Tag Archive: SPY

FX Weekly Review May 30 to June 3: Dollar’s Rally Ends with a Bang

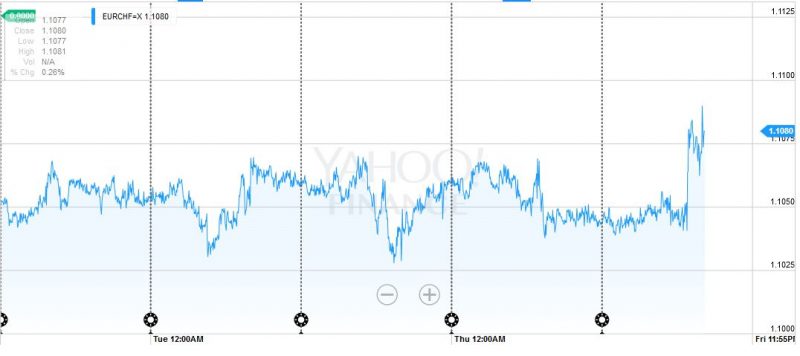

The dollar peaked on May 30, but it was not clear until the poor US jobs report sent the greenback reeling on June 3. The EUR/CHF surprisingly increased, despite weak US data. No wonder, speculators had to cover their short EUR positions.

Read More »

Read More »

FX Review May23 to May28: Dollar Set to Snap Three-Month Decline

Many linked sterling's outperformance (+0.8%) to a growing sense that the UK will vote to remain in the EU, despite angst reflected in the elevated cost of insurance (one-month options). The Canadian dollar (+0.7%) was helped by oil's flirtation wit...

Read More »

Read More »

Daily FX, May 20: Divergence Reasserted, Extends Greenback’s Recovery

The combination of stronger US economic data and signals from the Federal Reserve that it is looking to continue the normalization process helped the dollar extended its recovery. The dollar posted a significant technical reversal against many of the major currencies on May 3. The Dollar Index rose for its third week, as the greenback climbed …

Read More »

Read More »

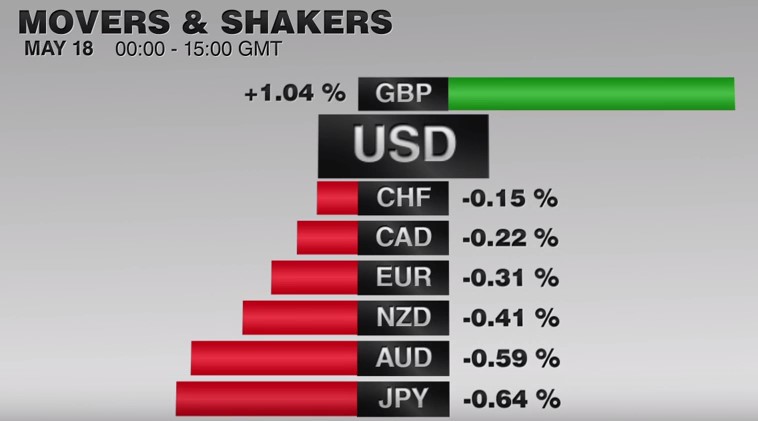

FX Daily, May 18: Greenback Recovers as Rate Support is Enhanced

Apart from GBP, the US dollar is rising against all the major currencies today. The Australian dollar is retracing a sufficient part of its recent gains to suggest that the current phase of the US dollar’s recovery is not over. Given that the Aussie topped out a week before the other major currencies, it is reasonable …

Read More »

Read More »

Dollar’s Technical Tone Improves, but No Breakout (Yet)

The US dollar continued the recovery begun May 3 and rose against most of the major currencies over the past week. A nearly 3.5% rally in oil prices, the fifth weekly gain in the past six weeks (a $9.5 advance over the period), helped the Norwegian krone turn in a steady performance. The Canadian dollar’s 0.2% … Continue...

Read More »

Read More »

Key Dollar Developments Include Bottoming against the Dollar-Bloc

The US dollar rose against all the major currencies last week. The importance of the price action does not lie with the magnitude or the breadth of the advance. Instead, the two takeaway technical observations are 1) the seemingly one-way market for euro and yen ended and 2) the dollar-bloc currencies appear to have put … Continue reading...

Read More »

Read More »

Will the Dollar Bloom like May Flowers after April Showers?

April was a cruel month for the US dollar. It fell against all the major currencies; even those whose central banks have negative yields. The greenback also fell against nearly all the emerging market currencies, but the Philippine peso and the Polish zloty. Through the first four months of the year, the dollar is lower …

Read More »

Read More »

FX Daily April 20: Bulls’ Charge Stalls, while Greenback Consolidates Losses

The US dollar has been largely confined to yesterday’s ranges against the major currencies. China’s yuan slipped lower for the first time in four sessions, while the Shanghai Composite fell 2.3%, the most since the end of February. While a few equity markets in Asia managed to follow suit after US equity market gains carried …

Read More »

Read More »

FX Weekly: The Dollar’s Technical Condition Remains Vulnerable

The US dollar turned in a mixed performance last week, which given the softer than expected inflation, retail sales data, and industrial output figures, coupled with the poor technical backdrop, could be a signal that its decline in recent months has run its course. The dollar-bloc continued its advance, led by the Australian dollar’s nearly …

Read More »

Read More »

FX Daily: Little Technical Evidence that Greenback’s Slump is Over

Although there is no convincing technical evidence that dollar's retreat in Q1 is over, we suspect it is nearly complete. We will be especially sensitive to reversal patterns, divergences with technical indicators, and other signs that the move is exhausted. The fundamental economic driver of our medium term constructive outlook for the US dollar, the …

Read More »

Read More »

FX Review Week March 21- March 25

The US dollar rose against all the major and most emerging market currencies last week. After selling off following the ECB and FOMC meetings, the dollar found better traction. It was helped by widening interest rate differentials. Regional Fed manufacturing surveys for March suggest the quarter is ending on a firm note. With new orders rising, …

Read More »

Read More »