Summary:

Risk that NAFTA collapses weighs on CAD and MXN.

Yen is slightly firmer despite US yields edging higher and weekend polls suggesting LDP could nearly secure a 2/3 majority of its own.

The sterling is consolidating after sharp moves at the end of last week.

(Greetings from San Francisco, where I will be speaking at a CFA seminar on currencies tomorrow. The rebuilding from destruction of the of hurricanes in Texas and the Southeast US has already begun and the distortion to US high frequency data is seen nearly every day. Some data, like auto sales and retail sales were lifted, and others like non-farm payrolls were depressed. Several fires continues to burn in northern California. At least 5700 structures are estimated to have been destroyed and over 217k acres have been affected. The economic and human toll continues to rise).

In a relatively quiet week for economic data, except for the UK, we suggested that politics may trump economics. Today, the Canadian dollar is the weakest of the major currencies, losing about 0.5%, while the Mexican peso is the poorest performer among emerging market currencies, losing closer to 1%. The move began last week. Over the past five sessions, the Mexican peso is the weakest currency in the world, losing 2.2% against the US dollar. The Canadian dollar is up 0.1% over the past five sessions that make it the worst of the major currencies.

The key consideration is NAFTA negotiations. Recall that US President Trump initially threatened to withdraw but was persuaded to negotiate a reformed deal. He preference for bilateral agreements over multilateral agreements seemed an issue of principle.

There are two ways to read the US demands. The first is from the perspective of “The Art of the Deal” where strong demands are made to forces a favorable compromise. The second is that making unreasonably onerous demands may force a collapse of the agreement that the US President has called among the worst in history. The domestic content proposal and the sunset provisions, as well as other positions, do not seem acceptable to Mexico and Canada at this juncture. The US Chamber of Commerce has come out critical of the White House position.

Earlier in the negotiations, it seemed like Canada was willing to sacrifice Mexico if needed to preserve a bilateral free-trade agreement with the US. However, some disputes have arisen or intensified, including lumber, dairy, steel, and airplanes, in the US-Canada trade relationship. The Trump Administration is also continuing to threaten to allow the government to shut down in December unless Congress authorizes funding for the controversial wall with Mexico. A collapse of NAFTA would see trade relations revert to WTO rules. Canada and Mexico officials have indicated that they are keen on a bilateral free-trade agreement.

In any event, the US dollar had fallen against the Canadian dollar from May (almost CAD1.38) to September (nearly CAD1.2020) amid a weaker greenback, and on the signal and delivery of two Bank of Canada rate hikes. As it became clearer that the Bank of Canada was largely interested in taking back the two cuts in 2015, and was not intending an aggressive tightening cycle, and the US dollar recovered more broadly as a December Fed hike seemed more likely, greenback recovered. Bank of Canada Governor Poloz appears to recognize the risks posed by NAFTA negotiations, and this seems to reinforce the cautious stance on monetary policy.

From early September through early October, the US dollar rose 4.7% against the Canadian dollar. It backed off a little last week but began climbing on the NAFTA developments in the second half of last week. The recent high near CAD1.26 is the immediate target, but beyond that is the CAD1.2725 area, which the 38.2% retracement of the decline since May and the $1.2780 area, the high from August.

Often the Canadian dollar is seen as a petro-currency. For major diversified economies, we typically put more weight on the movement of capital than the price of leading exports. That said, we note that the correlation between the (percent) change in oil prices and the percent change in the Canadian dollar over the past 60 days is the weakest in three years (-0.15). In the current environment, political considerations (NAFTA) are dominating. The correlation between the changes in the Canadian dollar and the two-year interest rate differential was a robust 0.7 over the summer now stands at less than 0.1.

After selling off sharply in the last past of 2016 amid aggressive rhetoric by the candidate and then President Trump, the Mexican peso staged a dramatic recovery in H1 17. It was the strongest currency in the world, backed rate hikes by the central bank. The US dollar peaked over MXN22.00 in January and fell to MXN17.45 by mid-July. It traded in its trough until late September. The dollar has soared as the NAFTA threat mounted. Also, populism-nationalism in the US may be favoring left populist-nationalist forces in the run-up to Mexico’s election next year. The MXN19.20 area corresponds to a 38.2% retracement of the dollar’s decline. The Q2 peak was a bit higher (MXN19.25-MXN19.30).

| There are other political developments, but the market impact seems considerably less than disruption by the increased fear of NAFTA’s demise. First, one cannot tell by the performance of Austrian stock or bond markets today that the weekend election reflects a shift to the right. Partly this is understandable as the shift to the right had taken place previously, and the election affirmed what was already known. On the other hand, the populist-nationalist Freedom Party came in a close third rather than a second place as it had appeared likely.

Second, Spanish bonds rallied alongside other EMU sovereign bonds today, as yields fell four basis points. However, the stock market fell 0.8%, to remain among the worst performers in Europe on the day and month. Puigdemont continues to claim the legitimacy of the recent referendum, but for the first time specified the “grace period” to be two months. This was not sufficient for Madrid. Unless there is a further climbdown by Puidgedemont in the next couple of days, Rajoy seems poised to begin the action to suspend Catalonia’s regional authority. This is a significant step, and not been tested. The Catalonia’s plenary session planned for later this week was suspended, but the implications are not clear. Third, sterling was whipsawed last week by Brexit comments by the EU’s chief negotiator. Today, amid news that Prime Minister May is unexpectedly flying to Brussels to discuss the issues ahead of the EU summit later this week has elicited practically no response from investors. The UK seems to be arguing that May’s offer of some funds for the divorce settlement should be sufficient to get the negotiations to the next stage, which is supposed to be about the new relationship rather than the amputation itself. The EU is not sufficient. |

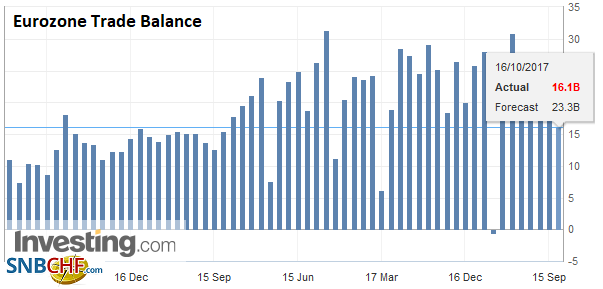

Eurozone Trade Balance, Aug 2017(see more posts on Eurozone Trade Balance, ) Source: Investing.com - Click to enlarge |

After losing her gamble of a snap election in June, May’s positions are vulnerable. If there is no guarantee that the talks will move forward in December, May might not be in a position to make more concessions, even if she were willing. One of the considerations that may have prevented a leadership challenge last month was that it could derail Brexit negotiations. Without evidence of progress in said negotiations, there may be less to lose on switching party leaders.

Sterling tested the 50% retracement objective of its slide from the year’s high on September 20 (~$1.3660) to the low recorded after the US employment data on October 6 (~$1.3025) last week (~$1.3340). This level must be overcome to signal a move toward $1.3415 and possibly back to the highs. BOE Governor Carney, speaking at the IMF meeting, continued to say that a rate hike may be needed in the coming months. Carney testifies before Parliament’s Treasury Committee tomorrow for the first time the June election.

The market has interpreted Carney’s comments to mean a hike next month (~82% according to Bloomberg’s interpolation of the OIS curve). We are less convinced, but recognize the important of this week’s data, which includes the CPI tomorrow, employment on Wednesday, and retail sales on Thursday.

Germany’s Lower Saxony went to the polls yesterday and delivered the SPD a victory over Merkel’s CDU. The CDU received the lowest support (34.5%) in modern times. However, it costs Merkel little in the Bundesrat as the state was previously governed by an SPD-Green coalition. The Green’s saw their support slip to 8.6%, which means that the old coalition will not suffice. A coalition between the SPD and CDU may be the most manageable, even though on the national level it has faltered. The AfD got a little less than 6% of the vote, less than half what they received nationally, but enough to get them in the local parliament. The FDP received 7.2% of the vote.

The dollar slipped to a new three-week low against the yen. This is despite the tick up in the US 10-year yield, which has tended to support the greenback, and the latest polls ahead of this weekend’s national elections. A poll found that the LDP could win between 281 and 303 seats of the 465 seats that will be decided. This suggests that the LDP itself could nearly win a super majority (2/3) on its own (307 seats). On the other hand, the poll found that nearly half of the surveyed (47%) when Abe to step down after the election.

For the fourth session, the dollar has recorded a lower high against the yen. It appears to be tracking the five-day moving average lower. It is found near JPY112.15 today. It has not closed above this moving average since October 5. We have been looking for a test of the last September lows near JPY111.60, but recognize that the 38.2% retracement of the dollar’s rally from JPY107.30 on September 8 is found closer to JPY111.10.

ChinaChina reported inflation figures over the weekend. Producer prices rose at their fastest clip in six months (6.9%), led by mining and extraction (17.2%) and raw materials (11.9%). In September alone, producer prices rose 1.0% after a 0.9% increase in August. |

China Producer Price Index (PPI) YoY, Sep 2017(see more posts on China Producer Price Index, ) Source: Investing.com - Click to enlarge |

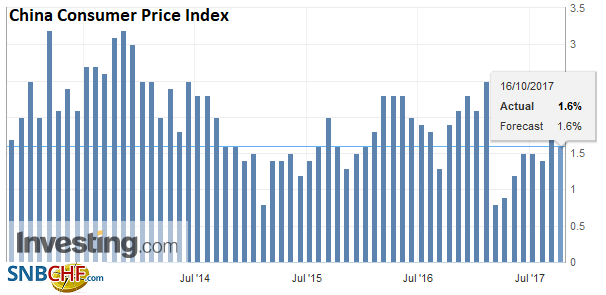

| On the other hand, consumer price inflation slowed to 1.6% from 1.8%, which was a seven-month peak. Lower food prices -1.4%), especially meats, appeared to be the main driver. Core inflation, excluding food and energy, stands at 2.3%, the highest in three years. |

China Consumer Price Index (CPI) YoY, Sep 2017(see more posts on China Consumer Price Index, ) Source: Investing.com - Click to enlarge |

The 19th Communist Party Congress starts in the middle of the week. The focus is on President Xi and his influence in filling key seats on the central committee. The government will report Q3 GDP on Thursday. The PBOC governor indicated over the weekend that growth in H2 17 would likely surpass the 6.9% pace seen in H1.

Fed Chair Yellen will speak at the end of the week on monetary policy since the financial crisis. Her comments over the weekend further underscore her intent to hike rates again at the December meeting. Amid the uncertainty over the significance of the drop in inflation earlier this year, Yellen said her “best guess” was that measured inflation would soon accelerate, and in any event, the US economy appears on solid footing.

The July FOMC minutes had seemed to emphasize that elevated asset prices, but in subsequent remarks, Yellen seems to play this down. She said that risks to financial stability are moderate. By talking about the strength of the economy while inflation undershoots, she appears to be backing into it again. While the December 2017, Fed funds futures have ticked lower (higher yield), today, the more significant development is in the deferred contracts, which have sold off more than the front-end.

The implied yield on the December 2018 Fed funds contract has risen three basis points today and is poised to record its lowest close in six months today (~1.65%). Separately, but related, the US two-year premium over Germany is at 2.25% today, which is the widest since 1999. The 10-year premium is widening, and near 1.92% today is at the upper end of where has been here in H2.

We identified a band of support for the euro between $1.1750 and $1.1775. Today’s low near $1.1780 approached the support zone without entering it. We see resistance now in the $1.1820-$1.1835 area.

Full story here Are you the author? Previous post See more for Next postTags: #USD,$CAD,$EUR,$JPY,$TLT,China Consumer Price Index,China Producer Price Index,Eurozone Trade Balance,MXN,NAFTA,newslettersent,Politics