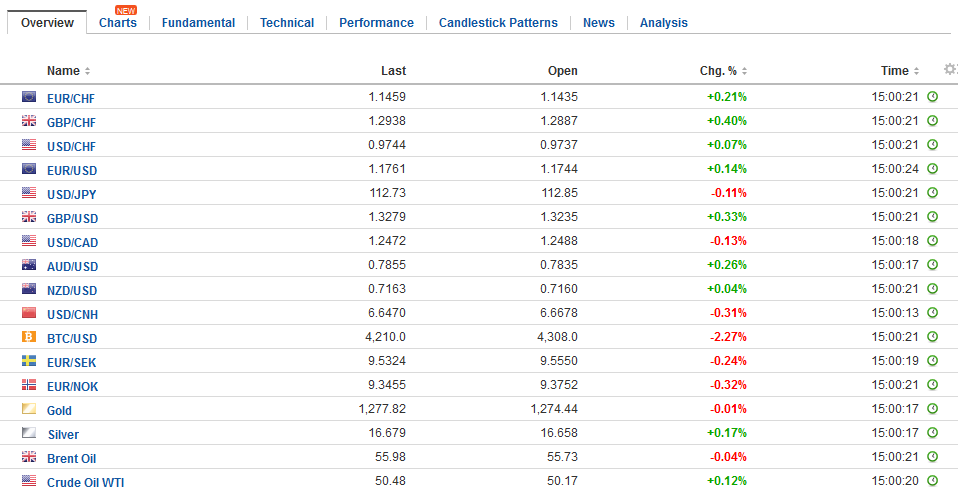

Swiss FrancThe Euro has risen by 0.10% to 1.1443 CHF. |

EUR/CHF and USD/CHF, October 04(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe US dollar has a softer tone today, and it was that way even for the European PMI. The greenback eased further after the upside momentum faded yesterday. The heavier tone in Asia seemed spurred by a hedge fund manager’s call that Minneapolis Fed President, and among the most dovish members of the FOMC, Kashkari would be the next Fed chair. This was quickly followed by reported leaks of a short list of candidates, which included the likely suspects, Yellen, Cohn, Warsh, and Powell. This may have seemed like new news in Asia, but in the US, even Powell’s inclusion is not a surprise. Indeed, as we have noted, Powell had moved into second place behind Warsh in the betting markets. Kashkari did not appear on the list. With the exception of the NY Fed, the skills set needed to be a regional Fed president may not be the same for the Chair. The President’s nomination is expected by the end of the month. Yellen speaks late in the North American session but is unlikely to address the nuances of monetary policy or her future in the welcoming remarks at a community bank event. |

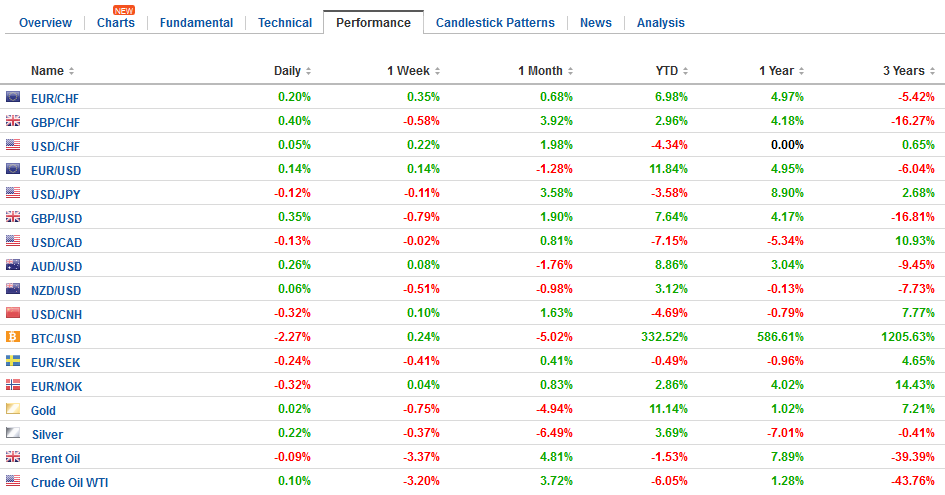

FX Daily Rates, October 04 |

| News that the EU is bringing charges against Ireland for not collecting the 13 bln euro tax charge against Apple may be among the talking points today. Ostensibly, Ireland was to be paid in January. Separately, the EU claims Amazon faces a 250 mln euro tax obligation from Luxembourg. US equities are trading with a slightly lower bias, while the Dow Jones Stoxx 600 is snapping a nine-day advancing streak itself. Asian equities may have been helped by the record highs in the US, and the MSCI Asia Pacific Index rose 0.25% to extend its advancing streak to the fourth consecutive session.

After failing to sustain another attempt through JPY113 yesterday, the dollar has eased against the yen, and US Treasury yields are a tad softer. Last week, a shelf was created near JPY112.20. In Japanese politics, Tokyo Governor and head of the new Party of Hope, Koike, has until October 10 to decide if she will run for a parliament seat. She is an awkward position. She was just re-elected Governor of Tokyo, and her party is not ready to fully challenge Abe and the LDP. The new party does not appear to be contending a sufficient number of seats. If she announces she will not run, as we suspect, the market interest may wane. That said, we highlight that a dramatic loss of seats, even if it remains the largest party, could still pose problems for Abe. |

FX Performance, October 04 |

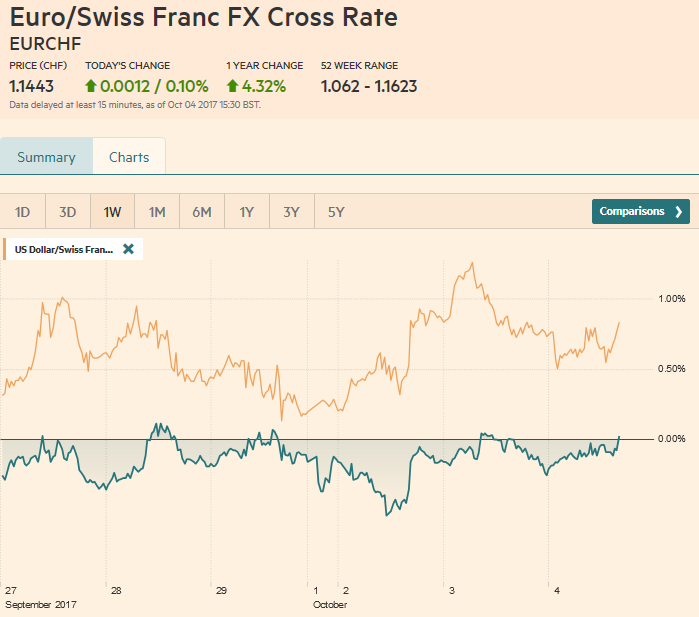

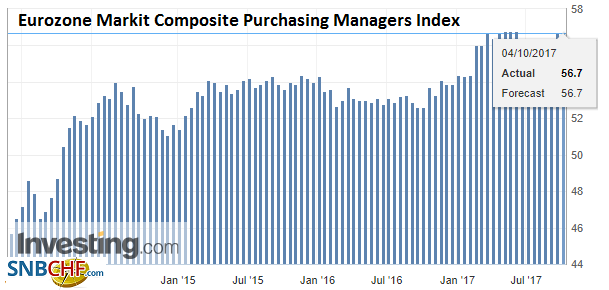

EurozoneEurope’s PMI is the main economic data points today. The eurozone services PMI rose to 55.8 from the flash reading of 55.6. It stood at 54.7 in August. It is the strongest since May. |

Eurozone Services Purchasing Managers Index (PMI), Oct 2017(see more posts on Eurozone Services PMI, ) Source: Investing.com - Click to enlarge |

| The composite was unchanged from the flash 56.7 estimate. It was a full point lower and is just off the peak of 56.8 seen in both April and May. The gains in new orders suggest good momentum going into the final quarter of the year. Among the large countries, Italy stands out for its weakness. |

Eurozone Retail Sales YoY, Aug 2017(see more posts on Eurozone Retail Sales, ) Source: Investing.com - Click to enlarge |

| The services PMI fell to its lowest since March, and the composite fell to its lowest since January. This would seem to warn that the political pressures as the new electoral law must be decided may intensify if the economy weakens. |

Eurozone Markit Composite Purchasing Managers Index (PMI), Oct 2017(see more posts on Eurozone Markit Composite PMI, ) Source: Investing.com - Click to enlarge |

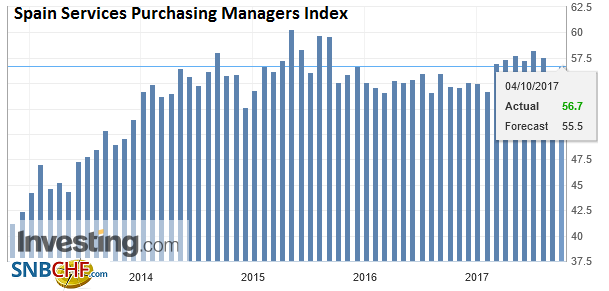

SpainSpain’s readings were stronger than expected, and the composite snapped a two-month decline that had seen it weaken in August to its lowest level since January. The events in Catalonia, which accounts for about a fifth of Spain’s GDP, may be picked up in next month’s report. Of course, since the weekend’s events, everyone is urging both sides to de-escalate, but the Catalonians seem set to declare independence within 48 hours. The EU cannot mediate because it would give legitimacy to every region in Europe that wants to secede from the national state. The EU cannot mediate because the Catalonian claim is unconstitutional, as ruled by the country’s top court. The Catalonian leader Puigdemont claimed that vote earned it the right to declare independence. But the vote and the funding for it violates Spanish laws, and an over 40% of the eligible voters did not vote. Spanish assets are continuing to underperform. The 10-year yield is up four bp compared with 2.5 bp in Italy. Most other countries are seeing lower yields. Spanish shares are off 2% today, led by a 3% loss in financials, but the not sector is higher today. Stocks were flat yesterday after falling 1.2% on Monday. The rating agency DBRS is set to announce the results of its review of Spain’s credit and comment on the recent political events ahead of the weekend. |

Spain Services Purchasing Managers Index (PMI), Sep 2017(see more posts on Spain Services PMI, ) Source: Investing.com - Click to enlarge |

United KingdomAfter reporting disappointing manufacturing and construction PMI, the UK surprised with a better than expected service reading today. The services PMI rose to 53.6 from 53.2 and edges above the three-month average. The service sector is so significant in the UK that its performance was sufficient to offset the other sectors’ weakness in full. |

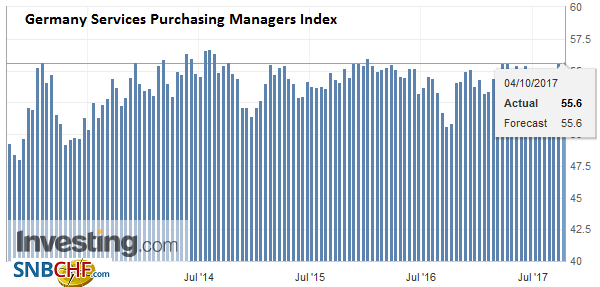

Germany Services Purchasing Managers Index (PMI), Sep 2017(see more posts on Germany Services Purchasing Managers Index, ) Source: Investing.com - Click to enlarge |

| This means that the composite PMI edged higher to 54.1 from 54.0. Sterling held the 50% retracement of the advance since late August yesterday, that is found near $1.3215. It is trading within yesterday’s range as May’s speech at the Tory Party Convention is awaited. |

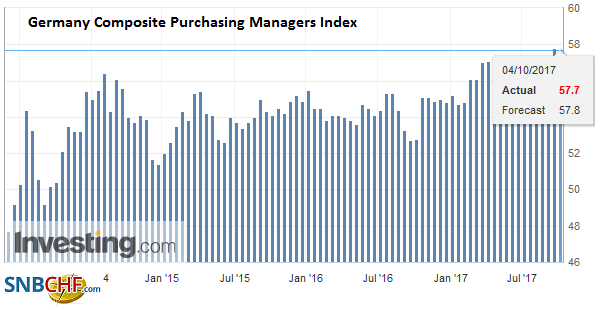

Germany Composite Purchasing Managers Index (PMI), Sep 2017(see more posts on Germany Composite Purchasing Managers Index, ) Source: Investing.com - Click to enlarge |

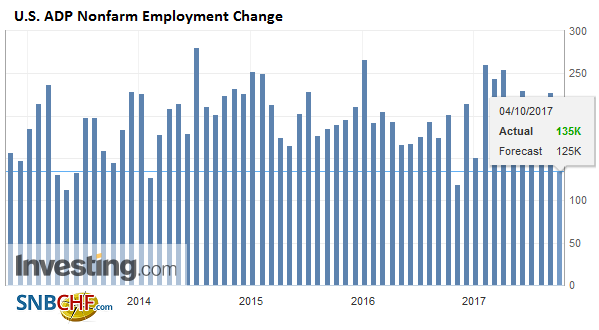

United StatesInvestors should be braced for weaker jobs data due to distortions caused by the adverse weather. This is front and center today with the ADP estimate. The median forecast from the Bloomberg survey was 135k, down from 237k in August. The NFP report is expected show around half of the 156k jobs that were created in August. However, the distortions are not just negative. Part of the surge in auto sales is due to the response to storms. Reports suggest that Harvey damaged or destroyed 500k vehicles while Irma took out 200k. Vehicle sales surged to an 18.57 mln unit pace in September, the highest in a dozen years. In September 2016, 17.72 mln vehicles were sold at a seasonally adjusted annual rate. |

U.S. ADP Nonfarm Employment Change, Sep 2017(see more posts on U.S. ADP Nonfarm Employment Change, ) Source: Investing.com - Click to enlarge |

| Auto sales in the region that includes Texas rose 14%. Auto sales rose 109% in the Houston area in the three weeks after Harvey hit compared with three weeks prior. The strong sales help US-based producers reduce the inventory overhang, which had begun cutting into production. Inventories fell to 76 days from 88 days in August. |

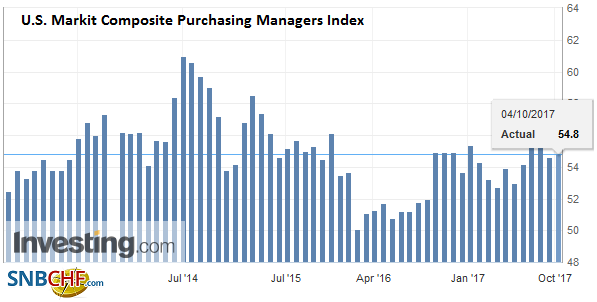

U.S. Markit Composite Purchasing Managers Index (PMI), Sep 2017(see more posts on U.S. Markit Composite PMI, ) Source: Investing.com - Click to enlarge |

| US auto stocks have rallied strongly since the first storm hit. Ford shares are up 16%, GM 24%, and Fiat Chrysler up almost 45%. The market share accounted for by these three companies has remained amazingly steady. Last year it averaged almost 78% and was virtually unchanged this year. |

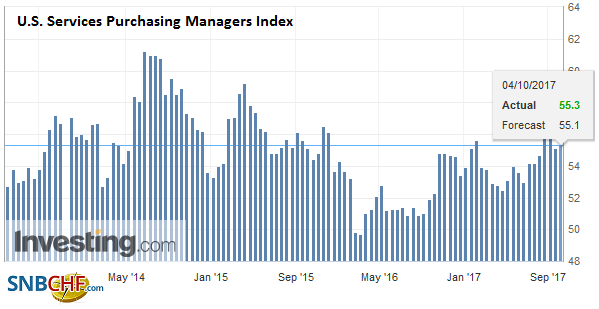

U.S. Services Purchasing Managers Index (PMI), Sep 2017(see more posts on U.S. Services PMI, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$EUR,$JPY,$TLT,EUR/CHF,Eurozone Markit Composite PMI,Eurozone Retail Sales,Eurozone Services PMI,Federal Reserve,Germany Composite Purchasing Managers Index,Germany Services Purchasing Managers Index,newslettersent,Spain Services PMI,U.K. Services PMI,U.S. ADP Nonfarm Employment Change,U.S. Markit Composite PMI,U.S. Services PMI,USD/CHF