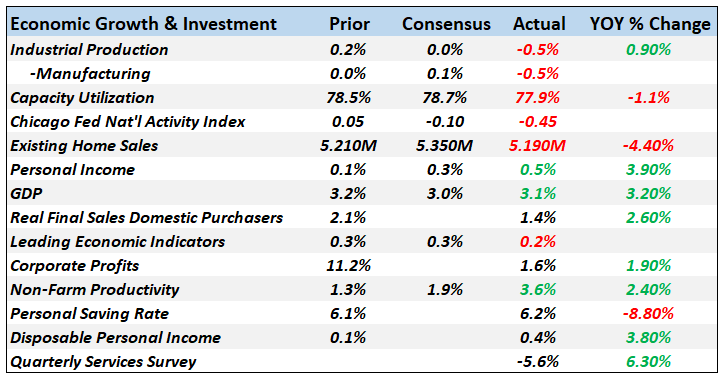

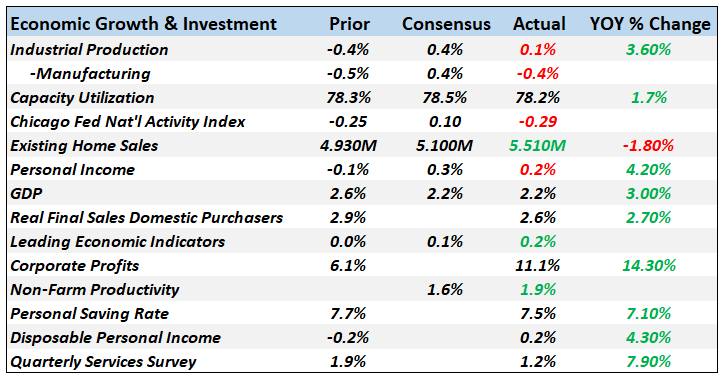

Summary:

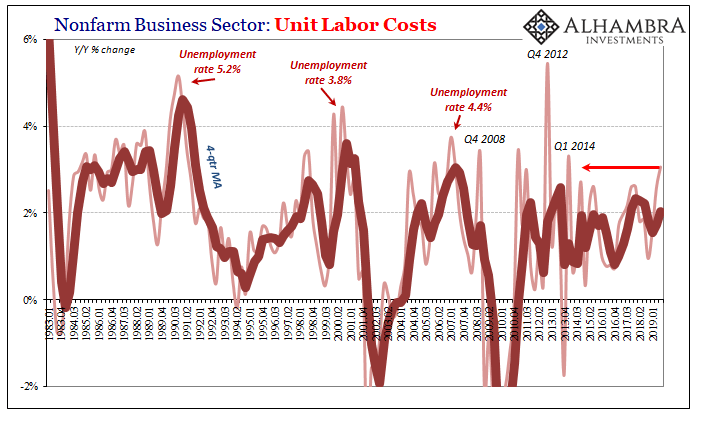

- Over the past several decades, US wage growth has not kept pace with productivity gains.

- Over the past decade, it has.

- Wages are sticky on the downside, but an increase in productivity is critical.

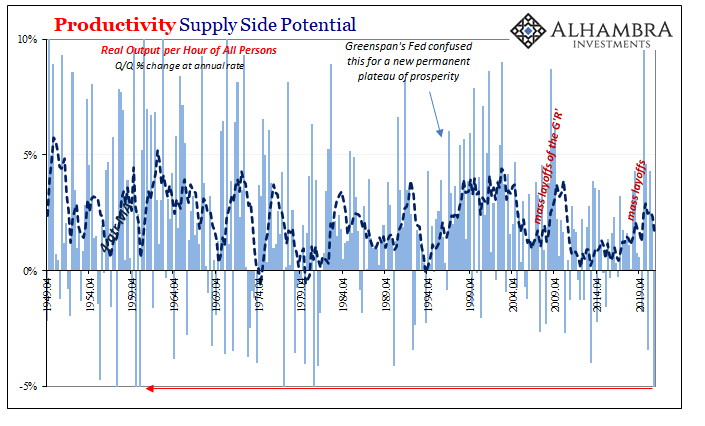

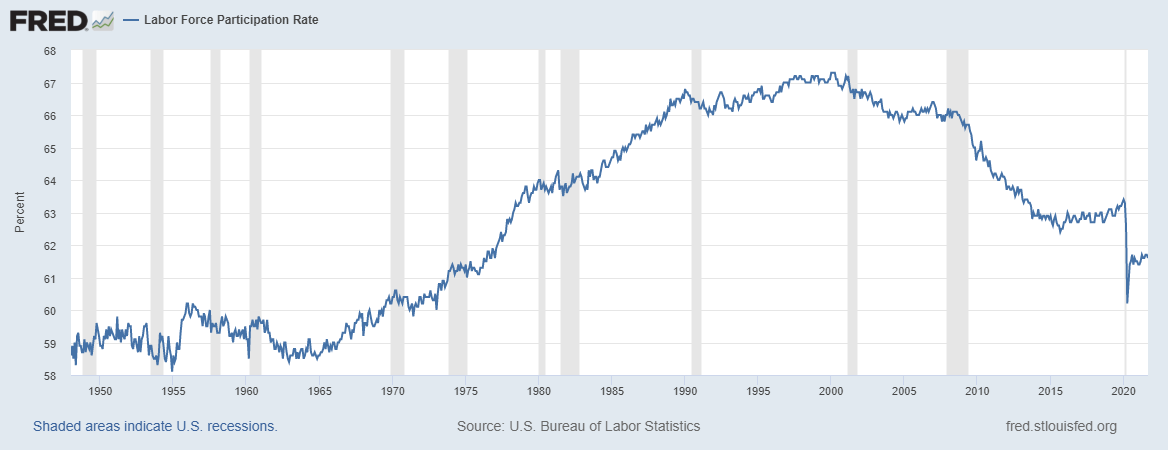

| One of the longstanding challenges to growth US aggregate demand has been that wages have not kept pace with inflation and productivity. The decoupling appears to have taken place in the late 1960s or early 1970s depending on exactly which metric one uses.

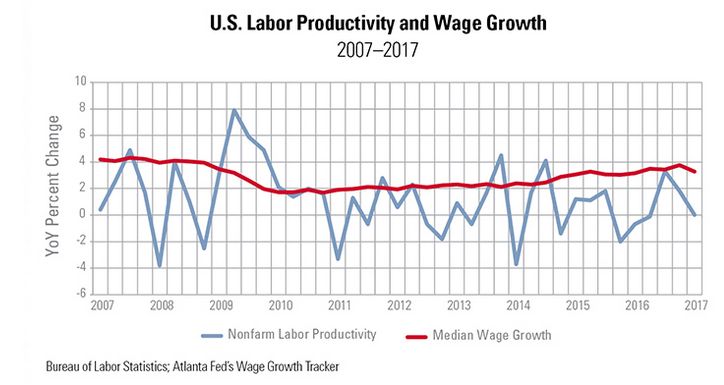

In my book, the Political Economy of Tomorrow, I argue the decoupling of men’s wages from productivity and inflation made it possible and necessary for women to enter the workforce in large numbers. This is not to suggest the inability of men’s wages to procure the American dream was the only factor spurring women to enter the market economy, but it seems to be an important factor. We know with the benefit of hindsight that having two-income households was not sufficient either. Nor was the increase in teenage employment sufficient to provide a secure middle class life style. Credit was used to cover the “funding gap.” The Great Financial Crisis signaled an end to that strategy. In Brown Brothers Harriman’s latest foreign exchange quarterly, my colleague Carter Johnson and I took a closer look at US wage growth and productivity. The Great Graphic is drawn data provided by the Bureau of Labor Statistics and the Atlanta Fed’s Wage Growth Indicator. For the past decade, admittedly with some exceptions, median wage growth (red line) has exceeded productivity growth (blue line). Wage growth is less than in past cycles. The problem is productivity growth is miserable, and not just in the US. Also, the performance illustrates that wages are sticky on the downside. This is part of some economists’ explanation for why wage growth is not stronger now. It should have fallen more, they argue, during the financial crisis. Leaving aside distributional issues, the weak productivity growth is one of the most important economic challenges we face. Weak productivity translates into weak growth and limited pricing power. Poor growth and lowflation increases the pressure on debtors. Poor productivity growth aggravates other economic (and social) problems. |

U.S. Labor Productivity and Wage Growth Compared, 2007 - 2017 |

Full story here Are you the author? Previous post See more for Next post

Tags: Great Graphic,newslettersent,productivity