Tag Archive: yields

No Turn Around Tuesday as Greenback Remains Firm

Taking the next few days off. Will be back with week ahead commentary on July 6. Overview: The sharp jump in US long-term interest rates has helped lift the greenback in recent sessions and it remains firm against most of the G10 currencies today. The Canadian dollar is the best performer, and it is nearly flat. The intraday momentum indicators warn that after a mostly consolidative Asia Pacific and European morning, the greenback may probe...

Read More »

Read More »

Fitch Roils Markets

Overview: Late yesterday, on the eve of the

quarterly refunding announcement, Fitch cut the US rating to AA+ from AAA,

citing project fiscal deterioration over the next few years and "the

erosion of governance". S&P also has the US as an AA+ credit. Ironically,

many observers who have been critical of the US monetary and fiscal policies,

like former Treasury Secretary Summers and El-Erian, were also critical of Fitch's

decision. The...

Read More »

Read More »

What Happened Today in a Few Bullet Points

1. The most important thing to appreciate is that the market has moved to price not one but two cuts next year. The first is priced into the September Fed funds futures and the second is in the Dec Fed funds futures.

Read More »

Read More »

FX Daily, June 11: US Yields Stabilize After Falling to Three-Month Lows

The 10-year US Treasury yield steadied after reaching a three-month low near 1.43%, despite the US CPI rising more than expected to 5% year-over-year. On the week, the decline of around a dozen basis points would be the largest in a year. Australia, New Zealand, and Italy benchmark yields have seen a bigger decline this week.

Read More »

Read More »

FX Daily, August 16: Markets Take Collective Breath Ahead of the Weekend

Overview: The global capital markets are ending the tumultuous week calmly, but it is far from clear that is will hold long. Next week's flash PMIs have potential to disappoint, and there is risk of new escalation in the US-China trade conflict as the PRC threatens to take action to countermeasures to the new US tariffs.

Read More »

Read More »

FX Daily, September 08: US Dollar Tracks Yields Lower

The US dollar has been unable to find any traction as US yields continue to move lower. The US 10-year year is slipping below 2.03% in European turnover, the lowest level in ten months. The risk, as we have noted, is that without prospects of stronger growth and inflation impulses, the yield returns to where was before the US election (~1.85%). The two-year note yield, anchored more by Fed policy than the long-end, is also soft. It yielded 1.25%...

Read More »

Read More »

Less Than Nothing

As I so often write, we still talk about 2008 because we aren’t yet done with 2008. It doesn’t seem possible to be stuck in a time warp of such immense proportions, but such are the mistakes of the last decade carrying with them just these kinds of enormous costs.

Read More »

Read More »

US Jobs: Who Carries The Burden of Proof?

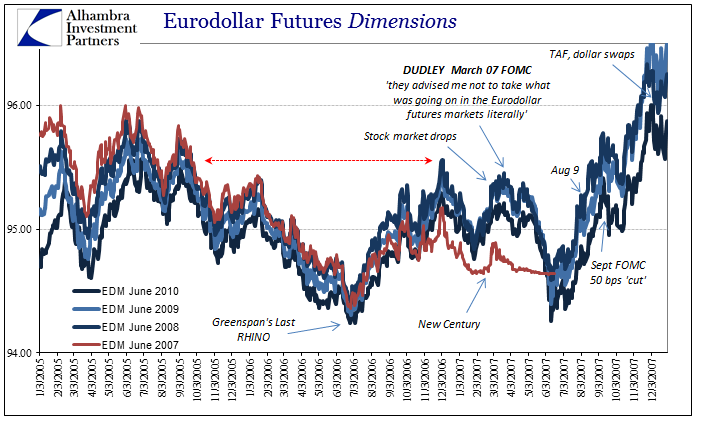

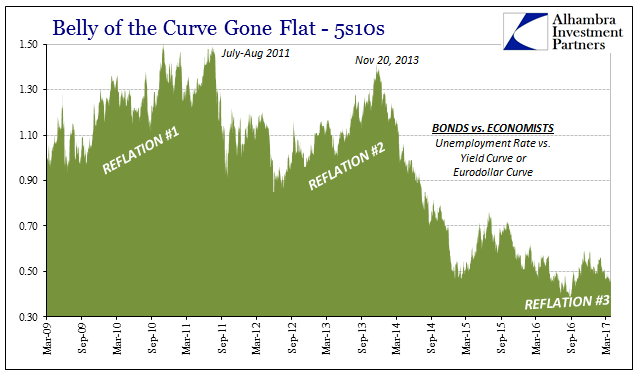

The idea that interest rates have nowhere to go but up is very much like saying the bond market has it all wrong. That is one reason why the rhetoric has been ratcheted that much higher of late, particularly since the Fed “raised rates” for a third time in March. Such “hawkishness” by convention should not go so unnoticed, and yet yields and curves are once more paying little attention to Janet Yellen.

Read More »

Read More »

Yen and US Yields

Dollar-yen has been driven by the sharp rise in US bond yields. There are some (dollar) bearish divergences in the JPY/USD technicals. US 10-year yields may also be putting in a near-term top.

Read More »

Read More »

US Political Anxiety Stems Bond Sell-Off

Bond yields have been rising in the US and Europe since the summer. There are some country-specific considerations and some generalized factors. Anxiety over US politics has helped bonds recover some lost ground.

Read More »

Read More »

The Yen in Three Charts

The dollar is taking out a several month downtrend against the yen. The correlation between the yen and the S&P 500 has broken down. The US 2-year premium over Japan has steadily risen.

Read More »

Read More »

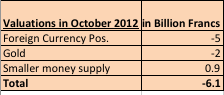

SNB Valuation Losses in October: Around 6 Billion Francs

The Swiss National Bank (SNB) had valuation losses of around 6 billion francs in October due to the weaker EUR/CHF exchange rate and a weaker gold price.

Read More »

Read More »

Are German Bunds finally heading for the big slide ?

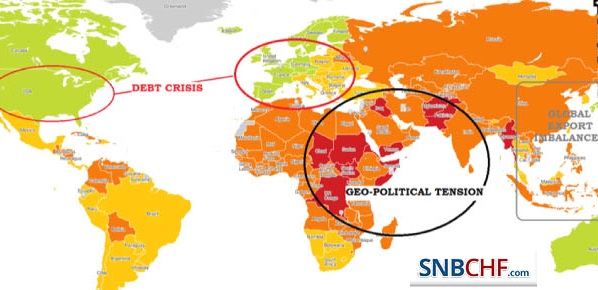

Citibank judges that the Swiss National Bank (SNB) does not need a peg anymore. The EUR/CHF exchange rate would be now over 1.20 even if exposed to the free market. Yesterday we showed that the upward move in the EUR/CHF is just the behavior of some euphoric Forex traders. In the meantime we see a completely … Continue reading »

Read More »

Read More »