Tag Archive: On Economy

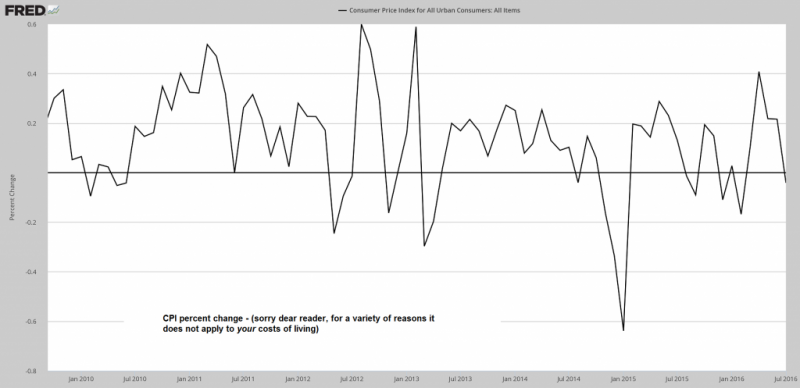

Yarns, Mysteries, and the CPI

Several ill-defined economic data points were unveiled this week. Namely, the Labor Department’s July consumer price index report. According to the government data, on whole, consumer prices for the month didn’t change one iota. In reality, the CPI is so distorted and disfigured it doesn’t really tell us much that’s useful. Empirical experience and common sense are much better indicators of inflation and deflation. What’s more, you don’t have...

Read More »

Read More »

Should we Be Concerned About the Fall in Money Velocity?

A fall in the US velocity of money M2 to 1.44 in June from 1.51 in June last year and 2.2 in May 1997 has alarmed many experts. Note that the June figure is the lowest since January 1959.

Read More »

Read More »

Does the UK Need Even More Stimulus?

“We are all Keynesians now, so let’s get fiscal.” This is one view according to Ambrose Evans-Pritchard from The Telegraph who believes the time is right for the UK government to loosen its fiscal stance. He suggests that the “Bank of England has done everything possible under the constraints of monetary orthodoxy to cushion the Brexit shock. It is now up to the British government to save the economy, and the sooner the better,” — argues the...

Read More »

Read More »

Retail Snails

Second Half Recovery Dented by “Resurgent Consumer”. We normally don’t comment in real time on individual economic data releases. Generally we believe it makes more sense to occasionally look at a bigger picture overview, once at least some of the inevitable revisions have been made. The update we posted last week (“US Economy, Something is Not Right”) is an example.

Read More »

Read More »

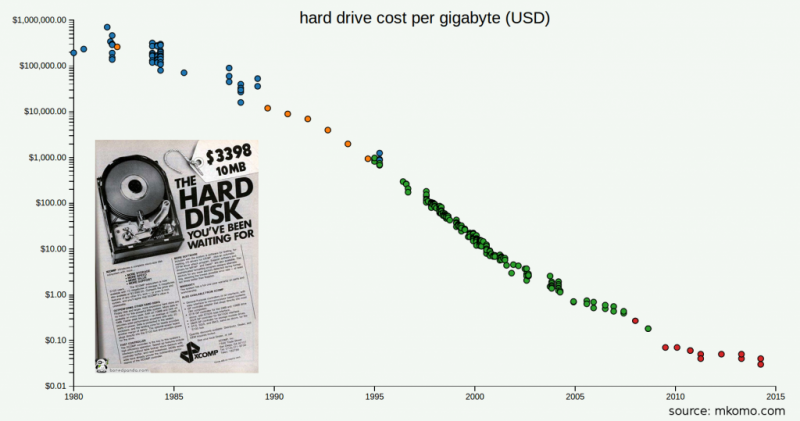

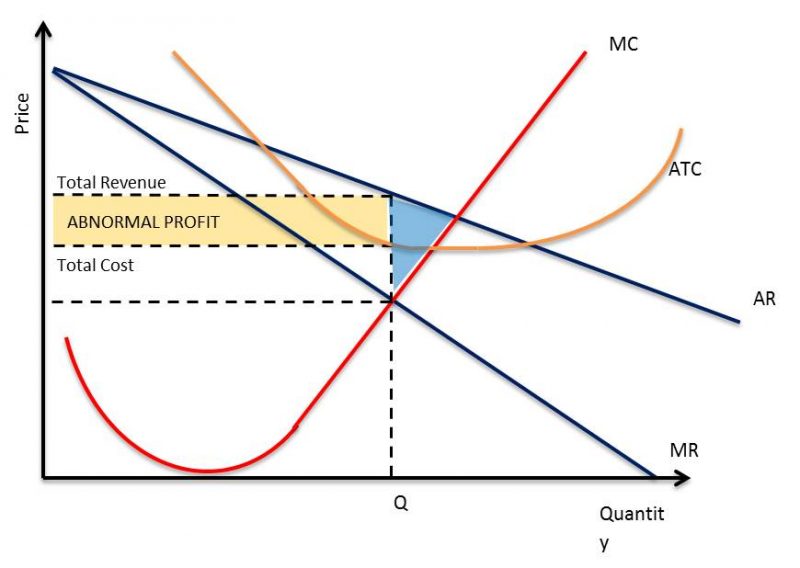

The Great Stock Market Swindle

Finding and filling gaps in the market is one avenue for entrepreneurial success. Obviously, the first to tap into an unmet consumer demand can unlock massive profits. But unless there’s some comparative advantage, competition will quickly commoditize the market and profit margins will decline to just above breakeven.

Read More »

Read More »

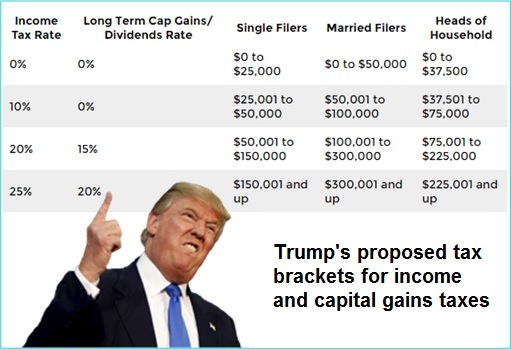

Trump’s Tax Plan, Clinton Corruption and Mainstream Media Propaganda

OUZILLY, France – Little change in the markets on Monday. We are in the middle of vacation season. Who wants to think too much about the stock market? Not us! Yesterday, Republican presidential candidate Donald Trump promised to reform the U.S. tax system.

Read More »

Read More »

Real vs. Nominal Interest Rates

Calculation Problem. What is the real interest rate? It is the nominal rate minus the inflation rate. This is a problematic idea. Let’s drill deeper into what they mean by inflation. You can’t add apples and oranges, or so the old expression claims. However, economists insist that you can average the prices of apples, oranges, oil, rent, and a ski trip at St. Moritz.

Read More »

Read More »

The Fabian Society and the Gradual Rise of Statist Socialism

The Brexit referendum has revealed the existence of a deep polarization in British politics. Apart from the public faces of the opposing campaigns, there were however also undisclosed parties with a vested interest which few people have heard about. And yet, they have been instrumental in transforming Great Britain into a State based on the principles of democratic socialism.

Read More »

Read More »

Jailing Banksters Will Not Resolve the Economic Crisis

Meet the scapegoats! Three Irish bankers sent to jail: former finance director at the failed Anglo Irish Bank, Willie McAteer (42 months); former Irish Life and Permanent Bank Chief Executive Denis Casey (33 months); and former head of capital markets at the Anglo Irish Bank, John Bowe (24 months).

Read More »

Read More »

Why Americans Get Poorer

OUZILLY, France – Both our daughters have now arrived at our place in the French countryside. One brought a grandson, James, now 14 months old. He walks along unsteadily, big blue eyes studying everything around him. He adjusted quickly to the change in time zones. And he has adjusted to the French culture, too – he likes gnawing on a piece of tough local bread. But when she has trouble getting the little boy to sleep, our daughter asks Grandpa for...

Read More »

Read More »

Should the Government Give Us Infrastructure?

“Bad” Monopolies? An argument against absolutely free markets comes up often. What about so-called natural monopolies? So-called infrastructure projects (e.g. sewage plants) have high barriers to entry, and are a challenge to true competition.

Read More »

Read More »

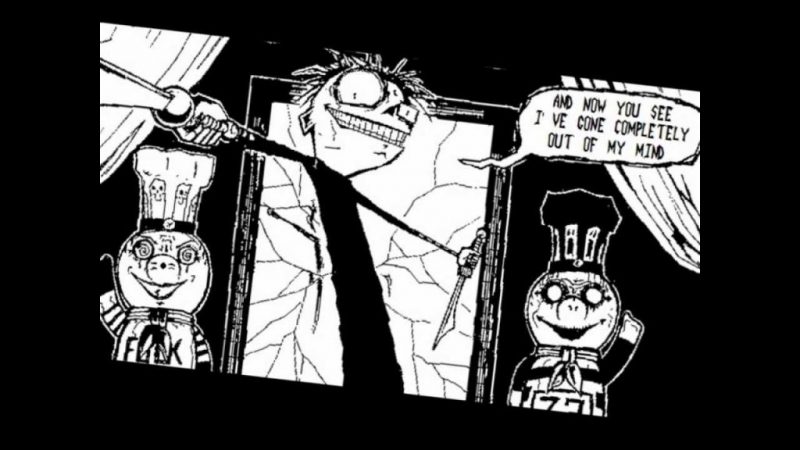

Visions of Tomorrow from the Permanently High Plateau

Mad as a Hatter. Somewhere, someone first said “bull markets don’t die of old age.” We suppose this throwaway phrase was first uttered in a time and place much like today. That is, in the midst of a protracted bull market where stock prices had detached from the assets and earnings of companies their shares represent claim to.

Read More »

Read More »

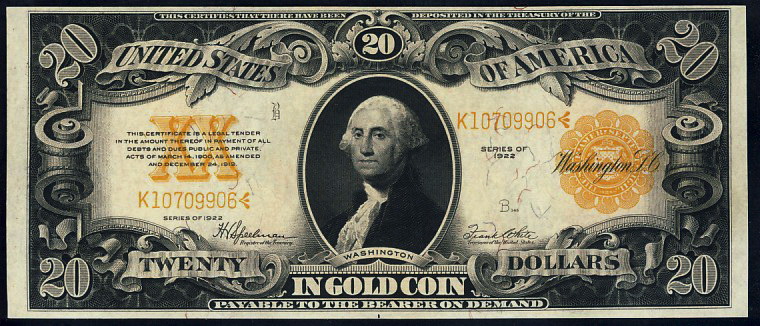

Unsound Money Has Destroyed the Middle Class

DUBLIN – When you start thinking about what money is and how it works, you face isolation, shunning, and possible incarceration. The subject is so slippery – like a bead of mercury on a granite counter top – you become frustrated… and then… maniacal. You begin talking to yourself, because no one else will listen to you. If you are not careful, you may be locked up among the criminally insane.

Read More »

Read More »

More Signs the End is Nigh

Hyperventilating Minds “What has been will be again, what has been done will be done again; there is nothing new under the sun,” explained Solomon in Ecclesiastes, nearly 3,000 years ago. Perhaps the advent of negative yielding debt would have been cause for Solomon to reconsider his axiom. We can only speculate on what his motive would be.

Read More »

Read More »

The Central Planning Virus Mutates

Readers are probably aware of recent events in Japan, the global laboratory for interventionist experiments. The theories of assorted fiscal and monetary cranks have been implemented in spades for more than a quarter of a century in the country, to appropriately catastrophic effect.

Read More »

Read More »

The Day They Killed the Dollar

LAS VEGAS – It was 113 degrees outside when we rolled through Baker, California, a few days ago. We drove along in comfort, but our sympathies turned to the poor pilgrims who made their way to California in covered wagons. How they must have suffered!

Read More »

Read More »

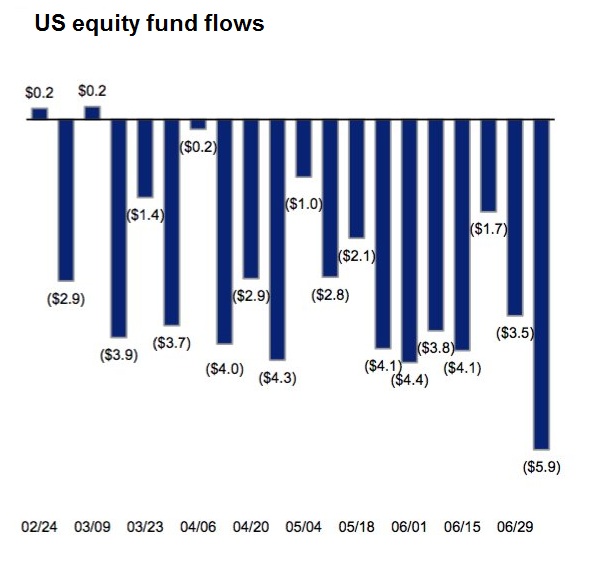

Three-Ring Circus

Speculator’s Market LOS ANGELES – Stocks were up again… Whoa! Hold on just a cotton-picking minute. Honest investors are getting out of the stock market. There have been net withdrawals of $80 billion from U.S. equity funds so far this year. Who’s buying?

Read More »

Read More »