Convocation of the CluelessThe Trump Administration has presented the first part of its plan to overhaul a number of Wall Street financial regulations, many of which were enacted in the wake of the 2008 financial crisis. The report is in response to Executive Order 13772 in which the US Treasury Department is to provide findings “examining the United States’ financial regulatory system and detailing executive actions and regulatory changes that can be immediately undertaken to provide much-needed relief.”* In release of the first phase of the report, Treasury Secretary Steven T. Mnuchin stated:

Some of its highlights include:

|

|

|

Not surprisingly, most of the banking industry expressed support for the report, critics (mostly Democrats) pointed out that it would lead to the type of practices that produced the 2008 panic in the first place. Both opponents and those in favor as well as the clueless financial press fail to grasp the underlying cause of not only the recent crisis, but the majority of those which have occurred for the past century.

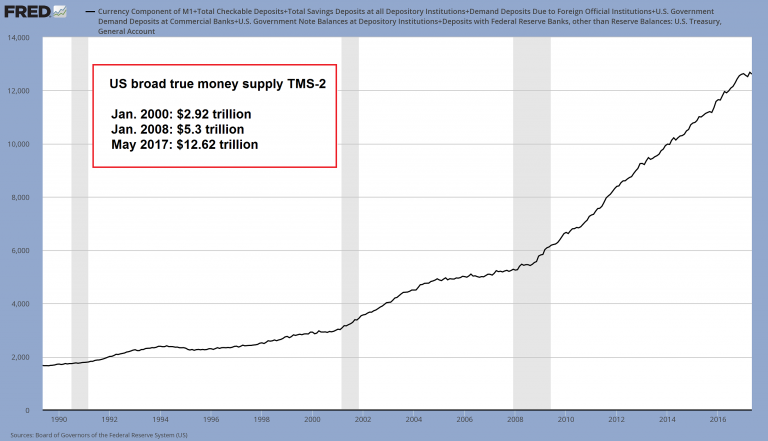

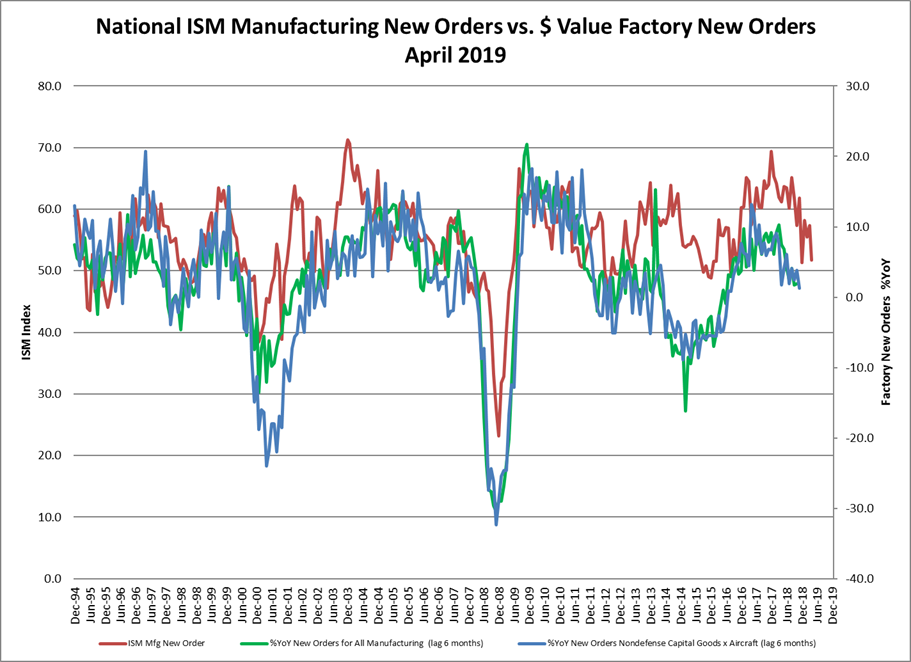

The broad true US money supply since 1988. Clearly, there is not enough inflation just yet… still, don’t you feel richer already looking at this? There is this huge pile of money, which has increased by 332% since the year 2000 alone. Some people are probably wondering where it all came from, and who has got it. And what does “getting” any of it even mean when there is now 4.32 times as much money in the economy than existed 17 years ago? Of course, only deplorables would think of such petty questions… the most important thing is that the banking system is hale and hearty again! As Hank Paulson said in July of 2008 (right after Indymac Bank failed): “It’s a safe banking system, a sound banking system. Our regulators are on top of it. This is a very manageable situation.” And sure enough, all it took was a little bit of fudging with accounting rules and pressing the |

US Broad True Money Supply, 1990 - 2017 |

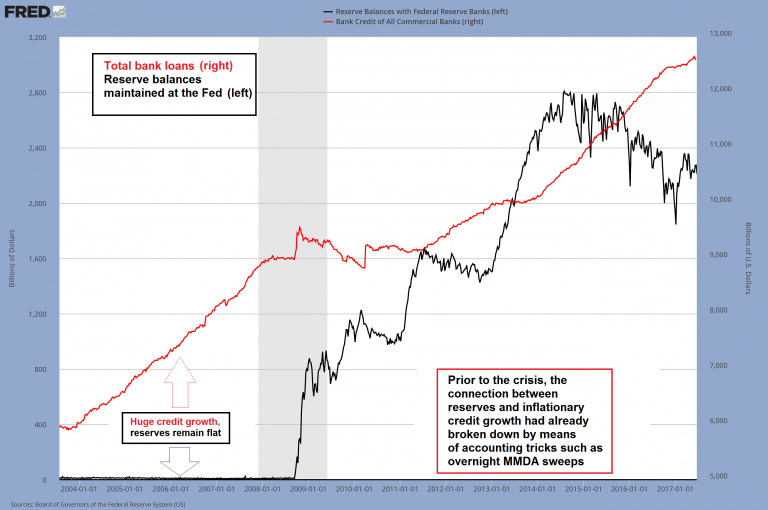

A Ruinous PracticeQuite simply: the fundamental cause of the 2008 financial crisis was fractional-reserve banking (FRB). FRB is the practice whereby banks keep a “fraction” of the funds deposited by customers in their vaults lending out the rest at interest and “profit.” Banks are thus inherently unstable since if all depositors came at once and demanded their money (a “bank run”), banks could not be able to redeem their deposits. Moreover, FRB encourages banks to engage in exceedingly speculative and risky behavior which creates unsustainable bubbles throughout the economy. This chart depicts bank reserves deposited with the Federal Reserve (black line, left hand scale) and total bank credit outstanding (red line, right hand scale). We want to draw your attention to the period before the “great financial crisis” (which ended with the Fed printing money directly in such jaw-dropping quantities that both bank reserves and deposit money soared into the blue yonder). As you can see, the fractionally reserved banking system was no longer constrained by reserve requirements. It expanded credit at warp speed, while reserves flat-lined at negligible levels. This was made possible by so-called “sweeps”, with banks reclassifying demand deposits by sweeping them overnight into money market deposit accounts (MMDAs), where they masqueraded as savings deposits. This fraud on top of a fraud was aided and abetted since 1995 by the vigilant regulators whom Mr. Paulson was praising so fulsomely in 2008 just before the excrement collided with the speed fan. The practice obviously turned out to be slightly problematic in 2007-2009. Readers who want to acquaint themselves with the workings, the history and the legal and economic problems posed by the fractionally reserved banking system from the bottom up should check out “The Problem of Fractional Reserve Banking – Part 1, Part 2 and Part 3”. As we inter alia point out there, the privilege enjoyed by banks flies into the face of Western legal tradition since antiquity (which should be no surprise, since it flies into the face of logic as well). |

Reserve Balances and Total Bank Loans, January 2004 - January 2017 |

|

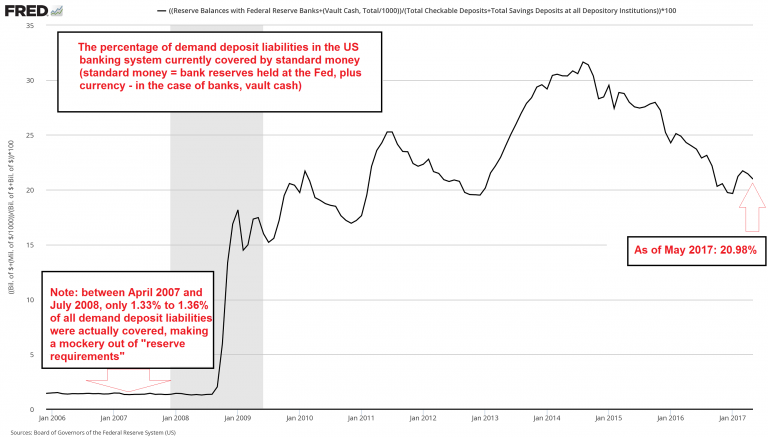

The nation’s central bank, the Federal Reserve, was created by the banksters and politicos to enshrine this immoral and economically ruinous practice into the heart of the American financial landscape. Any “reform” of Wall Street’s financial practices that does not address FRB by doing away with it and the institution (the Fed) which enables it to exist, is doomed. The banks in collusion with the Fed are able to expand the money supply through this process while enriching the banksters’ balance sheet. On the macro level, the creation of money through FRB is the genesis of the destructive boom-bust cycle. This is why banks and the entire financial system are so prone to reoccurring crisis and no regulation, reform, or Treasury Department “findings,” can make such a system “stable.” The only true reform is to abolish FRB and establish a monetary order that requires all financial institutions to keep 100% reserves of depositors’ assets. This chart shows the percentage of the US banking system’s deposit liabilities that are actually covered by standard money. Money substitutes that are not covered are so-called fiduciary media, also known as circulation credit. The term fiduciary media implies that depositors trust they will be among the first through the doors when a bank run begins, as there will be nothing left for those coming later. As this chart illustrates, the percentage of covered money substitutes has increased substantially as a result of “QE”. Currently only approximately 79% of the banks’ deposit liabilities consist of fiduciary media. Just before the beginning of the crisis, the “backing” of these liabilities amounted to a mere 1.33-1.36%, i.e., between 98.64% to 98.67% of all demand deposits were basically just numbers in accounts – money the banks did not have available (since 100% should be available “on demand” according to the contractual stipulations governing sight deposits, this percentage should be considered misappropriated funds). It is no surprise that banks immediately stopped trusting each other when the crisis began. |

Covered Money Substitutes in the Banking System Percentage, January 2006 - June 2017 |

| The Treasury Department’s recommendations are mere window dressing by the very banksters whose opulent livelihoods are predicated on FRB. The elimination of FRB would go beyond a beneficial financial revolution, but would affect the foreign policy of the USSA. Without the ability to create money via FRB, the murderous American Empire could simply not exist, nor would the nation’s draconian domestic security state. With his selection of crony capitalists and members of Goldman Sachs to his economic team, it is apparent that President Trump does not understand the true nature of the nation’s financial woes or what precipitated the last financial crisis and what will assuredly lead to a far bigger mess down the road. If he did, his next Executive Order would be to implement steps and procedures to eliminate the scourge of fractional reserve banking forever.

It started in medieval times already. “Where’s my money, dude?” “Why, I lent it out…”. As an aside, in the past there were indeed banks that operated with a 100% reserve on sight deposits, and contrary to the assertions often made by supporters of FRB, this did in no way retard economic progress – on the contrary. As might be expected, these principles were thrown overboard on the behest of governments eager to wage war. One bank in Europe that famously kept full cover for all demand deposits was the Bank of Amsterdam. This worked excellently for 170 years (beginning in 1609). As we noted in Part 1 of our series of articles on fractional reserve banking: “[D]uring the period of the bank’s operation as a 100% reserved bank, Amsterdam was widely recognized as one of the wealthiest cities of Europe, which sort of contradicts the alleged ‘necessity’ of fractional reserves to ‘grease the wheels of commerce’.” |

Full story here Are you the author? Previous post See more for Next post

Tags: newslettersent,On Economy

1 comment

Donna Bradshaw

2020-03-23 at 09:53 (UTC 2) Link to this comment

https://www.federalreserve.gov/monetarypolicy/reservereq.htm

They abolished it.