See the introduction and the video for the terms gold basis, co-basis, backwardation and contango.

Before it collapsed, the city of Rome had a population greater than 1,000,000 people. That was an extraordinary accomplishment in the ancient world, made possible by many innovative technologies and the organization of the greatest civilization that the world had ever seen. Such an incredible urban population depended on capital accumulated over centuries. But the Roman Empire squandered this capital, until it was no longer sufficient to sustain the city (we are aware the story is more complicated than this).

After the collapse, the population fell to about 8,000 people. Some fled and arrived at safe places, but surely most perished.

Monetary Reset

This is what we think of when we hear someone say, “There will be a reset”.

A reset is not a good thing. No one should look forward to it, and you certainly cannot profit from it. Not even from owning gold. Sure, those who don’t own gold may be worse off than those who do, but no one does well in a catastrophe like that.

Keith saw a museum exhibit, displaying gold hoards dating from the time of the fall of Rome. It had been the gold of several very wealthy men (each hoard had hundreds or thousands of ounces of gold!) Yet it did not avail them. Those people either fled or died, and their gold was lost for 1,500 years. And rediscovered by workers who were excavating foundations for big buildings in the late 20th century.

The monetary system is indeed headed towards this reset. We shouldn’t just wait passively for it, we should change course if possible. It is possible, but first, let’s look at what we can’t do.

Price Fixing Scheme

We can’t fix the right gold price. When you hear this proposed, don’t you get the picture of a central planner, a gnome with his tables and magic formulas? Lobbyists would line up in the greatest battle of special interest groups that Washington has ever seen. And a counterintuitive one, at that. We assume that most gold bugs are not debtors, and have savings (i.e. they are creditors). A low gold price benefits creditors. And a high price benefits debtors.

For example, suppose someone owes you $100,000. If the gold price is $1,000, he would need to give you 100 ounces. But if you owed that same amount, then a price of $100,000 lets you pay off your debt by handing over one gold Eagle.

Of course in any market, buyers always want a low price, and sellers always want a high price. There is no conflict of interest, unless the government fixes the price. Which is the essence of this approach.

That’s one fatal flaw. Another is that there is no way to set the price of gold. Look at all the banana republics which have tried to fix the exchange rate of their currency to the dollar. In the end, this scheme always fails. The problem is that Banco de Banana has to take the other side of the trade. So when market participants sell the baneso, Banco has to buy banesos and sell dollars. Since Banco only has so many dollars, it is overrun sooner or later.

The Swiss National Bank tried to fix the price of the franc in the other direction—they wanted to keep it down against the euro. Everyone believed they could do it, because obviously they couldn’t run out of francs when they have the power to print to infinity and beyond. Except it’s not printing, it’s borrowing. The SNB was borrowing francs to buy euro denominated assets. The market was pushing up the franc which is the liability of the SNB, and pushing down the euro which is the asset of the SNB. They could only take so much increase in their liability and so much decrease in their asset, before crying “uncle!” Keith wrote about this at the time, at Forbes.

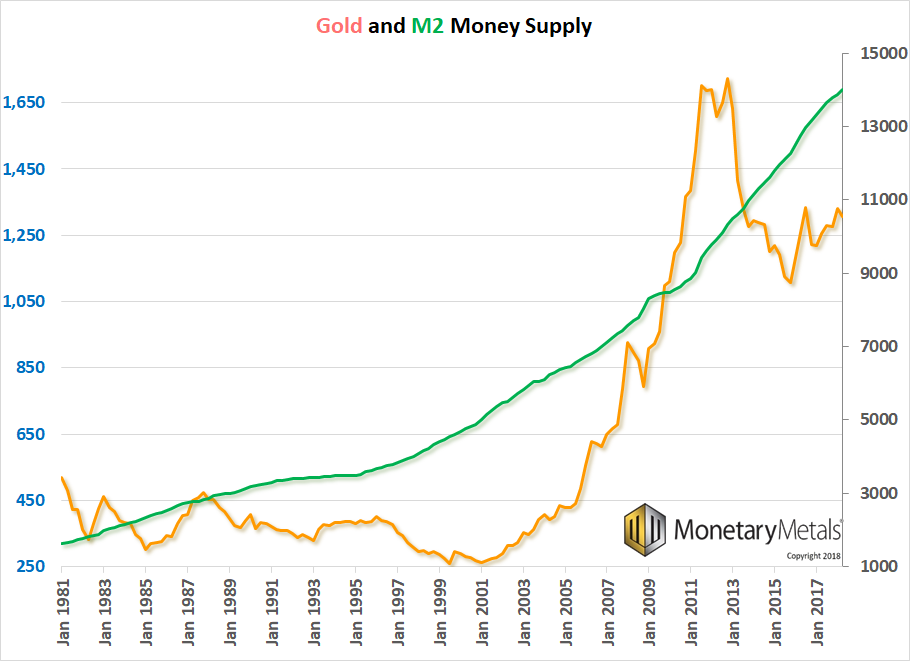

Money Supply TargetingAdvocates of a gold standard based on a fixed price of gold don’t usually propose buying and selling gold in order to maintain the peg. Instead, they say the Fed should print dollars if the price of gold drops below the target and unprint (our word, not theirs) dollars if the price of gold goes too high. There’s just one problem. Can you spot it, in this graph? Money supply has an almost perfect record of increasing, with the barest of downward blips during the worst crisis in nearly a century. At the same time, the price of gold is up and down. Suppose the Fed were trying to get the price of gold up to $1050 from 1996 through 2008. It was increasing the quantity of dollars at a good clip. But from 1997 through 2001, the price of gold was going down. What was the Fed supposed to do, borrow more dollars into existence even faster? Then the price of gold begins to rise, accelerating after 2005. By 2011, it overshoots by almost 100%. What should the Fed have done at that point? Pull mass quantities of dollars out of the economy from 2009 through 2013? Would any Fed Chairman have the guts to do that, given what was going on in the economy at the time? Would any president allow such a Chairman to remain in office? Would the people keep their pitchforks unsharpened, their torches unlit if so? At best, the connection between quantity of dollars and the price of gold is tenuous, and it isn’t realistic to think that the Fed could ever really reduce the quantity of dollars under any circumstances, much less do it in a crisis. |

Gold and M2 Money Supply 1981-2017 |

Gold Backed Currency

Another approach to the gold standard is to declare gold backing. Like many political slogans, this term is vague and ambiguous. What does backing mean, exactly? What could it possibly mean? We can think of two meanings. One is, “trust us, we have gold in the vault corresponding to X% of the dollars in circulation.” Uh, thanks guys, but our cup of trust is a little drained right now.

This is not a mechanism anyways. This leads us to choice two. Backing could mean, “we will buy gold below $X and sell gold above $X.” OK, that is at least a mechanism. And it would work—until the central bank runs out of gold. Just ask Banco de Banana about running out of dollars. And it would run out of gold when the market gets serious about buying gold. Which it will do, because the quality of the dollar keeps falling, regardless of its quantity.

Unlike during the classical gold standard, today the dollar is a completely different animal from gold. It is not a gold-redeemable promise—it is an irredeemable promise. There is no way to retroactively tie it to gold. That train left the station in 1971.

High Gold Price

One popular idea is that gold will begin to circulate as a medium of exchange, once the price gets high enough. The attraction of this idea is not so much economic theory, as relishing the thought that everyone will need gold when the dollar fails. Those who were foresighted enough to lay in a stock of gold will sell it to the masses. And thereby get very rich. One question arises, which is what does price mean when the dollar is going to zero?

This could never work. The collapse of our currency will be a calamity in the best case, even if it’s not 476AD. Those with capital will not be eager to consume it, by spending on consumer goods. Nor will they be buying businesses or real estate. Collapse will be a time of widespread defaults and bankruptcies. In a collapse, the gold will remain hidden. A rising price, much less a collapse, is not a mechanism to make gold begin circulating in the market.

Interest is the only force that can pull gold out of private hoards and into circulation. We have said many times, that interest is the regulator of flow in the gold standard. A lower rate will tend to push gold out of the market and into hoards. A higher rate will tend to draw it into the market.

This is the end of part I. We will include part II in next week’s Report.

Supply and Demand Fundamentals

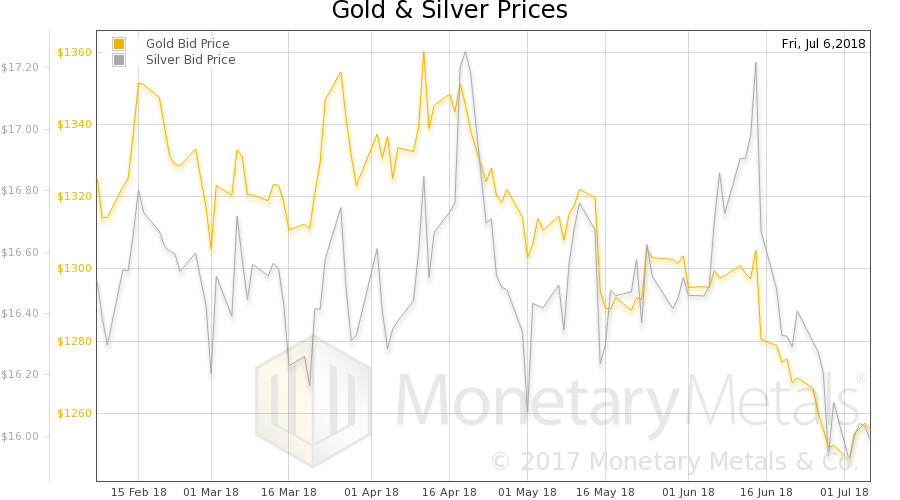

The price of gold rose two bucks this week, though the price of silver fell 10 cents.

We have seen several analyses recently predicting big price drops, in one case by at least $500 in gold by the end of the year. Is this what capitulation looks like? It’s said they don’t ring a bell at the top, but they don’t ring a bell at the bottom either.

We have also seen technical analysis arguing that silver is about to break out and that gold is bouncing off its support (which is said to be $1,250).

What could drive the prices of the metals higher? Whenever we ask this question, we mean durably. Of course, speculators in the futures markets could begin to buy long positions with leverage. But then what? Such buying inevitably turns to selling, unless there is real buying of the metal.

Right now, so far as we can see, there’s weak demand for retail coins and bars. The Indian rupee has been falling all year. The average Indian is about 7% less able to buy gold than he was at the end of December. The Russian ruble peaked at the end of January, and is now down 11.65. The Chinese yuan is down about 6% since its peak in early February.

And the reason for these big currency moves is simple. All around the world, governments and corporations have previously borrowed US dollars. Their revenues are in their local currencies. This mismatch creates a risk. It’s great when everyone from currency traders to yield-starved fund managers are borrowing dollars, to sell them short and buy other currencies. Then the local currency, which is their asset, is rising against the dollar which is their liability.

Eventually, the tide turns. It becomes a bit harder to generate local currency revenue. Perhaps because the world seems to be headed towards a repeat of the tariff policies that exacerbated the last great depression. Perhaps because it’s time for the cycle to turn. Perhaps because QE has become QT. It could even be that market participants lower their estimate of the quality of the debt backing these currencies.

Whatever the reason, market selling begins pushing these currencies down. This compounds the problems of dollar-debtors around the world. This makes their local currency bonds even less attractive, and hence their local currency too. What was a lot of fun on the way up, turns into a lot of pain on the way down.

Add to this the fact that interest rates in the dollar have risen. The cost of funding such “carry trades” is much higher, and the attractiveness of other higher-rate currencies is less compared to the dollar, than it was a few years ago.

This, by the way, is what it means that the dollar is the world’s reserve currency. The reserve currency is not whatever oil is priced in—oil is priced in dollars because it’s the reserve. It is that the dollar is an asset on every major balance sheet in the world. The other currencies are dollar-derivatives. It is appropriate to describe their motion up and down with reference to the dollar from which they derive.

We are painting a picture of credit stress. The first phase of such stress is a general impoverishment, reduction in profits, wages, and savings. This is not an environment for accumulating gold or silver. The question is will the second phase come, a.k.a. fear. This is when investors (those who are still solvent) rush to trade some of their paper for metal. When they don’t like the risk of the counterparties who issue that paper.

We are not embedded in the culture in India or Russia or China. We can speak only to America, and right now, there is a general optimism that GDP is doing great, the stock market is going great, employment is doing great, and even policies that harm the economy like tariffs are great. This won’t last, as these purported signs of greatness show accelerated capital consumption (along with the rise in debt levels). Not even counting the impact of tariffs which has not been felt yet.

So what would the reason be for someone to stack more gold and silver today? We don’t refer to someone who owns no metal (we always advise people to own some, and not worry about price for their first purchase). We mean someone who owns a few tubes of gold Eagles and a few monster boxes of silver. What is the reason for adding more?

Is it the greed to get rich when the price will suddenly skyrocket, that no more metal will be for sale soon? Seriously, after all this time, and all these gold-to-$50,000-stories not to mention deadlines for monetary doomsday (according to that sales squeeze page we’ve been mentioning, the one that had been urging action before July 1… the end of the world has now been rescheduled for December 31).

Is it the fear that the banks are failing? We see no backwardation in gold or silver. Nor any reports of major US banks about to fail. It’s a different story in Europe, and that will make Europeans want to sell their euros to buy dollars and deposit them in US banks. Gold will always be the distant second to the dollar in such trades.

We do see something that could precipitate a sustained buying trend and drive the price higher. The issuance of a gold bond by an AA-rated government: Nevada. If you live in this state, please call your legislators and tell them you support this historic measure.

Keith is going to be at the Sprott Natural Resources Symposium next week in Vancouver. Please contact us if you want to meet. Sprott gave us a discount code for $100 off registration: MDA2018.

Gold and Silver PricesSo whither the price of gold next? We will provide a picture of the changing gold and silver fundamentals. But first, here is the chart of the prices of gold and silver. |

Gold and Silver Prices(see more posts on gold price, silver price, ) |

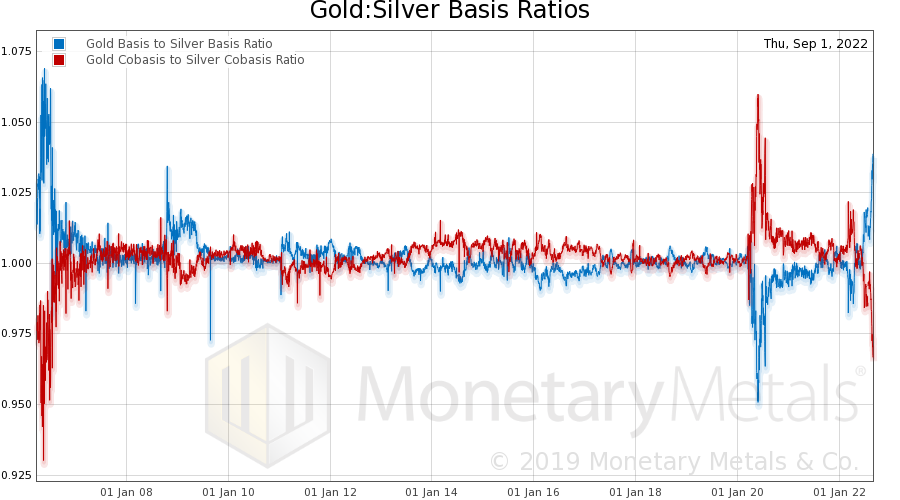

Gold: Silver RatioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). It went up this week. |

Gold: Silver Ratio(see more posts on gold silver ratio, ) |

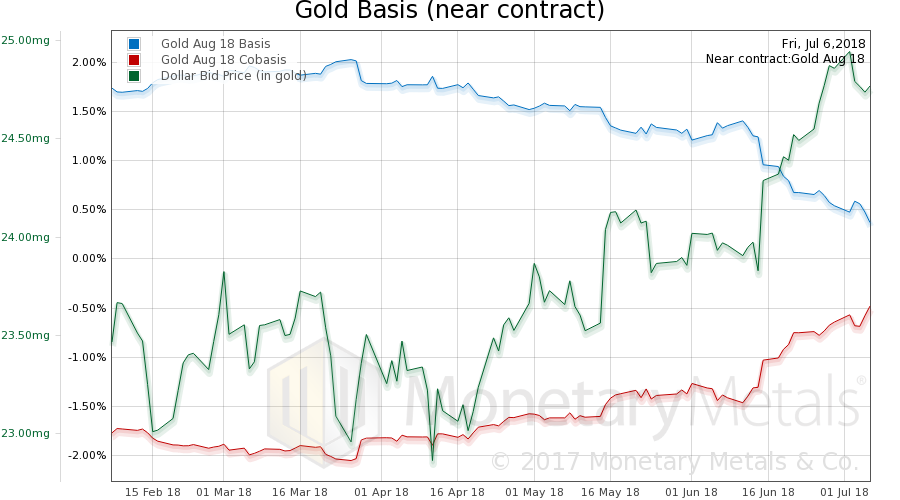

Gold Basis and Co-basis and Dollar PriceHere is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price. Look at that scarcity (i.e. cobasis) rising. However, this week the price did not fall. The Monetary Metals Gold Fundamental Price went up $2 this week to $1,300. |

Gold Basis and Co-basis and Dollar Price(see more posts on dollar price, gold basis, Gold co-basis, ) |

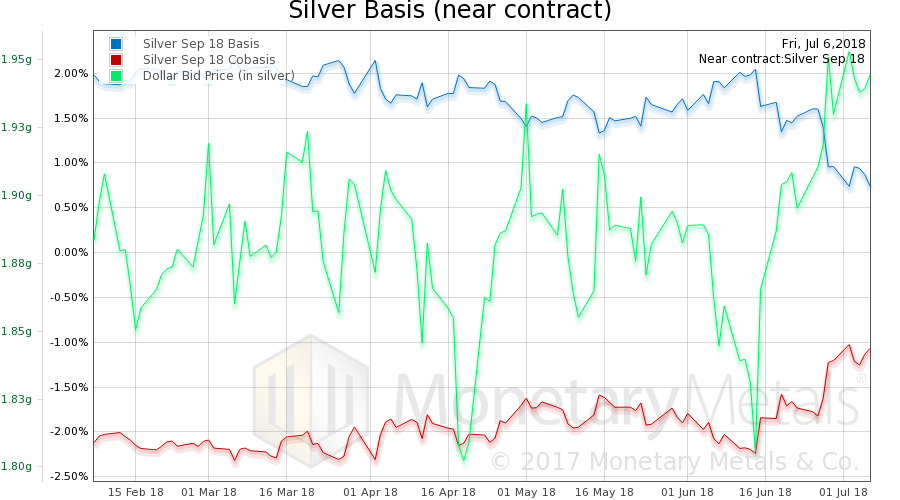

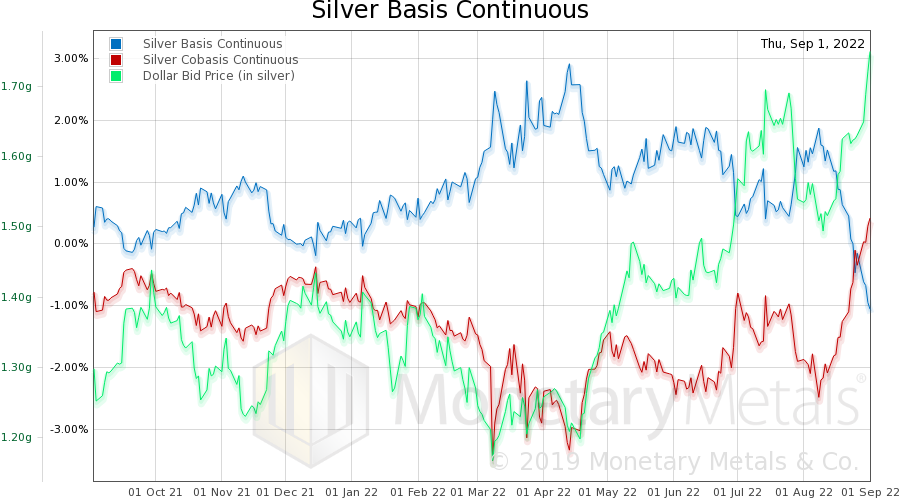

Silver Basis and Co-basis and the Dollar PriceNow let’s look at silver. The same thing in silver, rising cobasis, though against a drop in price. |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

The Monetary Metals Silver Fundamental Price fell 2 cents, to $17.44.

© 2018 Monetary Metals

Full story here Are you the author? Previous post See more for Next postTags: Basic Reports,dollar price,gold basis,gold bond,Gold co-basis,gold price,gold silver ratio,gold standard,Money Supply,newslettersent,silver basis,Silver co-basis,silver price