Tag Archive: Gold prices

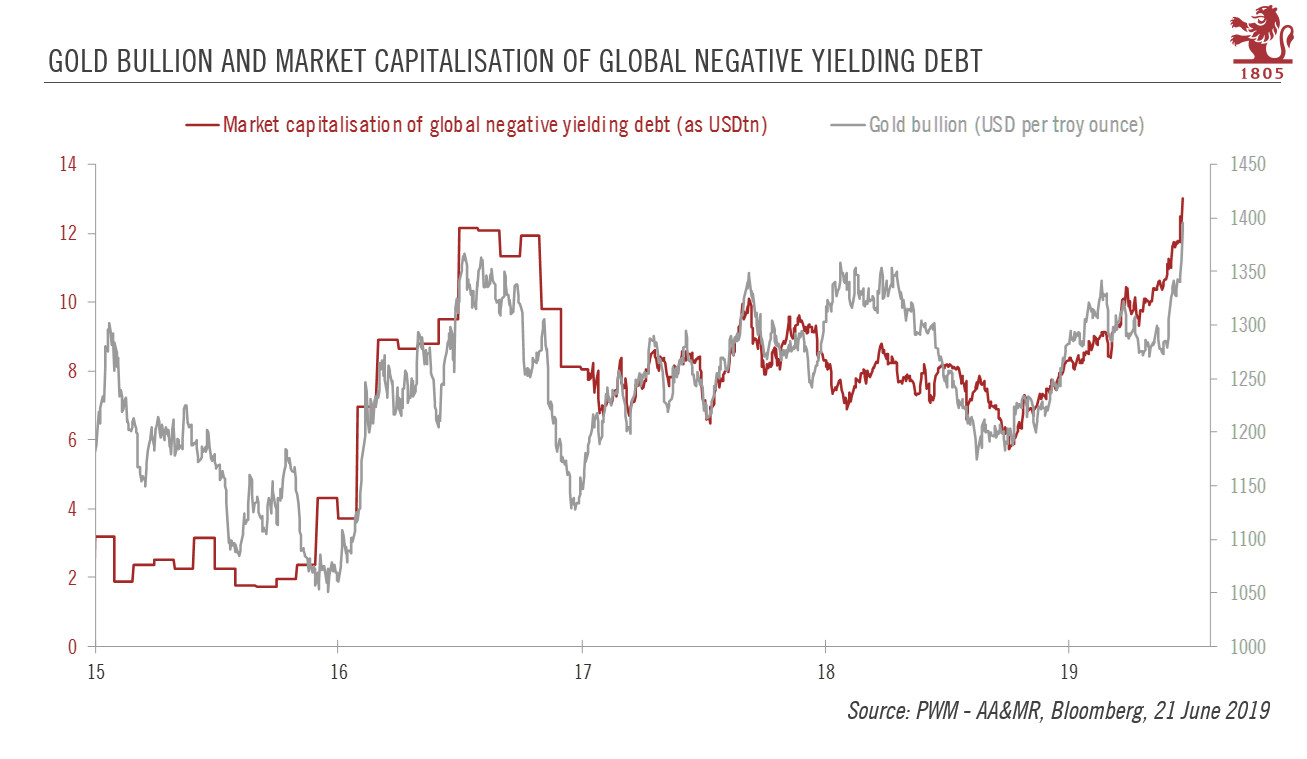

Update on gold – bad news is good news

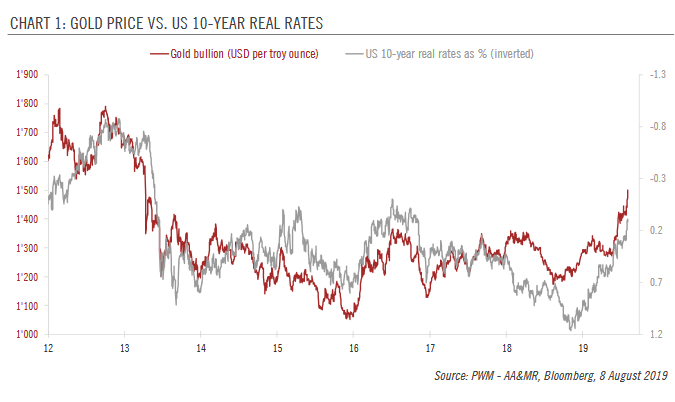

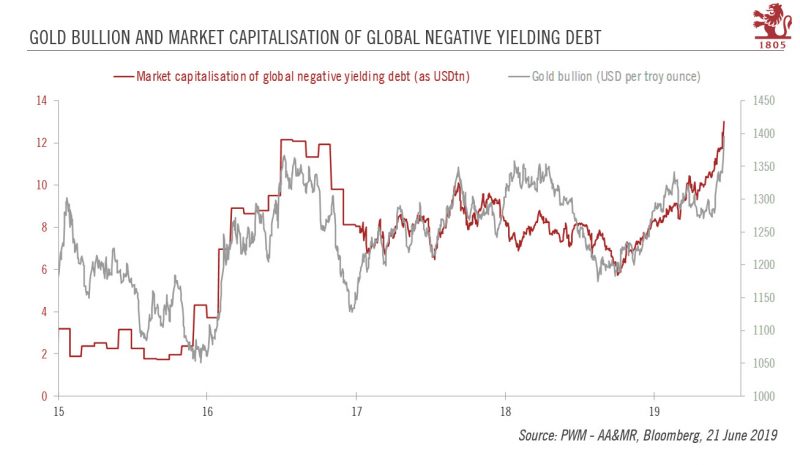

Increased trade tensions have boosted the gold price to above USD 1,500.The increased trade tensions following Trump’s 1 August tweet threatening additional tariffs on Chinese goods has boosted the gold price above USD 1,500 per troy ounce.The recent developments are supportive of gold investment demand because of a lower opportunity cost associated with holding gold and greater demand for safe haven assets.

Read More »

Read More »

Gold to consolidate before further leg up

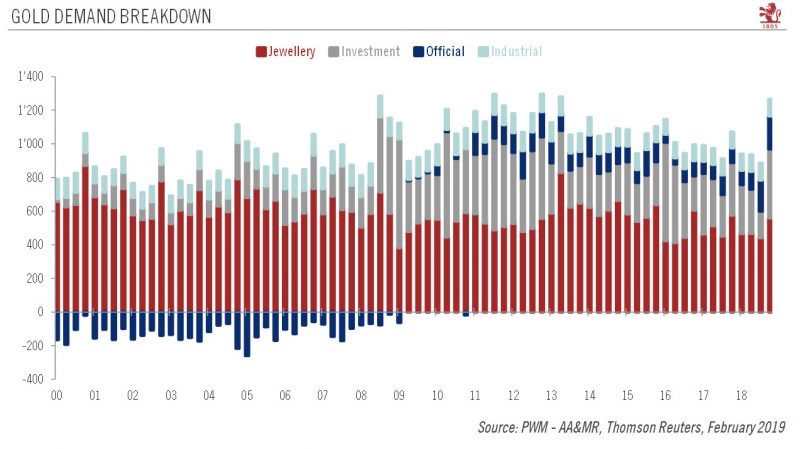

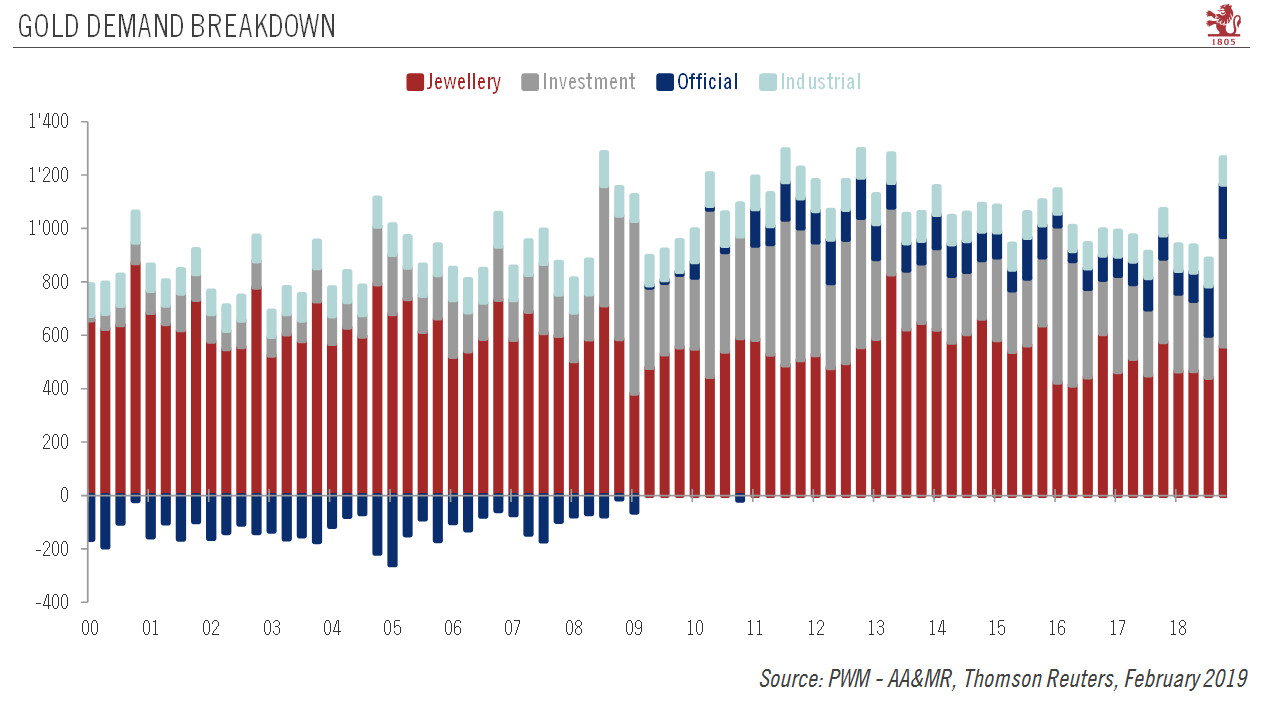

Some recent factors supporting gold are fading. However, while gold could sag in the short term, medium-term prospects look better.Last year ended on a very strong note for gold demand, with a significant increase in jewellery and investment demand in the fourth quarter (see chart), leading to strong price performance (7.7% in US dollar terms in Q4).

Read More »

Read More »

Gold $10,000 In Currency Reset as Russia, China Gold Demand To Overwhelm Futures Manipulation (GOLDCORE VIDEO)

Is the currency reset or global monetary reset (GMR) upon us? Russia dumped half their US Treasuries in April ($47.4 billion out of the $96.1 billion it had held) and bought 600k ozs of gold worth less than $800 million in May. Has the IMF “pegged” gold to SDRs at 900 SDR per ounce? China stops buying US Treasuries and quietly accumulates gold.

Read More »

Read More »

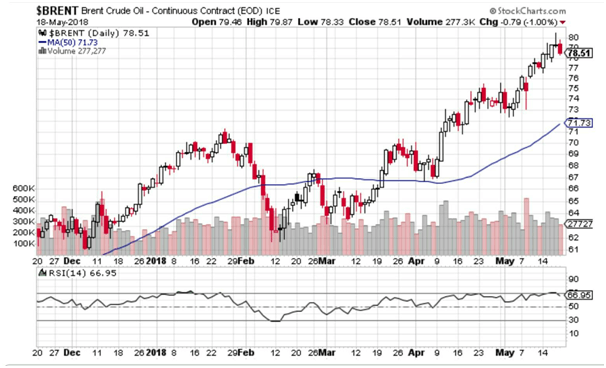

US 10-Year Surges, Emerging Markets Implode…Where Next for Gold?

US 10-Year Yields Top 3%, US Dollar Pushes Higher. Brent Hits $80, Highest in 4 years. Emerging Market Chaos, the Lira and Peso in Freefall. Italy’s New Coalition Signal Their Plans, Yields Jump. Japanese Economy Contracts, GDP Worst Since 2015. And Where Next for Gold?

Read More »

Read More »

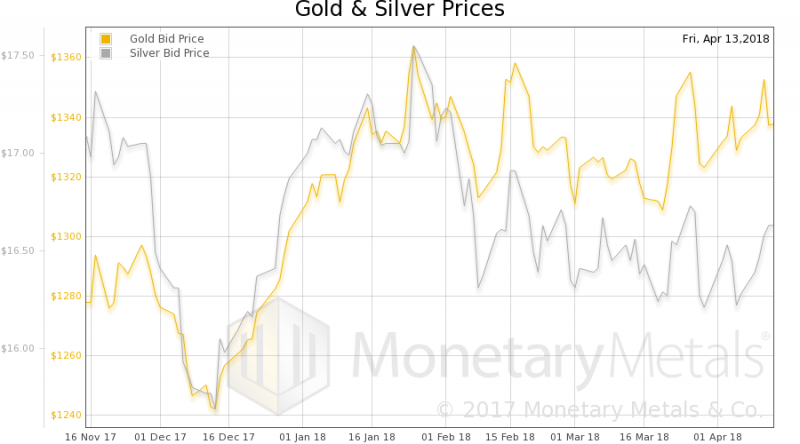

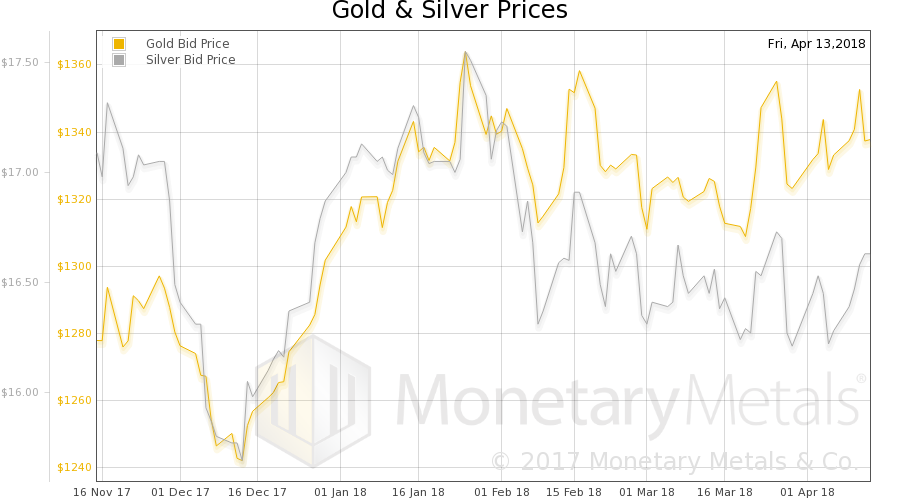

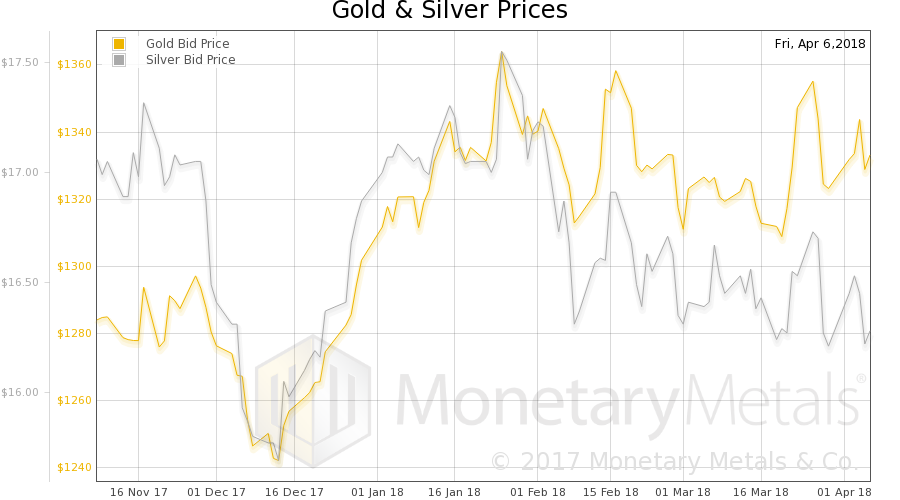

Oil price highest in 3 years, gold ready to follow

U.S. withdraws from Iran nuclear deal. Oil jumps past $70. Argentina hikes interest rates to 40%. S. 10 year disparity. Western buying returns to gold. Gold and silver both ended slightly up in a week dominated by heightening geopolitical news, weakening inflation data, and emerging market concerns.With gold closing the week at $1,318 (up 0.28%), €1,104 (0.37%), and £973 (0.2%).

Read More »

Read More »

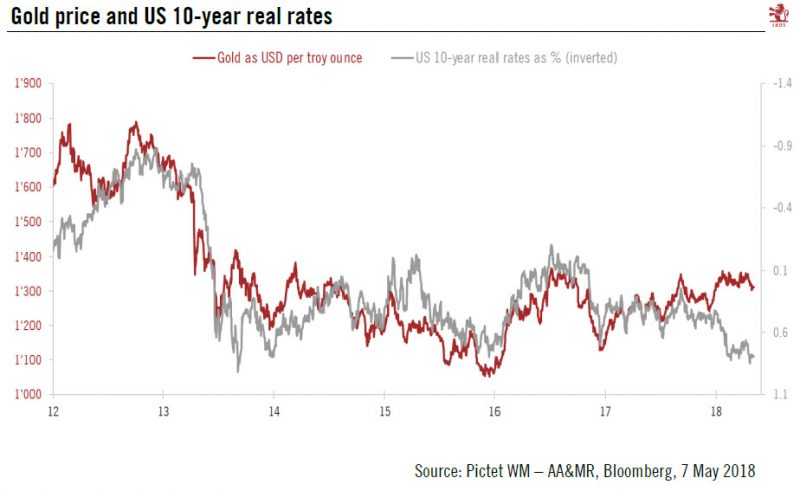

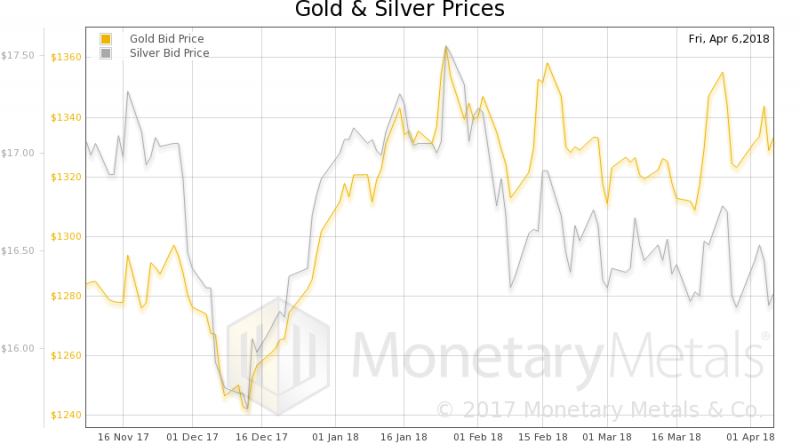

Gold price to remain trendless

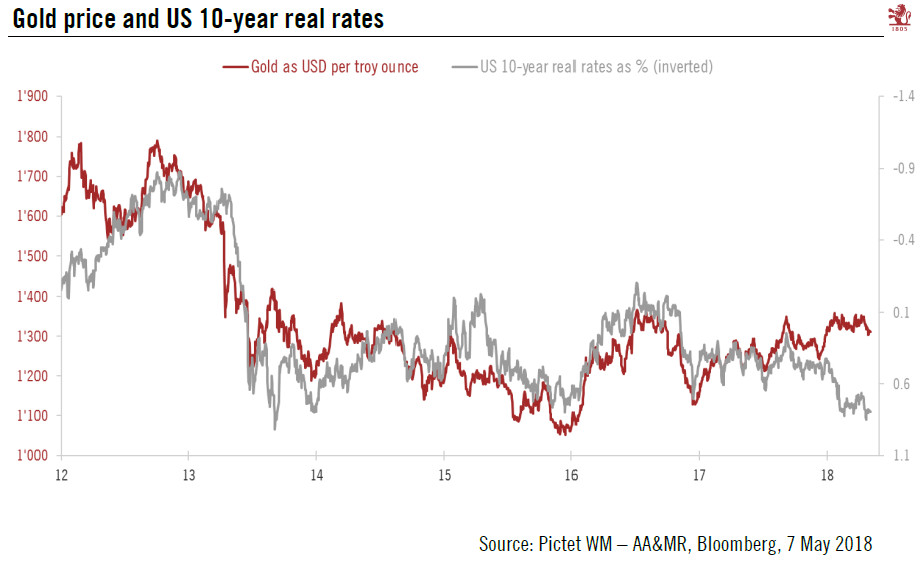

The recent strength of the US dollar coupled with the rise of the US 10-year Treasury yield has weighed on the price of gold and silver. Since 19 April, gold has lost roughly 2.3%, while silver lost almost 4.5% in USD terms.

Read More »

Read More »

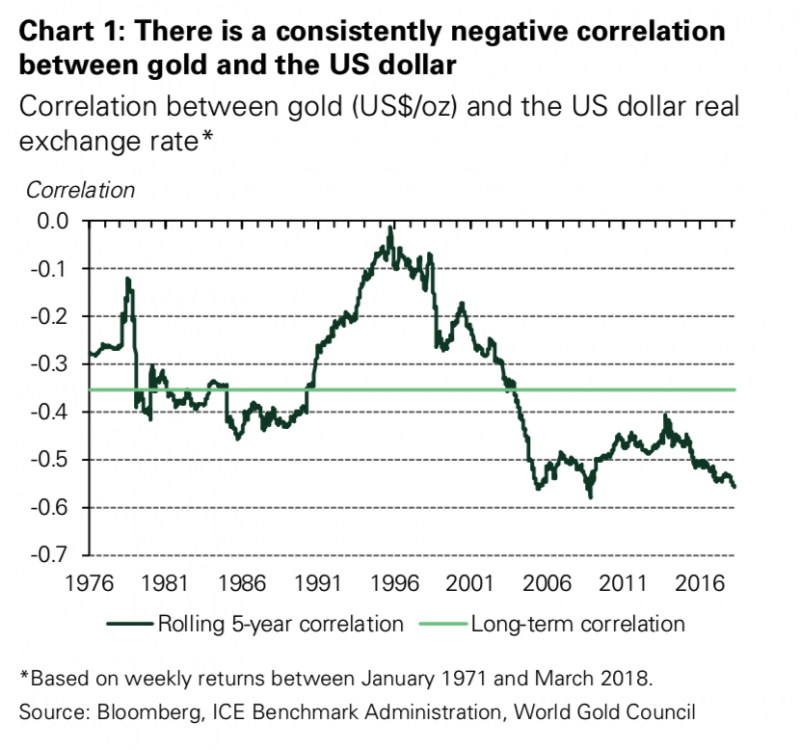

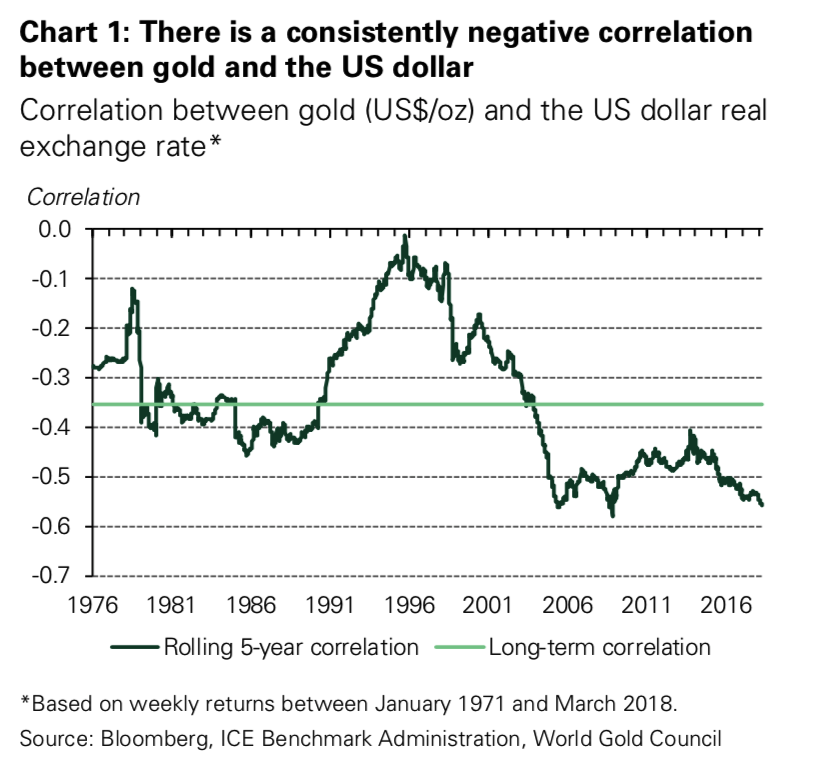

Gold Price Increasingly Influenced By Declining Dollar Rather Than Interest Rates

Gold Price Gains Due To Declining Dollar Rather Than Interest Rates. Investors should not be put off by higher interest rates, World Gold Council research finds they do not always have a negative impact on gold. Only short-term movements in gold are ‘heavily influenced by US interest rates’. Correlation between US interest rates and gold is waning, with US dollar a better indicator of short-term gold price. New findings will reassure gold investors...

Read More »

Read More »

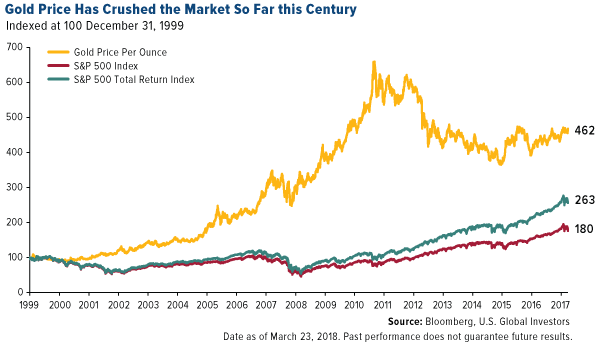

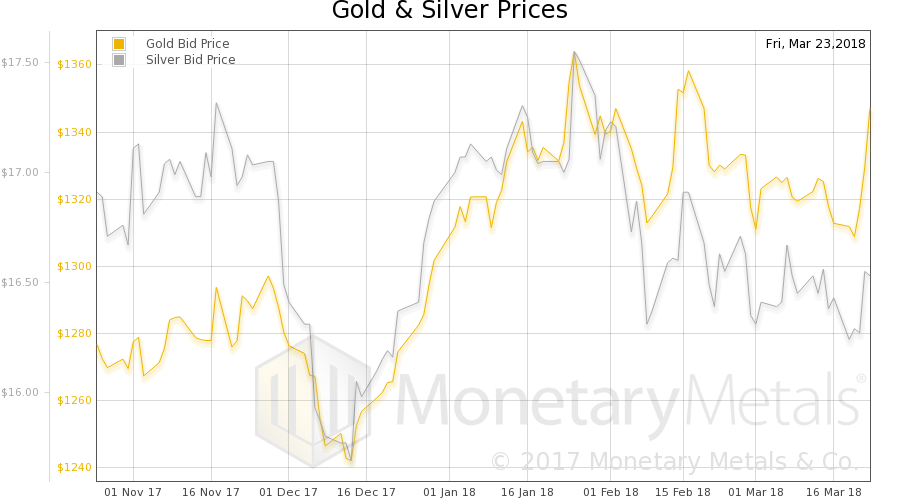

Gold Out Performs Stocks In 2018 and This Century By Ratio Of Two To One

– Gold outperforming stocks in 2018 and this century (see chart)

– Gold up close to 2% in 2018 while S&P 500 is down 2%

– Trump trade wars and Kudlow as Trump chief economic advisor is gold bullish

– Given gold’s performance, Kudlow’s dismissal of gold as “end of the world insurance” is “irrational”

– Market volatility could drive gold to $1,500/oz in 2018 – Holmes

Read More »

Read More »

Gold Hits New All Time Highs

2023-11-02

by Dave Russell

2023-11-02

Read More »