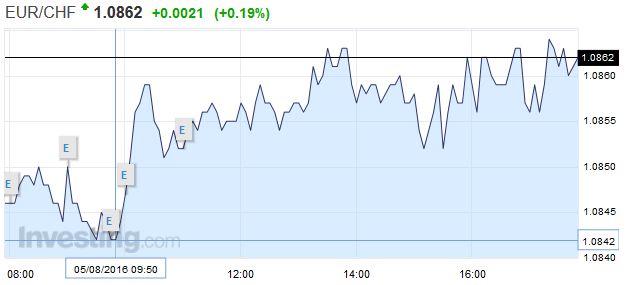

Swiss FrancAs usual, when U.S. data is good, then the EUR/CHF appreciates.

|

|

FX RatesThe focus is squarely on the US employment data today, ahead of which the capital markets are mostly consolidating yesterday’s Bank of England inspired moved. The Australian and New Zealand dollars, alongside sterling, which is up about half a cent after losing two yesterday.

The RBA’s monetary policy statement failed to tell investors anything they did not already know.There was not formal bias expressed, but the fact that the central bank expects inflation to undershoot its target over the forecasting period keeps many watchful for another rate cut. While this is possible of course, we think those who expect a quick follow up move may be disappointed. Meanwhile, the market has next week’s RBNZ move fully discounted. The attractiveness of these currencies is that even after the rate adjustments, they are still the highest among the high income countries, and as the BOE underscored, rates will be lower for longer.

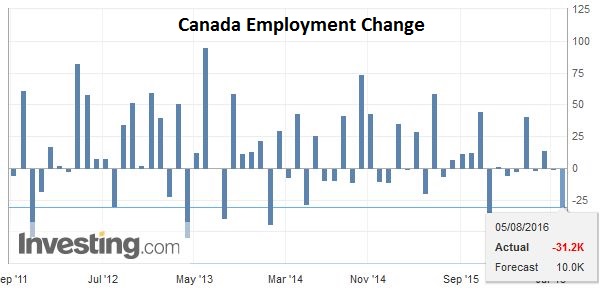

The US dollar has been able to distance itself from support near CAD1.30. The Canadian dollar has lagged the other dollar-bloc currencies. The combination of the recovery in oil prices, less disadvantageous interest rate differential with the US, and the recovery in equity prices today could see the CAD1.30 area give way. If so, chart-based support may not be found until closer to CAD1.2860.

|

|

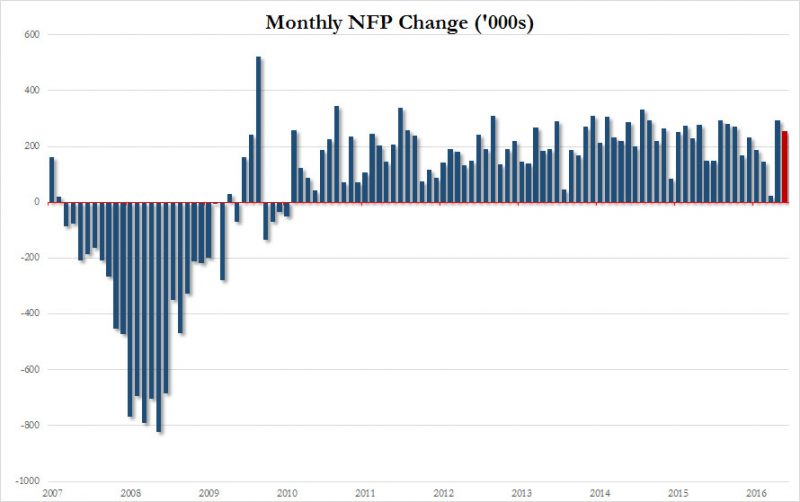

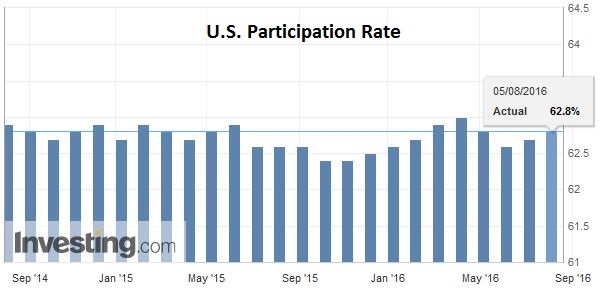

United StatesThe nearly flat US jobs growth in May continues to bedevil participants even though the June series snapped back–from the weakest in six years to the strongest in eight months. Most guesses for July appears to be gravitating around the average so far this year, which is 172k.

|

|

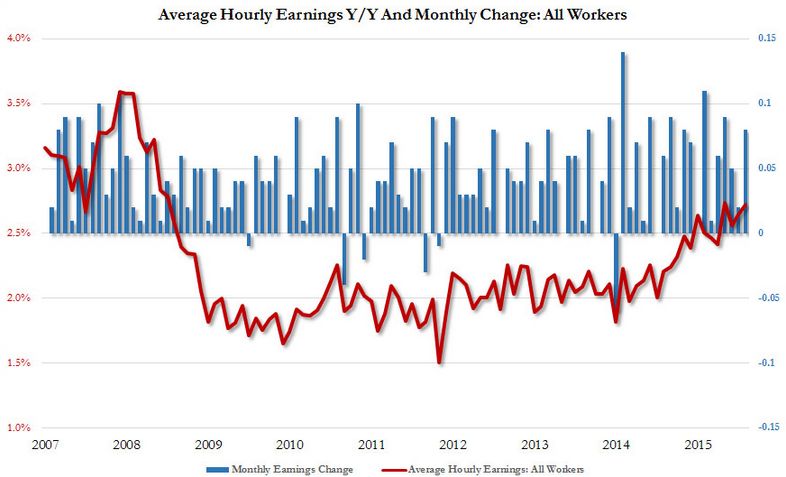

| Many look for the unemployment rate to ease back to 4.8% from 4.9%. A 0.2% increase in average hourly earnings is needed to keep the year-over-year pace at 2.6%. | |

| Many economists, including those at the Federal Reserve, recognize that as full-employment is reached the monthly jobs growth will slow. Indeed, this appears to be slowly happening. Consider that in 2014; monthly non-farm payrolls averaged 251k. Last year’s average was 229k. Investors and policymakers are trying to decipher this year’s trend, which is made more difficult by the recent volatility. |

Click to enlarge. Source Investing.com</a. |

| There seems to be an asymmetrical risk associated with today’s employment report. Strong jobs growth is unlikely to materially boost the market perception of the odds of a September hike. There is, after all, another jobs report the FOMC will see prior to its decision late next month. A disappointing report would more likely impact market expectations. This is to say that the dollar is more likely to fall on a weaker report than sustain gains on a strong one. |  |

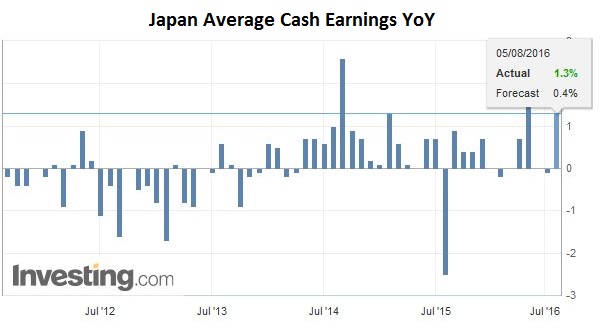

JapanAfter the Antipodean currencies, the yen is the strongest of the majors, though within the ranges established in the past two sessions after posting an outside down day on Tuesday that saw the greenback dip below JP100.70. Yesterday a BOJ official seemed to play down the need for more monetary stimulus, while earlier today, Japan reported an unexpected, though highly desired, jump in labor cash earnings. The median forecast was for a 0.3% increase in June from a year ago. Instead, labor cash earnings rose 1.3%. When adjusted for inflation, this is a 1.8% increase, more than four-times what the market anticipated. This is the strongest pace in six years. Although the Japanese labor market is tight, wages have not risen, and this is understood to be a major restraint on consumption. |

Click to enlarge. Source Investing.com |

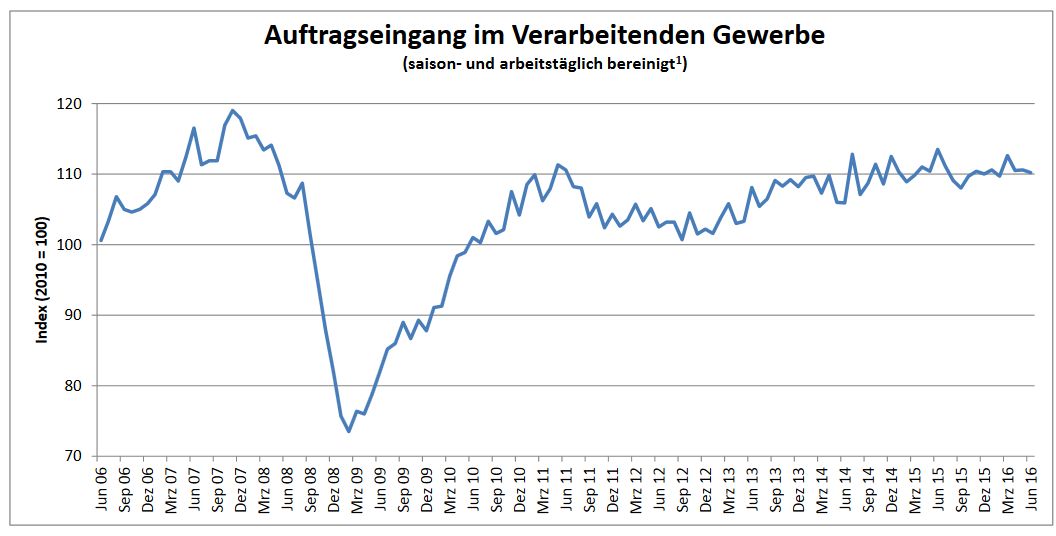

EurozoneThe economic news from Europe is not as favorable, though the euro is firm, fully recovering yesterday’s losses. German factory orders fell 0.4% in June. The market had forecast an increase of roughly the same magnitude. The May series was revised to 0.1% from flat, but this does little to blunt the impact and warn of the risk of a weaker industrial output figure next week.

|

Germany Factory Orders |

|

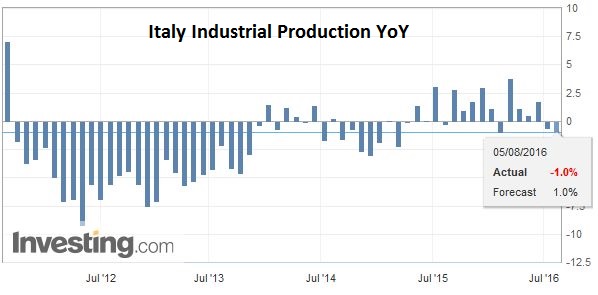

Italy and Spain reported June industrial production figures today. Italy’s disappointment is worrisome. Rather than recover from May’s 0.6% slide, Italian industrial output fell 0.4%. This keeps the pattern since Q1 15 intact. In this pattern, Italian industrial rises one month every quarter and falls in other two.

If the now-November constitutional referendum is really going to be a referendum on Renzi, it would be more helpful if the economy were showing greater strength. We are still watching to see if Renzi can backtrack from his threat to resign if the referendum does not pass. It seems, at least from the outside, reckless to tie the future of the government, which has provided political stability, to the referendum. |

Click to enlarge. Source Investing.com |

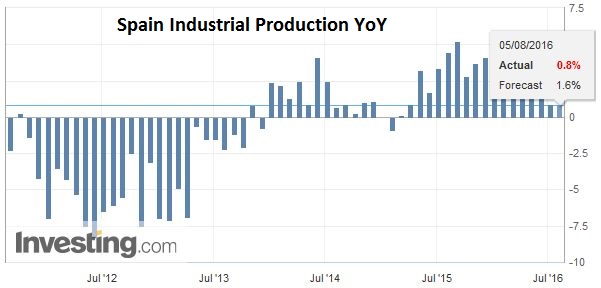

| Separately, Spain reported June industrial output rose 0.2%. This is better than Italy’s decline but was below expectations (0.5%) after a 0.5% fall in May. The recent string of data suggests that the Spanish economy is moderating after a period of outperformance. Remember too that Spain still has been unable to form a government after an two elections (December 2015 and June 2016). Rajoy is leading the caretaker government, but it does seem that if he were to offer to step down and allow and PP official replace him, a center-right government could be fairly quickly formed. |

Click to enlarge. Source Investing.com |

Canada

|

Click to enlarge. Source Investing.com |

Bank of England

Lastly, we return to the BOE decision yesterday. It succeeded when many other central banks have struggled in getting ahead of the curve of expectations. The 25 bp rate cut was, though widely anticipated. The central bank has a clear easing bias with another 10-15 bp cut likely in Q4. Carney explicitly rejected negative interest rates.

The GBP70 bln asset purchase program, of which GBP10 bln will be corporate bonds was more than many had anticipated. Of note, the ECB appears to be buying a small amount of nearly every corporate bond it can. Carney indicated that BOE wold buy those investment grade bonds of corporations that it judges make a material contribution to the UK. The program is projected to be complete in six months.

The BOE also announced a “Term Funding Scheme” (TFS), which is similar to the TLTROs of the ECB. Banks (and building societies) can have access to four-year funding from the central bank at a rate close to the base rate (now 25 bp) compared with the cost of funding that was nearer 1.0%. The lenders must maintain or expand their lending or face higher costs and loss of access to the facility. This GBP100 bln facility is bigger than the QE purchases but is also funded by the creation of new bank reserves (central bank money).

Despite the Bank of England doing more than the market expected, its economic assessment is not as dour as many in the private sector. The central bank expects growth to slow to 0.1% this quarter than then be stagnant in Q4 and Q1 17. It is not clear whether this that the UK escapes a recession, as there is no agreed upon definition of a recession. Two consecutive quarters of negative growth is not a technical definition but a rule of thumb, and one, incidentally, that is not used in the US by the NBER that is the official arbiter.

One criticism that has been levied at central banks is their hubris regarding the power of monetary policy. If that criticism is valid, which we have our doubts, Carney addressed it head-on. He was explicit. The shock to the economy can be cushioned but not overcome by monetary policy, seemingly hinting without being explicit, that there is a role for fiscal support. Yet he defended monetary action, noting that it is the first line of defense and can be brought to bear quicker than fiscal policy.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: Canada Employment Change,FX Daily,Germany Factory Orders,Italy Industrial Production,Japan Average Cash Earnings,newslettersent,Spain Industrial Production,U.S. Average Earnings,U.S. Nonfarm Payrolls,U.S. Participation Rate,U.S. Trade Balance,U.S. Unemployment Rate