Continued by Marc Chandler:

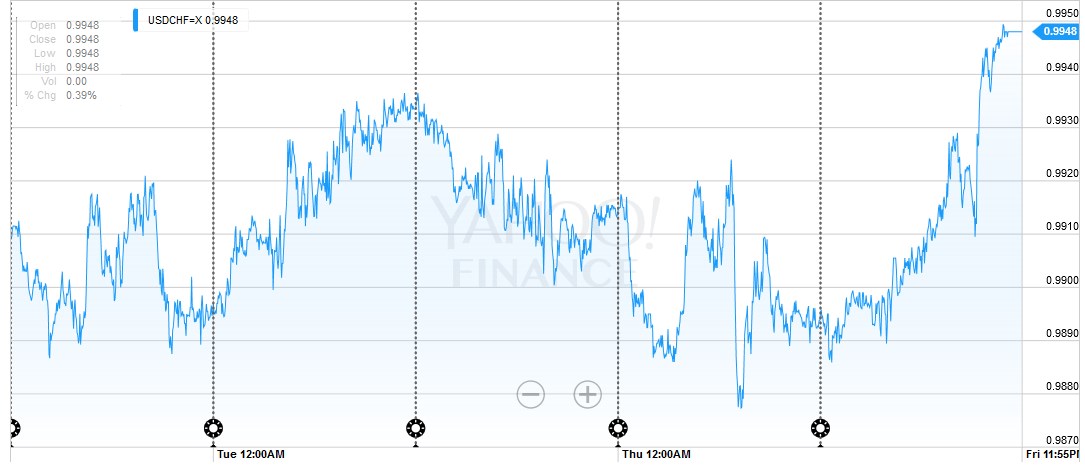

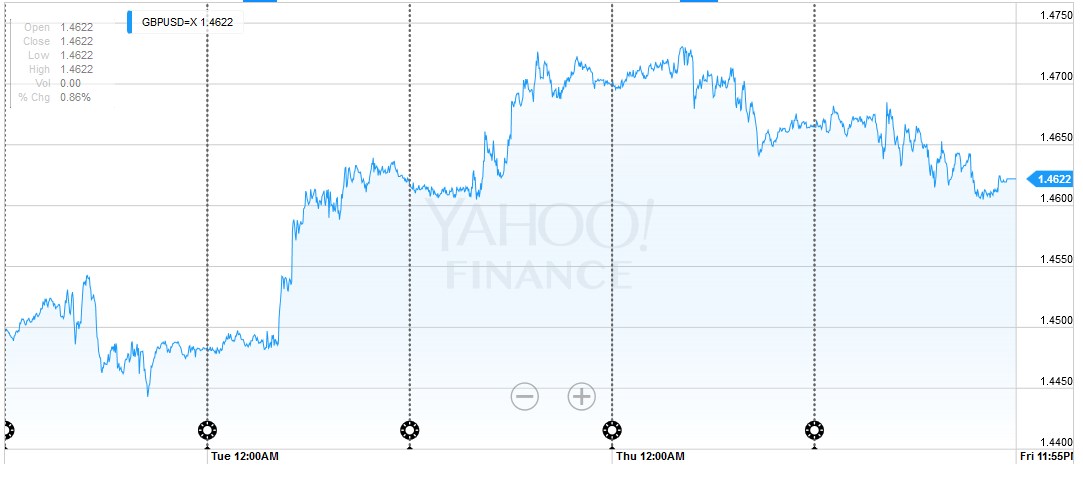

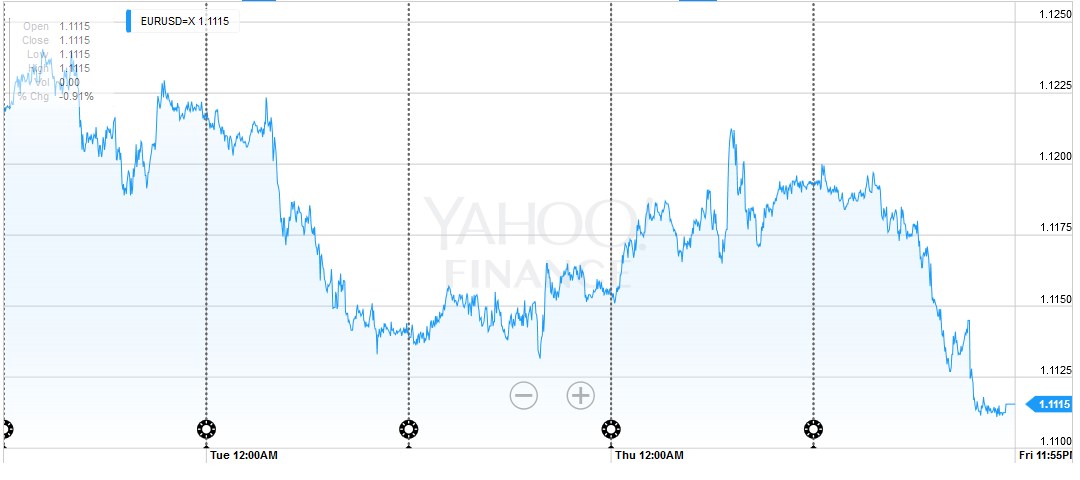

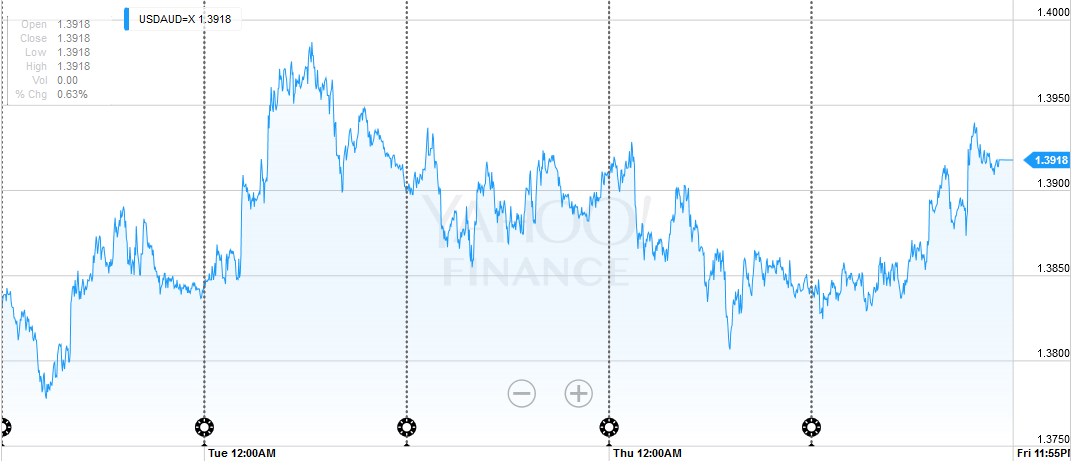

The US dollar was mostly firmer over the past week. There were two exceptions among the major currencies: Sterling and the Canadian dollar.

The firmer US dollar has not derailed the recovery in oil prices. The July contract flirted with the $50 barrel level but the market could not sustain the initial thrust. The pullback was shallow. Supply disruptions (and the drawdown in US inventories) appear to be the fundamental catalyst. OPEC is unlikely to reach an output freeze agreement. The RSI and MACDs suggest the market is stretched, but have yet to turn down. We will be on the lookout for a reversal pattern after the strong run-up.

Originally Posted by Marc Chandler on Marc to Markets, Charts and CHF data added by George Dorgan and the snbchf team

Tags: Japanese yen,newslettersent,SPY,usd-jpy