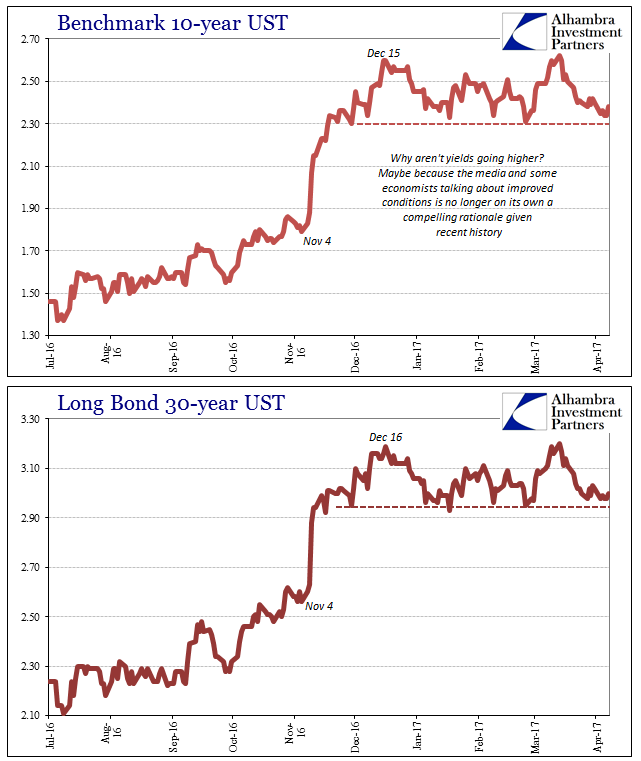

The idea that interest rates have nowhere to go but up is very much like saying the bond market has it all wrong. That is one reason why the rhetoric has been ratcheted that much higher of late, particularly since the Fed “raised rates” for a third time in March. Such “hawkishness” by convention should not go so unnoticed, and yet yields and curves are once more paying little attention to Janet Yellen. When Mohamed El-Erian wrote in what was I guess an oped in the Financial Times on Monday that bond investors were “distracted”, it was his subtle way of attacking them as wrong.

In that way, we are truly back to late 2013 and early 2014 all over again. But back then the Fed’s positivity side, thus bad for bonds, had a whole lot more going for it (even if it was in total still a thin catalog). Recovery at that point was at least plausible under the undetermined guidance of QE3 (and 4), whereas today not even Fed officials talk that way or even bring themselves to mention QE.

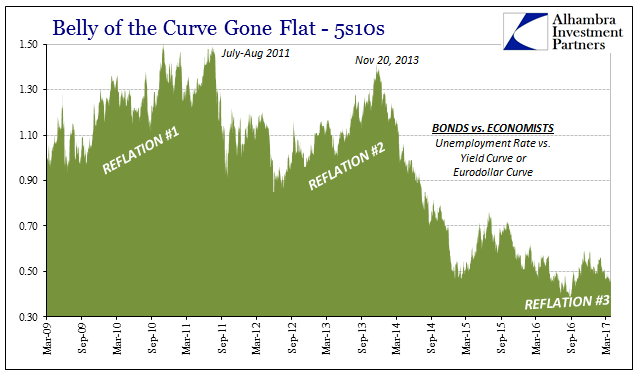

| This isn’t to say that the bond market or eurodollar futures have everything right, far from it. As I argued earlier this week, these very markets were way off at several points and for several years. Treasuries as well as eurodollar futures were firmly within the camp of higher interest rates and monetary policy support until 2011. In other words, bond investors then were wrong, and even though it took several years to fully appreciate the implications of the con job that was QE, the bond market and eurodollar futures curve have been far more right than wrong since then (the noted exception being late 2013). |

Belly of the Curve Gone Flat 2009-2017 |

| On its own, that doesn’t mean bond investors are now infallible and that treasury yields and the eurodollar curve together make up the definitive guide to the universe. Everything is about probabilities and really a spectrum of them, which means in simple terms the bond market deserves the benefit of the doubt where clearly economists and policymakers do not. Therefore, if there is a disagreement all over again between bonds and economists, particularly in similar fashion to 2014 and 2015, it does not make much sense to follow the latter particularly as interpretations on that side continue to rely upon the so far unreliable unemployment rate view of the economy. |

Benchmark 10-year UST, Long Bond 30-year UST compared |

| For the balance of presumed error to shift back in the favor of this mainstream interpretation will require far more tangible proof than “interest rates have nowhere to go but up.” Having already heard it before several times, and having witnessed that, no, interest rates can actually go lower, there needs to be compelling evidence to that effect. |

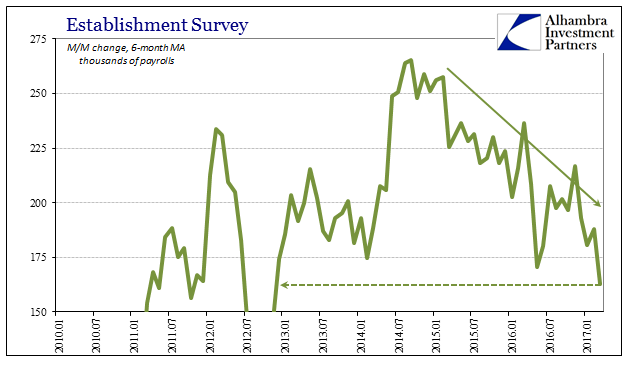

Establishment Survey, Non-Farm Payrolls 2010-2017 |

| To this point in 2017, already the second quarter, it remains absent. The payroll report today was but another reminder of that case, especially beyond the headline Establishment Survey number that while disappointing did not describe the full impact of that disappointment. By almost every facet of the BLS data did the unemployment rate fail, which was particularly troubling given that the rate itself fell to a new “cycle” low. In other words, there is no indication that unemployment rate today has any more meaning and significance than it did in 2014 when last “interest rates had nowhere to go but up” because the Fed was tapering. |

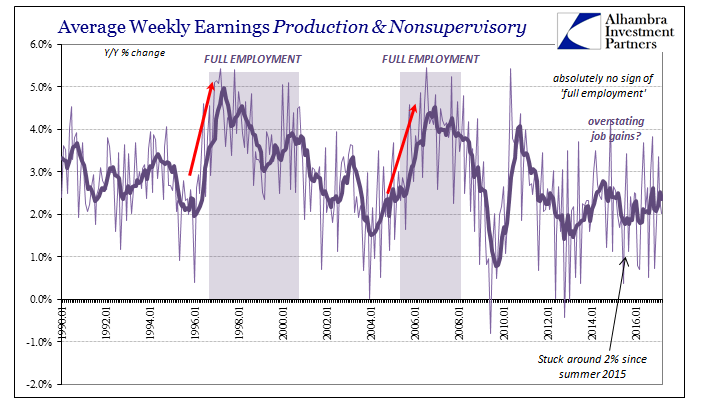

Average Weekly Earnings 1990-2017(see more posts on U.S. Average Earnings, ) |

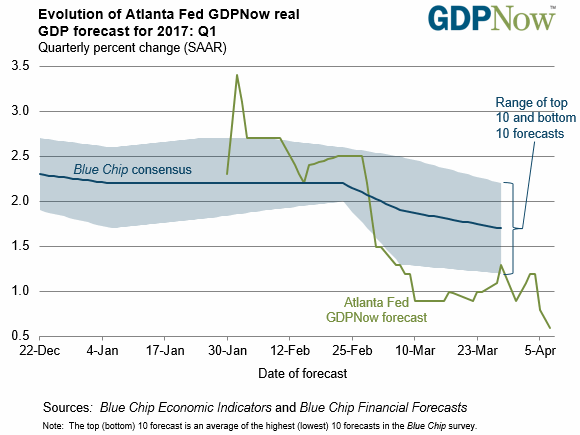

| Instead, economic indications beyond payrolls continue to suggest only sustained weakness. There is improvement in most accounts beyond the labor market, to be sure, but like the labor market data nothing that is close to convincing that a positive inflection is even realistic let alone close at hand. To emphasis that point further, the Atlanta Fed’s GDPNow tracking model was reduced today to project just 0.6% real GDP growth in Q1 – such a low level despite “residual seasonality” already built in even though there hasn’t been found any evidence any such thing as residual seasonality ever existed in the GDP data set. |

Evolution of Atlanta Fed GDPNow Real GDP forecast for 2017: Q1 |

When it comes to economic interpretation, pointing to the unemployment rate was never enough even if it satisfied everyone in the media. To do so now only further calls into question that position, for if the unemployment rate is all you have to define a “better” economy then you truly have nothing. As I wrote in late January last year, right amidst the then “unexpected” turmoil:

More than a year later, not even the Establishment Survey can be included on that sunny side of the ledger. When in the mainstream the bond market’s pessimism is decried as surely wrong, it is done so on the basis of econometric models that are, to put it simply, backward.

Even after two years of “full employment” the wage acceleration of full employment remains conspicuously missing; to the point that it in all likelihood the Fed’s models have given up on it. The latest payroll report suggests only continued significant slack which can only mean chronic weakness well beyond the unemployment rate’s overly narrow focus (participation problem). If there is any policy debate left it is only about what has caused this depression (or secular stagnation, low/negative R*, or however you wish to characterize what is a no-growth baseline). |

Potential Real GDP from 2005(see more posts on U.S. Gross Domestic Product, ) |

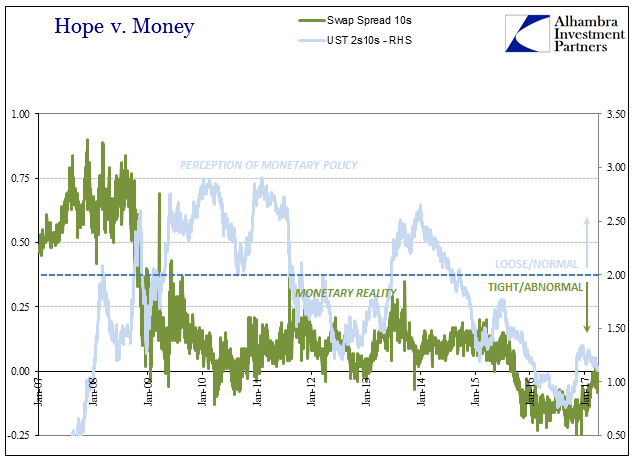

| Having seen through these statistics for what they really are, the treasury as well as eurodollar market reflects considerable and legitimate economic doubt drawn from realizing what money is (a whole lot more than bank reserves) and what it certainly wasn’t (QE). It is the optimists who share the burden of proof that this time is any different. The longer that evidence remains missing, the greater that burden. This is not a “distraction” as El-Erian would have it, but rather very ugly reality unchanged by time or effort. |

Hope v. Money 2007-2017 |

Hope v. Money 2007-2017 |

Tags: bond market,currencies,depression,economy,eurodollar futures,Federal Reserve,Federal Reserve/Monetary Policy,FOMC,Interest rates,Markets,Monetary Policy,newslettersent,rate hikes,secular stagnation,U.S. Average Earnings,U.S. Gross Domestic Product,U.S. Treasuries,yields