Crackpot SchemesPOITOU, FRANCE – “Nothing really changes.” Sitting next to us at breakfast, a companion was reading an article written by the No. 2 man in France, Édouard Philippe, in Le Monde. The headline promised to tell us how the country was going to “deblock” itself. But upon inspection, the proposals were the same old claptrap about favoring “green” energy… changing the tax code to reward one group and punish another… and spending more money on various humbug initiatives. Subsidized green energy scams are mainly creating eyesores – other than that, they add up to nothing but cronyism writ large. After the one of the biggest solar company bankruptcies ever happened in Spain, a detailed economic study found that for every subsidized renewable energy job the government “created” (at a cost of nearly $2 million per job!) 2.2 jobs were lost elsewhere. It is a good bet that the math isn’t much different elsewhere. To add insult to injury, there is precisely zero evidence that carbon emissions are reduced by even one iota due to these efforts. It is an apodictic certainty that no economy can possibly be “rescued” by the subsidization of this nonsense. There is a widespread belief in government circles that “economic growth” can somehow be conjured up by bureaucrats. That is a costly error that increasingly endangers the future of Western civilization. |

|

| Philippe claims, for example, that France will “invest” $50 billion in job training programs, new industries, and infrastructure. The idea behind it, although not stated expressly, is that a brighter future is out there somewhere, and that France’s politicians and bureaucrats will do a better job of going to meet it than the people themselves.

“Just like the U.S.,” our American companion continued. In order to “invest” $50 billion, the feds have to get the money from somewhere. Where? They earn no money. They can only get funds by taking them away from others. Tax it. Or borrow it. Either way, the resources used to build a new road or hire a new person must be taken away from other plans and programs set in motion by other people, who came by the resources honestly. The only possible way in which the economy, or the people as a whole, could benefit from shuffling resources from private use to public use would be if the feds were somehow better resource allocators. But the proposition is laughable. People invest their resources in many different ways. One wants a new car. Another prepares for his retirement. Still another remodels his home, moving his refrigerator closer to the TV screen so he won’t miss anything when getting another beer. The feds are completely ignorant about these investments. And completely inconsiderate of them. They just take the resources away… and use them for their own crackpot schemes. |

|

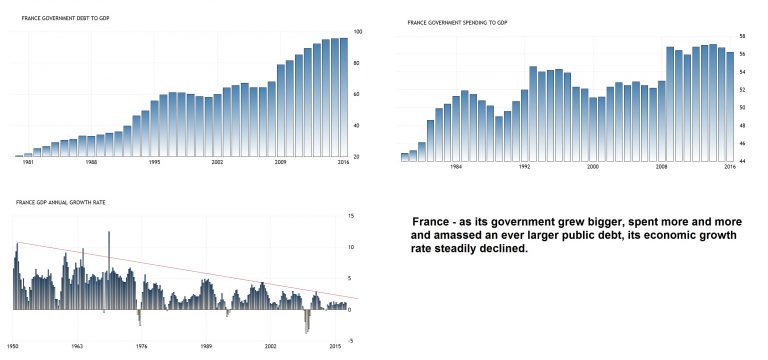

Terrible InvestorsThe feds are always terrible investors. They have little or no experience with real business. They’ve never earned a dime. They have no appreciation for risk; they never put their own money on the line, so they never learn. And their motives are always distorted by their own desire for re-election, payoffs, or political advantage. That is just business as usual. But things DO change. As more and more resources are diverted from bona fide uses and turned over to cronies and zombies, the more the economy creaks and groans. It takes real investment, real work, real innovation and competition, real resources and time to make people better off. In France, as in the USA, the real economy suffers as the claptrap programs and phony “investments” multiply. In the 1950s, 1960s, and 1970s, the French government commanded about 40% of the economy; growth and prosperity boomed. It was the “30 glorious” years. Now, the feds control 60% of the economy – and it limps along with 10% unemployment and negligible real growth. The “success” of big government in France – economic output has dwindled to what is best described as margin of error territory, in parallel with incessant growth in government spending. It seems highly unlikely that even more government intervention in the economy is going to improve the situation. “Just like the U.S.,” our companion repeated. In America, during the 1950s, 1960s and even the 1970s, government spending made up about 25% of the economy. Later, by expanding regulation, the feds got control of new segments of the economy – directing money into medical/pharmaceutical industries, schools and universities, housing (via Fannie Mae, Freddie Mac, and mortgage-interest deductions), and Wall Street (via fake money and cheap credit). The feds now effectively control 60% of the economy – roughly the same percentage as in France. |

France Government Debt, Spending and Growth Rate to GDP, 1981 - 2017(see more posts on France Gross Domestic Product, ) |

No “Trump Bump”And the U.S. economy, too, struggles to make headway. Many people thought they saw an unlikely messiah last year – in the person of Donald J. Trump. Here was a “disruptor” willing to shake up the system. Here was a brawler ready to take on the elite. Taxes and spending would be cut. Regulations, too. The economy would boom. Alas, there is no “Trump bump” for the economy. At least not yet. Writes the New York Times:

“What did I tell you?” asked our companion rhetorically. America’s new president and France’s new chief, Emmanuel Macron, promised something new. A breath of fresh air. But to make any real change, each would have to squeeze the power and money now flowing to the elites. And neither is inclined to do so. “Fresh air?” she asked again, not posing a question but jumping to a conclusion… “What I smell is the same stale gas. And it stinks.” |

Full story here Are you the author? Previous post See more for Next post

Tags: central-banks,France Gross Domestic Product,newslettersent,On Economy,On Politics