Tag Archive: On Economy

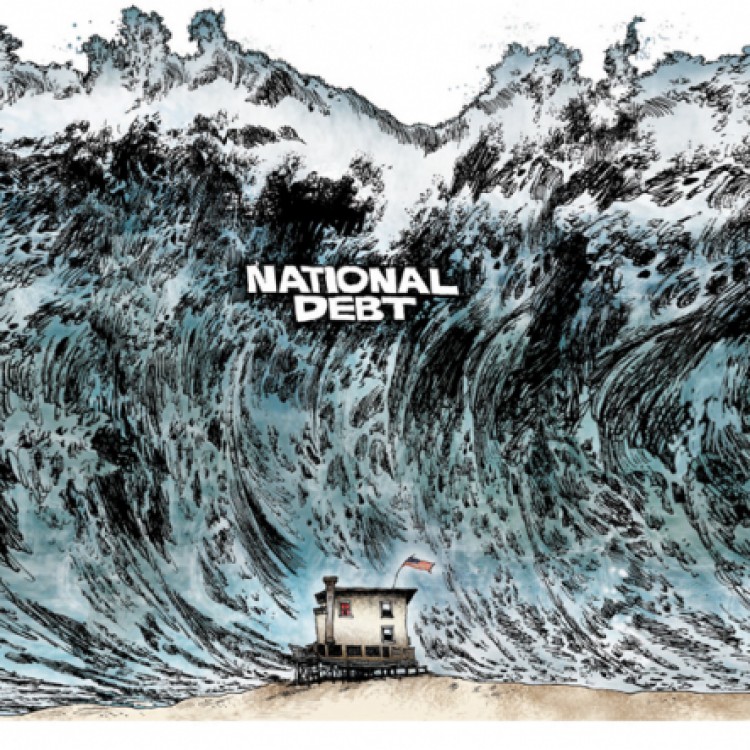

Why There Will Be No 11th Hour Debt Ceiling Deal

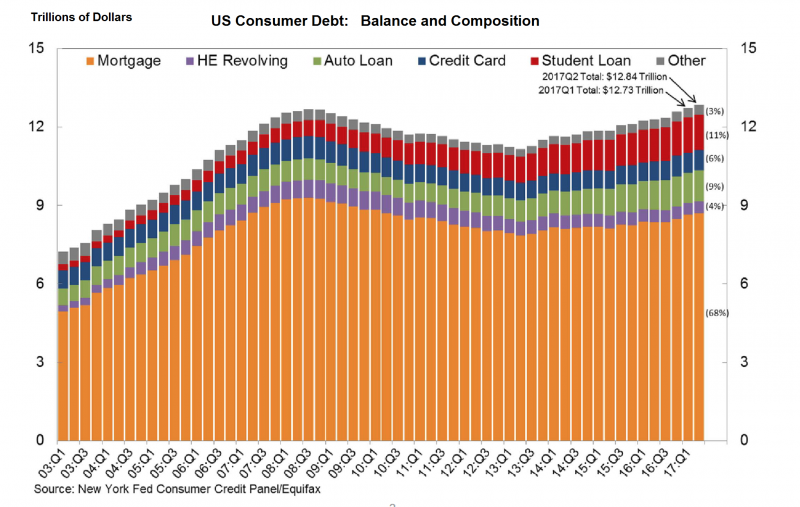

A new milestone on the American populaces’ collective pursuit of insolvency was reached this week. According to a report published on Tuesday by the Federal Reserve Bank of New York, total U.S. household debt jumped to a new record high of $12.84 trillion during the second quarter. This included an increase of $552 billion from a year ago.

Read More »

Read More »

Is Historically Low Volatility About to Expand?

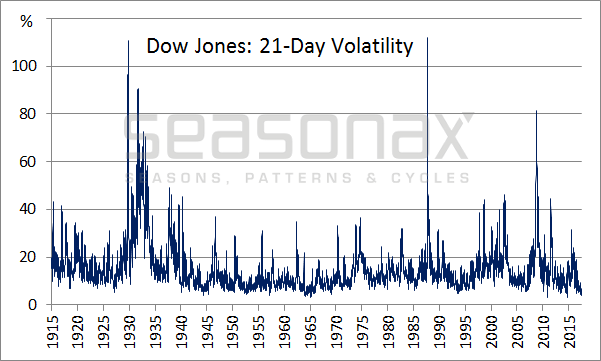

You have probably noticed it already: stock market volatility has recently all but disappeared. This raises an important question for every investor: Has the market established a permanent plateau of low volatility, or is the current period of low volatility just the calm before the storm?

Read More »

Read More »

What Went Wrong With the 21st Century?

POITOU, FRANCE – “So how much did you make last night?” “We made about $15,000,” came the reply from our eldest son, a keen cryptocurrency investor. “Bitcoin briefly pierced the $3,500 mark – an all-time high. The market cap of the entire crypto market shot up, too… with daily trading volume also rising.

Read More »

Read More »

Views From the Top of the Skyscraper Index

On a warm Friday Los Angeles morning in spring of 2016, we found ourselves standing at the busy corner of Wilshire Boulevard and South Figueroa Street. We were walking back to our office following a client wire brushing for events beyond our control. But we had other thoughts on our mind.

Read More »

Read More »

Incrementum Advisory Board Meeting, Q3 2017

The quarterly Incrementum Advisory Board meeting was held last week (the full transcript is available for download below). Our regulars Dr. Frank Shostak and Jim Rickards were unable to attend this time, but we were joined by special guest Luke Gromen of research house “Forest for the Trees” (FFTT; readers will find free samples of the FFTT newsletter at the site and in case you want to find the link again later, we have recently added it to our...

Read More »

Read More »

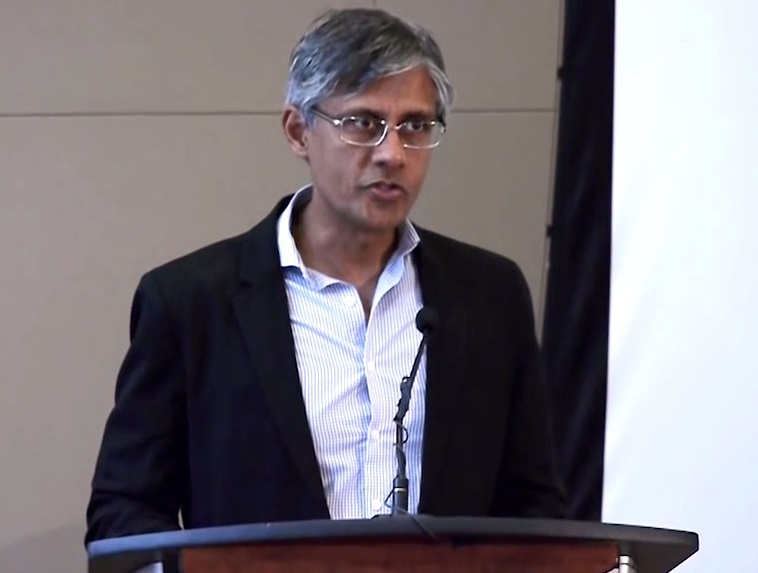

The Myth of India’s Information Technology Industry

When I was studying in the UK in early 90s, I was often asked about cows, elephants and snake-charmers on the roads in India. A shift in public perception— not in the associated reality — was however starting to happen. India would soon become known for its vibran

Read More »

Read More »

The Student Loan Bubble and Economic Collapse

The inevitable collapse of the student loan “market” and with it the take-down of many higher educational institutions will be one of the happiest and much needed events to look forward to in the coming months/years.

Read More »

Read More »

Congress’s Radical Plan to End Illegal Money

What Constitution? One of the many downfalls of being the United States Secretary of the Treasury is the requirement to place one’s autograph on the face of the Federal Reserve’s legal tender notes. There, on public display, is an overt record of a critical defect. A signature endorsement of a Federal Reserve note by the Treasury Secretary represents their personal ratification of unconstitutional money.

Read More »

Read More »

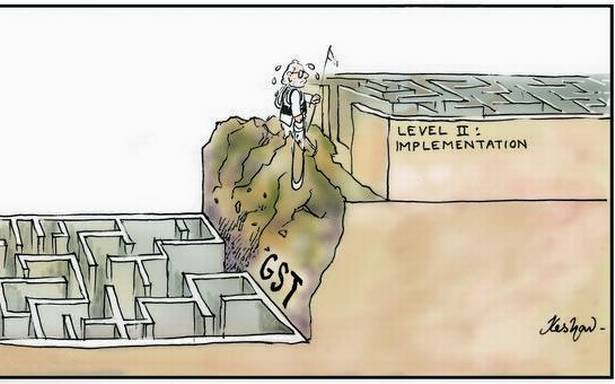

India: The Lunatics Have Taken Over the Asylum

Goods and Services Tax, and Gold (Part XV) Below is a scene from anti-GST protests by traders in the Indian city of Surat. On 1st July 2017, India changed the way it imposes indirect taxes. As a result, there has been massive chaos around the country. Many businesses are closed for they don’t know what taxes apply to them, or how to do the paperwork. Factories are shut, and businesses are protesting.

Read More »

Read More »

Russell 2000: The Dangerous Season Begins Now

Readers are surely aware of the saying “sell in May and go away”. It is one of the best-known and oldest stock market truisms. And the saying is justified. In my article “Sell in May and Go Away – in 9 out of 11 Countries it Makes Sense to Do So” in the May 01 2017 issue of Seasonal Insights I examined the so-called Halloween effect in great detail.

Read More »

Read More »

No “Trump Bump” for the Economy

POITOU, FRANCE – “Nothing really changes.” Sitting next to us at breakfast, a companion was reading an article written by the No. 2 man in France, Édouard Philippe, in Le Monde. The headline promised to tell us how the country was going to “deblock” itself.

Read More »

Read More »

The Money Velocity Myth

For most financial commentators an important factor that either reinforces or weakens the effect of changes in the money supply on economic activity and prices is the “velocity of money”.

Read More »

Read More »

Work is for Idiots

Disproportionate Rewards. The International Monetary Fund reported an unpleasant outlook for the U.S. economy on Wednesday. The IMF, as part of its annual review, believes the U.S. economic model isn’t working as well as it could to generate shared income growth.

Read More »

Read More »

The Ultimate Regulatory Reform: Abolish Fractional Reserve Banking!

The Trump Administration has presented the first part of its plan to overhaul a number of Wall Street financial regulations, many of which were enacted in the wake of the 2008 financial crisis. The report is in response to Executive Order 13772 in which the US Treasury Department is to provide findings “examining the United States’ financial regulatory system and detailing executive actions and regulatory changes that can be immediately undertaken...

Read More »

Read More »

Pope Francis and Angela Merkel: Enemies of European Civilization

Two of Europe’s greatest contemporary enemies recently got together to compare notes and discuss how they were going to further undermine and destabilize what remains of the Continent’s civilization. Pope Francis and German Chancellor Angela Merkel met on June 17, in the Vatican’s Apostolic Palace to discuss the issues which will be raised at a Group of 20 summit meeting in Hamburg, from July 7-8.

Read More »

Read More »

Quantitative Easing Explained

We have noticed that lately, numerous attempts have been made to explain the mechanics of quantitative easing. They range from the truly funny as in this by now ‘viral’ You Tube video with two robotic teddy-bears discussing the Fed chairman’s qualifications (‘my plumber has a beard too’), to outright obfuscation such as the propagation of this ‘Bernanke explains he’s not printing money, it’s just an asset swap‘ notion.

Read More »

Read More »

Recession Watch Fall 2017

One Ear to the Ground, One Eye to the Future Treasury yields are attempting to say something. But what it is exactly is open to interpretation. What’s more, only the most curious care to ponder it. Like Southern California’s obligatory June Gloom, what Treasury yields may appear to be foreshadowing can be somewhat misleading.

Read More »

Read More »

The Attack on Workers, Phase II

It’s been a long row to hoe for most workers during the first 17 years of the new millennium. The soil’s been hard and rocky. The rewards for one’s toils have been bleak.For many, laboriously dragging a push plow’s dull blade across the land has hardly scratched enough of a rut in the ground to plant a pitiful row of string beans. What’s more, any bean sprouts that broke through the stony earth were quickly strangled out by seasonal weeds....

Read More »

Read More »

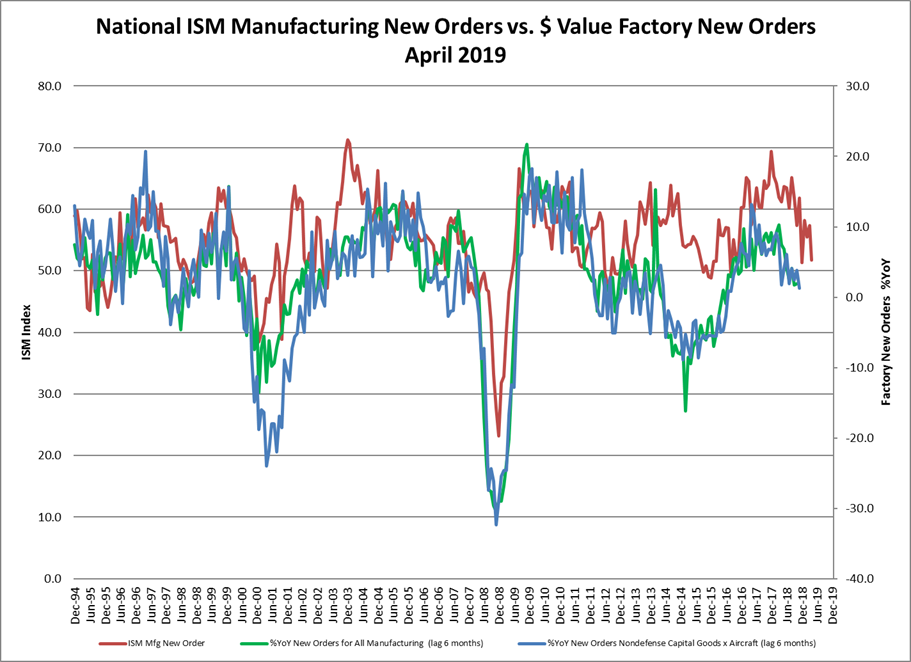

Moving Closer to the Precipice

The decline in the growth rate of the broad US money supply measure TMS-2 that started last November continues, but the momentum of the decline has slowed last month (TMS = “true money supply”). The data were recently updated to the end of April, as of which the year-on-year growth rate of TMS-2 is clocking in at 6.05%, a slight decrease from the 6.12% growth rate recorded at the end of March.

Read More »

Read More »