The Federal Reserve has been trying to propagate two big lies about the economy. Actually, it’s three but the third is really a combination of the first two. To start with, monetary authorities have been claiming that growing liquidity problems were the result of either “too many” Treasuries (haven’t heard that one in a while) or the combination of otherwise benign technical factors.

The other one has been about this epically tight labor market, which, Jay Powell points out, should keep the US economy on track whatever any minor fallout from the first problem or anything else in between.

Putting those two together you end up with a completed recovery and economic boom.

That’s the third lie. An awesome labor market which was given the space to materialize because the Fed fixed the financial system with four QE’s and trillions in bank reserves.

If you start questioning repo, especially the ridiculous previous explanation of “too many” Treasuries, you don’t see a fixed financial system at all. That’s before ever getting into the dollar.

And if you don’t have that, it would account for all the major inconsistencies in that whole “tight” labor market story. Slack, in other words. The big one. A persisting monetary drag that has kept the economy in its languishing underperformance.

Having written more than enough about repo this week, let’s now go after the other lie – the tight labor market which is penciled in as far better and more effective economic insurance than all the rate cuts in the world combined.

We can start right where it must hurt the FOMC the most – in the mirror. The Fed’s Beige Book is nothing more than a compendium of purposefully included anecdotes. It once served a legitimate purpose back when economic stats were crude, infrequent, and often hard to come by.

Today, the Beige Book simply holds up a mirror to Fed officials, telling the world little about the real state of the economy, instead revealing what those officials want to believe that state might be.

|

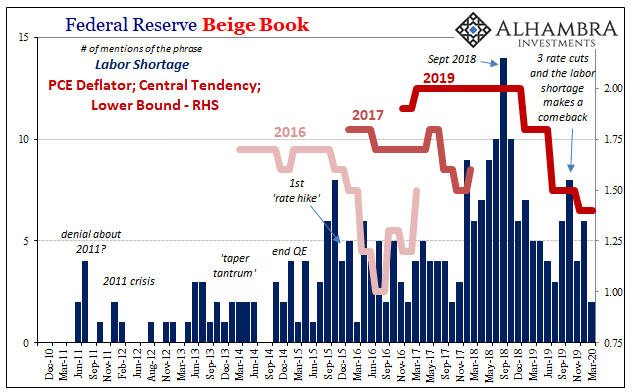

Unsurprisingly, then, there was a huge surplus of mentioning the term “labor shortage” cresting right at the September 2018 volume. Peak Jay Powell, the apex of the last, long ago hawkish regime. Interest rates were rising (modestly, curves flattening) and policymakers had convinced themselves it was all working in their favor despite growing evidence of global headwinds and more so the disinflationary pressures behind them. They ignored the rising dollar because, they thought, the labor market was so unbelievable great. Confirmation of the job well-done, a resilient system able to push past anything thrown in its way. But, as the economy turned downward first overseas (which had begun early on during 2018, all the while this labor shortage nonsense got out of hand) and then in the US – even the labor market stats other than the unemployment rate – curiously the number of inclusions for the term “labor shortage” dwindled from within the Beige Book. I had noted the inconsistency several times last year, including this one from June 2019:

After three rate cuts, though, it made a comeback! As policymakers were feeling better about having dodged a possible recession, during last fall’s surge in optimism there was a mini-surge in the “labor shortage.” Not in reality, of course, but in policymakers’ collectively conned conception of it. |

Federal Reserve Beige Book, 2010-2020 |

| All that is gone now. In the latest update, published just yesterday, the Beige Book notes “labor shortage” only twice. That’s quite conspicuously a new low – at the worst possible time, confidence-wise. There hadn’t been this few included since late 2017 when the inflation hysteria which had first nurtured these delusions was just getting started.

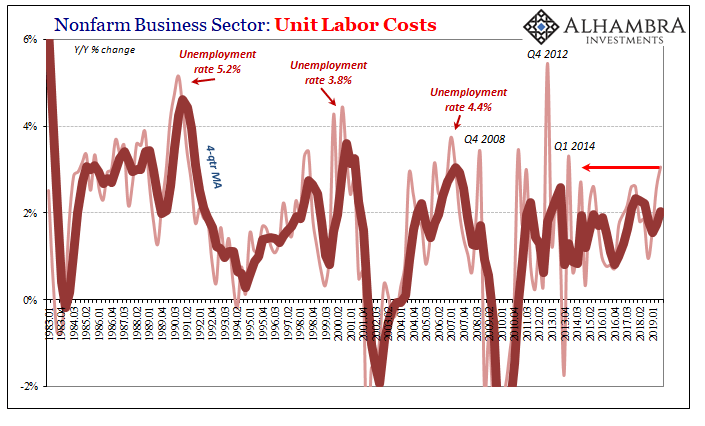

To add further insult, the Bureau of Labor Statistics (BLS) reports today that, through Q4 2019, there is still not a single bit of evidence that the labor market was ever mildly strained let alone so unbelievably tight it would have deserved all this attention and praise. Unit Labor Costs have remained meekly low, even the last estimate for Q3, which had been the highest in several years and still underwhelming, even that has been revised out of existence. |

Nonfarm Business Sector, 1983-2019 |

| Not even that much happened.

Below, the first chart shows you those prior estimates from last quarter followed by the current set. In neither case is there any condition like what the unemployment purportedly describes. |

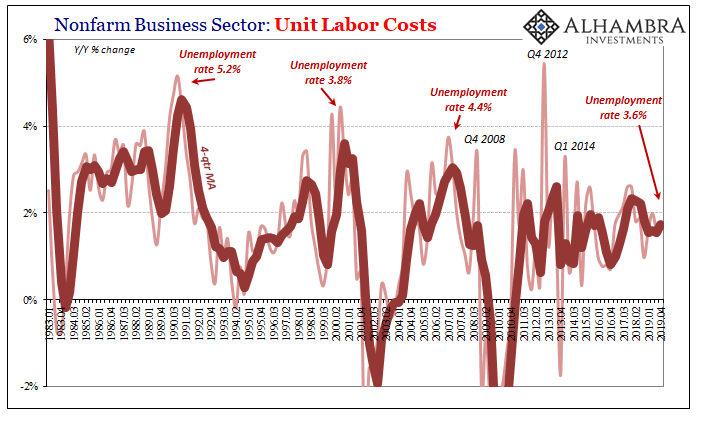

Nonfarm Business Sector, 1983-2019 |

| Not the slightest hint of wage pressures, and Unit Labor Costs include all manner of compensation beyond simply wage rates. The lack of acceleration is as important as the deceleration during 2019 – as the unemployment rate continued its descent into a 50-year low. The disconnect between that comparison and the wage data is beyond remarkable; it is disqualifying.

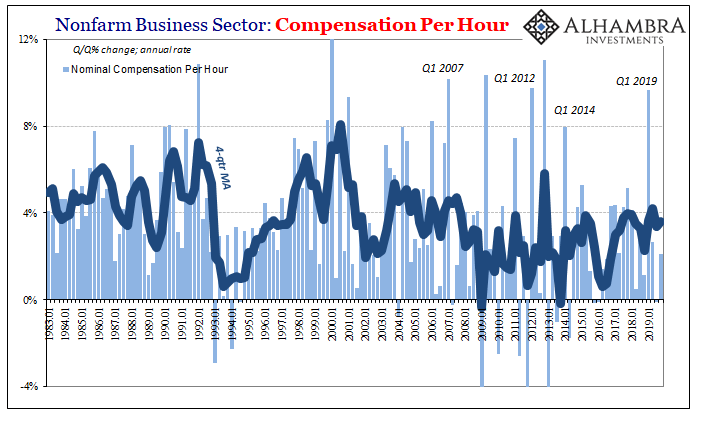

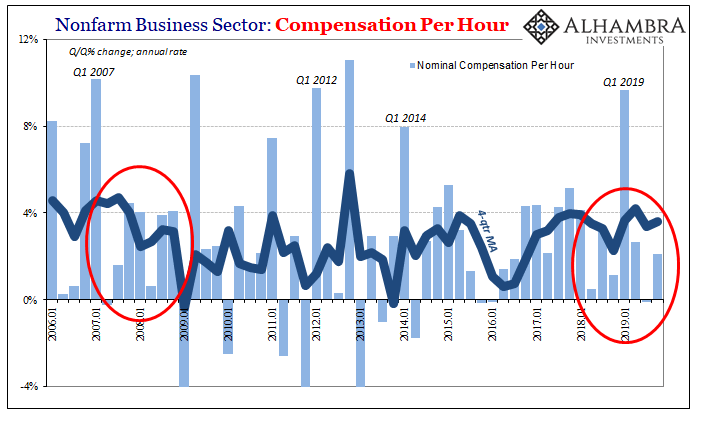

And, of course, it’s not just Unit Labor Costs. Hourly compensation estimates like the BLS’s CES wage figures are likewise restrained, with one caveat – not a good one. For reasons that are never revealed or explained, there had been another surge in nominal compensation during Q1 2019 (it looks often like a discontinuity in the data). |

Nonfarm Business Sector, 1983-2019 |

| Except, these singular quarterly jumps typical have corresponded with the peaks in each of the so far three completed eurodollar cycles. |

Nonfarm Business Sector, 2006-2019 |

| Since last year’s first quarter, over the final three quarters of 2019 compensation levels have practically flat-lined. The increase over those nine months is just 1.1%, an annual rate of barely 1.5%. Nominal compensation for three-quarters of a year at just 1.5% with the unemployment rate significantly below 4%!

As has been the case forever, it seems, there just is no corroboration anywhere for the notion that the labor market is somewhat close to capacity let alone way, way beyond full up. Worse, there’s never been any corroboration. Not once, even before revisions. Like the anecdotes, these central bankers have only been projecting their fondest wishes. What’s happened is that the more time passes the more it becomes clear it was all a big lie. |

US Treasury Curve, 2018-2020 |

| Therefore, what’s perhaps important about March’s Beige Book is that officials aren’t much in the mood anymore to repeat it. If the most optimistic bunch of optimists, those who felt so great about how sure they were everything was definitely going to be fine that they would go all the way out on the thinnest labor shortage limb, now they don’t want to talk about it.

How convenient for them, especially since you won’t hear a single thing about it in any of the mainstream or financial media. Only the unemployment rate. More than anything, the labor shortage story was the key. It was, or would’ve been, irrefutable confirmation that recovery had at long last been achieved. Therefore, the financial system must’ve been fixed, too, because, as Ben Bernanke correctly surmised in 2009, you don’t get recovery without first dealing with what had been the real problem to begin with. And it wasn’t subprime mortgages. As the second lie falls apart it sheds the same light on the first, and both then destroy the third. And that’s before we ever get to COVID-19. Why are bond markets at DEFCON1? Because being lied to for so long and so much about the state of the economy before the first coronavirus case was ever reported. It doesn’t instill much, or any, confidence. Instead, this all exposes yet again how they really have no idea what they are doing. |

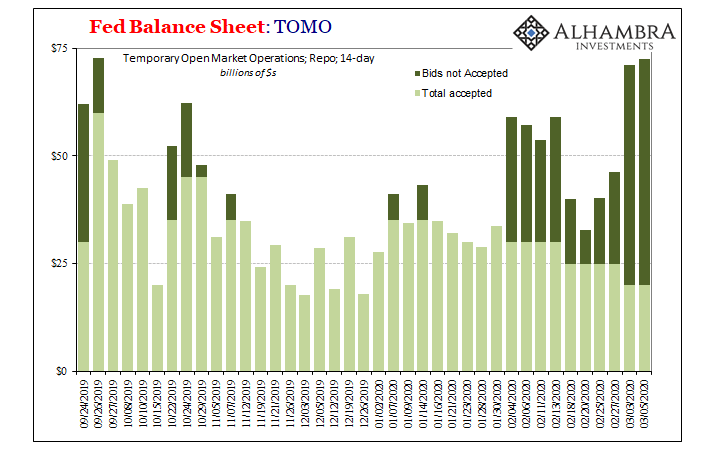

FED Balance Sheet, 2019-2020 |

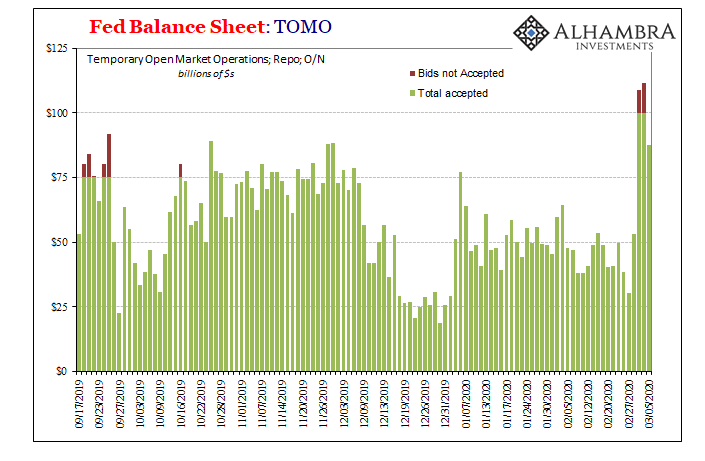

FED Balance Sheet, 2019-2020 |

Full story here Are you the author? Previous post See more for Next post

Tags: Bonds,currencies,economy,Federal Reserve/Monetary Policy,Labor Market,labor shortage,Markets,newsletter,productivity,repo,U.S. Treasuries,unemployment rate,unit labor costs,Yield Curve