Tag Archive: newslettersent

FX Daily, August 30: US Dollar Recovery Extended

The US dollar recovery that began in North American yesterday continued to in Asia and Europe. The geopolitical anxiety sparked by North Korea's missile over Japan subsided. The US response was seen as measured and tempered.

Read More »

Read More »

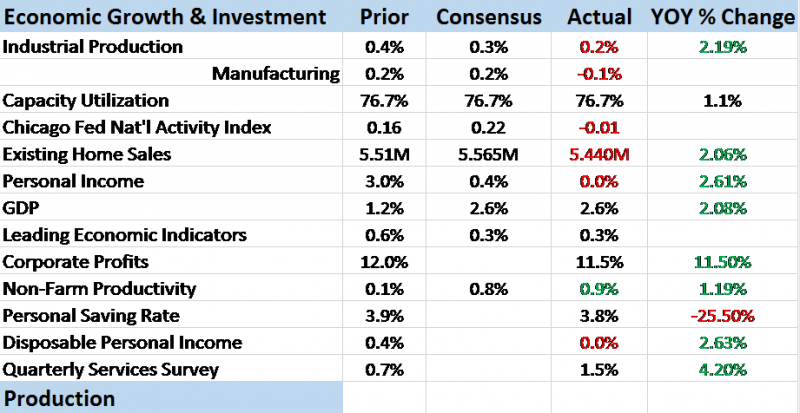

Bi-Weekly Economic Review: Don’t Underestimate Gridlock

The economic reports released since the last update were slightly more upbeat than the previous period. The economic surprises have largely been on the positive side but there were some major disappointments as well. The economy has been doing this for several years now, one part of the economy waxing while another wanes and the overall trajectory not much changed. Indeed, the broad Chicago Fed National Activity index probably says it all, coming...

Read More »

Read More »

Two Overlooked Takeaways from Draghi at Jackson Hole

The consensus narrative from the Jackson Hole Symposium was the Yellen and Draghi used their speeches to argue against dismantling financial regulation and the drift toward protectionism. Many cast this as a push against US President Trump, but this may be too narrow understanding.

Read More »

Read More »

FX Daily, August 29: Dollar Losses Accelerate After North Korea Sends Missile over Japan

A brief period of quiet, which some may have confused with a change in posture, North Korea followed up the weekend's test of three ballistic missiles with what appears to have been an intermediate missile that flew over Japan. South Korea responded with its own symbolic display of force by dropping bombs by the DMZ.

Read More »

Read More »

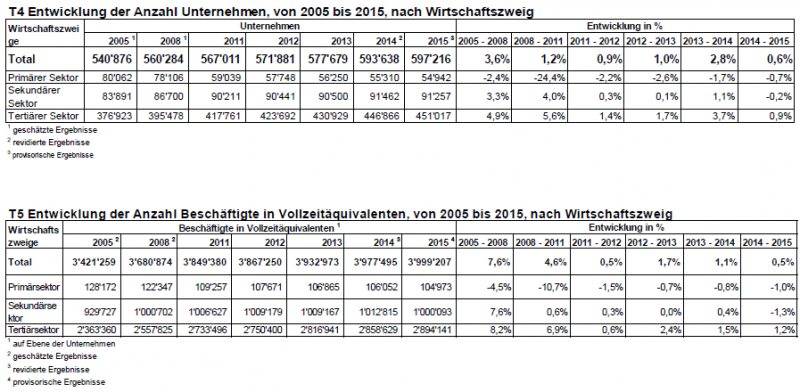

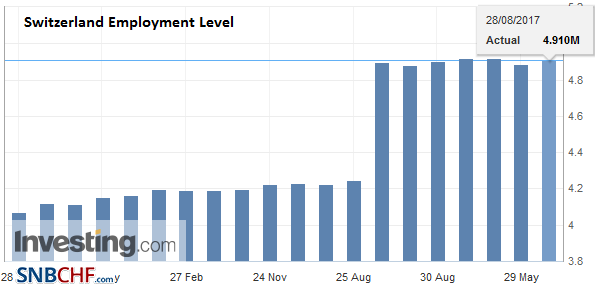

Structural Business Statistics 2015: Employment grows again thanks to the tertiary sector

here were 597,000 enterprises in Switzerland in 2015, i.e. an increase of 3578 entities (+0.6%) in one year. The number of jobs, measured in full-time equivalents, also saw similar growth (+0.5%). These changes were mainly due to the dynamism of very small and very large units in the tertiary sector, according to the latest findings of the structural business statistics (STATENT) from the Federal Statistical Office (FSO)

Read More »

Read More »

Power company Alpiq decides not to sell Swiss hydro assets

Swiss energy concern Alpiq has changed its mind about selling up to 49% of its hydropower portfolio due to a tough market environment. In March 2016, Alpiq declared that it was planning to sell a large share of its hydropower assets to investors, provoking strong reactions in the power sector and media. Hydropower is a central pillar of the Swiss electricity supply – some 60% of Switzerland's energy is produced by water.

Read More »

Read More »

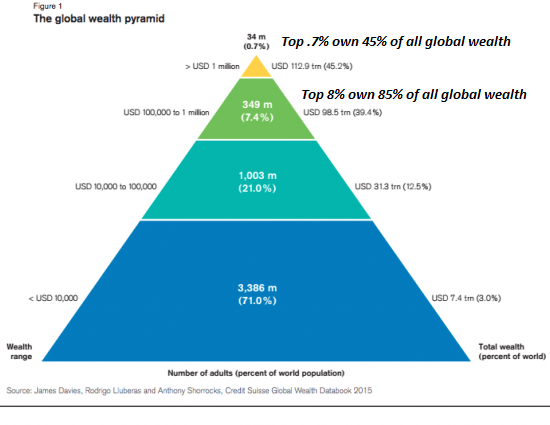

The 5 Steps to World Domination

You don't need an army to achieve World Domination; all you need is enough cheap credit to buy up everything that generates the highest value and/or income.

Read More »

Read More »

FX Daily, August 28: Monday’s Dollar Blues

The US dollar's pre-weekend losses were extended initially in Asia before it recovered sufficiently to give European participant a better selling level. The dollar selling into the shallow bounce reflects the bearish sentiment, which as we see it, was simply fanned by both Yellen and Draghi did not alter the status quo in their Jackson Hole speeches.

Read More »

Read More »

Weekly Speculative Positions (as of August 22): Sterling Bears Press, but Too Much?

The net speculative CHF position has risen from 1.2K short to 2K contracts short (against USD). Speculators continued to amass a significant short sterling position in the futures market. In the CFTC reporting week ending August 22, speculators added 11.7k contracts to the gross short position, lifting it to 107.4k contracts.

Read More »

Read More »

FX Weekly Preview: Three Drivers in the Week Ahead

EMU preliminary August CPI headline rise may not translate into core. US jobs growth is fine; earnings growth is key. Trump's coalition is fraying, and the weekend pardon will not help mend fences.

Read More »

Read More »

Emerging Market: Preview of the Week Ahead

EM FX ended last week on a strong note, buoyed by perceived dovishness from Yellen at the Jackson Hole symposium. However, US jobs data this Friday could test the market’s convictions. Within EM, data are likely to support our view that EM central banks can retain their largely dovish posture into 2018.

Read More »

Read More »

Il y a plus d’esclaves aujourd’hui qu’il n’y en a eu du XVIe au XIXe siècle, par Annie Kelly

« La vie humaine est devenue plus sacrifiable » : pourquoi l’esclavage n’a-t-il jamais rapporté autant d’argent. Une nouvelle étude montre que l’esclavage moderne est plus lucratif que jamais, les trafiquants du sexe engrangeant des bénéfices records.

Read More »

Read More »

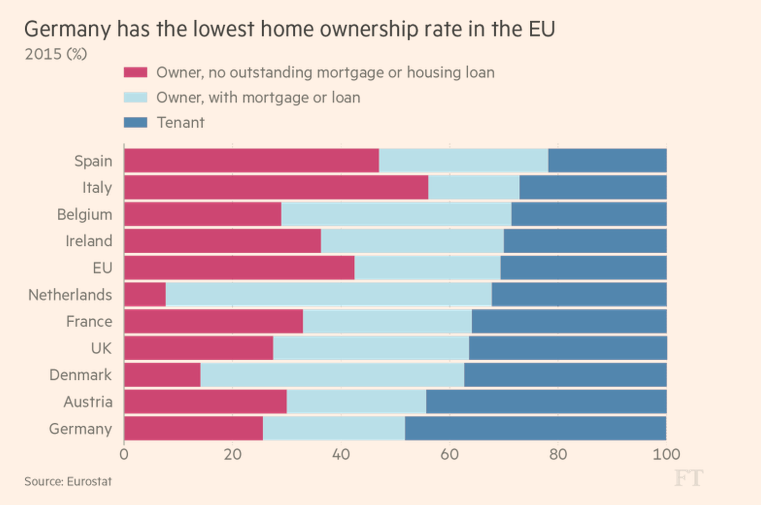

Great Graphic: Home Ownership and Measuring Inflation

Home ownership varies throughout the EU but is overall near US levels. Germany has the lowest home ownership, and Spain has the most. Italy has the least amount of mortgages. US include owner equivalent rents in CPI, the EU does not.

Read More »

Read More »

Parents of murdered au pair get compensation

The parents of a 16-year-old au pair who was murdered in canton Aargau eight years ago have received compensation from the canton in an out-of-court settlement. The authorities have admitted that they made mistakes.

Read More »

Read More »

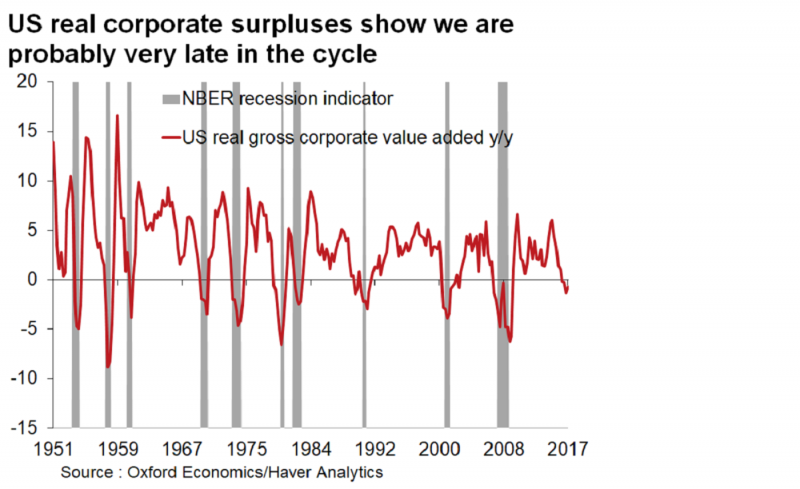

More Noise Than Signal

A number of people have forwarded this Bloomberg article – Wall Street Banks Warn Downturn Is Coming – to me over the last couple of days. That fact alone is probably a good argument to ignore it but I can’t help but read articles like this if for no other reason than to know what the crowd is thinking.

Read More »

Read More »

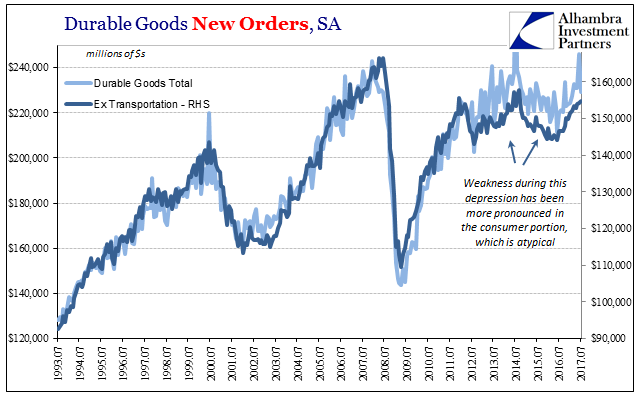

United States Durable Goods In July; Rinse, Repeat

The Census Bureau reported today updated estimates for Durable Goods in July 2017. Quite frankly, nothing has changed so minimal commentary is all that is required. The aircraft anomaly from last month faded, leaving total new orders of $229.2 billion (seasonally-adjusted). That is less than in May before the Boeing surge, and less even than estimated order volume in March 2017.

Read More »

Read More »

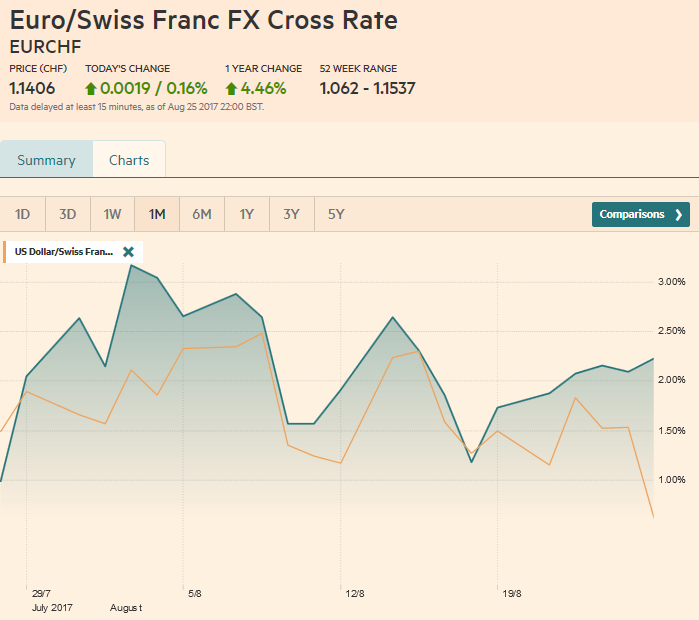

FX Weekly Review, August 21 – August 26: Dollar Loses its Gains Against CHF

The broad technical condition of the dollar deteriorated materially before the weekend. The dollar had some gains versus the franc during the last month, but it lost all during the last days.The EURCHF continues with a 2.5% win for the last month.

Read More »

Read More »