Tag Archive: silver price

A Dire Warning, Report 29 July 2018

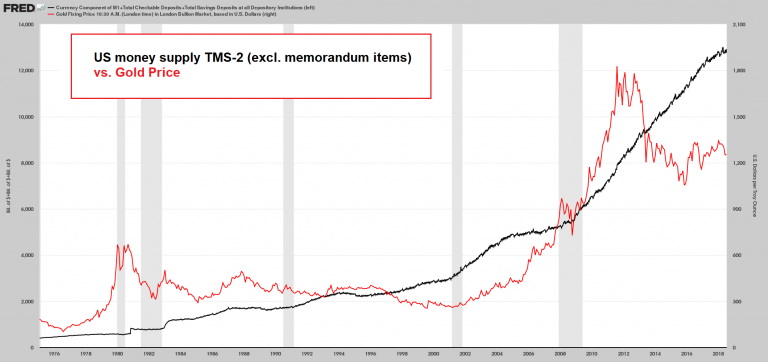

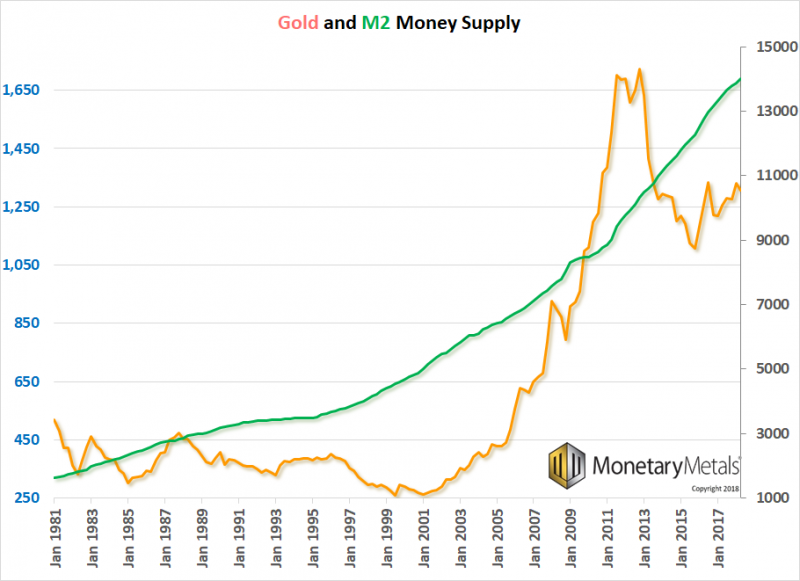

Let’s return to our ongoing series on the destruction of capital, and how to identify the signs. Steve Saville posted a thoughtful article this week entitled The “Productivity of Debt” Myth. His article provides a good opportunity to add some additional thoughts. We have written quite a lot on this topic. Indeed, we have a landing page for marginal productivity of debt (MPoD) with four articles so far.

Read More »

Read More »

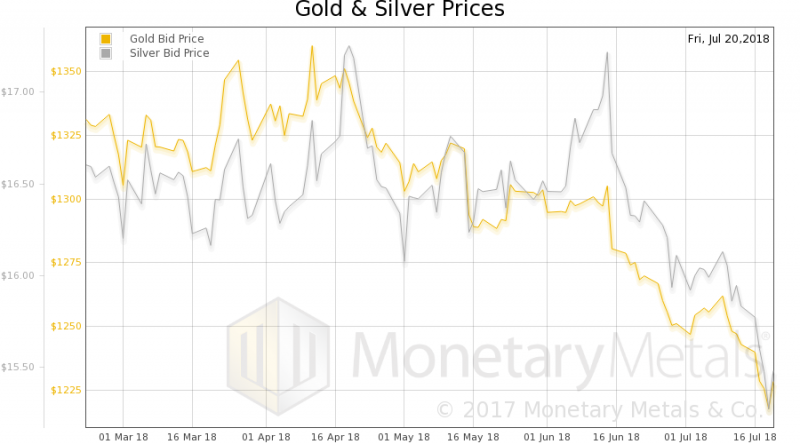

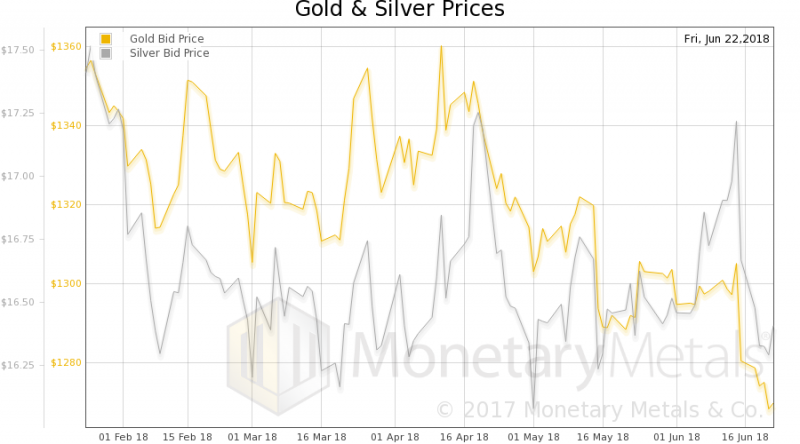

Crying Wolf, Report 22 July 2018

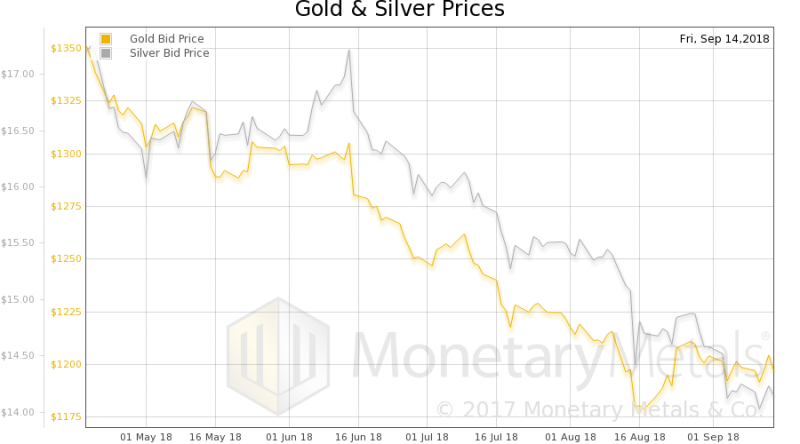

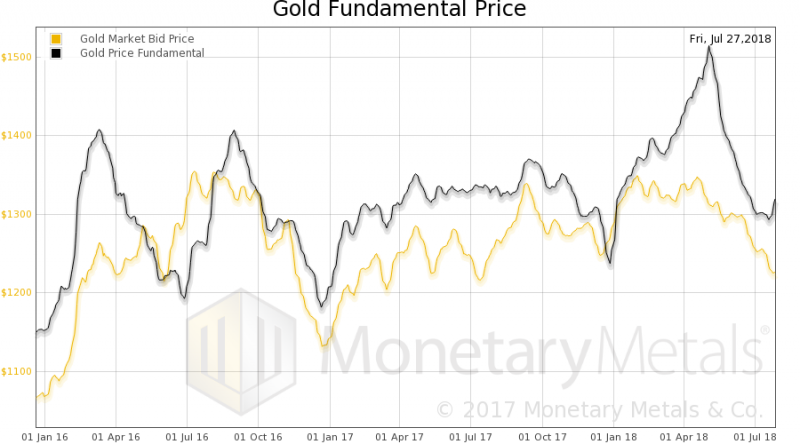

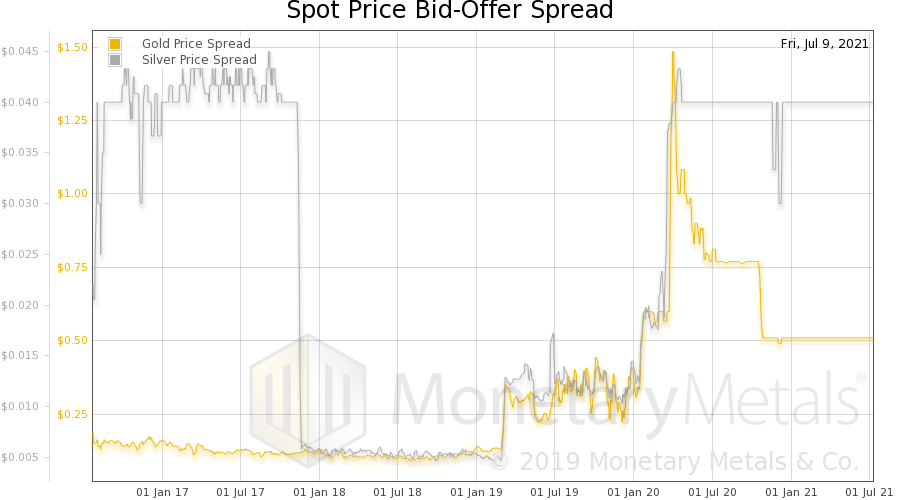

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

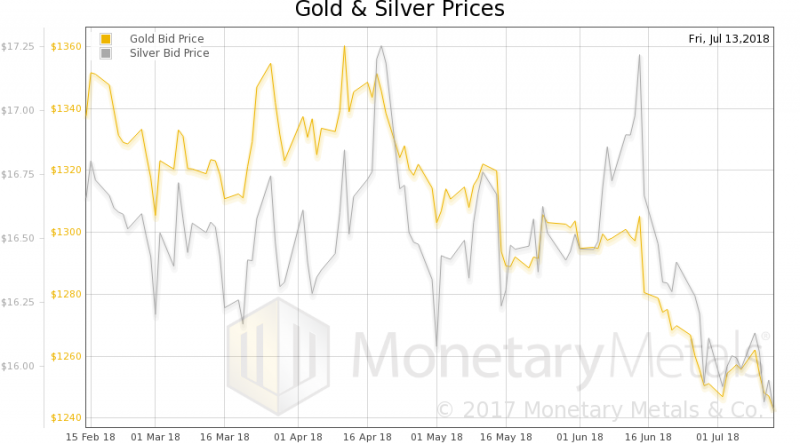

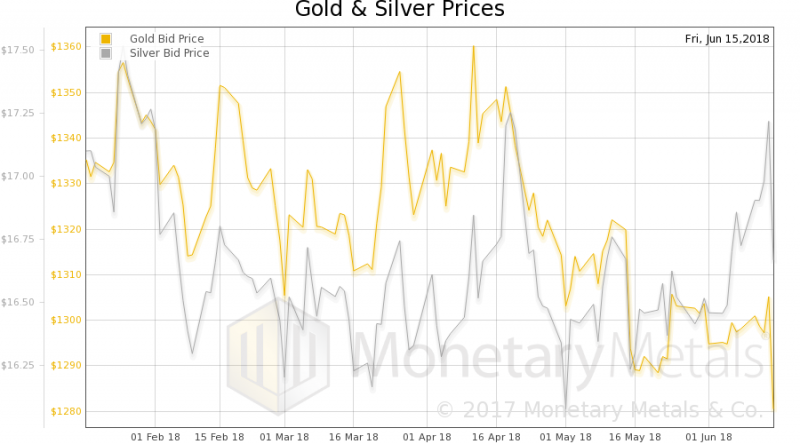

The Great Gold Upgrade, Report 15 July 2018

In part I the Great Reset, we said that a reset is a terrible thing. The closest example is the fall of Rome in 476AD, in which more than 90% of the population of the city fled or died. No one should wish for this to happen, but we are unfortunate to live under a failing monetary system. Debt is growing exponentially. A way must be found to transition to the use of gold. We covered a few ways that won’t work.

Read More »

Read More »

The Great Reset, Report 8 July 2018

Before it collapsed, the city of Rome had a population greater than 1,000,000 people. That was an extraordinary accomplishment in the ancient world, made possible by many innovative technologies and the organization of the greatest civilization that the world had ever seen. Such an incredible urban population depended on capital accumulated over centuries. But the Roman Empire squandered this capital, until it was no longer sufficient to sustain...

Read More »

Read More »

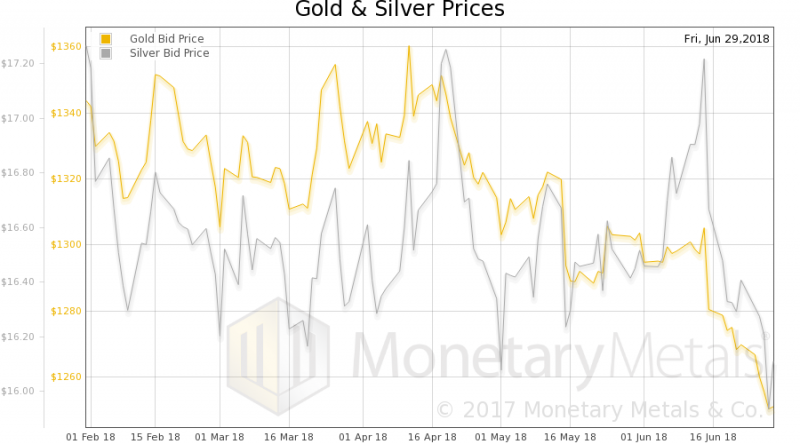

The Wealth Effect, Report 24 Jun 2018

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »