Tag Archive: Bitcoin

“Inflation it is not an act of God”

INTERVIEW WITH GODFREY BLOOM:

Over the last couple of years, the UK has been increasingly in the news – for all the wrong reasons. The cost of living crisis, in particular, has been monopolizing headlines at home and abroad. Of course, inflation is by no means unique to the country. To the contrary, it has been hovering at similar or higher levels in virtually all advanced economies for quite some time. What is unique to the UK though, is that...

Read More »

Read More »

#1133 Bitcoin Fear & Greed, 43 Mio Bitcoin Hodler & Indian RBI Krypto Verbot

1.) Bitcoin steps out of ‚Fear‘ for the first time in nine monthsThe Bitcoin Fear and Greed Index reached an index score of 52 over the weekend, marking the first time its hit neutral territory in three quarters.

Read More »

Read More »

Crypto Winter Wipes Out 72,000 Bitcoin Millionaires in 2022

Crypto comparison website Bitstacker conducted a study which found that there was a 70% drop in Bitcoin millionaires in November 2022 when compared to January 2022 due to the ongoing ‘crypto winter’.

72,000 Bitcoin holders were no longer millionaires due to the drop in BTC prices from US$46,208 at the start of 2022 to US$15,759 at the time of the study in November.

Read More »

Read More »

#1099 Stablecoin Krieg, Kraken Russland Sanktionen & Kazakhstan Mining

1.) A stablecoin’s rise in market share has ignited the ‘Second Great Stablecoin War’Since Binance announced it would auto-convert USDC, USDP and TUSD into BUSD on Sept. 6, BUSD’s share of the total stablecoin market has risen from 10.01% to 15.48%.

Read More »

Read More »

N26 Launches New Cryptocurrency Trading Feature With Bitpanda

German neobank N26 has launched its cryptocurrency product in Austria to enable customers to buy and sell 194 cryptocurrencies in their app.

The N26 Crypto feature will be made available progressively to eligible customers in Austria over the coming weeks, as well as in other key markets over the next six months.

The launch addresses strong local demand, where internal research showed that 40% of N26 users are either actively trading, or have...

Read More »

Read More »

It’s Not Nothing, It’s Everything (including crypto)

Markets got aggressive long before the FOMC did. Everything, and I mean everything, has been trending the other way. Jay Powell says inflation risks are most pressing when markets have consistently priced the opposite for a whole lot longer.

Read More »

Read More »

Peak Inflation (not what you think)

For once, I find myself in agreement with a mainstream article published over at Bloomberg. Notable Fed supporters without fail, this one maybe represents a change in tone. Perhaps the cheerleaders are feeling the heat and are seeking Jay Powell’s exit for him?

Read More »

Read More »

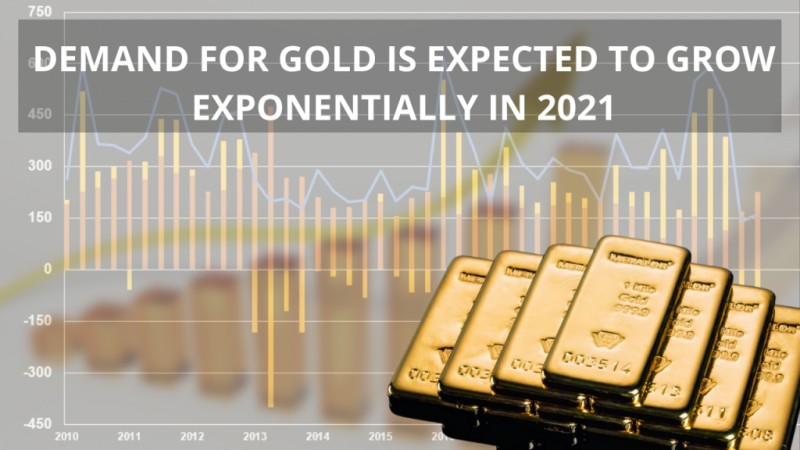

Demand for Gold is Expected to Grow Exponentially in 2021

The difference between physical gold investing and ETF investing was stark in the first quarter 2021 according to the World Gold Council’s Gold Demand Trends data released last week. Before focusing in on investment demand below a few notes on overall gold demand in the first quarter.

Read More »

Read More »

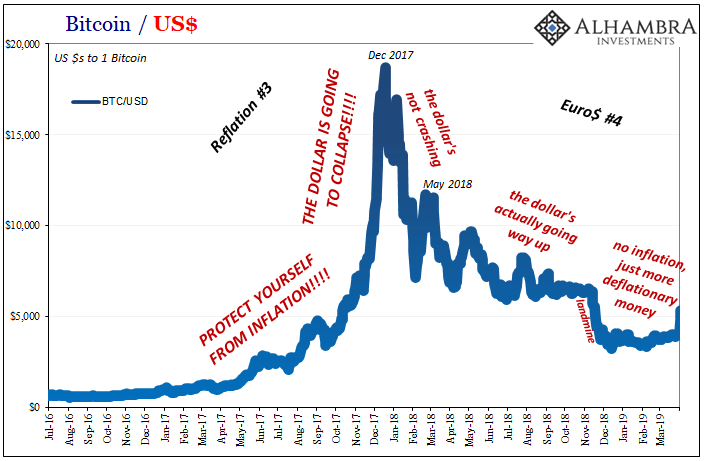

The bitcoin surge in its proper context

Over the last few weeks we’ve been witnessing a historic surge in the Bitcoin price, a seemingly unstoppable ride that the mainstream media headlines can hardly keep up with. Especially following the news that Elon Musks’ Tesla bought $1.5 in the cryptocurrency, sending it to new record highs, most of the media coverage appears to be focused on all the wrong things.

Read More »

Read More »

The Bitcoin is ‘as-good-as-gold’ myth is over

2022-11-19

by Stephen Flood

2022-11-19

Read More »