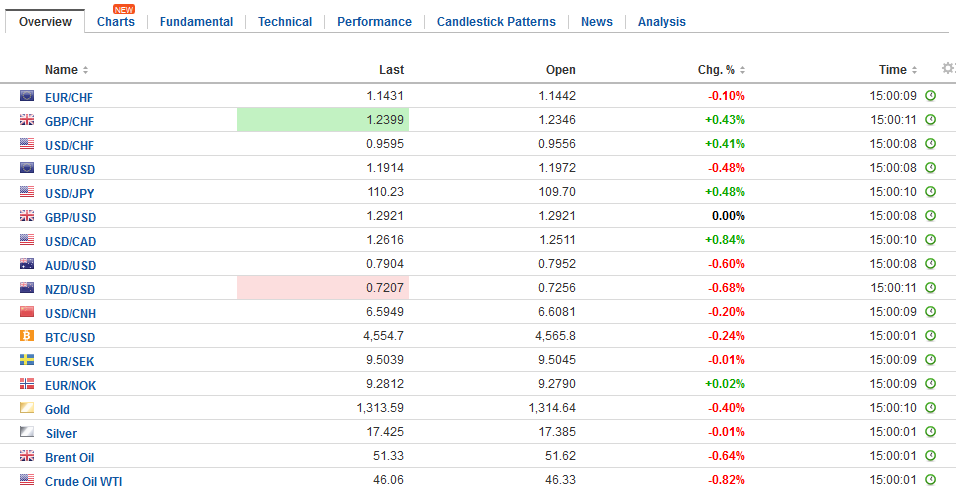

Swiss FrancThe Euro has fallen by 0.09% to 1.1427 CHF. |

EUR/CHF and USD/CHF, August 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe US dollar recovery that began in North American yesterday continued to in Asia and Europe. The geopolitical anxiety sparked by North Korea’s missile over Japan subsided. The US response was seen as measured and tempered. North Korea indicated that the missile test was to protest the annual military exercises of the US, South Korea and other allies in the region. During the military exercises last year, North Korea also protested with a missile launch. Geopolitical tensions often seem to spur a short-lived even if the sharp reaction in the capital markets. However, recall that the dollar was already selling off before the latest developments on the Korean peninsula. The geopolitical developments accelerated the move, and then the profit-taking was triggered. The Australian dollar was among the weakest of the major currencies yesterday, and today it is the only major not weakening against the dollar. Sterling reached almost $1.2980 yesterday before reversing lower and settled on its lows near $1.2915. Selling brought it briefly below $1.29 in early European activity. It has since rebounded toward session highs near $1.2940. Part of the overcrowded euro trade was expressed against sterling and sterling is recovering a bit on the cross after the poked through GBP0.9300 yesterday. Initial support is seen near GBP0.9230. There is a GBP225 mln option struck at $1.29 that expires today. |

FX Daily Rates, August 30 |

| The Dollar Index reached 91.62 yesterday, the lowest level since early 2015. The 91.20 area corresponds to the 50% retracement of the big rally since the middle of 2014. Our constructive strategic outlook for the dollar was fundamentally anchored into divergence theme, which we think is still intact (balance sheet and policy rates have not reached peak divergence). Our more tactical bearish stance on the dollar was, in part, based on the understanding thatthe dollar’s down move this year is a correction to the rally since 2014. A break of the 91.20 area would suggest the risk of a new leg down to the 6.18% retracement, which is found near 88.25.

The long dollar position was crowded at the end of the year, but now formal surveys, some speculative positioning in the futures, anecdotal stories, the way implied vol moves in the options market, all point to the short dollar position as being overcrowded. In terms of time, we have anticipated a better fourth quarter for the dollar, but we are concerned that the US debt ceiling and spending authorization deadlines looming can weigh on the dollar first. The euro closed last week at $1.1924, according to Bloomberg. It has been dipped briefly below $1.1940 today, after reaching $1.2070 yesterday. The 50% retracement of its decline since 2014 is found just below $1.2170. The consensus narrative of the euro’s rally this year emphasizes the disappointment with progress on Trump’s legislative agenda and the softer US inflation data. However, the one factor that does not get its fair due, in our view, is changed the political climate in Europe. Specifically, what signaled in the euro’s move higher was the gap higher opening on April 24 when it became clear that the populist-nationalist wave was going to be turned back in France. |

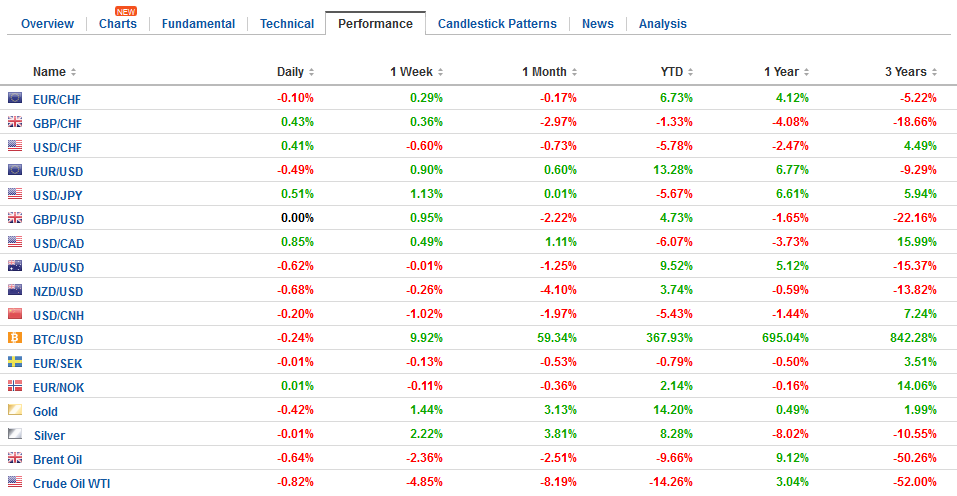

FX Performance, August 30 |

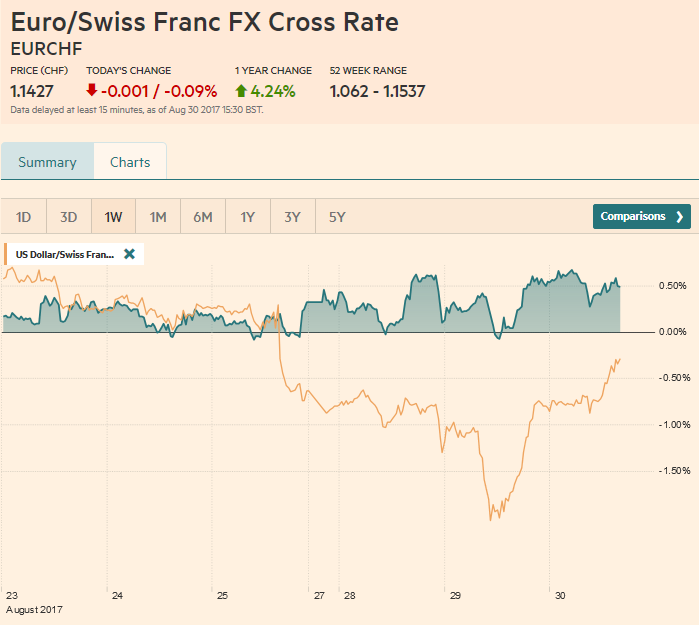

JapanJapan reported a 1.1% rise in July retail sales, well above the 0.3% median forecast. The Japanese consumer has recovered in recent months, and this is clearly helping to support the economy. Auto purchases have been particularly robust and rose for the 12th consecutive month on a year-over-year basis. The dollar staged a big potential key reversal against the yen. It fell sharply to the recent lows and recovered to close above the previous day’s highs. Follow through buying lifted the greenback to nearly JPY110.20 before running out of steam. Support is seen int he JPY109.40-JPY109.50 area. There are large options expiring today struck at JPY109.50 ($825 mln) and JPY110 ($360 mln). |

Japan Retail Sales YoY, Jul 2017(see more posts on Japan Retail Sales, ) Source: Investing.com - Click to enlarge |

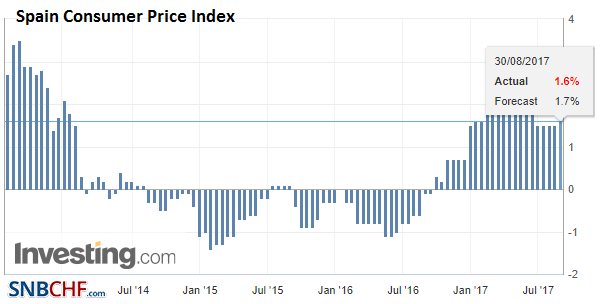

SpainThere is more talk that the strength of the euro could prompt a dovish tapering from the ECB next week. Tomorrow the EMU’s preliminary August CPI will be reported. Today the Spanish and German reports warn of upside risks. Spain’s CPI rose 0.2% in August for a 2.0% year-over-year pace. It was 1.7% in July, after peaking at 3.0% in February. |

Spain Consumer Price Index (CPI) YoY, Aug 2017(see more posts on Spain Consumer Price Index, ) Source: Investing.com - Click to enlarge |

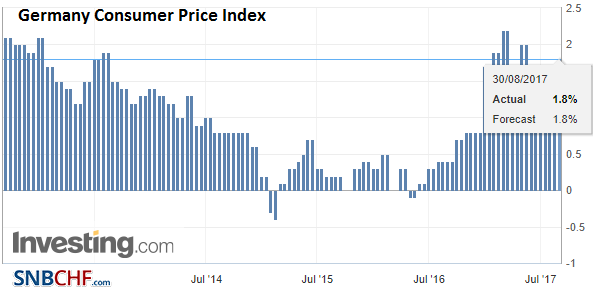

GermanyThe German states have reported firmer inflation figures, and the risk is on the upside of the national report due shortly, where the year-over-year rate is likely to rise from July’s 1.5%. It peaked at 2.2% in February. |

Germany Consumer Price Index (CPI) YoY, Aug 2017(see more posts on Germany Consumer Price Index, ) Source: Investing.com - Click to enlarge |

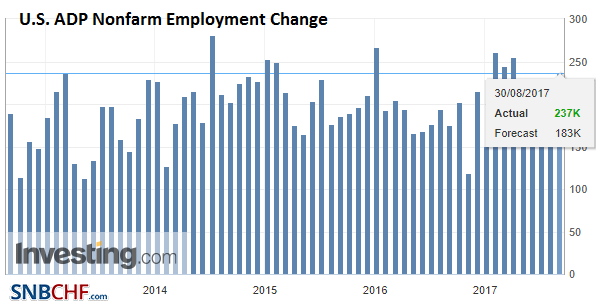

United StatesUS data includes the ADP private sector employment estimate. A small increase from 178k in July is expected. It would not help fine tune expectation for the national report due out at the end of the week but would be seen to remove the downside risks. |

U.S. ADP Nonfarm Employment Change, Aug 2017(see more posts on U.S. ADP Nonfarm Employment Change, ) Source: Investing.com - Click to enlarge |

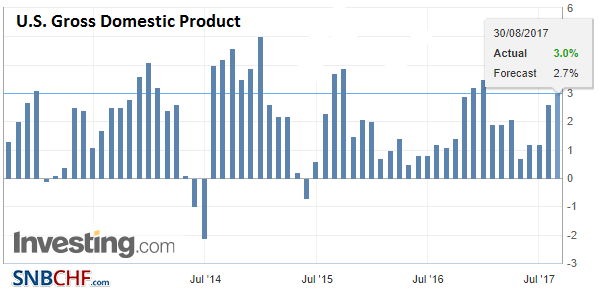

| The US will also report an updated estimate for Q2 GDP. It may have ticked up to 2.7% from 2.6%, helped by a consumer sector that is aided by the continued improvement in jobs and wages. |

U.S. Gross Domestic Product (GDP) QoQ, Q2 2017(see more posts on U.S. Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

| The US reports the Fed’s preferred inflation measure, the core PCE deflator tomorrow. It may have slowed from 1.5% to 1.4%, which would be the lowest since the end of 2015. Such a report could weigh on the dollar through the interest rate channel. |

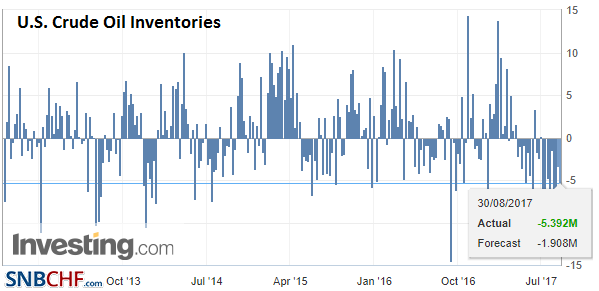

U.S. Crude Oil Inventories , 30 Aug 2017(see more posts on U.S. Crude Oil Inventories, ) Source: Investing.com - Click to enlarge |

Last year, foreign investors sold roughly $100 bln of European equities. This year European equities have been a market favorite, and roughly $30 bln has returned. Yet the equity performance has been disappointing. The Dow Jones Stoxx 600 is up about 2.4% year-to-date. The real return for foreign investors comes from the dollar’s slide. For dollar-based investors, the Dow Jones Stoxx 600 has returned 16.3% this year, compared with a 9.3% return for the S&P 500.

The Dow Jones Stoxx 600 is up about 0.4% in late morning turnover in Europe. It has recovered about half of what it lost yesterday. Real estate and industrials are leading the market higher. The utility sector is the only one lower on the day. Asian markets mostly moved higher. The regional leader, Hong Kong’s Hang Seng, which was up 26.5% for the year before today, tacked on another 1.2%. Korea’s Kospi, which recovered smartly yesterday and closed near its highs, recovered another 0.3% today, though foreign investors were small net sellers.

Canada reports its Q2 current account position. The deficit likely grew. Tomorrow Canada reports Q2 GDP. It is expected to have matched the first quarter pace of 3.7% annualized, and will likely reinforce expectations for the Bank of Canada to hike rates in October.

Graphs and additional information on Swiss Franc by the snbchf team.

Are you the author? Previous post See more for Next postTags: #GBP,#USD,$CAD,$EUR,$JPY,EUR/CHF,Germany Consumer Price Index,Japan Retail Sales,newslettersent,Spain Consumer Price Index,U.S. ADP Nonfarm Employment Change,U.S. Crude Oil Inventories,U.S. Gross Domestic Product,USD/CHF