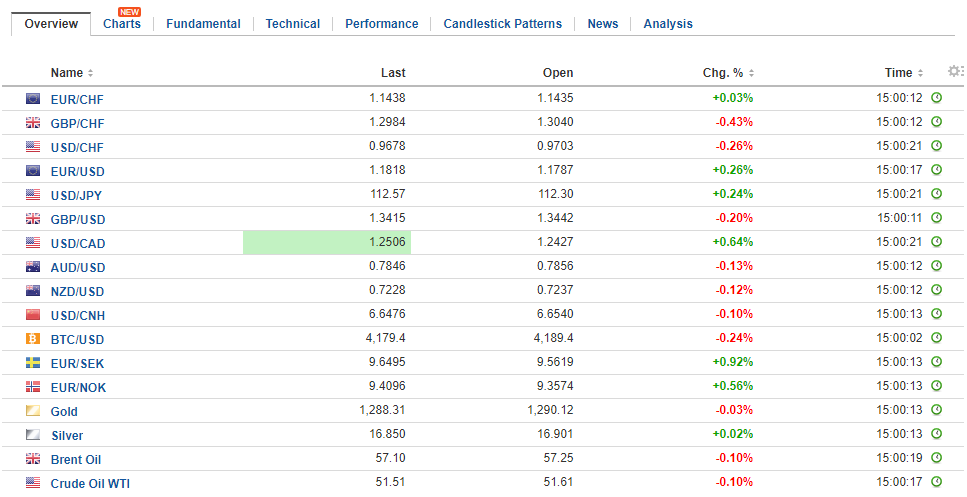

Swiss FrancThe Euro has risen by 0.17% to 1.1449 CHF. |

EUR/CHF and USD/CHF, September 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesSupported by a sharp rise in interest rates and ideas of tax reform, the US dollar is closing one of its best months of the year. The Dollar Index is snapping a six-month decline, and the euro’s monthly advance since February is ending. This month, the US 10-year yield has risen 18 bp, and the two-year yield has risen 13 bp. It is the biggest increase since last November. The implied yield on the December Fed funds futures contract rose five basis points this month to 1.25%. Bloomberg and the CME differ on its significance. At the end of August, their interpolations from the pricing of the futures contract were nearly the same. Bloomberg calculated the odds of a hike by the end of the year near 34%, and the CME was near 33%. Now Bloomberg sees the odds at 66%, and the CME is at 76%. Over the course of the month, the expectations of the next Fed chair have changed. At the end of August, according to PredictIt, Cohn was just ahead of Yellen at 23 cents to 22 cents (to win a dollar if the person was the next Fed chair). His odds have fallen now at 18 cents. He trails Yellen who stands at 32 cents now. She ha not been above 33 cents this month. Warsh who was in third place at the end of last month (at 15 cents), is now in first place at 35 cents, though off the recent peak of 48 cents. |

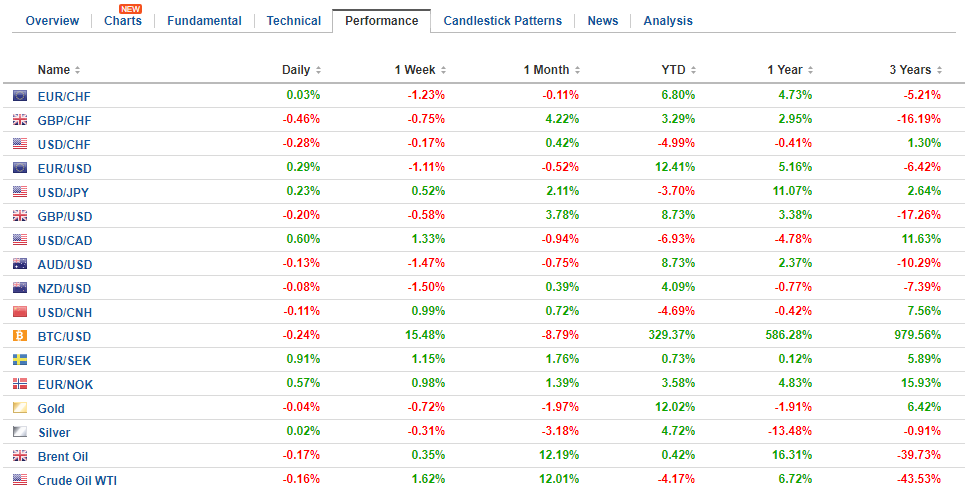

FX Daily Rates, September 29 |

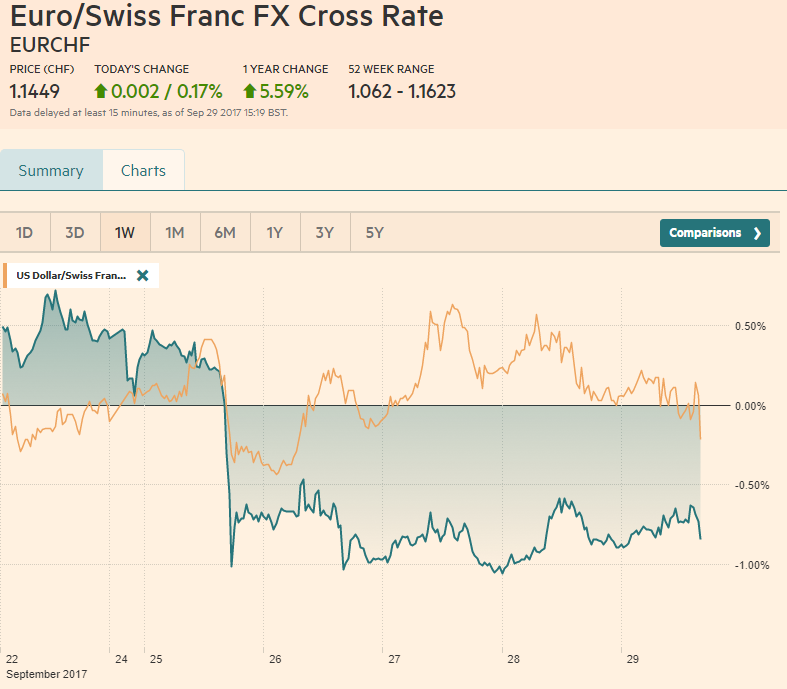

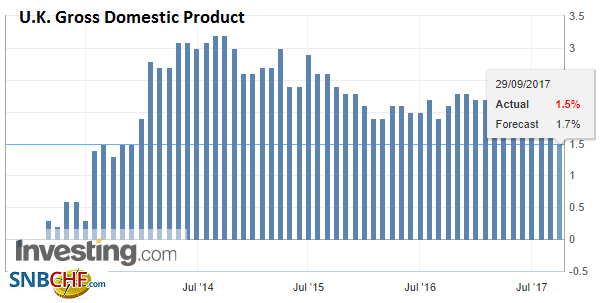

| The US dollar is consolidating against the euro and yen, while sterling and the Antipodean currencies are trading with a heavier bias. While the Australian and New Zealand dollar losses seem to be a function of the shifting interest rate considerations, sterling’s losses were extended by poor economic data, which included a larger than expected Q2 current account deficit (GBP23.2 bln) while the Q1 shortfall was revised sharply higher (GBP22.3 bln from GBP16.9 bln). And although Q2 GDP was unchanged at 0.3%, the year-over-year rate was shaved to 1.5% from 1.7%. Services in July contracted by 0.2% while the consensus expected a 0.1% gain.

Sterling, we have noted, is particularly sensitive to high frequency data because the Bank of England is thought to be as well. According to Bloomberg, the OIS curve is implying a high degree of confidence of a rate hike (77% chance for the November meeting and 81.5% chance of a hike before year-end). However, as has been the case in recent years (leaving aside last year), threats by Carney and the BOE to hike rates have diminished in the face of disappointing data. This time may not be different, and that makes sterling vulnerable. It is the strongest currency in the world this month, rising 3.8% against the US dollar, twice as strong as its closest rival, the Russian ruble, which is up 1.7% in September. The dollar was pushed back from the test on JPY113, but a near-term shelf has been created near JPY112.20. If US yields remain firm, the dollar can overcome JPY113 to rise toward JPY114.00-JPY114.50, which is where the greenback peaked in May and July. |

FX Performance, September 29 |

United KingdomNext week, the UK will report its three PMI. Each is expected to have recorded small declines. Such an outcome could lift short-sterling futures while weighing on sterling. Yesterday and today, sterling had returned to the range seen when the BOE’s hawkish statement was published on September 14. Watch the $1.3335 area, where the 20-day moving average is found. Sterling has not traded below this moving average since the start of the month. The $1.3350 area corresponds to the 61.8% retracement of those BOE-inspired gains. There are a little more than GBP800 mln of options struck at $1.3365-$1.3385 that expire today. |

U.K. Gross Domestic Product (GDP) YoY, Q2 2017(see more posts on U.K. Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

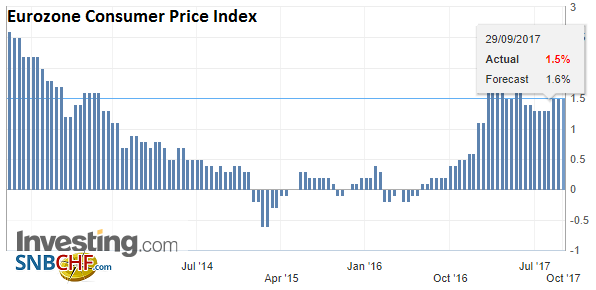

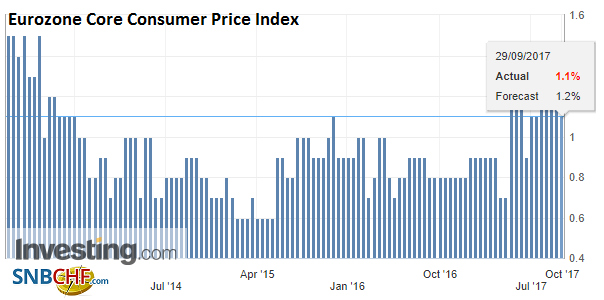

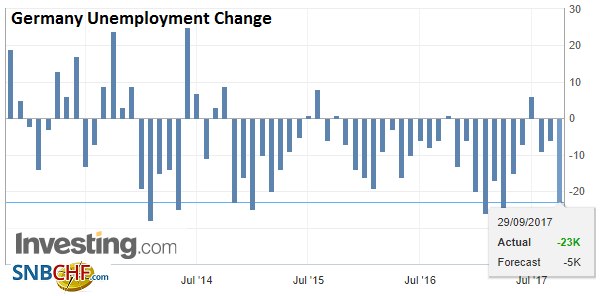

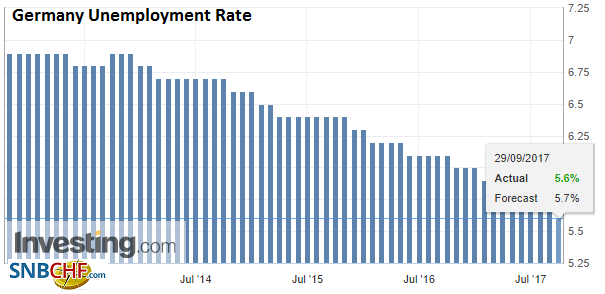

EurozoneSofter eurozone inflation seemed to cap the euro as it tried to recover through $1.18 after seeing at mid-week a little below $1.1720. The flash headline CPI was unchanged at 1.5%. The consensus had looked for a small increase. The core rate, which had been expected to be unchanged at 1.2%, slipped to 1.1%. The underlying message from the recent string of data, including German unemployment data reported today (new post-unification low unemployment rate and record employment) underscore that growth in the region is robust, but price pressures remain unsatisfactory to the ECB.

|

Eurozone Consumer Price Index (CPI) YoY, Sep 2017(see more posts on Eurozone Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| Although many are still talking convergence, we are less sanguine. Yes, growth has converged, but monetary policy has not. In fact, we argue peak divergence is still ahead. The divergence is on the respective balance sheets. The Fed’s will shrink in Q4 by a modest $30 bln. The ECB’s will expand by 180 bln euros. The Fed will likely raise rates, while the ECB’s first hike is probably more than a year away.

We would peg resistance in the euro in the $1.1830 area, and initial support now near $1.1760. There are two option strikes that may be in play today. One is stuck at $1.18 for 682 mln euros. The other is struck at $1.1750 for 593 mln euros. |

Eurozone Core Consumer Price Index (CPI) YoY, Sep 2017(see more posts on Eurozone Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

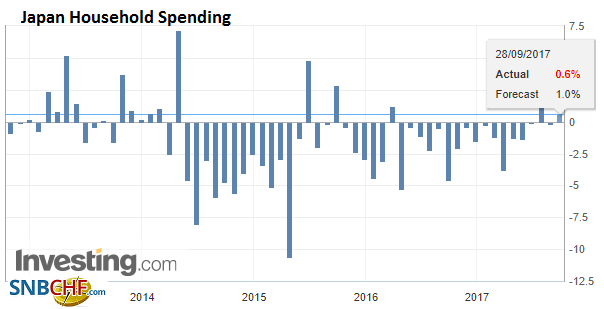

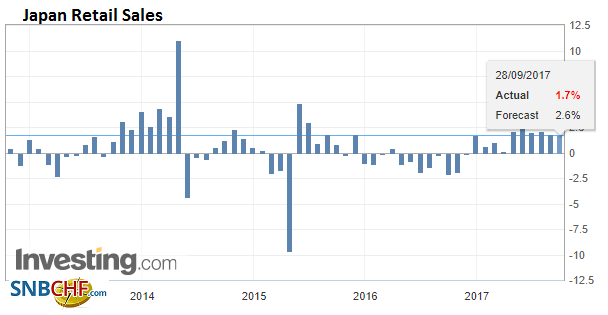

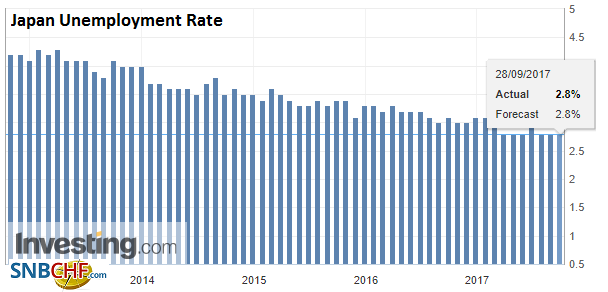

JapanJapan reported stronger than expected overall household spending, industrial production, and inflation measures. The data did not do the yen much good, as there does not appear to be any policy implication, and the underlying driver, US yields are steady to firm.

|

Japan Household Spending YoY, Aug 2017(see more posts on Japan Household Spending, ) Source: Investing.com - Click to enlarge |

| Although Japanese retail sales disappointed (1.7% year-over-year vs. Reuters survey median of 2.6% and a downward revision to the July series to 1.8% from 1.9%), but the overall household spending rose to 0.6% in August from -0.2% in July. Industrial output, helped by robust exports and firm domestic demand, rose 2.1% month-over-month in August. The Bloomberg consensus was for a 1.8% gain after a 0.8% decline in July. |

Japan Retail Sales YoY, Aug 2017(see more posts on Japan Retail Sales, ) Source: Investing.com - Click to enlarge |

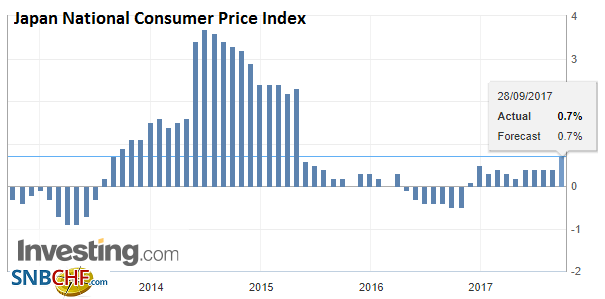

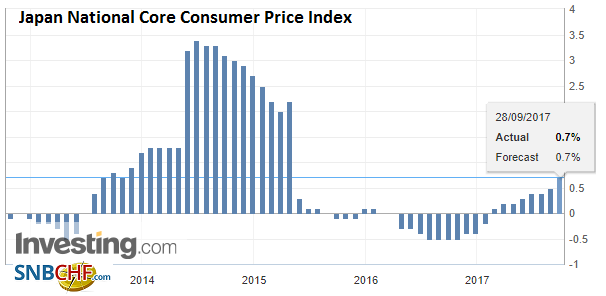

| The most important data point was CPI. The headline rate rose to 0.7% from 0.4%. It is the highest in two years. The core rate, which excludes fresh food, also rose to 0.7%. The median expectation was for a rise to 0.5% form 0.4%. Core inflation was flattered by a 5.2% rise in utilities (fuel, electricity, and water) and a 1.8% rise in medical prices. |

Japan National Consumer Price Index (CPI) YoY, Aug 2017(see more posts on Japan National Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| However, the underlying signal is not quite as constructive. Consider that excluding fresh food and fuel, consumer prices are up 0.2% year-over-year, up from 0.1% in July. Separately, note that the Tankan Survey will be released first thing Monday in Tokyo and a small increase in sentiment is expected. |

Japan National Core Consumer Price Index (CPI) YoY, Aug 2017(see more posts on Japan National Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

Japan Unemployment Rate, Aug 2017(see more posts on Japan Unemployment Rate, ) Source: Investing.com - Click to enlarge |

|

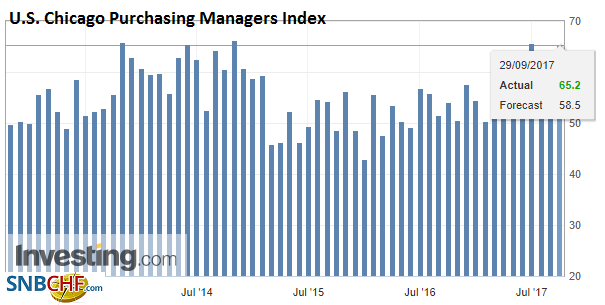

United StatesYesterday the US reported a smaller than expected merchandise trade deficit and a larger build of wholesale and retail inventories. All of which are supportive of Q3 growth. Although Q2 GDP revisions edged higher, consumption was unchanged at a strong 3.3% annualized pace. Consumption in Q3 appears to have moderated a bit, and today’s PCE report is expected to be soft. However, the focus is more on the core deflator of those expenditures. A 0.2% rise in August would be the largest since January. We suspect this would be more important than the fact that due to the base effect, the year-over-year pace would be unchanged at 1.4%.

|

U.S. Chicago Purchasing Managers Index (PMI), Sep 2017(see more posts on U.S. Chicago PMI, ) Source: Investing.com - Click to enlarge |

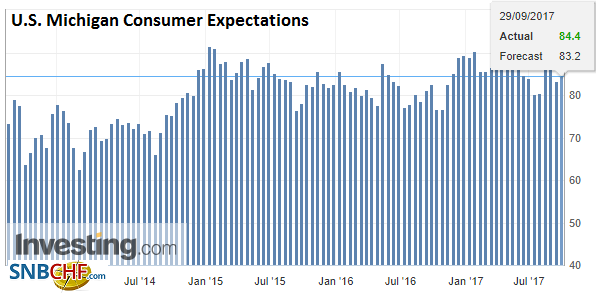

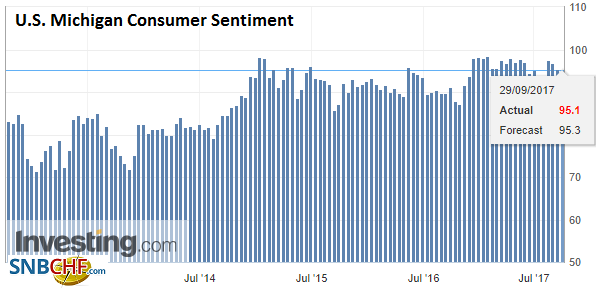

| Separately, but related, the University of Michigan’s long-term (5-10 year) inflation expectation stood at 2.6%, matching the year’s high in the preliminary report. |

U.S. Michigan Consumer Expectations, Oct 2017(see more posts on U.S. Michigan Consumer Expectations, ) Source: Investing.com - Click to enlarge |

| Confirming it or beating it could weigh on US Treasuries, and through that help the dollar. Note that the 10-year breakeven is near 1.88%, which is the upper end of where it has been in four months. |

U.S. Michigan Consumer Sentiment, Oct 2017(see more posts on U.S. Michigan Consumer Sentiment, ) Source: Investing.com - Click to enlarge |

Germany |

Germany Unemployment Change, Sep 2017(see more posts on Germany Unemployment Change, ) Source: Investing.com - Click to enlarge |

Germany Unemployment Rate, Sep 2017(see more posts on Germany Unemployment Rate, ) Source: Investing.com - Click to enlarge |

|

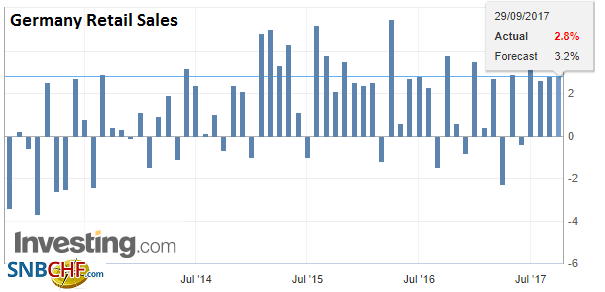

Germany Retail Sales YoY, Aug 2017(see more posts on Germany Retail Sales, ) Source: Investing.com - Click to enlarge |

|

Italy |

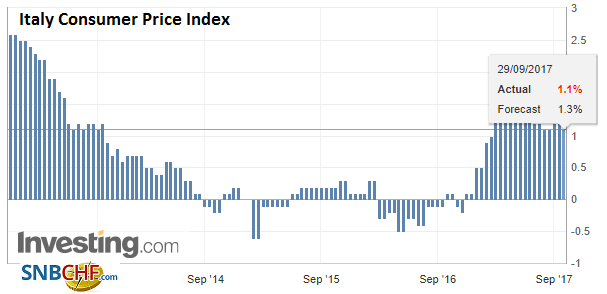

Italy Consumer Price Index (CPI) YoY, Sep 2017(see more posts on Italy Consumer Price Index, ) Source: Investing.com - Click to enlarge |

Canada reports July GDP figures. A small 0.1% rise is expected after a 0.3% gain in June. The implied yield of the December BA futures slipped seven basis points this week as the Bank of Canada continued its campaign to lean against speculation that it would hike rates next month at the third consecutive meeting, for which we have been skeptical. The US dollar recovers to its best level since the end of August near CAD1.25, around which it is consolidating.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$CAD,$EUR,$JPY,$TLT,EUR/CHF,Eurozone Consumer Price Index,Eurozone Core Consumer Price Index,Germany Retail Sales,Germany Unemployment Change,Germany Unemployment Rate,Italy Consumer Price Index,Japan Household Spending,Japan National Consumer Price Index,Japan National Core Consumer Price Index,Japan Retail Sales,Japan Unemployment Rate,newslettersent,U.K. Gross Domestic Product,U.S. Chicago PMI,U.S. Michigan Consumer Expectations,U.S. Michigan Consumer Sentiment,USD/CHF