Disproportionate RewardsThe International Monetary Fund reported an unpleasant outlook for the U.S. economy on Wednesday. The IMF, as part of its annual review, believes the U.S. economic model isn’t working as well as it could to generate shared income growth. |

|

On the same day, in an unrelated interview on PBS Newshour , billionaire investor Warren Buffett offered a similar outlook:

No doubt, U.S. wealth has become exceedingly concentrated into a very small number of hands over the last 40 years. At the same time the middle class has been hollowed out into a shell of its former self. Wages have stagnated. Well-paying jobs that could support a family on a single income have disappeared. On the other hand, asset prices, like stocks and real estate, have gone sky high. These increases in asset price have served to magnify wealth at the upper end of the wealth spectrum while pricing out everyone else, particularly millennials with entry level incomes and massive student loan debt. Certainly, asset prices will crash again like in 2000-02 and 2007-09. But this won’t do anything to balance out middle class incomes. What to do about it? Both the IMF and Buffett offer several recommendations… |

The homely sage is known for frequently complaining that he “doesn’t pay enough in taxes”. But nothing would be easier than to cut the IRS a check voluntarily. We’re sure they would gladly take his money. Funny enough, after realizing that he couldn’t take the loot with him to the grave, Buffett decided not to trust the State with his moolah after all – instead he gave it away to a private foundation. That is exactly how it should be. Zthroughout history many of America’s self-made rich – including the much bemoaned “robber barons” of the Gilded Age – were well-known for their generous philanthropy. Throwing money into the insatiable maw of the State so that politicians can waste it would be utterly insane, which is why Buffett has presumably avoided doing so to the best of his legal possibilities for his entire life (we have little doubt he and his company employ an army of accountants and tax consultants to make sure of that). So when he publicly complains that he doesn’t pay enough in taxes, he probably means to say that you don’t pay enough. [PT] |

Insider Claims to the PieThe clever fellows at the IMF identified with careful detail and delicate precision how to go about fixing the U.S. economy to “ensure a broad-based improvement in living standards.” Their recommendations even include the “need to incorporate reforms on multiple, macro-critical fronts.” We’re not quite sure what that all means. Fortunately, the IMF dumbed it down for us into a single sentence synopsis of what’s needed to improve living standards across the income spectrum:

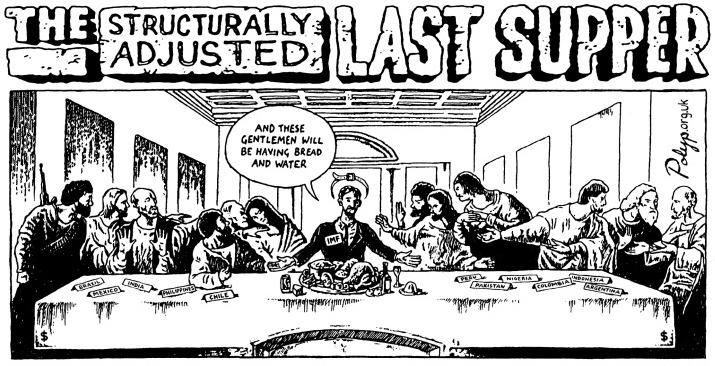

Piece of cake, right? A splash of this. A dash of that. Before you can say Jack Robinson the policy makers have mixed up just the right policy elixir. Higher living standards for all are attainable in our time. Yet this makes the erroneous assumption that Congress will snub its individual commitments to lobbyists and special interests. These commitments, remember, include applications of massive amounts of lard to all efforts at tax reform, education improvements, regulations, spending allocations, and immigration and welfare policy. For every reform effort, there are armies of special interests that have already bought a claim to a piece of the pie. Instead of streamlining persistent drags on the economy, government reforms increase them. The insiders get their bread buttered on both sides and the politicians get their campaigns financed. The broad populace – that’s you – is left paying for programs that don’t work, which the country can’t afford. The reality is, the recommendations offered by the IMF are impossible for the U.S. government of the early 21st century to execute. And, as elaborated below, they are also pointless. |

|

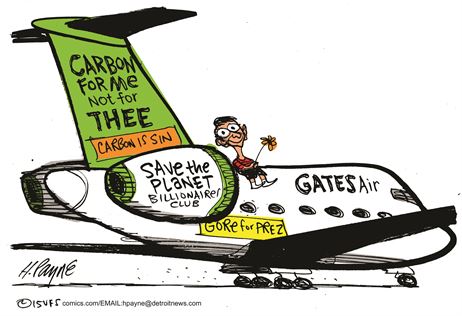

Work is for IdiotsBuffett’s recommendations, on the other hand, are more lofty. Specifically, Buffett wants rich people to give their money away. In fact, that’s what he and fellow billionaire Bill Gates are doing. They even co-founded the GivingPledge so that rich people can make a voluntary commitment to give away at least half of their wealth. The goal of the GivingPledge, you see, is not only to help those in need. But to encourage others to do the same. They call it a commitment to philanthropy. Surely, this is a noble cause. Certainly, if you are super rich, it helps flatter your ego. But what good is it, really? |

Uncle Warren outed himself as a bit of a crony capitalist during the GFC if memory serves. He certainly advocated the employment of tax payer money to support companies he had pretty sizable interests in at the time – and he ultimately profited handsomely from the crisis, as a 100% side effect of assorted bail-outs and massive money printing by the Fed. Oddly enough, he has never had anything critical to say about the monetary system – on the contrary, if anything, he has frequently voiced his disdain for the most sound currency known to man. [PT] |

| Does giving people money for nothing help them or handicap them? Moreover, does it correct the inherent injustice perpetrated by misguided, or perhaps sinister, monetary policies which inhibit people from being self-supporting through their own contributions?

When it comes down to it, the IMF’s and Buffett’s recommendations merely rearrange the deck chairs as the Titanic takes on water. Even if they’re executed with flawless perfection these recommendations won’t stop the ship’s hull from filling up and sinking. |

Unfortunately many of today’s self-anointed world improvers are not without their flaws. We have nothing against their charitable efforts as such, but their political agenda is often marred by hypocrisy. And we do of course agree with Matt that hand-outs are not the best help people can be offered. An environment that encourages self-help by making it worthwhile is worth a lot more. [PT] |

| As far as we can tell, a trifecta of offenses has over taken the U.S. economy that debase the rewards of hard work, saving money, and paying one’s way. Plain and simple, central bank fiat money creation, multiplied by commercial banks through fractional-reserve banking, propagates financial and economic chaos.

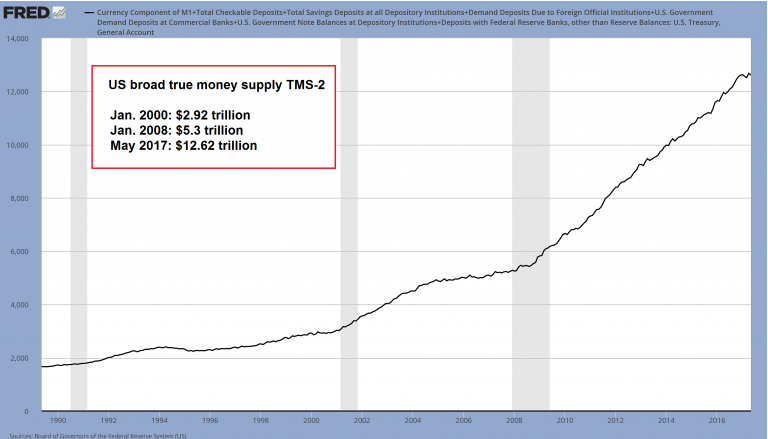

For each new digital monetary credit the banking system creates, value is subtracted from the existing money stock. This has the ill effect of covertly confiscating wealth from people’s wages and savings while inflating asset prices. It also has the ill effect of reducing the idea of ‘an honest day’s work for an honest day’s pay’ to a fool’s tale. Thanks to the Fed, hard work is now for idiots. The dole pays better for more and more people. After that, gambling and gaming schemes offer more opportunity. Until the Fed’s mischief is stopped, and Federal Reserve Notes are replaced with honest money, no IMF policy recommendation, philanthropic commitment, or silly minimum wage increase, will do a lick for rewarding hard work with equitable pay. All efforts otherwise are merely noise. Chart by: St. Louis Fed

Chart and image captions by PT |

A chart our readers should know quite well by now – the US true broad money supply TMS-2. There is now 4.32 times more money in the US economy than 18 years ago. It is an apodictic certainty that each money unit is worth a lot less than it would otherwise be. It is by the way irrelevant in this context that consumer prices have risen at a significantly slower pace than the money supply – that only means that they would have declined absent this increase. Consumers still ended up paying a lot more for everything than they should be paying and incomes and savings that are worth less than they should be worth. As an aside, the notion – much-beloved by central bankers – that declining consumer prices are somehow “bad” for the economy is complete balderdash. This can be shown both theoretically and empirically – this is even admitted in the Fed’s own historical studies. [PT] |

Full story here Are you the author? Previous post See more for Next post

Tags: newslettersent,On Economy,On Politics

![An illustration of the little flaw the IMF’s planners have overlooked. This image is a little dated, as the size of the IOU is approaching trillion by now. Other than that, the illustration is timeless. [PT] Cartoon via goldseek.com](https://snbchf.com/wp-content/uploads/2017/07/central-planning.png)