Tag Archive: $TLT

FX Daily, October 19: Kiwi Drop and Sterling Losses Punctuate Subdued FX Market

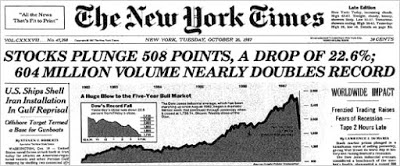

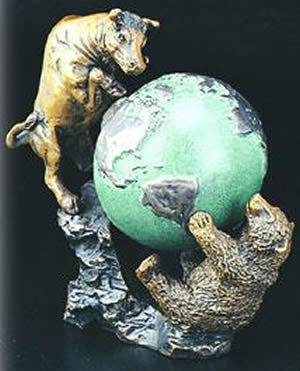

The 30th anniversary of the 1987 equity market crash the major US benchmarks at record highs. The drop in the market was at least partly a function of the lack of capacity, sufficient instruments, and regulatory regime. Each of these factors has been addressed to some extent. Circuit breakers have been introduced, and have evolved. The financial capacity has grown immensely.

Read More »

Read More »

Central Bank Chiefs and Currencies

Market opinion on the next Fed chief is very fluid. BOE Governor Carney sticks to view, but short-sterling curve flattens. New Bank of Italy Governor sought. A second term for Kuroda may be more likely after this weekend election.

Read More »

Read More »

NAFTA Worries Take Toll, Yellen’s Best Guess Supports Greenback

Risk that NAFTA collapses weighs on CAD and MXN. Yen is slightly firmer despite US yields edging higher and weekend polls suggesting LDP could nearly secure a 2/3 majority of its own. The sterling is consolidating after sharp moves at the end of last week.

Read More »

Read More »

FX Weekly Preview: The Markets and the Long Shadow of Politics

Rise in paper asset prices, including so-called cyber currencies, reflects the abundance of capital. Have we forgotten what Minski taught again? Political considerations may dominate ahead of the ECB meeting later this month.

Read More »

Read More »

Political Focus Shifting in Europe

There was a huge sigh of relief among investors when it became clear that the populist-nationalist wave that ostensibly led to Brexit and Trump's election was not going to sweep through Europe. The euro gapped higher on April 24, and it has not looked back. We have suggested that with the outcome of the German election, European politics shift from tailwind to headwind.

Read More »

Read More »

FX Daily, October 13: Sterling Extends Yesterday’s Recovery; US Data Awaited

The EU's leading negotiator whipsawed sterling yesterday. The net effect was to ease fears that the UK would leave the EU without the agreement Initial concerns that the negotiations had stalled sent sterling to nearly $1.3120. The willingness to discuss a two-year transition period spurred sterling's recovery. After trading on both sides of Wednesdays, it closed on its highs was a bullish technical signal and there has been follow-through buying...

Read More »

Read More »

Dollar Dropped like Hot Potato After Core CPI Disappointed

The dollar was bid before the US economic data. The market responded quickly upon seeing the disappointing 0.1% rise in core CPI. Given the base effect, the 0.1% increase kept the year-over-year rate at 1.7% for the fourth consecutive month. The dollar reversed lower.

Read More »

Read More »

FX Daily, October 12: Discipline Argues Against Consensus Narrative

Following the release of the FOMC minutes from last month's meeting, the consensus narrative that has emerged says that it was dovish because there is a growing worry the reason inflation fell is not simply due to transitory factors. This explains, according to the narrative the dollar's losses and the stock market rally.

Read More »

Read More »

FX Daily, October 11: Markets Looking for a New Focus

The US dollar is consolidating after retreating since reversing lower following the US jobs data at the end of last week. While the greenback has largely been confined to yesterday's ranges against the major currencies, the euro has made a marginal new high, briefly trading through the $1.1830 area noted yesterday.

Read More »

Read More »

FX Weekly Preview: Forces of Movement

Over the past few weeks, the markets have come to accept the likelihood of a December Fed hike. US interest rates have adjusted. The pricing of December Fed funds futures contract is consistent with around an 80% chance of a hike. The two-year yield is trading at the upper end of what is expected to be the Fed funds target range at the end of the year, after slipping below the current range a month ago. The Dollar Index formed a bottoming pattern.

Read More »

Read More »

FX Daily, October 04: Consolidative Tone in FX Continues

The US dollar has a softer tone today, and it was that way even for the European PMI. The greenback eased further after the upside momentum faded yesterday. The heavier tone in Asia seemed spurred by a hedge fund manager's call that Minneapolis Fed President, and among the most dovish members of the FOMC, Kashkari would be the next Fed chair.

Read More »

Read More »

FX Daily, October 02: Dollar Upbeat to Start Fourth Quarter

The US dollar is broadly higher as the quarter-end positioning losses seen at the end of last week area reversed. Developments in the US are seen as dollar positive, while the Catalonia-Madrid conflict, and slightly softer EMU manufacturing PMI weighs on the euro. The UK also reported a disappointing manufacturing PMI, and more differences with the Tory government are taking a toll on sterling. Japan's Tankan Survey was stronger than expected, but...

Read More »

Read More »

FX Weekly Preview: Changing Dynamics

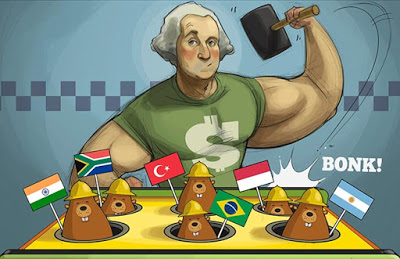

We agree with the consensus that the markets are in a transition phase. The consensus sees this transition phase as a new economic convergence. European and Japanese economic growth continues above trend. Large emerging markets, including BRICs, are also expanding. Central banks are gradually moving away from the extreme accommodation.

Read More »

Read More »

FX Daily, September 29: Dollar’s Gains Pared, but Set to Snap Six Month Losing Streak Against the Euro

Supported by a sharp rise in interest rates and ideas of tax reform, the US dollar is closing one of its best months of the year. The Dollar Index is snapping a six-month decline, and the euro's monthly advance since February is ending. This month, the US 10-year yield has risen 18 bp, and the two-year yield has risen 13 bp. It is the biggest increase since last November.

Read More »

Read More »

FX Daily, September 28: Greenback Consolidates while Yields Continue to March Higher

The US dollar is consolidating inside yesterday's ranges against the euro and yen while extending its gains against sterling and the dollar-bloc currencies. The sell-off in the US debt market continues to drag global yields higher. The 10-year Treasury yield reached 2.01% on September 8 and now, nearly three weeks later, is near 2.35%. It had finished last week at 2.25%.

Read More »

Read More »

FX Daily, September 27: Dollar Builds on Gains

The Federal Reserve may not be on a coordinated campaign to convince the markets of a pending rate hike as it did so effectively in late February and early March. But investors are getting the message. The Bloomberg calculation of the odds of a rate hike before the end of the year has risen to 70% from 53% before last week's FOMC meeting and 33.5% at the end of last month. The CME puts the odds at 81% up from 37% a month ago.

Read More »

Read More »

FX Daily, September 26: Weekend Election and North Korea Rhetoric Helps Greenback Remain Firm

The US dollar is firmer against most major currencies today. The implications the Jamaica coalition in Germany is understood to be less likely to support a new vision for Europe in the aftermath of Brexit and the Great Financial Crisis. The euro's low for the year was set at the very start near $1.0340. The first quarter or so was spent consolidating the gains in H2 16. It was trading below $1.06 in early April.

Read More »

Read More »

FX Weekly Preview: Old and New Drivers in the Week Ahead

Last week's developments will continue to shape the investment climate in the week ahead, and at the same time, new inflation readings from the US, EMU, and Japan will add incrementally to investors' information set.

Read More »

Read More »

FX Daily, September 20: Shrinkage and Beyond

After much anticipation, the FOMC decision day is here. Much of the focus is on the likely decision that the Fed will allow its balance sheet to shrink gradually. No other country who employed quantitative easing has is in a position to begin unwinding the emergency expansion of its balance sheet. The Fed's experience in QE, communication, and now unwinding, will be part of the information set other central banks can draw upon.

Read More »

Read More »

FX Daily, September 19: Quiet Tuesday, Follow the Leader

Politics seems to dominate the talking points today. Boris Johnson's weekend op-ed has been rejected by May, and there is talk that Johnson may resign or fired. Sterling is consolidating after pulling back yesterday. Carney said that if the UK does hike it will be gradual and limited. The markets did respond dramatically to the BOE minutes and suggestions by even some of the doves that rates may need to be lifted, but there is still a good reason...

Read More »

Read More »