Tag Archive: U.S. Average Earnings

The Average Earnings Index measures change in the price businesses and the government pay for labor, including bonuses. The Average Earnings figure gives us a good indication of personal income growth during the given month.

Dollar Drivers in the Week Ahead

The key issue facing the foreign exchange market is whether the modicum of strength the US dollar demonstrated last week is the beginning of a sustainable move. It is possible that the market is again at a juncture in which the price action will...

Read More »

Read More »

FX Daily April 20: Bulls’ Charge Stalls, while Greenback Consolidates Losses

The US dollar has been largely confined to yesterday’s ranges against the major currencies. China’s yuan slipped lower for the first time in four sessions, while the Shanghai Composite fell 2.3%, the most since the end of February. While a few equity markets in Asia managed to follow suit after US equity market gains carried …

Read More »

Read More »

Four Keys to The Week Ahead

There are four events that will shape market psychology in the week ahead. They are Yellen's speech to the NY Economic Club, US jobs data, eurozone March CPI and PMI, and Japan's Tankan Survey. The broad backdrop is characterized by the rebuilding of risk appetites since the middle of February, though the MSCI emerging market … Continue reading...

Read More »

Read More »

Dollar Firm Ahead of the FOMC, UK Budget Looms

Since the Federal Reserve hiked rates in December, both the European Central Bank and the Bank of Japan have eased policy further. The idea that because they cut rates means that the Fed cannot raise rates is a not a particularly helpful way to ...

Read More »

Read More »

FX Daily 03/14: Five Central Banks Meet as Monetary Policy is Downgraded

Fixed exchange rates limit the degrees of freedom for policymakers. The breakdown of Bretton Woods in 1971 removed this constraint on official action, and the results were larger budget deficit and higher inflation. The zero bound on interest rates also posed a constraint on behavior. Until this year, despite the long struggle against deflation, the Bank …

Read More »

Read More »

Investment Climate Improves

Sometimes the news stream drives prices, and sometimes the price action drives the narratives. We argued that the sharp decline in equities at the start of the year was fanned the doom and gloom in the media and market commentary. Many had been taking about a new financial crisis and parallels were drawn between the … Continue...

Read More »

Read More »

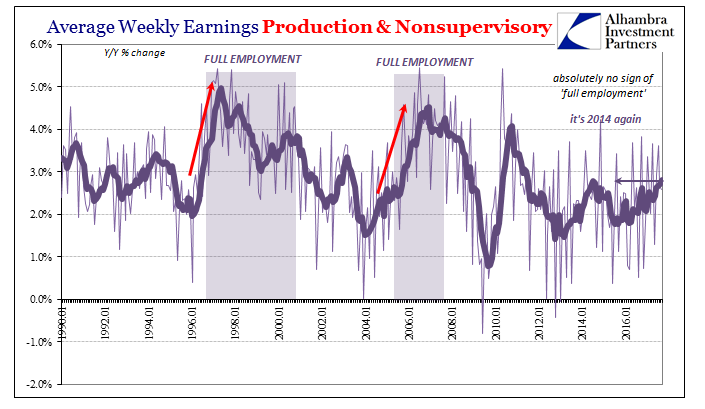

Bizarro World of Negative Interest Rates and Central Banks Pushing for Wage Increases

In many ways, the world has turned upside down. It is not just central banks that have set policy rates below zero, but the entire German curve out through eight years have negative yields. Japan, which has the largest debt burden relative to GDP, has negative yields out through nine years. The Swiss curve is …

Read More »

Read More »

Easing of US Recession Fears will Likely Lend Dollar Support

With many equity markets having fallen 20% from their peaks, meeting a common definition of a bear market, investors, analysts, and journalists understandably seek a narrative that gives it meaning. At the very start of the year, the culprit singled out was drop in Chinese shares and the yuan. However, the yuan has stabilized as the …

Read More »

Read More »

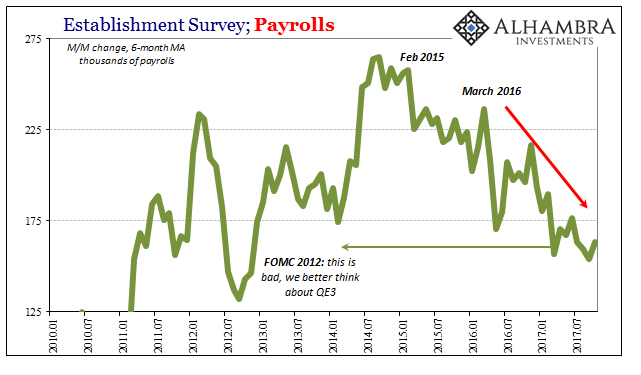

Employment Details Better than the Headlines

The US created fewer jobs than anticipated and the December gain was revised lower. However, the other details were favorable--better than expected. The unemployment rate ticked down to 4.9%, a new cyclical low, despite the rise in the participation rate (62.7% from 62.6%). Average hourly earnings were stronger than expected at 2.5%. The consensus expected …

Read More »

Read More »

Markets Resume New Year Slide

The market meltdown is extending into the third consecutive week. Once again, the attempt to stabilize has failed, and bottom pickers have been punished. It is easy to line up poor news developments, including IMF cutting world growth on the same day that the IEA warns of an extended glut in the oil market, the … Continue reading »

Read More »

Read More »

Tomorrow’s News Today

There are three important economic events tomorrow. The UK will release its December employment report and November weekly earnings data. The US reports December CPI. The Bank of Canada meets, and is widely expected to be the first centra...

Read More »

Read More »

Markets Calm Ahead of US Jobs Data

For the first time this week, the PBOC set higher central reference rate for the yuan and Chinese shares rallied, with the apparent assistance of officials, after the circuit breakers were abandoned. This, coupled with somewhat firmer oil pri...

Read More »

Read More »

Dollar: State of Play

The start of a new calendar year does not necessarily mean the rise of new market drivers. In fact, the key issues investors face at the start of 2016 are the same that dominated Q4 2015. These issues center around pace of Fed tightening, the outlook for the world's second largest economy and its … Continue reading »

Read More »

Read More »

The Dollar’s Technical Tone at the Start of the New Year

The US dollar firmed against nearly all the major currencies in the last week of 2015. The exceptions were the Antipodean currencies and the Japanese yen. The relatively high short-term yields offered Australia, and New Zealand may have attract...

Read More »

Read More »

2015 Draws to a Close

Many financial centers in Asia and Europe are on holiday today, and those that are open, are experiencing a minimum of activity. Turnover may pick up briefly in the North American morning, but conditions will remain thin and only those who need to transact will. The US reports weekly jobless claims and the Chicago PMI. … Continue reading...

Read More »

Read More »

Near-Term Dollar Outlook: May the Force be With You

The dollar rose against all the major currencies over the past week. The divergence meme we have emphasized has continued to unfold. The ECB eased policy at the start of the month. Less than 48 hours after the Fed hiked rates, the BOJ tweaked its asset purchase program to sustain it. Holiday-thin markets make for more … Continue reading...

Read More »

Read More »

Fe Fi Fo Fed

The much awaited Fed meeting is here. A 25 bp increase in the Fed funds range to 25-50 bp is widely expected. The near certainty of this contrasts to the high uncertainty of the immediate impact stocks, bonds, and the dollar. There are five components of the Fed's decision that will command attention. First, is … Continue reading...

Read More »

Read More »

After ECB’s Hawkish Cut, Is the Fed about to Deliver a Dovish Hike?

After much hemming and hawing since mid-year, the Federal Reserve is finally poised to raise rates for the first time in nearly a decade. Indeed, given the speeches by the leadership and the economic data, especially the labor market readings, the failure to raise rates would likely be more destabilizing at this juncture than lifting them. …

Read More »

Read More »

Jobs Data Keeps Fed on Track to Hike

After the ECB's disappointment yesterday market nerves were shattered, but the largely as expected US jobs data may help the focus return to the underlying fundamental fact. The ECB just eased policy. Not as much as the market expected, and t...

Read More »

Read More »

From the ECB’s Failure to Communicate to US Jobs to Confirm Fed Signals

The only way to explain the largest swing in the euro in six years yesterday is to appreciate the disconnect between what was expected and what was delivered by the ECB. Draghi's urgency and commitment to do "what it must" fanned expectations, a...

Read More »

Read More »