Tag Archive: Gold prices

Gold +1.8 percent, Silver +2.5 percent As Fed Increases Rates And Trade War Looms

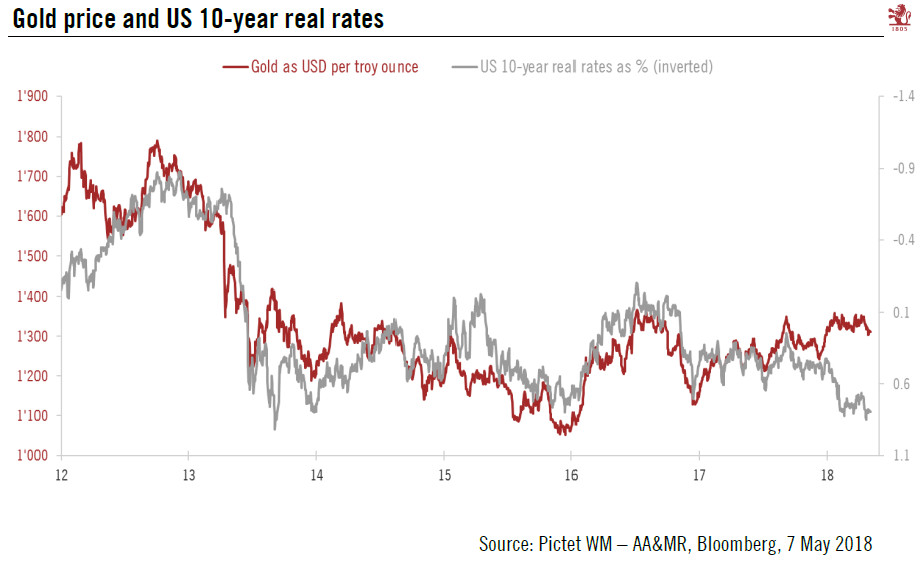

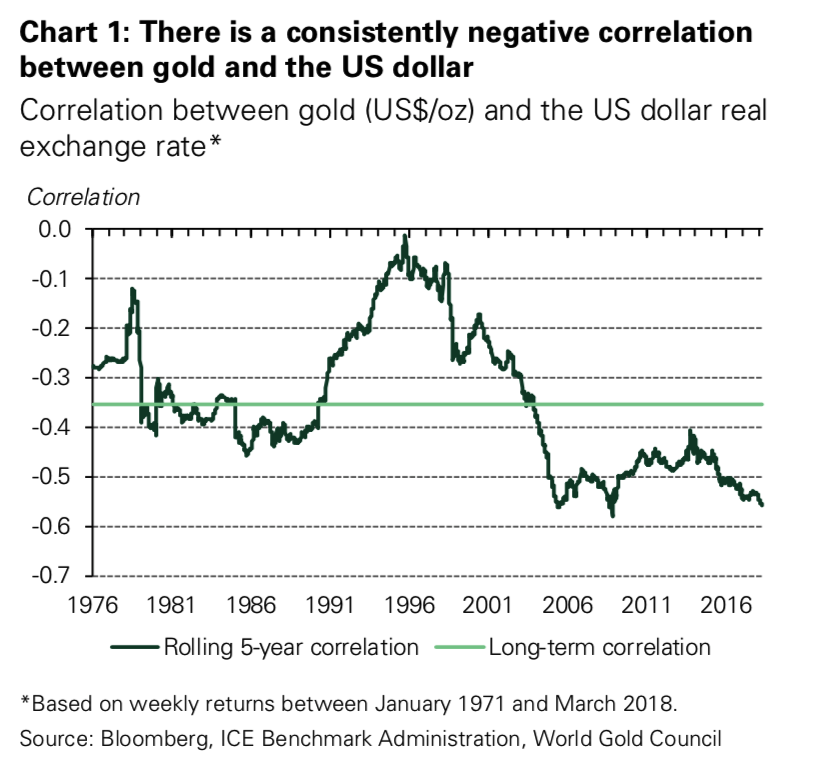

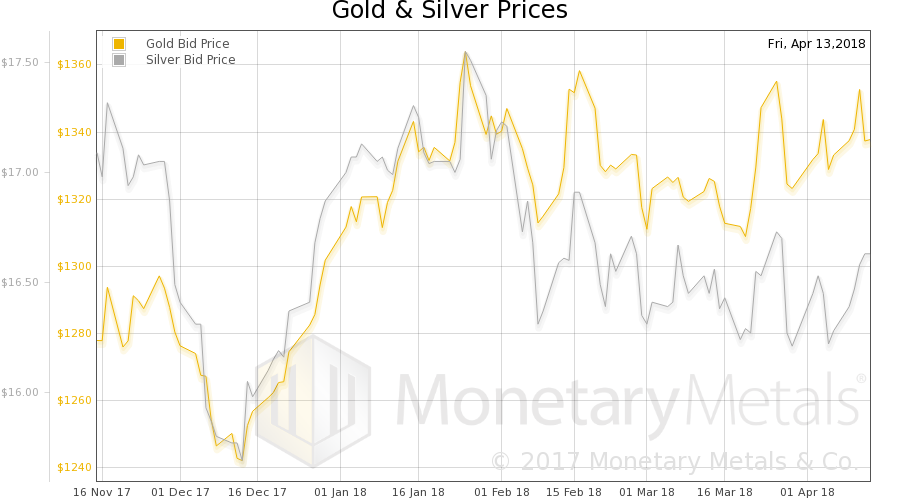

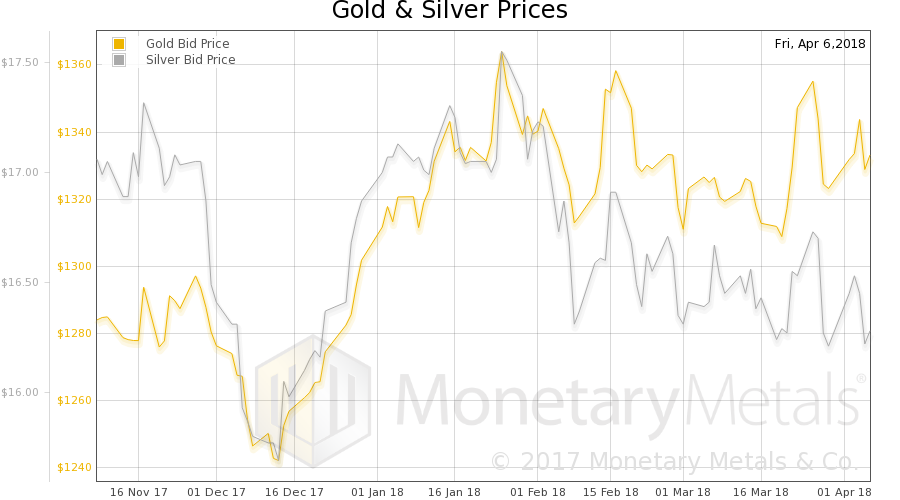

Gold gained 1.8% and silver 2.5% to $1,333/oz and $16.60/oz yesterday. Gold climbs as Fed increases interest rates by 0.25% – now 1.5% to 1.75% range. Dovish Fed Chair Powell plans fewer than expected rate hikes in 2018. Markets disappointed at lack of hawkish comments from new Fed Chair. Dollar LIBOR rises to highest level since November 2008 – $200 trillion worth of dollar-denominated financial products including mortgages based off LIBOR.

Read More »

Read More »

Bitcoin or British Pound ‘Pretty Much Failed’ As Currency?

Bitcoin has ‘pretty much failed’ as a currency says Bank of England Carney. Bitcoin is neither a store of value nor a useful way to buy things – BOE’s Carney. Project fear against crypto-currencies or an out of control investing bubble? Bitcoin will likely recover in value but is speculative and not for widows and orphans. British pound has been a terrible store of value – unlike gold. Pound collapsed 30% in 2016 and down 11.5% per annum versus...

Read More »

Read More »

Gold Up 3.8percent In Week – If Closes Above $1,360/oz Will Be Biggest Weekly Gain In Nearly 2 Years

Gold Up 3.8% In Week – If Closes Above $1,360/oz Will Be Biggest Weekly Gain In Nearly 2 Years. Gold rose as the dollar fell to near a three-year low against a basket of currencies on Friday, heading for its biggest weekly loss in nine months, as a slew of bearish factors including firming inflation and a fall in retail sales and industrial production hit the dollar.

Read More »

Read More »

Shrinkflation Intensifies – Stealth Inflation As Thousands of Food Products Shrink In Size, Not Price

Shrinkflation continues to take hold across UK, Ireland and US for sixth year running. Shrinkflation sees consumers gets less product, but at the same or increased price. 2,500 products have shrunk according to Office of National Statistics in UK. Reported inflation is between 1.7% and 3% but actually much higher. Shrinkflation is financial fraud, unreported inflation in stealth mode. Gold is hedging inflation and shrinkflation.

Read More »

Read More »

The Next Great Bull Market in Gold Has Begun – Rickards

The Next Great Bull Market in Gold Has Begun – Rickards on Peak Gold And Technicals. ‘Gold is in the early stages of a sustainable long-term bull market’ Rickards. Rickards believes the next bull market in gold will be even more powerful than those of 1971–1980 and 1999–2011. This new rally could send gold $1,475 or higher by next summer thanks to Fed rate hikes. Warns of Peak Gold ‘Physical gold is in short supply. Refiners can’t get enough to...

Read More »

Read More »

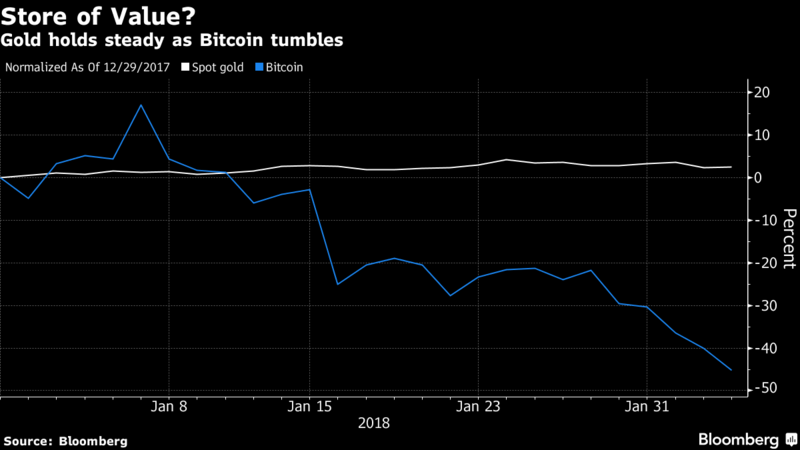

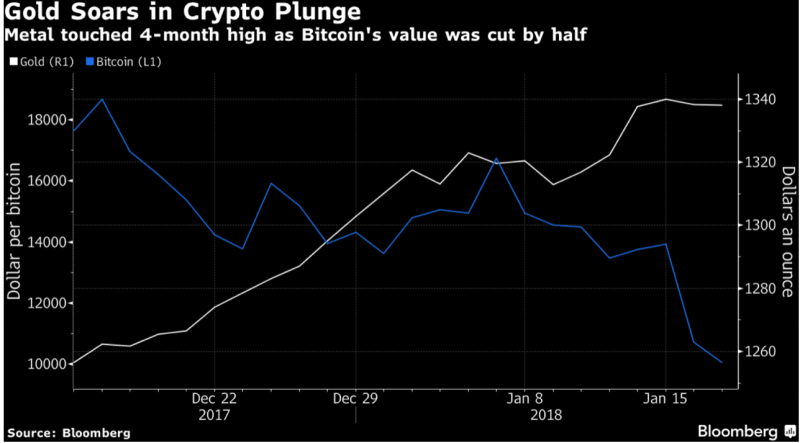

Digital Gold Flight To Physical Gold Coins and Bars

‘Digital Gold’ Bitcoin Flight To Safe Haven Physical Gold. Latest bitcoin, crypto crash causes gold coin and bar demand to surge. Bitcoin down 40% from high, Ripple down 50% and Ethereum down 30%. Ripple and ‘Digital gold’ Bitcoin fall past key psychological price levels. $300bn wiped from cryptocurrency fortunes in just 36 hours. New research says that there is ‘Price Manipulation in the Bitcoin Ecosystem’.

Read More »

Read More »

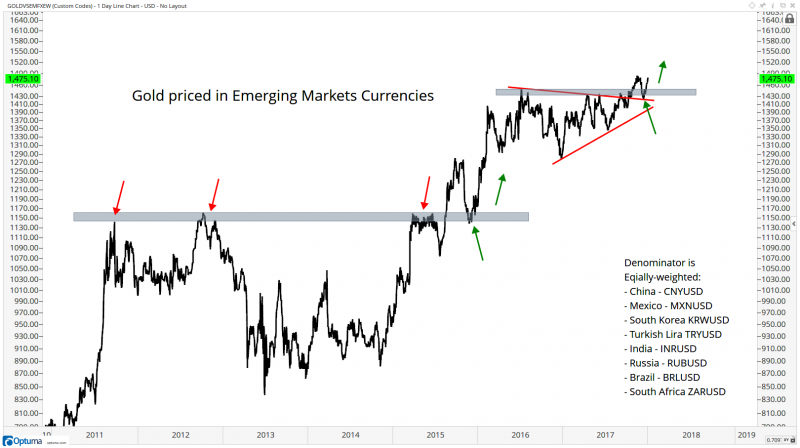

Gold Hits All-Time Highs Priced In Emerging Market Currencies

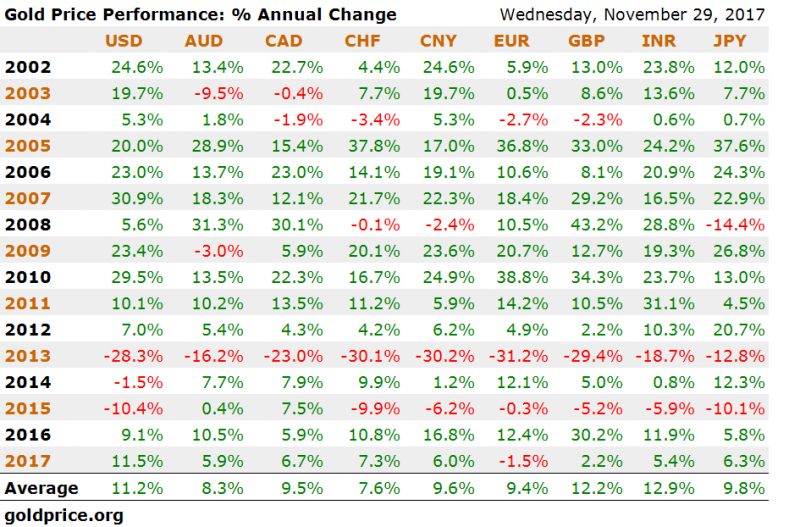

Gold Hits All-Time Highs Priced In Emerging Market Currencies. Gold at all time in eight major emerging market currencies. A stronger performance than seen when priced in USD, EUR or GBP. As world steps away from US dollar hegemony expect new gold highs in $, € and £. Gold is a hedge against currency debasement and depreciation of fiat currencies.

Read More »

Read More »

Gold Prices Rise To $1,326/oz as China U.S. Treasury Buying Report Creates Volatility

Gold prices rise to $1,326/oz on concerns China may slow U.S. Treasury buying. Equities fell sharply on the report as did Treasurys and the U.S. dollar. Chinese officials think U.S. debt is becoming less attractive compared to other assets. Trade tensions could provide a reason to slow down or halt U.S. debt purchases. U.S. dollar vulnerable as China remains biggest buyer of U.S. sovereign debt. Currency wars to return as China rejects U.S....

Read More »

Read More »

10 Reasons Why You Should Add To Your Gold Holdings

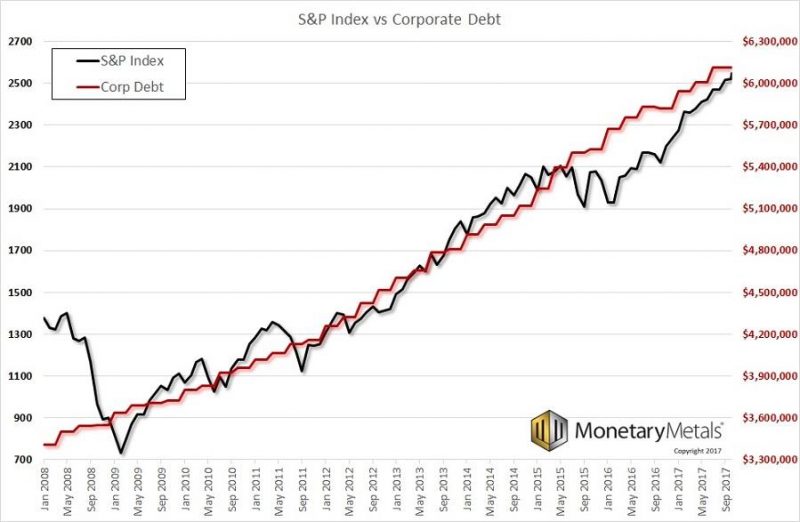

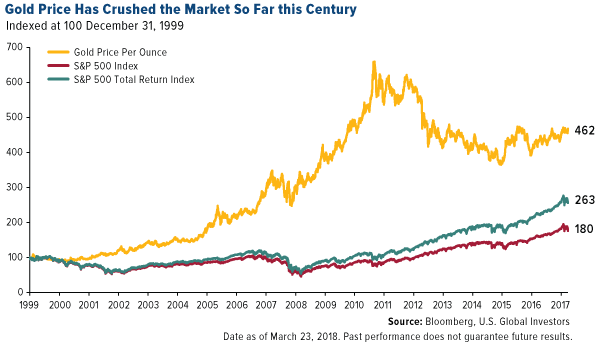

10 Reasons Why You Should Add To Your Gold Holdings. Gold currently undervalued. Since 2000, the gold price has beaten the S&P 500 Index. A ‘a once-in-a-decade opportunity’ as gold-to-S&P 500 ratio is at its lowest point in 10 years. Reached ‘peak gold’ as exploration budgets continue to tighten. $80 trillion sits in global equities, a ‘ticking time bomb’. Gold remains an appealing diversifier in the current environment of high valuations and...

Read More »

Read More »

Low Cost Gold In The Age Of QE, AI, Trump and War

‘Fear and Loathing In the Age of QE … AI’ is a presentation given at Mining Investment London earlier this week. Stephen Flood, CEO of GoldCore presentation (28 minutes) was well received at the conference which is a strategic mining and investment conference for leaders in the mining and investment sectors, bringing together attendees from 20 countries.

Read More »

Read More »

Geopolitical Risk Highest “In Four Decades” – Gold Demand in Germany and Globally to Remain Robust

Geopolitical risk highest “in four decades” should push gold higher – Citi. Elections, political and macroeconomic crises and war lead to gold investment. Political uncertainty in Germany means “gold likely to remain in good demand as a safe haven” say Commerzbank. “There has rarely been such political uncertainty in Germany at any time in the country’s post-war history” – Commerzbank. Reduce counter party risk: own safe haven allocated and...

Read More »

Read More »

Ne conservez pas votre or dans une banque. Egon Von Greyerz

Ne détenez pas d’or dans une banque suisse ou dans n’importe quelle autre banque. Nous voyons régulièrement des exemples dans des banques suisses de taille moyenne et de grande taille qui devraient fortement inquiéter les clients. En voici quelques-uns : Un client entrepose de l’or physique dans une banque, mais lorsqu’il souhaite le transférer vers des coffres privés, l’or n’y est plus et la banque doit s’en procurer.

Read More »

Read More »

Brexit Budget – Grim Outlook As UK Economy Downgraded

Brexit budget – Grim outlook as UK economic forecasts downgrade. UK Chancellor uses housing market policy as smoke-screen for deteriorating economy. UK budget matters more than ever due to BREXIT risks. Policy on stamp duty will fail to aid worsening housing market. Real GDP expected to grow by just 1.5%, 40% less than projections 2 years ago. Households now face an unprecedented 17 years of stagnation in earnings. Critics claim Budget failed to...

Read More »

Read More »

Gold Price Reacts as Central Banks Start Major Change

Bank of England raised interest rates for the first time in ten years. President Trump announces Jerome Powell as his choice to lead the U.S. Federal Reserve. Most investors outside the US Dollar and Euro see gold prices climb after busy week of central bank news. Inflation now at five-year high of 3%. Inflation, low-interest rate, debt crises and bail-ins still threaten savers and pensioners.

Read More »

Read More »