Tag Archive: newslettersent

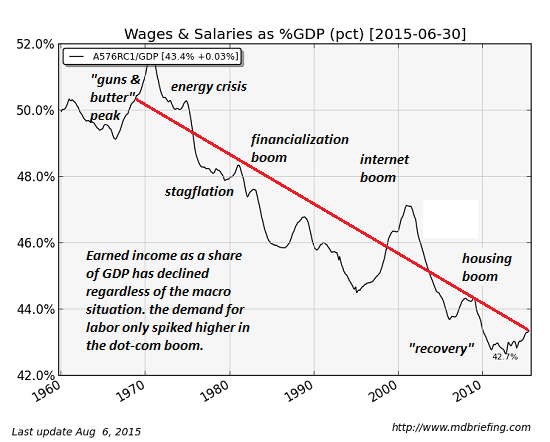

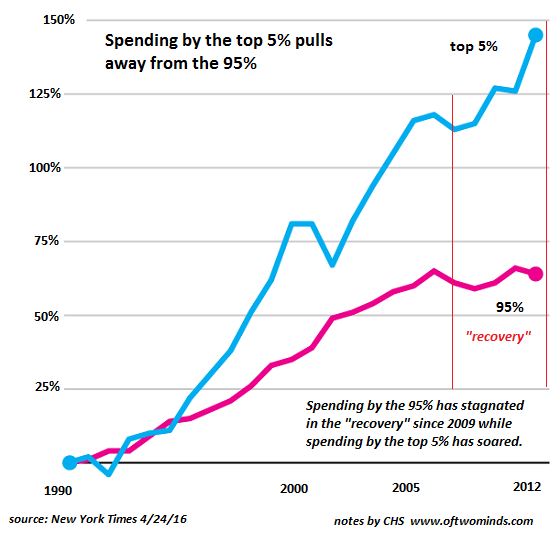

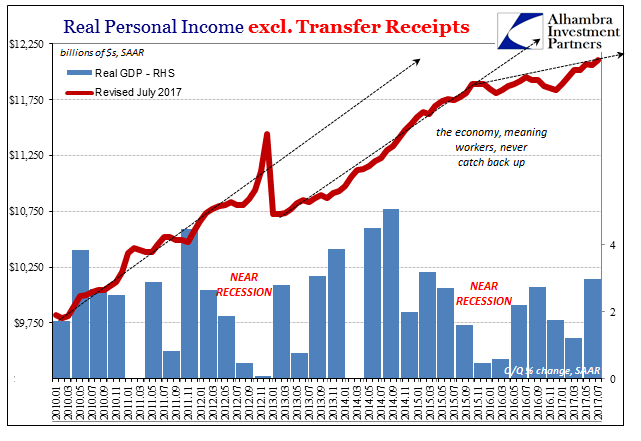

The Real Reason Wages Have Stagnated: Our Economy is Optimized for Financialization

Labor's share of the national income is in freefall as a direct result of the optimization of financialization. The Achilles Heel of our socio-economic system is the secular stagnation of earned income, i.e. wages and salaries. Stagnating wages undermine every aspect of our economy: consumption, credit, taxation and perhaps most importantly, the unspoken social contract that the benefits of productivity and increasing wealth will be distributed...

Read More »

Read More »

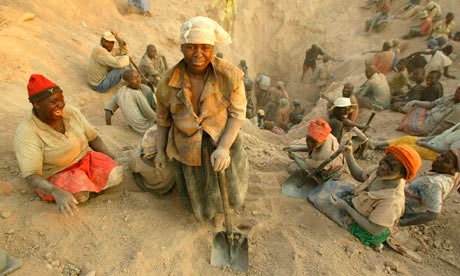

Les «diamants de sang» zimbabwéens circulent librement sur les marchés internationaux. La Tribune

L’ONG britannique Global Witness vient de publier ce 11 septembre un rapport explosif qui met à nu des opérations de détournement des revenus du secteur minier zimbabwéen par l’élite militaire et politique du pays pour financer les opérations répressives du régime du président Mugabe.

Read More »

Read More »

FX Daily, September 15: Short Note Ahead of the Weekend

Sporadic updates continue as the first of two-week business trip winds down. North Korea missile launch failed to have much impact in the capital markets. The missile apparently flew the furthest yet, demonstrating its ability to hit Guam. However, there was not an immediate response from the US. South Korea said it had simultaneously conducted its own drill which included firing a missile into the Sea of Japan (East Sea).

Read More »

Read More »

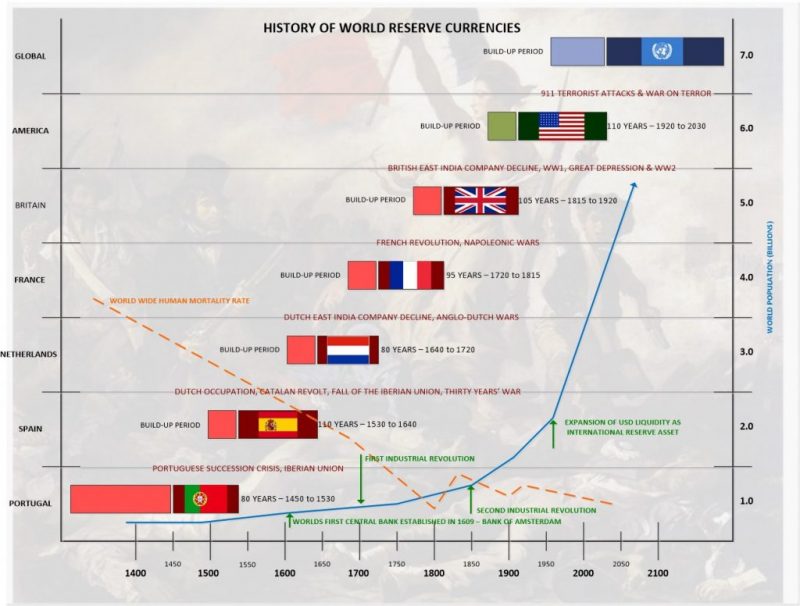

Oil Rich Venezuela Stops Accepting Dollars

President Maduro ” Venezuela will create a basket of currencies to free us from the dollar,”. Oil traders ordered to stop accepting U.S. dollar in exchange for crude oil. Order comes following calls from Russia and China to find alternatives to current reserve system. U.S. Dollar accounts for two-thirds of global trade. Venezuela has over ten-times more oil than United States. Super powers are gradually turning to gold to avoid using world’s main...

Read More »

Read More »

Possible buyer for Air Berlin Swiss subsidiary

A potential buyer has been found for Belair, the Swiss subsidiary of insolvent airline Air Berlin, according to Swiss media reports which cite an internal communication to Belair employees. Belair management wrote that there was at least one offer for the airline, according to the az Nordwestschweiz newspaperexternal link and the Swiss news agency on Friday. Both have seen the communication, which was dated last Tuesday. The name of the airline’s...

Read More »

Read More »

Is the High Cost of Housing Crushing Wages?

The authors' thesis doesn't explain the 47-year downtrend of labor's share of the economy. A provocative essay, Don't Blame the Robots, makes the bold claim that "Housing Prices and Market Power Explain Wage Stagnation." (Foreign Affairs) In other words, the stagnation of the bottom 95% of wages isn't caused by automation or offshoring, but by the crushingly high cost of housing:

Read More »

Read More »

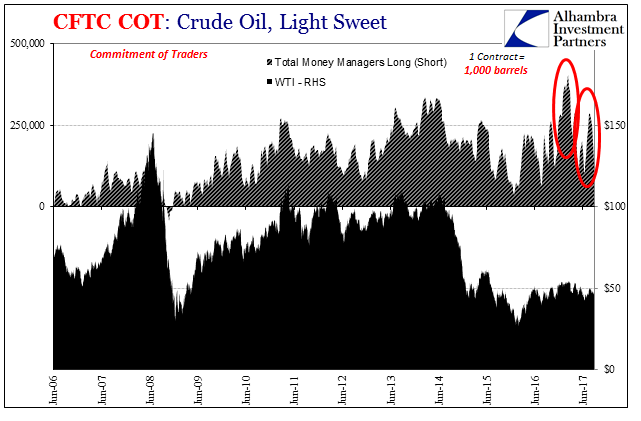

COT Report: Black (Crude) and Blue (UST’s)

Over the past month, crude prices have been pinned in a range $50 to the high side and ~$46 at the low. In the futures market, the price of crude is usually set by the money managers (how net long they shift). As discussed before, there have been notable exceptions to this paradigm including some big ones this year.

Read More »

Read More »

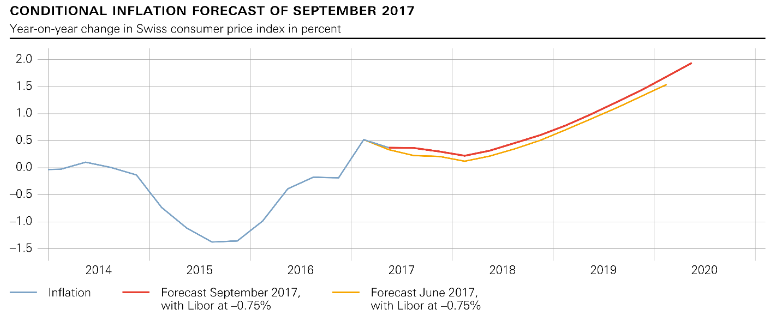

SNB Monetary Policy Assessment September 2017 and Comments

The SNB projects that she will reach her inflation target, shortly under 2% in the medium term, i.e. in 2019/2020. One reason might be the weakening of the Swiss Franc. But she does not prepare for a normalization of her policy: From the history we know that - once the franc is weakening - inflation may rise very quickly.

Read More »

Read More »

FX Daily, September 14: New Trump Tactics Help Greenback and Rates

In the face of much cynicism and pessimism about the outlook for the Trump Administration's agenda, we have repeatedly pointed out the resilience of the system of checks and balances. Many of the more extreme positions have been tempered, either on their own accord, such as naming China a currency manipulator or pulling out of NAFTA or KORUS, or the judiciary branch, such as on immigration curbs, or the legislative branch itself, as in limiting the...

Read More »

Read More »

Swiss Life under scrutiny of US authorities for tax evasion

nsurance firm Swiss Life has announced that it has been approached by the US Department of Justice (DOJ) regarding its cross-border business with US clients. After going after Swiss banks with a vengeance for abetting tax evasion, it appears that it is now the turn of the Swiss insurance industry to attract unfavourable attention from the DOJ. Products called “insurance wrappers” – offered by Swiss Life affiliates – could potentially have aroused...

Read More »

Read More »

Swiss mobile roaming charges – a glimmer of hope

Switzerland’s federal council, the country’s seven-person executive or cabinet, has come up with a plan to cut those exorbitant mobile roaming phone bills that many of us return home to after trips abroad, an experience which hurts even more now roaming charges have been eliminated for EU residents.

Read More »

Read More »

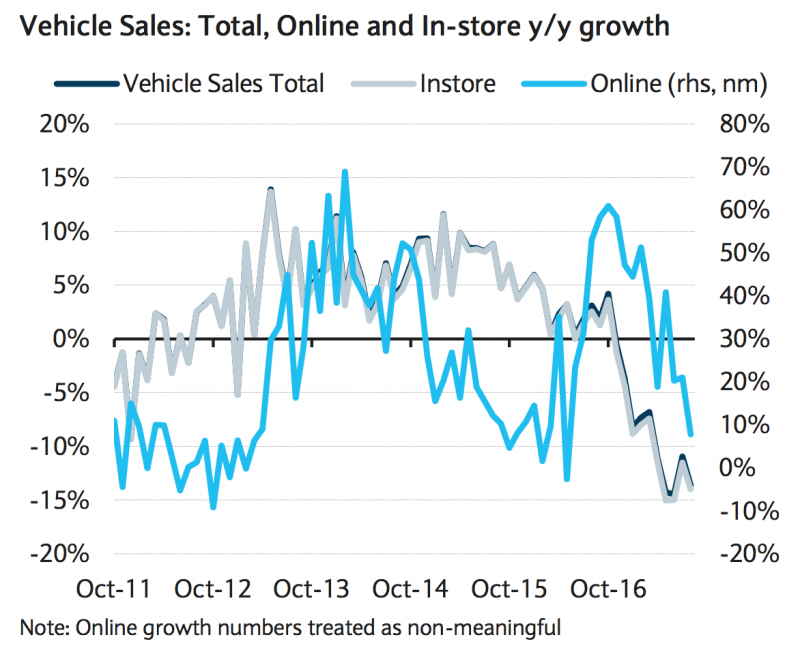

British People Suddenly Stopped Buying Cars

British people suddenly stopped buying cars. Massive debt including car loans, very low household savings. Brexit and decline in sterling and consumer confidence impacts. New cars being bought on PCP by people who could not normally afford them. UK car business has ‘exactly the same problems’ as the mortgage market 10 years ago, according to Morgan Stanley. Bank of England is investigating to make sure UK banks are not overly expose.

Read More »

Read More »

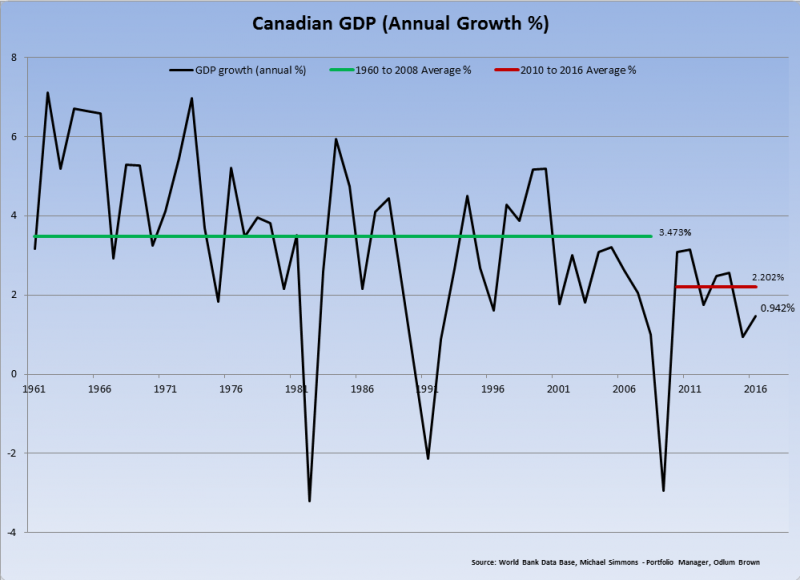

Canada’s RHINO(s)

The Bank of Canada “raised rates” again today, this time surprising markets and economists who were expecting more distance between the first and second policy adjustments. The central bank paid typical lip service to being data dependent. It has a vested interest if you, as any Canadian reader, believe that to be a fact.

Read More »

Read More »

Swiss Producer and Import Price Index in August 2017: +0.6 YoY, +0.3 MoM

The Producer and Import Price Index rose in August 2017 by 0.3% compared with the previous month, reaching 100.0 points (base December 2015 = 100). The rise is due in particular to higher prices for petroleum products and chemical products. Compared with August 2016, the price level of the whole range of domestic and imported products rose by 0.6%.

Read More »

Read More »

FX Daily, September 13: Sterling Shines While Euro Stalls in Front of $1.20

The next leg of the business trip takes me to Frankfurt. Sporadic updates will continue. We have been identifying the $1.3430 area is a reasonable technical target for sterling. It represents the 50% retracement of sterling's losses since the day of the referendum June 2016 when it briefly traded $1.50. Also helping sterling is the unwinding of short cross positions against the euro.

Read More »

Read More »

Fewer planes carry more passengers

Some 52 million passengers took off, landed or transited via Swiss airports last year. But while the number of passengers continues to soar, there are fewer planes in operation than in 2000. In 2016, Switzerland's national airports in Zurich, Geneva and Basel-Mulhouse-Freiburg as well as other regional airports reported a total of 51.8 million passengers (both local and in transit). Since 2000, the number of passengers has increased by 50%,...

Read More »

Read More »

Buy Gold for Long Term as “Fiat Money Is Doomed”

Buy gold for long term as fiat money is doomed warns Frisby. Gold’s “winning streak” will continue in long term. September is traditionally a good month for gold, as we head into the Indian wedding season. “It’s just a matter of time before gold comes good again…” by Dominic Frisby, Money Week. Today folks, by popular demand, we’re talking gold.. It’s had a nice summer run. What now?

Read More »

Read More »

US Export/Import: ‘Something’ Is Still Out There

In January 2016, just as the wave of “global turmoil” was cresting on domestic as well as foreign shores, retired Federal Reserve Chairman Ben Bernanke was giving a series of lectures for the IMF. His topic wasn’t really the so-called taper tantrum of 2013 but it really was. Even ideologically blinded economists like Bernanke could see how one might have followed the other; the roots of 2016 in 2013.

Read More »

Read More »

Forget Tulips & Bitcoin – Here’s The Real Bubble

While the broader market for Swiss stocks has risen modestly this year, one 'entity' has outperformed its peers by such a staggering margin, it has left bamboozled market experts struggling for an explanation. And that company is…the Swiss National Bank. The price of a share in Swiss National Bank in August rose above 3,000 francs ($3,143) for the first time, more than double the level of a year ago, and up 50% since mid-July, as the Financial...

Read More »

Read More »