,Israel,newsletter,SEK,U.S. Industrial Production,USD/CHF