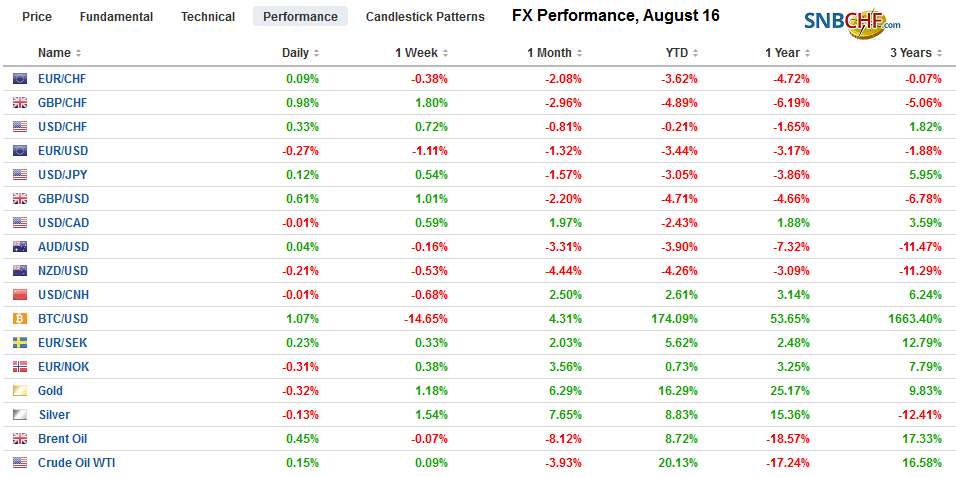

Swiss FrancThe Euro has fallen by 0.01% to 1.0841 |

EUR/CHF and USD/CHF, August 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

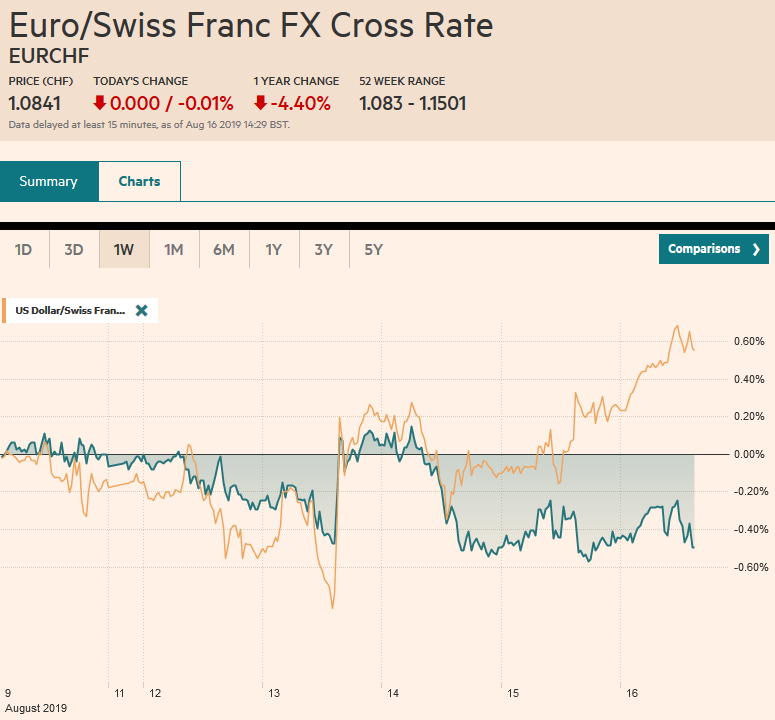

FX RatesOverview: The global capital markets are ending the tumultuous week calmly, but it is far from clear that is will hold long. Next week’s flash PMIs have potential to disappoint, and there is risk of new escalation in the US-China trade conflict as the PRC threatens to take action to countermeasures to the new US tariffs. Most equity markets are higher, but the gains pare the week’s losses but extend the losing streak. The MSCI Asia Pacific’s has fallen nearly 7% of the four-week skid. The Dow Jones Stoxx 600 is having its best day of the week, gaining about 0.75% in the European morning, but will extend its decline for a third week, over which time it has lost nearly 6%. The S&P 500 will pare this week’s 2.4% decline at least at the start today, but the downdraft is three weeks old and has taken 6% off the benchmark, coming into today. US and European benchmark 10-year yields are a little firmer today, though New Zealand’s 10-year yield dropped below 1% for the first time and Greece’s 10-year bond yield dipped below 1.95% to a new record low. The dollar is firm against most of the majors, though sterling and the Australian and Canadian dollar are the main exceptions. It has been quite a while since we have been able to say this, but sterling is the only G10 currency to gain against the dollar this week. The liquid accessible emerging market currencies (e.g., South Africa, Turkey, Mexico) are leading the emerging market currencies higher. Eastern and Central European currencies appear to be dragged lower by the falling euro. The Argentine peso is the worst-performing currency this week, losing almost 21% of its value. Gold is paring this week’s gains, but it will likely post its third consecutive weekly advance, over which time it has risen about 5.5%. Oil is snapping a two-week slide. It is up more than 1.25% today through the European morning with WTI advancing about 1.2% this week and Brent about 0.8%. |

FX Performance, August 16 |

Asia Pacific

China says it will take countermeasures following the US decision to go forward with a new tariff on more Chinese goods. Officials claim the new tariffs violate the agreement that Trump and Xi struck in Japan a couple months ago. At the same time, reports confirm that China bought 10.2k metric tons of pork from the US in the week through August 8, which accounted for around half of the US pork exports that week. Recall China had canceled its purchase of 14.7k tons a couple of weeks ago in protest to the new US tariff threat. Separately, today’s PBOC dollar fix (CNY7.3012) was slightly stronger for the dollar than had been expected (CNY7.0305). It is the second day that the dollar fix was above bank projections. The US dollar has firmed slightly for the second day slipping lower for the first three sessions of the week, for a cumulative loss of about 0.3%.

Japan’s innovative yield curve control strategy is floundering. The purpose of the policy was to steepen the yield curve by allowing the long-end to rise. However, the 10-year yield has remained above the BOJ’s +/= 20 bp band. The BOJ responded today by reducing the amount of 5-10 year bonds it will buy this month to JPY450bln from JPY480 bln. This seemed to barely make an impression on the market, and the benchmark 10-year JGB yield finished at minus 24.2 bp, about half a basis point off its record low.

Elsewhere Taiwan confirmed Q2 GDP of 2.4% year-over-year. Hong Kong revised its estimate of Q2 GDP to -0.4% from the initial report of -0.3%. The year-over-year rate slipped to 0.5% from 0.6%. Singapore’s non-oil exports fell 11.2% year-over-year in July, which was not as large a drop as the 15.4% decline that the median economist forecast in the Bloomberg survey. In June, non-oil exports were off 17.4%. The 3.7% gain on the month provides some glimmer of hope that the worst may be passed.

The dollar is firm against the yen but is still trading within the ranges set earlier this week. Today is so far the first time in two weeks that the dollar has not traded below JPY106.00. The intraday technicals are stretched in late European morning turnover with the greenback near JPY106.50, where a $355 mln option will be cut later today. The Australian dollar also remains in a consolidative phase. It is barely lower than last week’s close of about $0.6785, but if it cannot rise to the occasion, it will extend its losing streak for a fourth consecutive week.

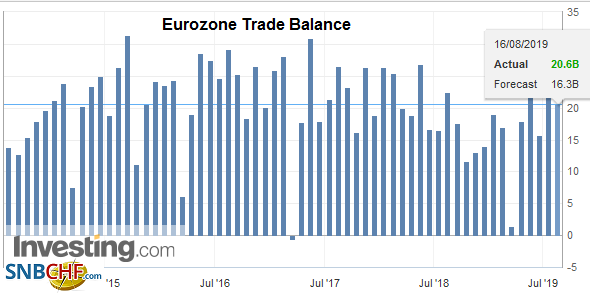

EuropeNew developments from Europe are thin. The Gibraltar court decision to allow the release of the seized Iranian ship ostensibly breaking embargo by transporting oil to Syria has antagonized the US. Some US officials reportedly are threatening sanctions. Separately, though perhaps related, President Trump complained that Europe treats the US worse than China does. News that the Trump Administration is interested in buying Greenland is a non-starter and a distraction from the more pressing issues. Trump will visit Denmark in early September, but the Danes have little interest in selling Greenland, on which the US has a substantial military presence. The focus next week is on the record from the recent ECB meeting as investors look for clues of next month’s policy steps. Toward the end of the week, the flash August PMI will be reported. Italy’s Prime Minister Conte may face a vote of confidence after League leader Salvini withdrew support for the government in which he is a deputy PM. Italy’s 10-year yield fell 33 bp this week, 20 bp more than Germany. The two-year yield fell 17 bp in Italy compared with a little more than 2 bp in Germany. |

Eurozone Trade Balance, June 2019(see more posts on Eurozone Trade Balance, ) Source: investing.com - Click to enlarge |

The euro continues to bleed lower. It is the fourth consecutive session that the euro is losing 0.2-0.3%. It has pushed below $1.11 for the first time since August 2. It has lost a little more than 1% this week, its largest weekly loss since early July. There is an option for 523 mln euros struck at $1.1080 and around 950 euros at $1.1100. Both will expire today. Recall that the low from August 1, before Trump ended the tariff truce was almost $1.1025. Sterling is making new highs for the week today, above $1.2150. Some sterling demand seems to be a function of cross rate adjustment. Sterling’s record 14-week slide against the euro is over. The euro is off more than 2% against sterling this week. The high so far this month is about $1.2210.

America

St. Louis Fed’s Bullard became a hero to many who think the Fed is behind the curve camp when he delivered the first dissent under Chairman Powell in June in favor of an immediate rate cut. However, he is not the uber-dove that some may think. He too subscribed to the mid-course adjustment framing of the July rate cut and favors one more by the end of the year. Yet the implied yield of the January 2020 fed funds futures contract fell 5.5 basis points yesterday to 1.415%. The market is discounting 70.5 bp of easing this year. And this is after the 1% rise in core retail sales, more than twice what economists expected, and a 2.8% three-month annualized rise in core CPI. The implied yield has fallen 20 bp in the past two weeks.

The dollar initially spiked higher against the Mexican peso on news of a surprise 25 bp rate cut that brought the overnight rate to 8%. However, the greenback surrendered those gains a bit more in the waning hours of the session. Banixco maintained its neutral stance and offered an economic assessment that was little changed from the last. The market leans toward another cut in November rather than at the next meeting in September. About a 20% chance that the overnight rate will be down to 7.5% at the end of the year appears to have been discounted.

The US reports July housing starts and permits. Both are expected to have firmed. Housing starts fell in May and June. Permits fell sharply in June (the 6.1% drop was revised to only –5.2%). The lower interest rate environment may help spur homebuilding. Next week new and existing home sales will be reported. The University of Michigan’s consumer confidence report may attract attention after some observers argued that the worrisome headlines were undermining consumer confidence. Trump blames the press and the Fed. Most economists attribute much of the economic anxiety to the tariffs. University of Michigan’s consumer confidence reading stood at 98.9 in July. It averaged 98.5 in Q2 and 94.5 in Q1. Canada reports its June international transactions, while Mexico’s economic calendar is empty.

The US dollar is paring this week’s gains against the Canadian dollar. It is the fifth consecutive week the greenback has gained on the Loonie, but the momentum may be stalling. The US dollar was unable to take out the month’s high set last week near CAD1.3345, and the move back below the 200-day moving average (CAD1.3310) seems to be encouraging some profit-taking. Mexico’s surprise rate cut yesterday has not spurred new peso sales today. The dollar is near MXN19.57 after finishing yesterday above MXN19.60. Initial resistance is seen in the MXN19.65 area, while support is pegged near MXN19.50.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Currency Movements,EUR/CHF,Eurozone Trade Balance,FX Daily,newsletter,USD/CHF,yields