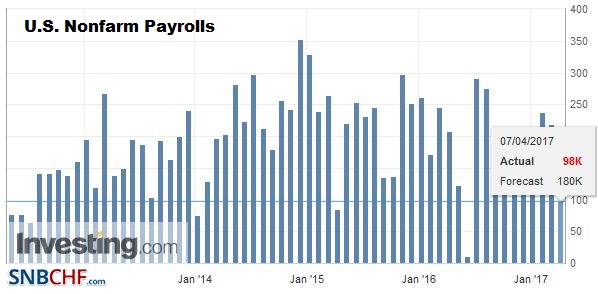

| The US jobs data is notoriously difficult to accurately forecast consistently. I do not claim to do so now. My intent is more modest. It is simply to point out why I there is risk that the jobs data is disappointing, especially after the stronger than expected ADP estimate. |

U.S. Nonfarm Payrolls, March 2017(see more posts on U.S. Nonfarm Payrolls, ) Source: investing.com - Click to enlarge |

| The same forces that weighed on March auto sales may have slowed net job growth; namely the weather and reversion to mean. The US non-farm payrolls rose more in January and February than in Q4 16 (473k to 443k). Better weather may have inflated February’s results, and March’s storm warns of payback. |

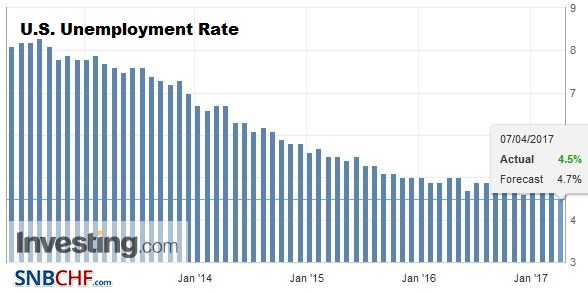

U.S. Unemployment Rate, March 2017(see more posts on U.S. Unemployment Rate, ) Source: investing.com - Click to enlarge |

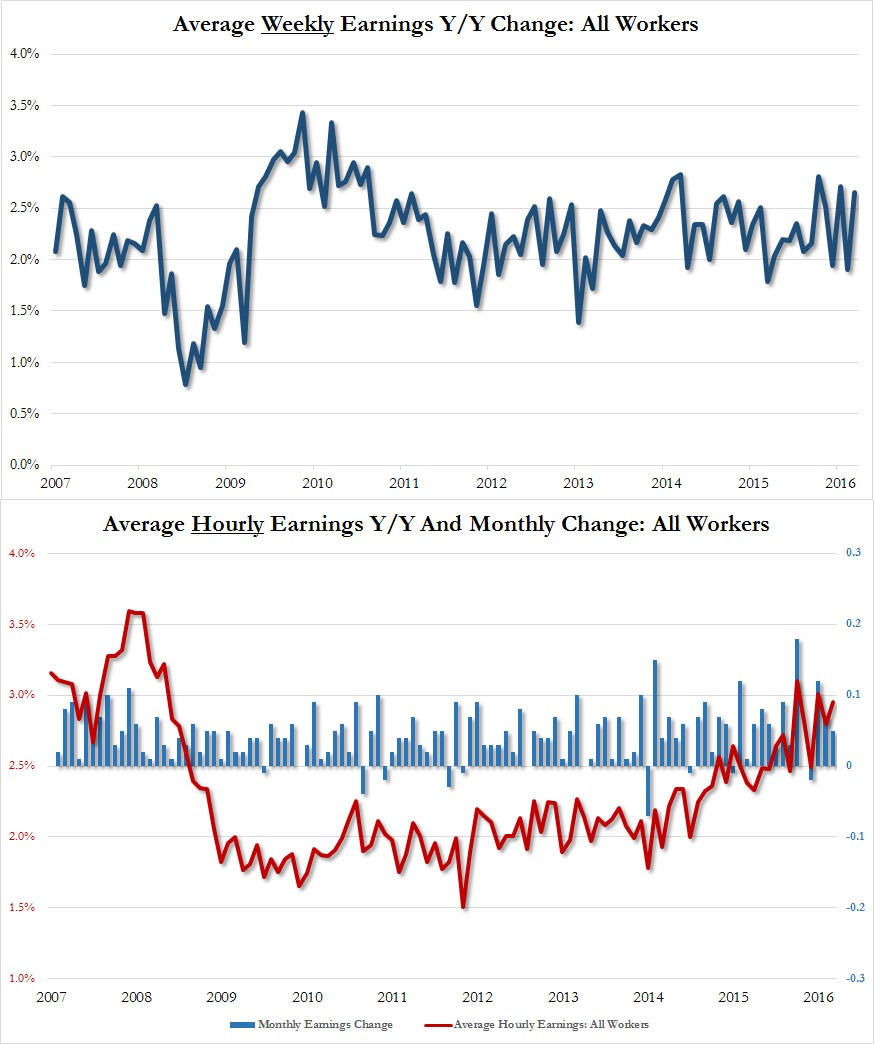

| This is not a mono-causal argument. Weekly initial jobless claims also moved higher. The PMIs and ISMs showed softness in labor indicators. ADP stands as an exception, and it’s curve fitting tendency may be picking up the echo of past job strength, and underestimating the impact of weather. There is also risk that this spills over and impacts hours worked. A 0.3% rise in hourly earnings is necessary to keep the year-over-year rate steady at 2.8%, which is anticipated. |

U.S. Average Hourly Earnings, March 2017(see more posts on U.S. Average Earnings, ) Source: zerohedge.com - Click to enlarge |

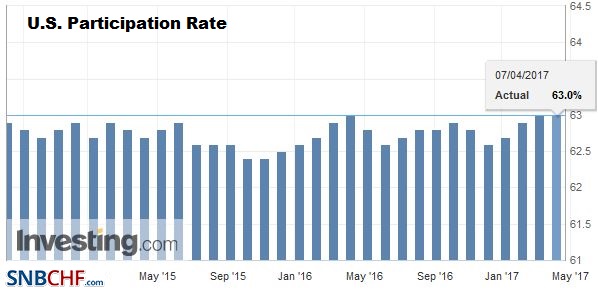

| A disappointing report means little in the grand scheme of things. Growth appears to have slowed as the consumer pulled back after a shopping spree in Q4 16. However, the Fed hiked last month, and it’s future course has little to do with March jobs report. Practically no one expects a May hike. The CME’s model suggest about 6.3% chance is discounted, and for good reason. Whatever gradual normalization means, it does not mean hikes at back-to-back meetings. Nevertheless, disappointment would likely weigh on the dollar. |

U.S. Participation Rate, March 2017(see more posts on U.S. Participation Rate, ) Source: investing.com - Click to enlarge |

Graphs by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Labor Market,newslettersent,U.S. Average Earnings,U.S. Nonfarm Payrolls,U.S. Participation Rate,U.S. Unemployment Rate