- This week the BoJ will hold its regular policy meeting.

- Global uncertainty, linked to the trade war and Brexit, has strengthened the value of the Swiss franc and Yen.

CHF/JPY is struggling to maintain the upside as the Yen picks up a safe haven bid, anchored on geopolitical developments following a textbook risk-off response in global financial markets following the strike on Saudi Arabia’s oil facilities over the weekend.

Both the CHF and Yen picked up a bid as equities dipping while treasuries and precious metals lifted. However, the Dollar came through in the end and did damage across, multiple crosses, including both USD/JPY and USD/CHF, both crosses respecting the rising channel’s support.

BoJ and SNB in focusThis week the BoJ will hold its regular policy meeting in an environment which has brought a wave of easing from central banks around the world – “Speculation is building that although policy is set to remain on hold this week, that the BoJ may be prepared to lower short-term rates further into negative territory in the coming months. While the forward guidance offered by the BoJ this week could be a crucial determinant of the BoJ’s resolve, a crucial component in the outlook for the JPY and potentially in the policy decisions made by the BoJ in the coming months relates to the Fed.” Meanwhile, this week the BoJ will hold its regular policy meeting in an environment which has brought a wave of easing from central banks around the world. “Speculation is building that although policy is set to remain on hold this week, that the BoJ may be prepared to lower short-term rates further into negative territory in the coming months,” analysts at Rabobank explained, adding, “While the forward guidance offered by the BoJ this week could be a crucial determinant of the BoJ’s resolve, a crucial component in the outlook for the JPY and potentially in the policy decisions made by the BoJ in the coming months relates to the Fed,” analysts at Rabobank explained. With respect to the Yen, the analysts at TD Securities expect “USD/JPY to drift in a 107/109 range in the short-term as bond markets continue to adjust from a fatalist attitude. Some risk of a punch above the range towards the 200dma but we expect this to be solid resistance. Strategically, we see value in scaling in EUR/JPY shorts.” With respect to the Swiss National Bank, the global uncertainty, linked to the trade war and Brexit, has strengthened the value of the Swiss franc since the summer – Should we see a rise in global uncertainty, the SNB may need to implement other measures, including a rate cut. |

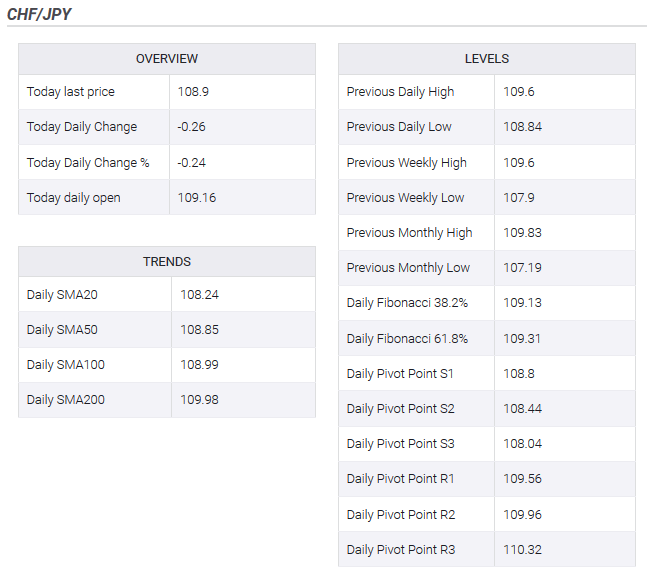

CHF/JPY levels, September 17 |

Tags: newsletter