Tag Archive: silver prices

Will Silver Prices Go Up to $300?

This week’s guest is so bullish on silver that he’s even written a best-selling book ‘The Great Silver Bull’ where he takes an in-depth look at why silver will outperform gold once again and even go as high as $300 an ounce.

Read More »

Read More »

Long Term Gold Price Prediction

What do the weather and the markets have in common? Quite a bit says this week’s guest! Kevin Wadsworth is a meteorologist-turned-chart analyst who has a lot of interesting insight and predictions into market movements and the price of gold.

Read More »

Read More »

SWIFT Ban: A Game Changer for Russia?

As part of the sanctions against Russia, seven Russian banks have been cut off from SWIFT.

We start by discussing what SWIFT is, and then the implications of completely cutting Russia out of SWIFT.

What is SWIFT and Why Russia is Being Excluded

SWIFT – The Society for Worldwide Interbank Financial Telecommunication is a messaging system that links more than 11,000 banks in 200 countries.

The system doesn’t move actual...

Read More »

Read More »

Silver Backwardation Returns, Gold and Silver Market Report 2 March

The big news this week was the drop in the prices of the metals (though we believe that it is the dollar which is going up), $57 and $1.81 respectively. Of course, when the price drops the injured goldbugs come out. We have written the authoritative debunking of the gold and silver price suppression conspiracy here. We provide both the scientific theory and the data.

Read More »

Read More »

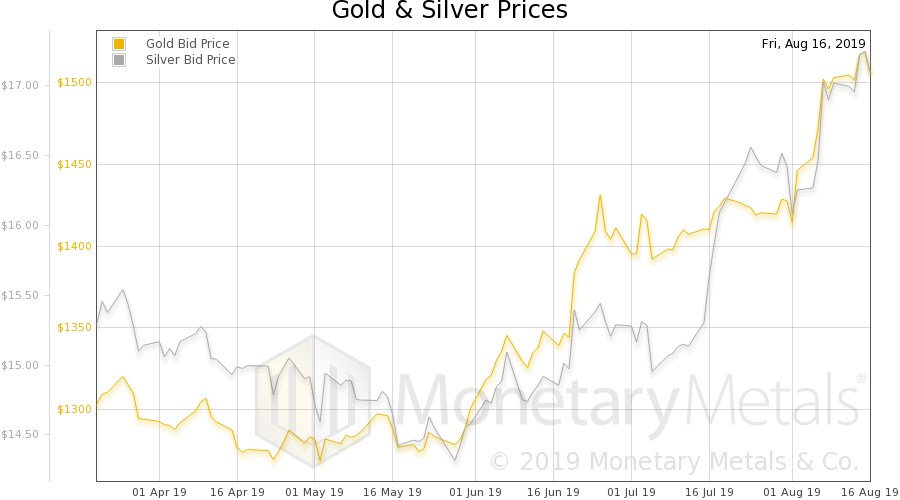

Deflation Is Everywhere—If You Know Where to Look, Report 18 Aug

At a shopping mall recently, we observed an interesting deal at Sketchers. If you buy two pairs of shoes, the second is 30% off. Sketchers has long offered deals like this (sometimes 50% off). This is a sign of deflation. Regular readers know to wait for the punchline. Manufacturer Gives Away Its Margins

Read More »

Read More »

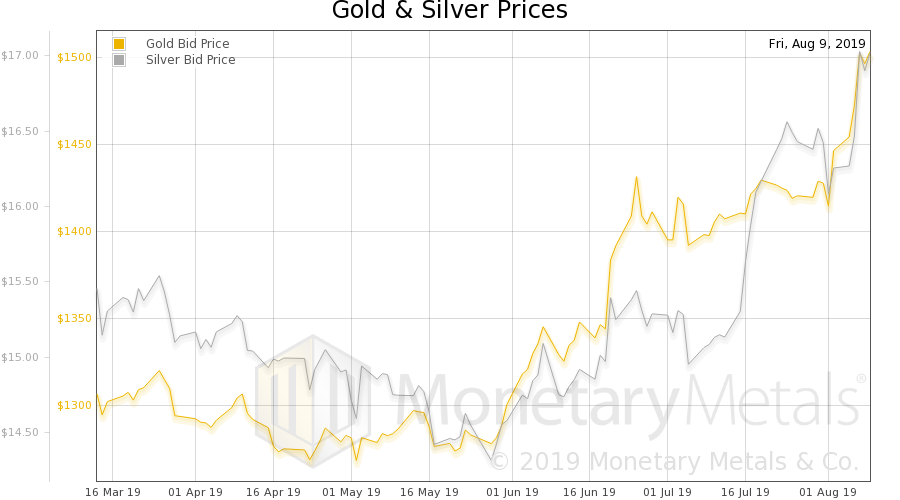

The Economic Singularity, Report 11 Aug

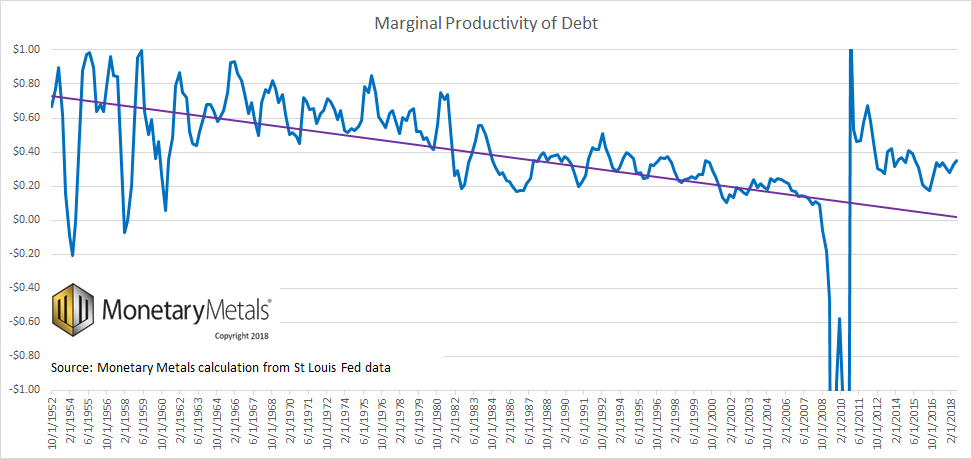

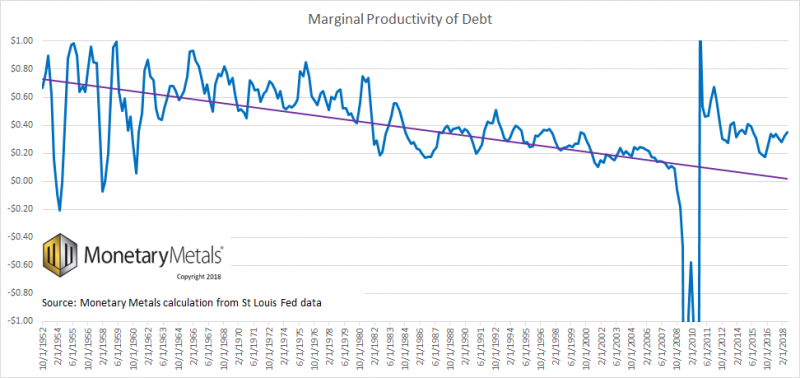

We have recently written several essays about the fallacious concept of Gross Domestic Product. Among GDP’s several fatal flaws, it goes up when capital is converted to consumer goods, when seed corn is served at the feast. So we proposed—and originally dismissed—the idea of a national balance sheet.

Read More »

Read More »

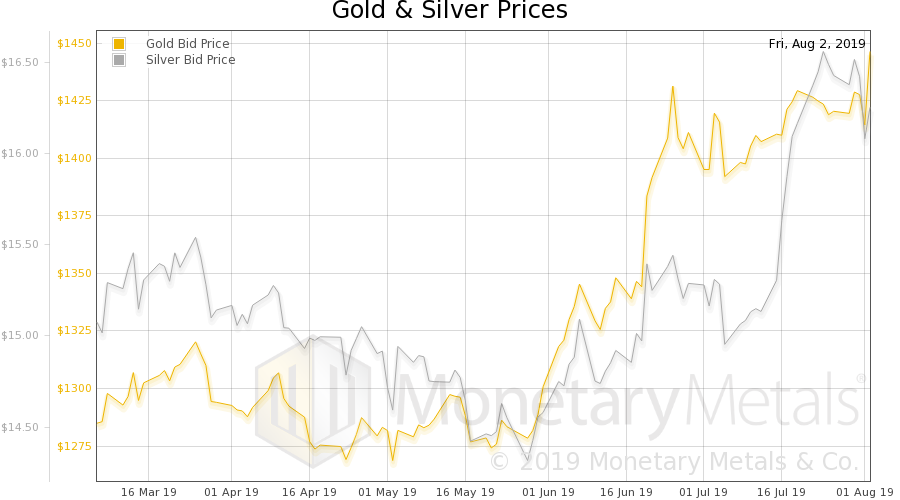

I Know Usury When I See It, Report 4 Aug

“I know it, when I see it.” This phrase was first used by U.S. Supreme Court Justice Potter Stewart, in a case of obscenity. Instead of defining it—we would think that this would be a requirement for a law, which is of course backed by threat of imprisonment—he resorted to what might be called Begging Common Sense. It’s just common sense, it’s easy-peasy, there’s no need to define the term…

Read More »

Read More »

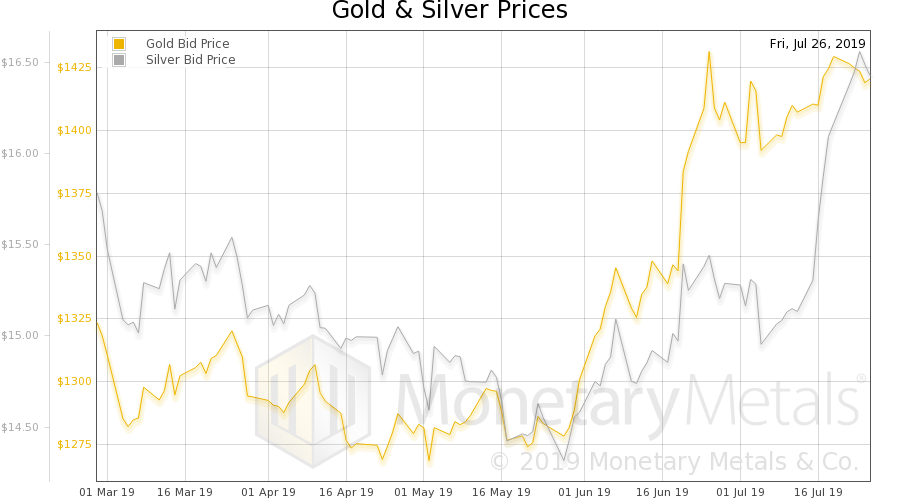

Obvious Capital Consumption, Report 28 Jul

We have spilled many electrons on the topic of capital consumption. Still, this is a very abstract topic and we think many people still struggle to picture what it means. Thus, the inspiration for this week’s essay. Suppose a young man, Early Enterprise, inherits a car from his grandfather. Early decides to drive for Uber to earn a living. Being enterprising, he is up at dawn and drives all day.

Read More »

Read More »

The Fake Economy, Report 21 Jul

Folks in the liberty movement often say that the economy is fake. But this does not persuade anyone. It’s just preaching to the choir! We hope that this series on GDP provides more effective ammunition to argue with the Left-Right-Wall-Street-Main-Street-Capitalists-Socialists.

Read More »

Read More »

How to Fix GDP, Report 14 Jul

Last week, we looked at the idea of a national balance sheet, as a better way to measure the economy than GDP (which is production + destruction). The national balance sheet would take into account both assets and liabilities. If we take on another $1,000,000 debt to buy a $1,000,000 asset, then we have not added any equity.

Read More »

Read More »

More Squeeze, Less Juice, Report 7 Jul

We have been writing on the flaws in GDP: that it is no measure of the economy, because it looks only at cash and not the balance sheet, and that there are positive feedback loops.

“OK, Mr. Smarty Pants,” you’re thinking (yes, we know you’re thinking this), “if GDP is not a good measure of the economy, then what is?!”

Read More »

Read More »

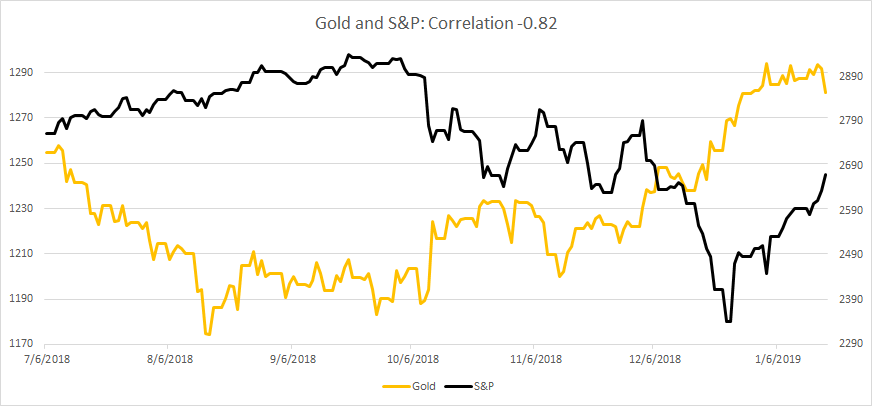

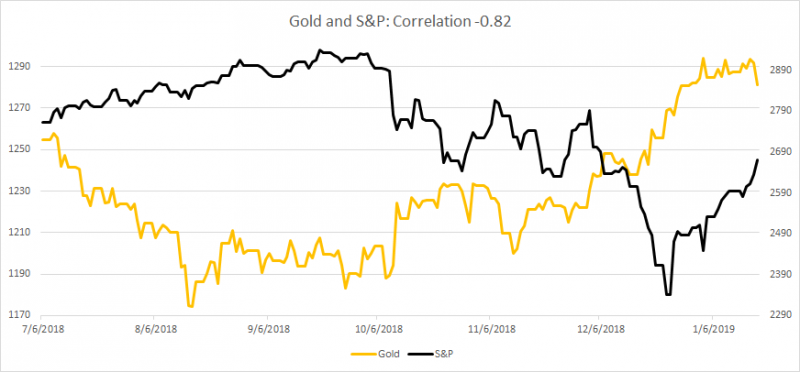

The Dollar Works Just Fine, Report 20 Jan 2019

Last week, we joked that we don’t challenge beliefs. Here’s one that we want to challenge today: the dollar doesn’t work as a currency, because it’s losing value. Even the dollar’s proponents, admit it loses value. The Fed itself states that its mandate is price stability—which it admits means relentless two percent annual debasement (Orwell would be proud).

Read More »

Read More »

The Interesting Seasonal Trends of Precious Metals

Prices in financial and commodity markets exhibit seasonal trends. We have for example shown you how stocks of pharmaceutical companies tend to rise in winter due to higher demand, or the end-of-year rally phenomenon (last issue), which can be observed almost every year. Gold, silver, platinum and palladium are subject to seasonal trends as well.

Read More »

Read More »

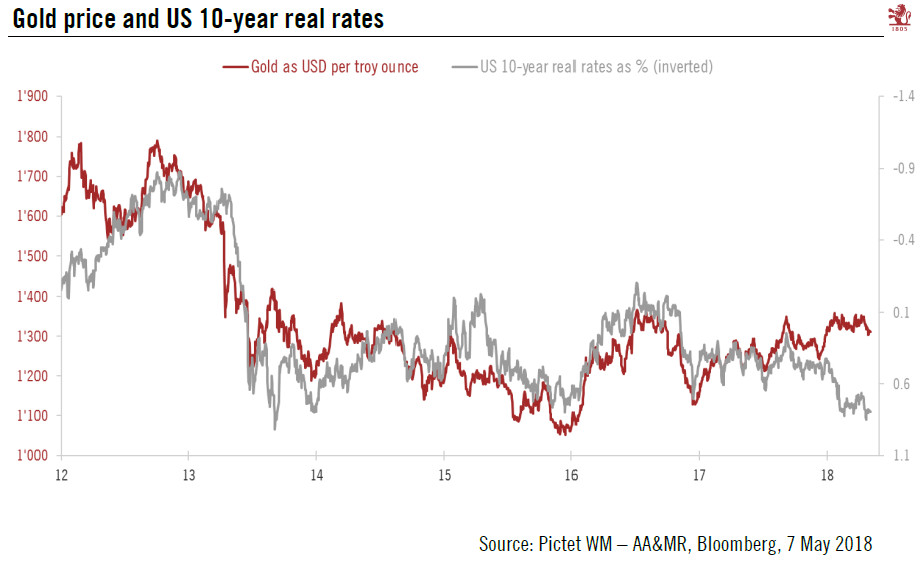

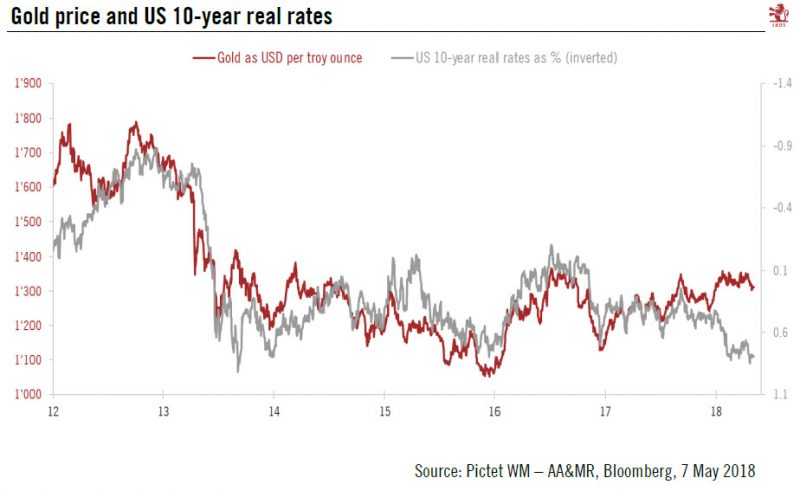

Gold price to remain trendless

The recent strength of the US dollar coupled with the rise of the US 10-year Treasury yield has weighed on the price of gold and silver. Since 19 April, gold has lost roughly 2.3%, while silver lost almost 4.5% in USD terms.

Read More »

Read More »

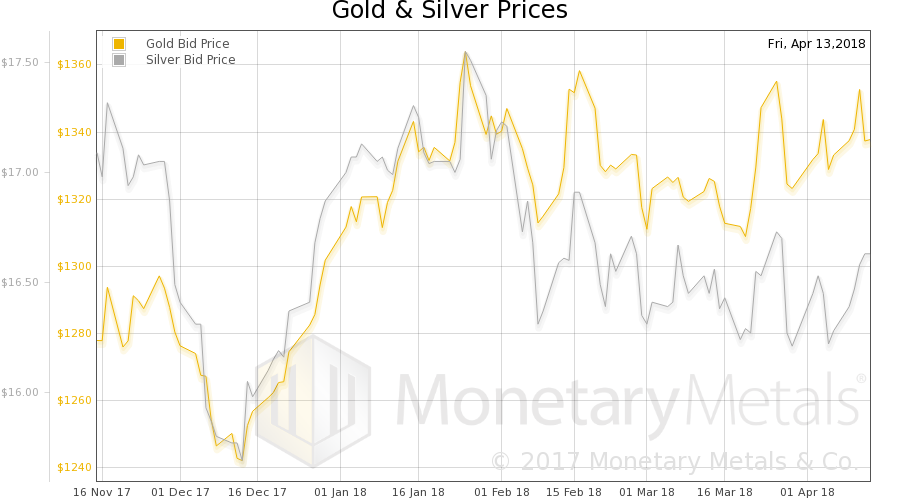

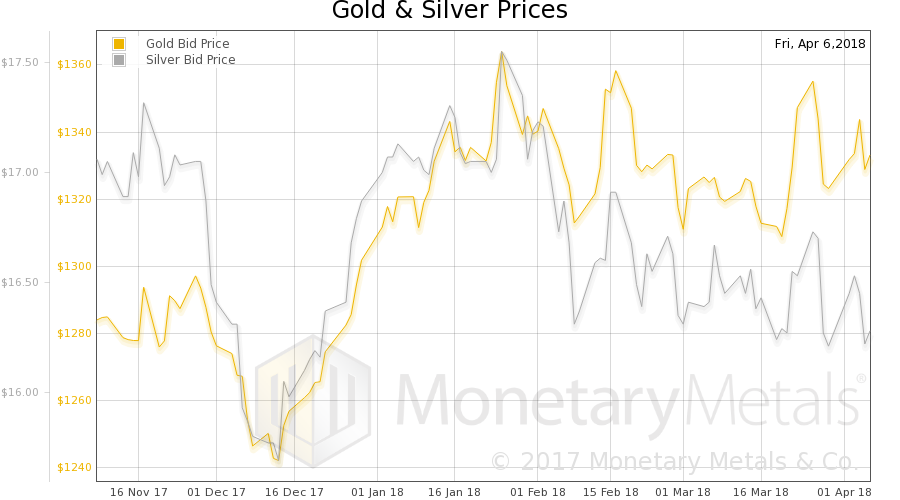

Fear and Longing – Precious Metals Supply and Demand

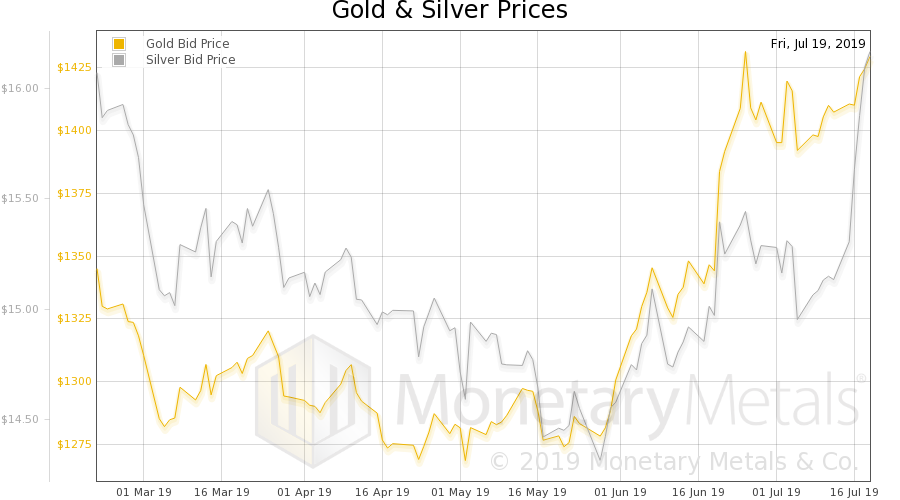

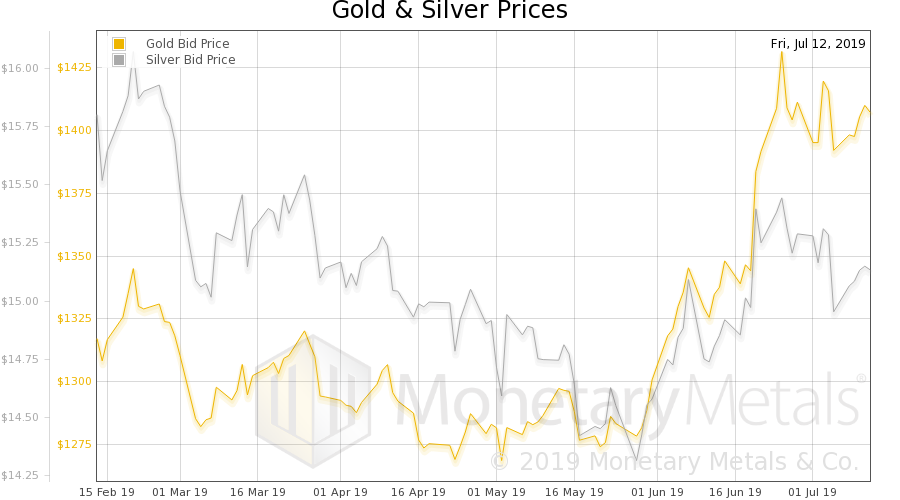

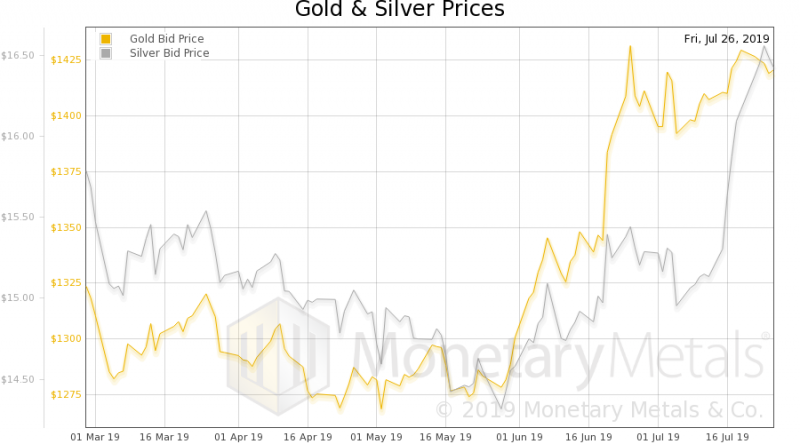

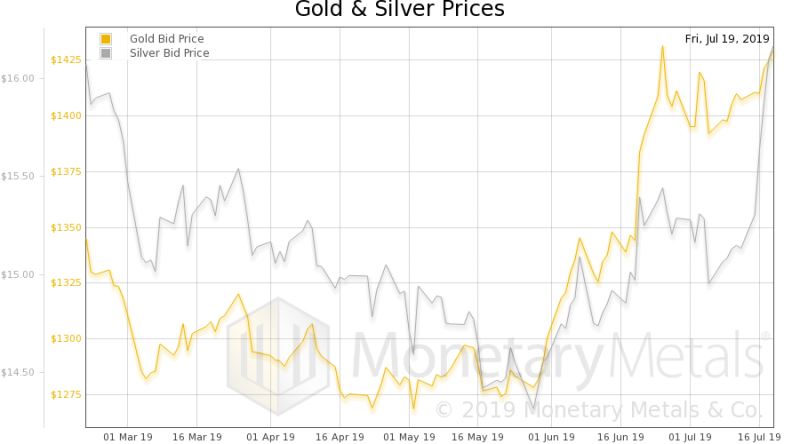

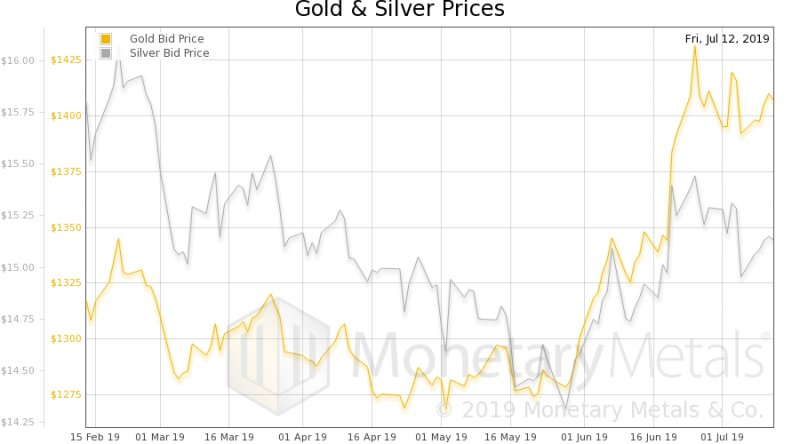

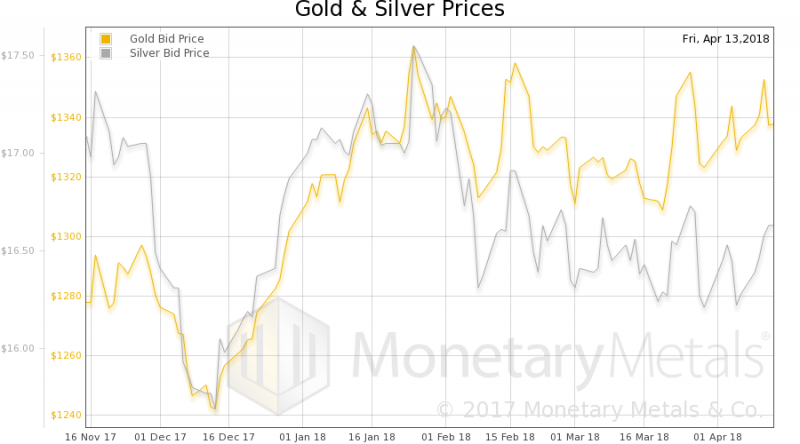

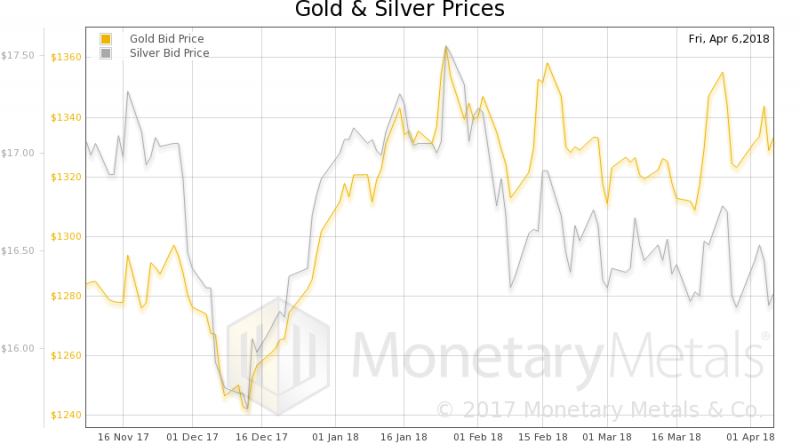

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

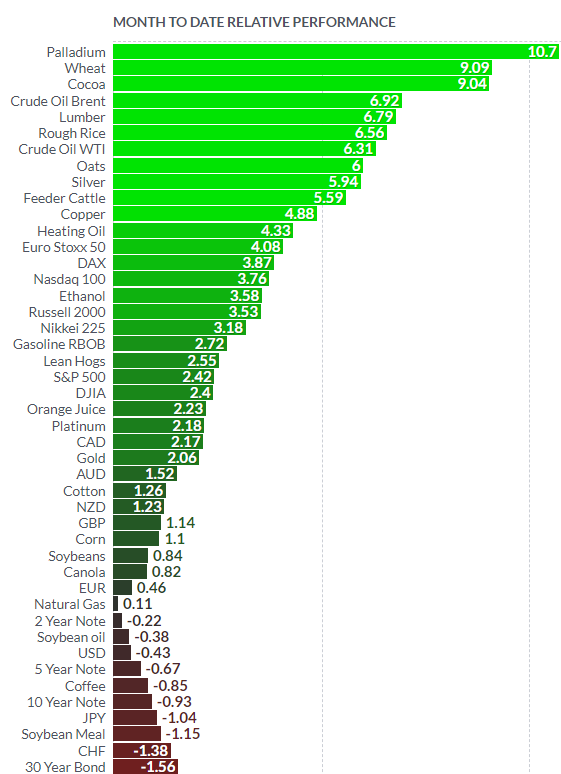

Palladium Bullion Surges 17percent In 9 Days On Russian Supply Concerns

Palladium bullion has surged a massive 17% in just nine trading days. From $895/oz on Friday April 6th to over $1,052/oz today (April 19th). The price surge is due to palladium being due a bounce after falling in the first quarter and now due to Russian supply concerns. In a volatile month, precious metals and commodities have been the clear winners so far, with palladium having the greatest gains of all – up 10.7% in April (see table below).

Read More »

Read More »

Flight of the Bricks – Precious Metals Supply and Demand

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

No Revolution Just Yet – Precious Metals Supply and Demand Report

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Prices and Predictions – Precious Metals Supply and Demand

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Donate to SNBCHF.com

Donate to SNBCHF.com Via Paypal or Bitcoin To Help Keep the Site Running

Please consider making a small donation to Snbchf.com. Thanks

Bitcoin wallet: bc1qa2h6hgd0xkuh7xh02jm5x25k6x8g7548ffaj3j

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

USD/CHF gains ground near 0.8850, potential upside seems limited

9 days ago -

USD/CHF holds below 0.8950 amid Middle East geopolitical risks

2024-06-25 -

SNB Sight Deposits: increased by 2.4 billion francs compared to the previous week

5 days ago -

SNB Surprises the Market (Again)

2024-06-20 -

USD/CHF appreciates to near 0.8950 due to hawkish Fed, SNB Financial Stability Report eyed

2024-06-13

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: increased by 2.4 billion francs compared to the previous week

5 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Canada’s “Worst Decline in 40 Years”

Canada’s “Worst Decline in 40 Years” -

No exceptions, please!

-

#517 Wie viel ist dein Immobilienfonds noch wert? #fonds

#517 Wie viel ist dein Immobilienfonds noch wert? #fonds -

Roboter – KI und Verdrängung des Menschen

Roboter – KI und Verdrängung des Menschen -

El Legado de Biden es PEOR de lo que Parece…

El Legado de Biden es PEOR de lo que Parece… -

Kamala’s Palace Coup

-

How to Invest in High Safety Corporate Bonds

How to Invest in High Safety Corporate Bonds -

7-26-24 Should You Tap Your Home Equity for Retirement Income?

7-26-24 Should You Tap Your Home Equity for Retirement Income? -

UBS questioned by US Senator over $350 million tax evasion case

UBS questioned by US Senator over $350 million tax evasion case -

Lanz: Das Allein “beseitigt” keine AfD Wähler!

Lanz: Das Allein “beseitigt” keine AfD Wähler!

More from this category

Why we couldn’t be happier that gold is boring

Why we couldn’t be happier that gold is boring23 Aug 2022

Will Silver Prices Go Up to $300?

Will Silver Prices Go Up to $300?11 Aug 2022

Long Term Gold Price Prediction

Long Term Gold Price Prediction22 Jul 2022

SWIFT Ban: A Game Changer for Russia?

SWIFT Ban: A Game Changer for Russia?4 Mar 2022

Silver Backwardation Returns, Gold and Silver Market Report 2 March

Silver Backwardation Returns, Gold and Silver Market Report 2 March2 Mar 2020

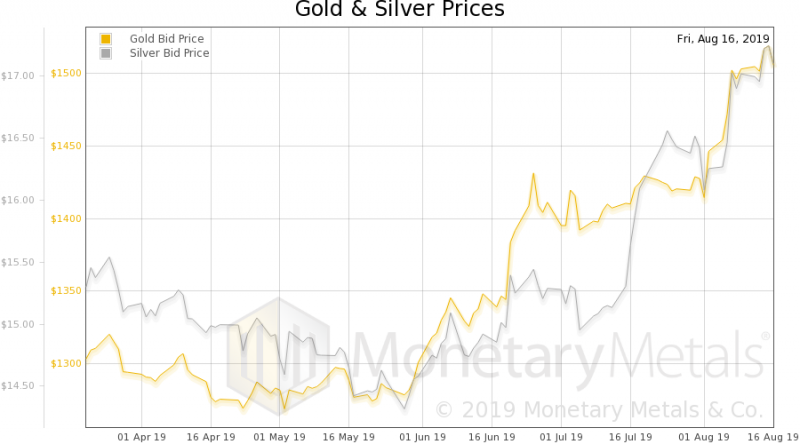

Deflation Is Everywhere—If You Know Where to Look, Report 18 Aug

Deflation Is Everywhere—If You Know Where to Look, Report 18 Aug19 Aug 2019

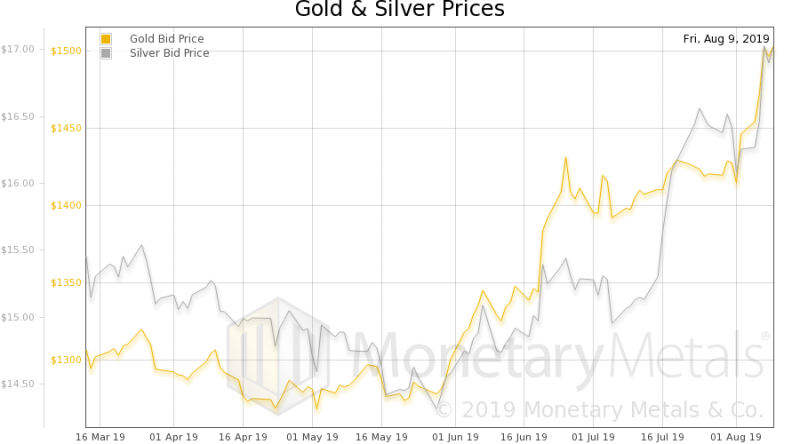

The Economic Singularity, Report 11 Aug

The Economic Singularity, Report 11 Aug13 Aug 2019

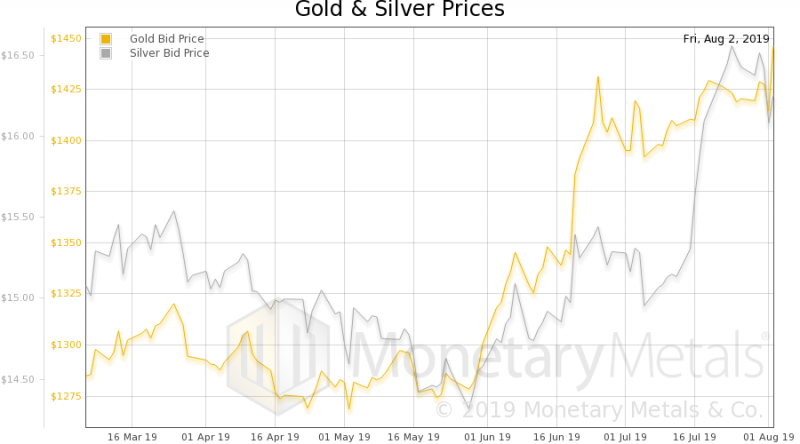

I Know Usury When I See It, Report 4 Aug

I Know Usury When I See It, Report 4 Aug5 Aug 2019

Obvious Capital Consumption, Report 28 Jul

Obvious Capital Consumption, Report 28 Jul30 Jul 2019

The Fake Economy, Report 21 Jul

The Fake Economy, Report 21 Jul23 Jul 2019

How to Fix GDP, Report 14 Jul

How to Fix GDP, Report 14 Jul16 Jul 2019

More Squeeze, Less Juice, Report 7 Jul

More Squeeze, Less Juice, Report 7 Jul8 Jul 2019

The Dollar Works Just Fine, Report 20 Jan 2019

The Dollar Works Just Fine, Report 20 Jan 201923 Jan 2019

The Interesting Seasonal Trends of Precious Metals

The Interesting Seasonal Trends of Precious Metals20 Nov 2018

Gold price to remain trendless

Gold price to remain trendless10 May 2018

Fear and Longing – Precious Metals Supply and Demand

Fear and Longing – Precious Metals Supply and Demand8 May 2018

Palladium Bullion Surges 17percent In 9 Days On Russian Supply Concerns

Palladium Bullion Surges 17percent In 9 Days On Russian Supply Concerns22 Apr 2018

Flight of the Bricks – Precious Metals Supply and Demand

Flight of the Bricks – Precious Metals Supply and Demand19 Apr 2018

No Revolution Just Yet – Precious Metals Supply and Demand Report

No Revolution Just Yet – Precious Metals Supply and Demand Report10 Apr 2018

Prices and Predictions – Precious Metals Supply and Demand

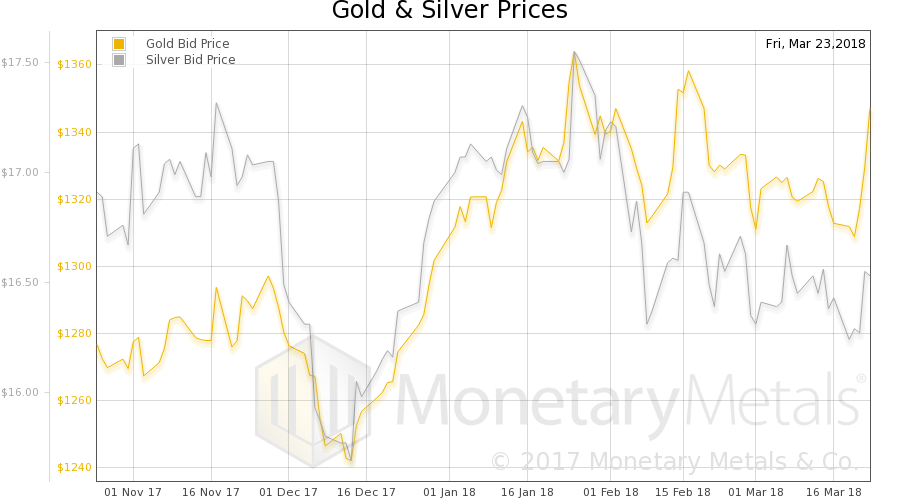

Prices and Predictions – Precious Metals Supply and Demand27 Mar 2018

Why we couldn’t be happier that gold is boring

2022-08-23

by Stephen Flood

2022-08-23

Read More »