Tag Archive: U.S. Average Earnings

The Average Earnings Index measures change in the price businesses and the government pay for labor, including bonuses. The Average Earnings figure gives us a good indication of personal income growth during the given month.

Four Point One

The payroll report for October 2017 was still affected by the summer storms in Texas and Florida. That was expected. The Establishment Survey estimates for August and September were revised higher, the latter from a -33k to +18k. Most economists were expecting a huge gain in October to snapback from that hurricane number, but the latest headline was just +261k.

Read More »

Read More »

FX Daily, November 03: Dollar Firms Ahead of What is Expected to Be Strong US Jobs Data

The US dollar is firm but is not going anywhere quickly. The lack of fresh interest rate support and uncertainty over the US tax proposals, which the Brady, the Chair of the House Ways and Means Committee hopes to have a revised version out after the weekend so the committee work can begin on Monday.

Read More »

Read More »

The Payroll Report To Focus On Is August’s, Not September’s

The hurricanes didn’t disappoint, causing major damage at least to the BLS. Precisely how much the statistics were affected by the disruptions in Texas and Florida really can’t be calculated, not that everyone won’t try. It makes this month’s payroll report a Rorschach test of sorts. You can pretty much make it out to be whatever you want.

Read More »

Read More »

US Storm-Skewed Report Means Nothing about Anything

US interest rates and the dollar rose in response to the data. It was firm before the report. The US Dollar Index is up for a fourth consecutive week. It is the longest streak since Q1. US 10-year yields are near 2.40%, an area that has blocked stronger gains for nearly six months.

Read More »

Read More »

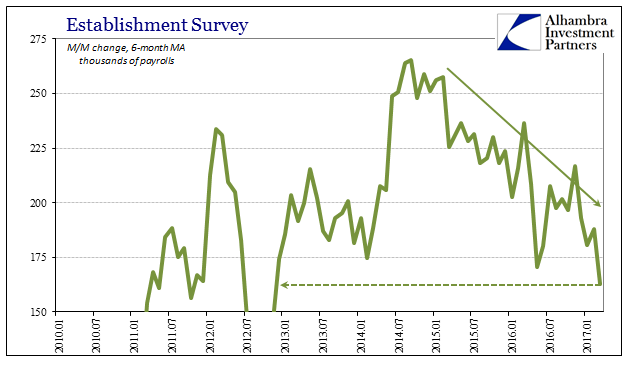

2017 Is Two-Thirds Done And Still No Payroll Pickup

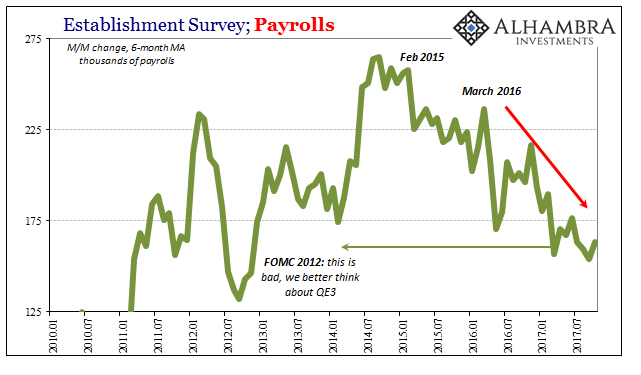

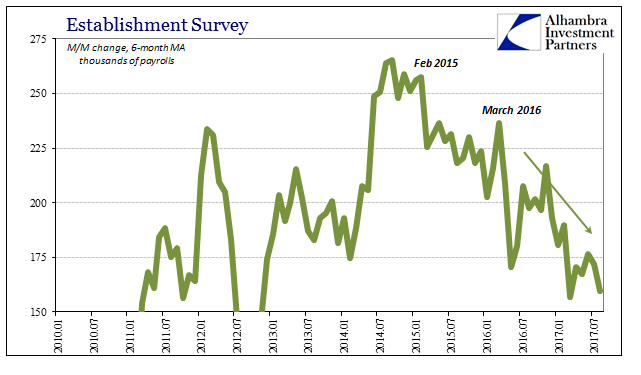

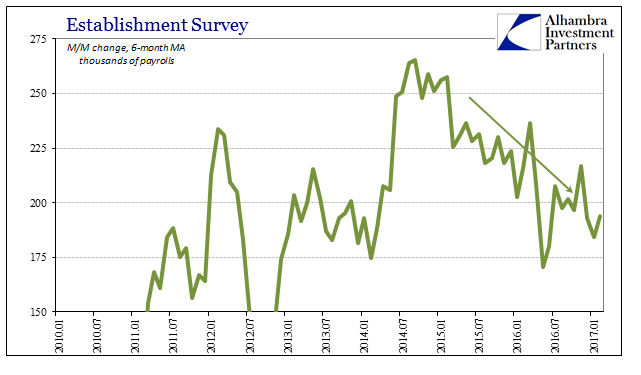

The payroll report for August 2017 thoroughly disappointed. The monthly change for the headline Establishment Survey was just +156k. The BLS also revised lower the headline estimate in each of the previous two months, estimating for July a gain of only +189k. The 6-month average, which matters more given the noisiness of the statistic, is just +160k or about the same as when the Federal Reserve contemplated starting a third round of QE back in 2012.

Read More »

Read More »

FX Daily, September 01: Manufacturing PMIs, US Jobs, and Implications of Harvey

As the markets head into the weekend, global equities are firmer, benchmark 10-year yields are mostly lower, and the dollar is consolidating after North American pared the greenback's gains yesterday. Manufacturing PMIs from China, EMU, and the UK have been reported, while in the US, the August jobs data stand in the way of the long holiday weekend for Americans.

Read More »

Read More »

Constructive US Jobs, but Where Do the Euro Bulls make a Stand?

The US created 209k jobs in July and jobs growth in June was revised higher (+9k) to 231k. The underemployment rate was unchanged at 8.6%. The unemployment rate ticked down to 4.3%, matching the cyclical low set in May. This is all the more impressive because the participation rate also ticked up (62.9% from 62.8%).

Read More »

Read More »

FX Daily, August 04: Does the Employment Report Matter?

There are some chunky option strikes that could come into play today. There are 920 mln euros struck at $1.1850 that expire today. There are A$523 mln struck at $0.7950 expiring today. There are $680 mln struck at CAD1.2550 that will be cut.

Read More »

Read More »

Reports on a Quarterly Survey Conducted: Qualifying Shortage (Labor)

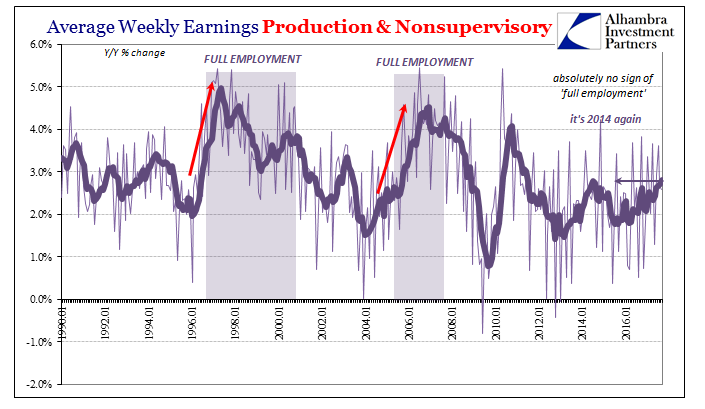

There isn’t a day that goes by in 2017 where some study is released or anecdote is published purporting a sinister labor market development. There is a shortage of workers, we are told, often a very big one. The idea is simple enough; the media has been writing for years that the US economy was recovering, and they would very much like to either see one and be proven right (and that recent revived populism is illegitimate), or find an excuse why...

Read More »

Read More »

Drop in the US Unemployment Rate Not Sufficient to Mask Disappointing Report

Poor jobs growth won't challenge June hike expectations but September and balance sheet. Little positive in today's report. Drop in unemployment explained by drop in participation rate. Trade deficit was larger than expected, which may point to slower Q2 growth.

Read More »

Read More »

FX Daily, June 02: Dollar Marks Time Ahead of US Jobs Report

The foreign exchange market is becalmed, leaving the US dollar narrowly mixed. The euro has been confined to less than a 20-pip range through the Asian session and most of the European morning. The news stream is light. The US withdrawal from the Paris Accord may have garnered the headlines, but as a market force, it is difficult to detect the immediate impact.

Read More »

Read More »

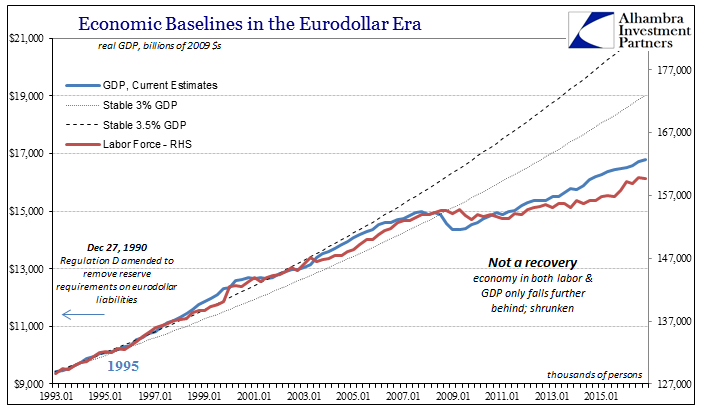

Simple (economic) Math

The essence of capitalism is not strictly capital. In the modern sense, the word capital has taken on other meanings, often where money is given as a substitute for it. When speaking about things like “hot money”, for instance, you wouldn’t normally correct someone referencing it in terms of “capital flows.” Someone that “commits capital” to a project is missing some words, for in the proper sense they are “committing funds to...

Read More »

Read More »

April Jobs Won’t Change Minds

There is something for everyone in today's US jobs report, and at the end of the day, it is unlikely to sway opinion about the direction and timing of the next Fed move. The greenback itself may remain range bound after the initial flurry. On the other hand, the disappointing but noisy Canadian data underscores the risk of a more dovish slant to the central bank's neutral stance next week.

Read More »

Read More »

FX Daily, May 05: Mixed Dollar Ahead of US Jobs Data and Fed Talk

The US dollar is narrowing mixed as the employment data, and Fed speeches are awaited. Six Fed officials speak today, including Yellen and Fischer. Regional Presidents Williams, Rosengren Evans and Bullard also speak. It will be the first flurry of speeches since the FOMC meeting.

Read More »

Read More »

Money In America

In 1830, France was once more swept up in revolution, only this time at the end of it was installed one king to replace another. Louis-Phillipe became, in fact, France’s last king as a result of that July Revolution. The country was trying to make sense of its imperial past with the growing democratic sentiments of the 19th century.

Read More »

Read More »

It Was And Still Is The Wrong Horse To Bet

The payroll report disappointed again, though it was deficient in ways other than are commonly described. The monthly change is never a solid indication, good or bad, as the BLS’ statistical processes can only get it down to a 90% confidence interval, and a wide one at that. It means that any particular month by itself specifies very little, except under certain circumstances.

Read More »

Read More »

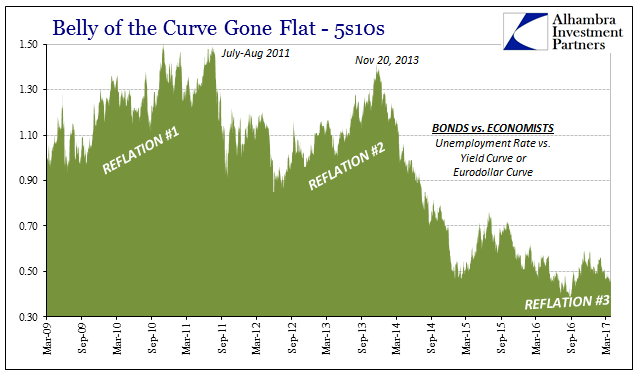

US Jobs: Who Carries The Burden of Proof?

The idea that interest rates have nowhere to go but up is very much like saying the bond market has it all wrong. That is one reason why the rhetoric has been ratcheted that much higher of late, particularly since the Fed “raised rates” for a third time in March. Such “hawkishness” by convention should not go so unnoticed, and yet yields and curves are once more paying little attention to Janet Yellen.

Read More »

Read More »

US Jobs Growth Disappoints

The US jobs growth slowed considerably more than expected in March and the disappointment pushed the dollar and equities initially lower. The US created 98k jobs in March, well below market expectations for around 175k jobs. Adding insult to injury, revisions to the January and February data took off another 38k job.

Read More »

Read More »

Short Note on US Employment Report

The US jobs data is notoriously difficult to accurately forecast consistently. I do not claim to do so now. My intent is more modest. It is simply to point out why I there is risk that the jobs data is disappointing, especially after the stronger than expected ADP estimate.

Read More »

Read More »

Payrolls Still Slowing Into A Third Year

Today’s bland payroll report did little to suggest much of anything. All the various details were left pretty much where they were last month, and all the prior trends still standing. The headline Establishment Survey figure of 235k managed to bring the 6-month average up to 194k, almost exactly where it was in December but quite a bit less than November. In other words, despite what is mainly written as continued “strength” is still pointing down...

Read More »

Read More »