| While the broader market for Swiss stocks has risen modestly this year, one ‘entity’ has outperformed its peers by such a staggering margin, it has left bamboozled market experts struggling for an explanation.

And that company is…the Swiss National Bank. The price of a share in Swiss National Bank in August rose above 3,000 francs ($3,143) for the first time, more than double the level of a year ago, and up 50% since mid-July, as the Financial Times noted in a story about its performance. Shares of the SNB trade like any other company listed on the Swiss stock exchange, though because of their price liquidity is somewhat thinner. The Swiss cantons together own 45% of the SNB while 15% is owned by cantonal banks and the remaining 40% by private individuals or companies. The Swiss Federal Government owns no shares. Given the SNB’s holdings – it has demonstrated a voracious appetite for Apple stock and currently holds more than $80 billion in US stocks – the shareholder-backed hedge fund is also having one hell of a year. Perhaps it’s understandable that shareholders see these gains as a driver of value. |

Swiss National Bank, Jan 2016 - Sep 2017(see more posts on Swiss National Bank Stock, ) |

| And of course, the FT has a few theories about what’s been driving the bank’s astounding gains.

One is that, because of the bank’s stellar P&L, it will almost certainly make a dividend payment this year (it has occasionally failed to do so, like in 2015). Dividend payments are fixed by law at a maximum of 15 Swiss franc per share. If paid in full, that would amount to a yield of 50 basis points – far superior to the minus 15 basis-point yield on the country’s 10-year bond. Another is that some German investing newsletter issued what amounts to a “buy” call:

Of course, these arguments seem specious: Investors could still probably lock in higher yields by buying Treasurys and hedging their exposure, as one example. And the influence of that newsletter sounds like it’s being overstated. However, the FT hints at one possible driver that’s probably closer to the truth: Private investors are trying to front-run a possible share buyback by the central bank. As the FT notes, the SNB wouldn’t be the first central bank to buy back its shares. |

Swiss National Bank, Jan - Sep 2017(see more posts on Swiss National Bank Stock, ) |

Regardless of their motives, the stock’s gains are almost definitely being driven by private shareholders. As we reported last year during a smaller bout of appreciation in the SNB’s stock, it’s unlikely that a canton or a cantonal bank would buy the shares en masse because their ownership has been carved in stone for many years. And as the FT notes…

|

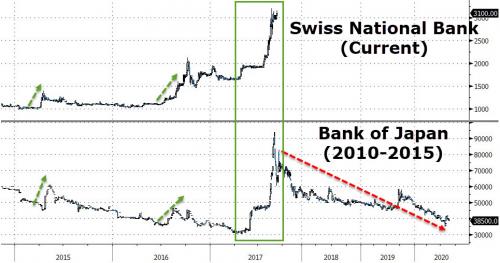

Swiss National Bank and Bank of Japan, 2015 - 2020(see more posts on Bank of Japan, Swiss National Bank Stock, ) |

| The alternative is that a private investor is quietly buying up all the stock available. The single largest private shareholder is a German national called Theo Siegert, a German business leader and professor at Munich University. He owns 6.7% of the Bank, more than any Swiss canton except Bern. Still, if the buyer was Siegert, he would have to file a new report as a large shareholder once he crosses a 10% threshold.

While buybacks are unlikely, and a leveraged buyout of the central bank woud be impossible – though it’d make for an interesting case study – there’s only one probable conclusion left: The SNB is pushing global stock prices up, in the process creating the next bubble. And now private traders are gobbling up shares of the bank itself, adding a dangerous feedback loop to the equation. The SNB isn’t the only central bank that trades publicly. Both the Bank of Japan and the Bank of Greece are publicly traded, as is the Bank of Belgium; but when it comes to massive wealth-multiplying asset purchases, the BOJ is the real master. And we all know how that turned out. |

Full story here Are you the author? Previous post See more for Next post

Tags: Apple,Bank of Japan,Belgium,Bitcoin,Bond,Business,central banks,Finance,Financial markets,fixed,Greece,Institutional Investors,Japan,money,newslettersent,stock market,Swiss Franc,Swiss National Bank,Swiss National Bank Stock,Zurich