Home › 6a) Gold & Monetary Metals › 6a.) GoldCore › Why we couldn’t be happier that gold is boring

Permanent link to this article: https://snbchf.com/2022/08/flood-why-happier-gold/

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

US Dollar rallies on Wednesday with US yields surging higher

9 hours ago -

USD/CHF depreciates to near 0.8650, downside risk seems restrained due to higher US yields

2 days ago -

USD/CHF Price Forecast: Corrects to near 0.8630 despite upbeat US Dollar

2 days ago -

USD/CHF Price Prediction: Consolidates within short-term uptrend

7 days ago -

USD/CHF trades around 0.8630, recovers recent losses due to less-dovish Fed

8 days ago

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: decreased by 4.2 billion francs compared to the previous week

9 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Washington! We Have (a $35 Trillion) Problem!

Washington! We Have (a $35 Trillion) Problem! -

KAMALA HARRIS TERMINA DE HUNDIRSE EN UNA ENTREVISTA CON FOX NEWS

KAMALA HARRIS TERMINA DE HUNDIRSE EN UNA ENTREVISTA CON FOX NEWS -

Bank of Canada rate decision ahead. What technical levels are in play for the USDCAD?

Bank of Canada rate decision ahead. What technical levels are in play for the USDCAD? -

Kickstart the FX trading day for Oct 23 w/a technical look at the EURUSD, USDJPY & GBPUSD

Kickstart the FX trading day for Oct 23 w/a technical look at the EURUSD, USDJPY & GBPUSD -

US Dollar rallies on Wednesday with US yields surging higher

US Dollar rallies on Wednesday with US yields surging higher -

Continued Backing Up of US Rates Extend the Greenback’s Gains

Continued Backing Up of US Rates Extend the Greenback’s Gains -

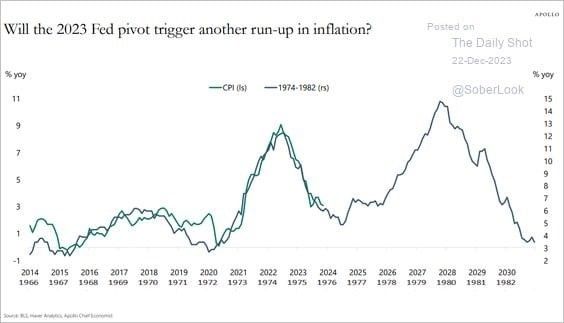

Memory Inflation Warps Bond Yields

Memory Inflation Warps Bond Yields -

Mit Waffen schafft man keinen Frieden! – Interview von Bismarck / Günther

Mit Waffen schafft man keinen Frieden! – Interview von Bismarck / Günther -

Ab 2025: Angriff auf Anleger die auswandern wollen!

Ab 2025: Angriff auf Anleger die auswandern wollen! -

USDJPY Technical Analysis – Higher Treasury yields revive the carry trade

USDJPY Technical Analysis – Higher Treasury yields revive the carry trade

More from this category

US Dollar rallies on Wednesday with US yields surging higher

US Dollar rallies on Wednesday with US yields surging higher23 Oct 2024

Continued Backing Up of US Rates Extend the Greenback’s Gains

Continued Backing Up of US Rates Extend the Greenback’s Gains23 Oct 2024

Memory Inflation Warps Bond Yields

Memory Inflation Warps Bond Yields23 Oct 2024

IMF lowers Switzerland’s 2025 growth forecast

IMF lowers Switzerland’s 2025 growth forecast23 Oct 2024

- It’s Good to be Skeptical of Elections

23 Oct 2024

- Americans Trust Trump on Economy, but “Experts” Don’t?

22 Oct 2024

- The Secret Economic Theory Behind the $100,000 Birkin Bag

22 Oct 2024

Russophobia, Historically Considered

Russophobia, Historically Considered22 Oct 2024

- Copernicus Was Also Right in Economics

22 Oct 2024

Greenback Consolidates

Greenback Consolidates22 Oct 2024

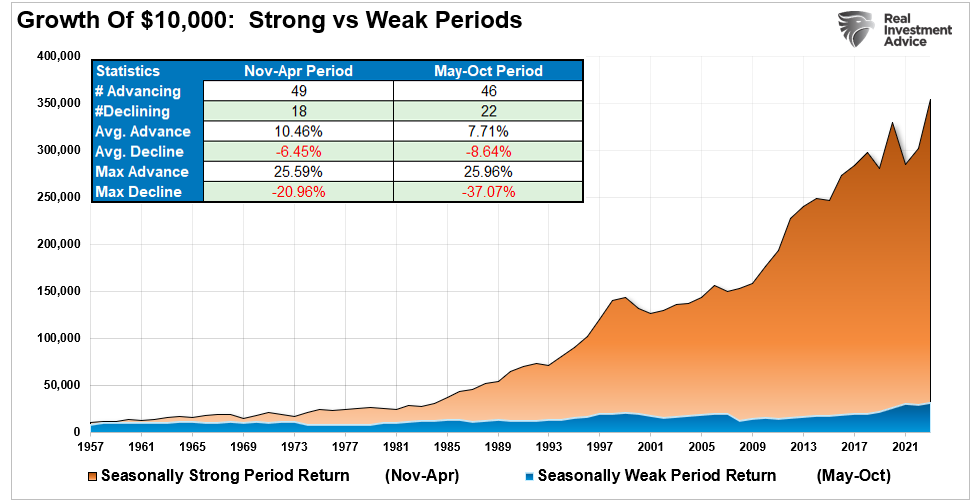

Seasonality: Buy Signal And Investing Outcomes

Seasonality: Buy Signal And Investing Outcomes22 Oct 2024

- Why The Israel-Occupied Levant Must Be Liberated

22 Oct 2024

- USD/CHF depreciates to near 0.8650, downside risk seems restrained due to higher US yields

22 Oct 2024

- Peace as a Prerequisite for Civilization

22 Oct 2024

Global rankings: where Switzerland gets good marks – and where it could do better

Global rankings: where Switzerland gets good marks – and where it could do better21 Oct 2024

Swiss steel workers hold demonstration to save their plant

Swiss steel workers hold demonstration to save their plant21 Oct 2024

Switzerland keeps its four three-star Michelin restaurants

Switzerland keeps its four three-star Michelin restaurants21 Oct 2024

USD/CHF Price Forecast: Corrects to near 0.8630 despite upbeat US Dollar

USD/CHF Price Forecast: Corrects to near 0.8630 despite upbeat US Dollar21 Oct 2024

- Why the Money Supply Is Growing Again

21 Oct 2024

SWISS extends cancellation of Tel Aviv flights

SWISS extends cancellation of Tel Aviv flights21 Oct 2024

Why we couldn’t be happier that gold is boring

Published on August 23, 2022

Stephen Flood

My articles My videosMy books

Follow on:

But then what? There aren’t any major price moves, it’s not like you see any huge crashes or major leaps to keep you on your toes, not like with crypto.

But, as you’ll read below, boring really is the best way to be. Well, when it comes to investments that is.

Gold V/S Crypto

The gold price is hovering around US$1,800 per ounce, where it has averaged since the beginning of 2021.

Your feelings about the gold price likely are similar to ours: gold has been boring compared to stocks and crypto.

Since the beginning of last year the gold price, with the exception of a rise of around 14% when Russia invaded Ukraine (note that the safe-haven demand due to the invasion which resulted in this rise was in contrast to the decline in cryptocurrencies and equity markets), has oscillated around 5% of the average just over US$1800.

.

Equity markets have had swings in the middle; more swing than physical metals but less swing than Bitcoin, oscillating around 20% from their respective averages since 2021 began.

The above shows the store of value of gold and gold’s low volatility. Both qualities help to stabilize an investment portfolio in times of turmoil.

Therefore, no matter how “boring” gold has been in recent months – the alternatives have had worse performances.

Adding to the store of value is the fact that counterparty risk is avoided by holding physical metals. This factor has gained importance versus paper contracts and versus investing in cryptocurrencies of late.

.

Versus paper contracts:

This is a follow-up to our July 14 post titled Gold traders on trial: Only buy physical where we discussed the trial of former JP Morgan traders for manipulating trades.

Last week the traders were convicted on charges of fraud, spoofing, and market manipulation of markets for more than a decade.

The oversized position of JP Morgan in the futures market gave the traders the power to move prices and manipulate the worldwide price.

The criminal case against the former JP Morgan traders is only one example of many scams and manipulation of markets.

And this example shows manipulation in regulated markets, while the scams in cryptocurrency markets are even more blatant and expensive.

Versus investing in cryptos

The second point is growing cryptocurrency scams. One of these scams is called a digital ‘rug pull’.

According to cryptowallet.com: A rug pull is a term used in the crypto community to refer to cryptocurrency projects that turned out to be exit scams.

A rug pull is said to have occurred if the developers of a crypto project abscond with investors’ money.

There are several types of digital rug pull in the crypto space, which include a form of Ponzi scheme where the project manager convinces investors to buy specific crypto and then flees with the funds.

There are also cases where the head of a crypto exchange claims the exchange has been hacked and then takes off with the assets in the exchange wallets. The prevalence of ‘rug pulls’ is growing and there have been digital ‘rug pulls’ every month so far in 2022.

Chainalysis reports the total loss to scam victims was over $7.7 billion worldwide in 2021. The chart below from chainalysis.com shows the estimated total value of scams from 2017-2021.

Total Yearly Cryptocurrency value received by scammers, 2017-2021 ChartIt is important to recall that emotions and exciting movements can cause trouble for investors.

Therefore boring is beautiful … investors hold onto boring investments far longer than the next new creation, which could turn out to be a scam or decline significantly after a ‘bubble’ run-up in price.

The store of value of gold has been demonstrated repeatedly. Long-term investments give better results because they are easier to buy and hold…which makes boring investments into better investments.

All of this reinforces our belief in physical metals and that is why Goldcore stays true to the physical metals.

Next week we will be interviewing Jim Rogers on GoldCore TV. Recently Jim issued some stark warnings about cryptos and security.

For Jim, right now is a great time to own precious metals, and he recommends we all buy silver. Make sure you are subscribed to GoldCore TV so you don’t miss it!

If you can’t wait for Jim’s interview then why not head to GoldCore TV now for a new offering, a dinner party with Jim Rickards, Marc Faber and David Morgan. If you’ve ever wondered what Marc Faber’s biggest investment regret is, or maybe what books Jim Rickards would recommend then now is your chance.

.

Full story here Are you the author?Follow on:

No related photos.

Tags: Commentary,Economics,Featured,Geopolitics,Gold,gold and silver,gold forecast,gold price,gold price prediction,gold price today,Gold prices,inflation,News,newsletter,Precious Metals,silver,silver price,silver prices,Stock markets